Understanding the “0 Down” Concept

The “0 down” financing option is a popular, but often misunderstood, approach to purchasing a used car. It presents a tempting prospect of immediate ownership without a significant upfront payment. However, a deeper dive into the specifics reveals both advantages and disadvantages.

The “0 down” financing structure, while appealing, often comes with specific terms and conditions that can impact the overall cost and financial responsibility of the buyer. Understanding these details is crucial to making an informed decision.

Defining “0 Down” Financing

“0 down” financing essentially means the buyer borrows the full purchase price of the used car, with no upfront cash payment. This loan is secured by the car itself, and the monthly payments are calculated based on the loan amount, interest rate, and loan term. The seller might also provide an extended warranty as part of the financing package.

Common Misconceptions About “0 Down” Deals

Many believe “0 down” means the car costs less. This is a common misconception. Instead, “0 down” financing simply shifts the upfront cost to monthly payments. The total cost of the vehicle, including interest, may end up being significantly higher than a loan with a down payment. It’s crucial to understand the total cost of the vehicle over the loan term. Another common misconception is that the interest rate is always lower. In actuality, interest rates for 0-down loans can be higher compared to those with a down payment, as the lender takes on more risk.

Benefits of “0 Down” Financing

“0 Down” financing can be attractive for buyers with limited cash on hand. It allows immediate possession of the vehicle, potentially convenient for those needing a car urgently. However, this benefit needs to be weighed against the potential for increased costs.

Drawbacks of “0 Down” Financing

The primary drawback is the potential for higher total costs. Interest rates on 0-down loans are frequently higher, increasing the overall cost of the vehicle over time. The monthly payments can also be significantly higher than with a loan that includes a down payment, potentially straining the buyer’s budget. Furthermore, the buyer’s creditworthiness is thoroughly scrutinized, and those with poor credit history might face higher interest rates.

Examples of “0 Down” Financing Structures and Terms

Different financing institutions offer various “0 down” financing packages. Some may include a higher interest rate, while others might add fees or charges. Loan terms vary significantly. A 5-year loan could lead to substantially different monthly payments and total interest compared to a 7-year loan, even with the same interest rate. It’s important to compare various options from different lenders to find the most suitable one for your specific needs.

Comparing Financing Options: 0 Down vs. 10% Down

| Feature | 0 Down Financing | 10% Down Financing |

|---|---|---|

| Initial Payment | $0 | 10% of vehicle price |

| Loan Amount | Full vehicle price | 90% of vehicle price |

| Interest Rate | Potentially higher | Potentially lower |

| Monthly Payment | Potentially higher | Potentially lower |

| Total Cost (including interest) | Potentially higher | Potentially lower |

| Risk to Buyer | Higher, due to higher loan amount | Lower, due to lower loan amount |

The table above highlights the potential differences between 0-down and 10% down financing options. It’s essential to meticulously review the complete terms of each financing package before making a final decision. Consider factors such as the vehicle’s price, the interest rate, and the loan term to determine the most financially advantageous option.

Identifying Used Car Market Trends

The used car market is a dynamic arena, constantly shaped by evolving consumer preferences, economic factors, and technological advancements. Understanding these trends is crucial for businesses operating in this sector, particularly those offering “0 down” financing options. This analysis delves into recent market shifts, pinpointing factors influencing “0 down” popularity and examining the availability of these options across various vehicle types.

The recent surge in used car prices, followed by a more moderate market, has created a complex environment for consumers and sellers. This fluctuating market has influenced consumer behavior, impacting the demand and acceptance of financing options like “0 down.” Understanding these nuances is essential for effective marketing and strategy in the used car sector.

Recent Trends in the Used Car Market

The used car market has experienced significant shifts in recent years. Historically high demand, fueled by supply chain disruptions and the pandemic, drove prices to record levels. Subsequently, a correction has occurred, though pricing remains elevated compared to pre-pandemic averages. This volatility necessitates a keen understanding of current trends to navigate the market effectively. Factors such as the global chip shortage and fluctuating fuel costs have had a significant impact on both new and used vehicle pricing.

Factors Influencing the Popularity of “0 Down” Financing Options

Several factors contribute to the enduring popularity of “0 down” financing options in the used car market. The perceived affordability and ease of entry are primary drivers, allowing buyers with limited upfront capital to access vehicles. Furthermore, competitive financing terms and streamlined purchase processes offered by many dealerships and online platforms contribute to the appeal. The market is also being driven by the changing financial landscape, with a focus on low-interest rates, or zero-down deals to encourage sales.

Comparison of “0 Down” Financing Options Across Vehicle Types and Brands

The availability of “0 down” financing options varies across different vehicle types and brands. Luxury vehicles often present a more limited availability of such deals due to their higher price points and the associated financing complexities. Compact cars and lower-priced vehicles often show a higher prevalence of “0 down” financing promotions, aiming to attract a broader customer base. Dealerships may offer special financing terms for specific makes and models, contingent on inventory and market conditions.

Role of Online Platforms in Facilitating “0 Down” Used Car Deals

Online platforms have become pivotal in facilitating “0 down” used car deals. These platforms provide access to a wider range of inventory, allowing consumers to compare prices and financing options across multiple dealerships. This increased transparency and access to a broader market have significantly impacted the purchasing process. Consumers can also find financing options through online marketplaces, further facilitating deals with “0 down” payments.

Top 3 Factors Influencing Used Car Demand

| Factor | Description |

|---|---|

| Affordability | The perceived affordability of used cars, particularly with “0 down” options, remains a key driver of demand. |

| Supply and Demand Imbalances | Fluctuations in the supply and demand dynamics of specific vehicle models and types directly influence the pricing and availability of “0 down” financing options. |

| Consumer Confidence | Consumer confidence in the economy and their ability to manage car payments impacts the demand for used cars, including those with “0 down” financing options. |

Consumer Behavior and “0 Down” Purchases

The “0 down” financing option for used cars has become increasingly popular, attracting a specific segment of consumers. Understanding the motivations and characteristics of these buyers is crucial for dealerships to effectively market their products and for potential buyers to make informed decisions. This approach often appeals to those seeking immediate car ownership without the upfront financial burden.

This segment of the market, typically characterized by limited savings or credit history, is often drawn to the immediate gratification of owning a car without a significant initial investment. The ease of securing a loan with no down payment can be a significant motivator, particularly for those with a desire to avoid the perceived complexity of traditional financing methods. However, a deep dive into the associated risks and costs is essential for responsible decision-making.

Typical Consumer Profile

This demographic often includes first-time car buyers, individuals with limited savings, or those with recent financial setbacks. They might be employed in lower-paying jobs or have inconsistent income streams, potentially impacting their creditworthiness. Financial literacy and understanding of the long-term implications of such financing are often less developed compared to more financially stable consumers. The need for transportation, coupled with a desire for immediate gratification, often outweighs concerns about potential financial consequences.

Motivations Behind “0 Down” Financing

The allure of “0 down” financing stems from its perceived simplicity and ease of access. Buyers are often attracted to the immediate gratification of owning a vehicle without a significant upfront cost. Furthermore, the lack of a down payment can make the purchase appear more affordable in the short term. This, coupled with potential lack of awareness about long-term costs and potential financial risks, can influence the decision.

Risks Associated with “0 Down” Financing

“0 down” financing, while seemingly attractive, carries inherent risks. The most significant risk is the potential for high monthly payments, which can strain a buyer’s budget and create financial hardship. The extended loan terms associated with such financing can lead to significantly higher total interest payments over the life of the loan. This can easily escalate the overall cost of the vehicle beyond the initial purchase price.

Dealership Strategies for Promoting “0 Down” Deals

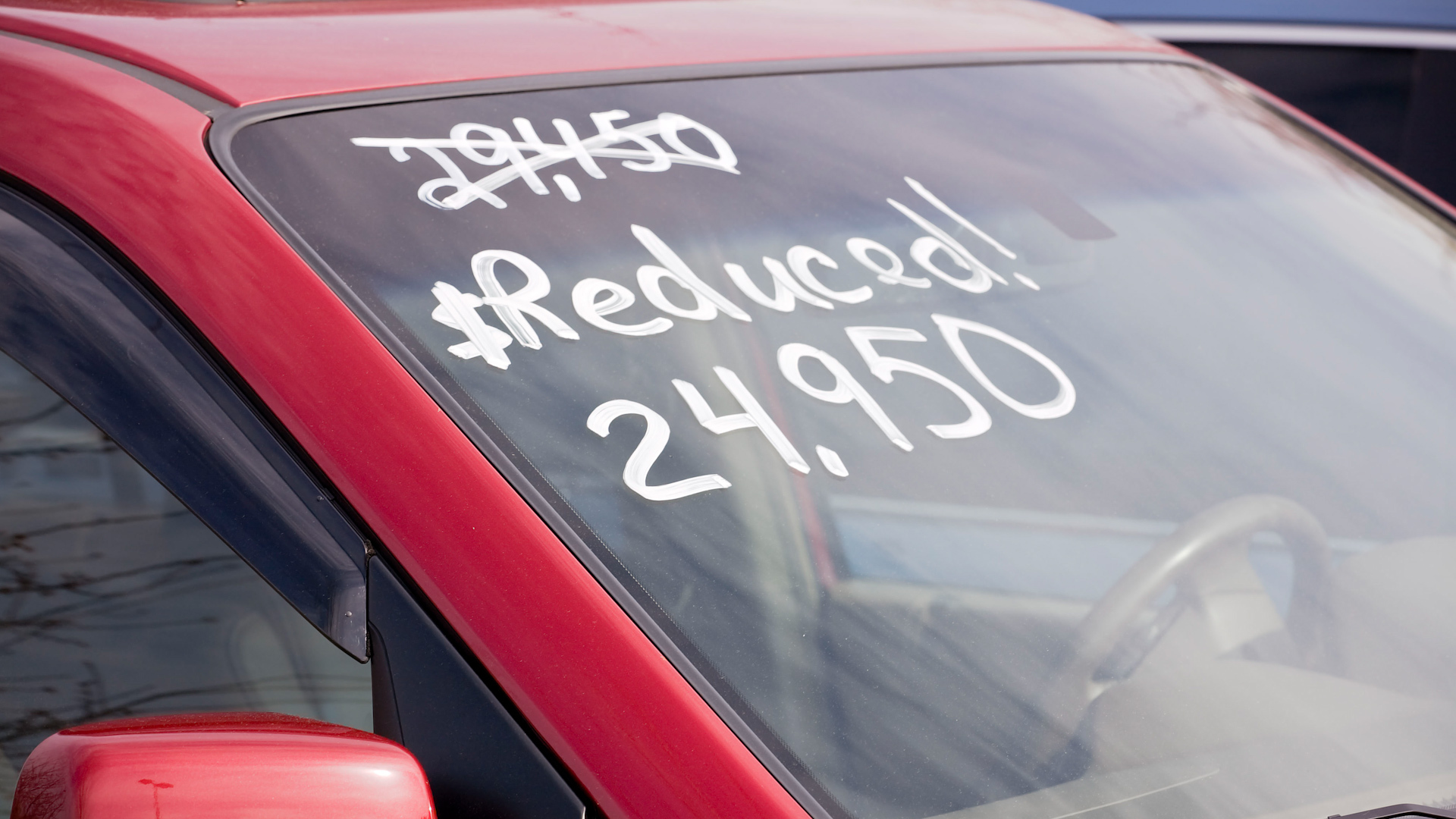

Dealerships often use aggressive marketing tactics to promote “0 down” deals. This may involve highlighting low monthly payments as the primary selling point, potentially obscuring the total cost of the vehicle over the loan term. These strategies can create an illusion of affordability that masks the true financial implications. Aggressive sales tactics can also contribute to an environment where the buyer feels pressured to make a quick decision, without a thorough understanding of the risks.

Evaluating the True Cost of a “0 Down” Purchase

To determine the true cost of a “0 down” used car purchase, buyers should not solely focus on monthly payments. Instead, they should consider the total cost of the vehicle over the loan term, including interest payments. A useful tool is calculating the total amount financed (the price of the car) plus the total interest to be paid over the loan term. This comprehensive approach reveals the actual cost of the car and allows for a more informed financial decision.

Financing and Credit Considerations

Navigating the “0 down” used car market often involves a delicate balance between affordability and responsible financial decisions. Understanding the financing specifics is crucial for avoiding hidden costs and ensuring a smooth transaction. This section delves into the critical aspects of credit, interest rates, and potential fees, empowering buyers to make informed choices.

Credit Scores and Credit History

Credit scores and history play a pivotal role in securing “0 down” financing. Lenders assess creditworthiness to evaluate the borrower’s ability to repay the loan. A higher credit score typically translates to better loan terms, including lower interest rates and potentially more favorable financing options. Conversely, a lower credit score may result in higher interest rates, increased loan fees, or even denial of the loan. This evaluation considers factors like payment history, outstanding debts, and credit utilization. A strong credit history, demonstrated by consistent on-time payments and low debt levels, enhances the likelihood of approval and favorable terms.

Interest Rates

Interest rates associated with “0 down” used car loans typically fluctuate based on market conditions and the borrower’s creditworthiness. Borrowers with excellent credit scores can expect lower interest rates compared to those with lower scores. Interest rates on “0 down” loans are often higher than those on loans with a down payment, reflecting the increased risk for the lender. Current market rates can vary considerably; therefore, it’s vital to shop around for the best possible rates. For instance, a borrower with a FICO score of 750 might secure a loan with an interest rate of 8%, while a borrower with a 650 score could face an interest rate of 10% or higher.

Hidden Fees and Costs

“0 down” financing often involves various fees and charges beyond the interest rate. These may include loan origination fees, documentation fees, and prepayment penalties. It’s essential to carefully scrutinize the fine print of any financing agreement to understand the complete cost of the loan. Lenders may also impose additional charges, such as an appraisal fee, if the car requires an independent assessment. Therefore, it’s crucial to obtain a comprehensive breakdown of all associated fees upfront.

Comparing Financing Offers

To effectively compare different financing offers, focus on both the interest rate and associated fees. A lower interest rate might seem appealing, but it’s essential to evaluate the overall cost. Use a simple calculation to determine the total cost of the loan. A crucial step is to calculate the total interest payable over the loan term, and compare this to the total cost of the loan with different financing offers.

Loan Terms and Monthly Payments

Loan terms directly impact monthly payments and the total interest paid. Shorter loan terms generally result in higher monthly payments but lower total interest charges. Conversely, longer loan terms entail lower monthly payments but accumulate higher interest costs over the loan’s life. The following table illustrates the potential impact of different loan terms on monthly payments:

| Loan Term (Years) | Estimated Monthly Payment (Example) | Estimated Total Interest Paid (Example) |

|---|---|---|

| 3 | $350 | $800 |

| 4 | $280 | $1200 |

| 5 | $250 | $1600 |

Note: The example figures are illustrative and can vary based on the interest rate, loan amount, and other factors.

Legal and Regulatory Aspects

Navigating the used car market, especially when considering “0 down” financing options, requires a keen awareness of legal and regulatory frameworks. These safeguards are put in place to protect consumers from unscrupulous practices and ensure fair dealings. Understanding these aspects is crucial to making informed decisions and avoiding potential pitfalls.

Consumer Protection Laws

Used car financing is governed by a complex web of consumer protection laws designed to shield buyers from unfair or deceptive practices. These laws vary by jurisdiction but generally aim to prevent dealerships from engaging in misleading advertising, hidden fees, or predatory lending practices. Federal and state laws frequently address issues such as disclosure requirements for financing terms, the right to cancel or return a vehicle under certain conditions, and the limitations on pre-payment penalties.

Role of Regulatory Bodies

Regulatory bodies, such as state departments of motor vehicles and consumer protection agencies, play a critical role in overseeing used car dealerships and financing options. They enforce consumer protection laws, investigate complaints, and impose penalties on businesses that violate regulations. These agencies often conduct audits of dealerships to ensure compliance with established standards. Their oversight helps maintain a level playing field for both buyers and sellers.

Potential for Fraud and Scams

“0 down” financing offers can be attractive, but they also present a heightened risk of fraud and scams. Unscrupulous dealers might use misleading language or hidden fees to conceal high-interest rates or unfavorable terms. Consumers should exercise caution and avoid making impulsive decisions based solely on the “0 down” promise. It’s crucial to understand the complete financial picture before committing to a purchase. Common examples include fraudulent dealerships operating under fake names, or individuals posing as legitimate finance companies.

Red Flags to Watch Out For

Recognizing red flags is essential for avoiding fraudulent “0 down” deals. These might include unusually low interest rates that seem too good to be true, pressure to make a quick decision, vague or unclear financing details, or the absence of a clear contract outlining all terms and conditions. Dealerships that refuse to provide detailed information or answer questions promptly should raise suspicion. A lack of transparency is a major red flag.

Verifying the Legitimacy of a “0 Down” Offer

A step-by-step process can help consumers verify the legitimacy of a “0 down” financing offer:

- Thorough Research: Investigate the dealership’s reputation and history online through reviews, government websites, and consumer complaint databases. Check for any reported complaints or negative reviews.

- Independent Verification: Contact the lending institution directly to verify the existence and details of the financing offer. Insist on a detailed, written agreement outlining all fees, interest rates, and repayment terms.

- Legal Counsel: Consult with a legal professional or consumer protection agency for guidance on the specific terms of the contract. Ensure that the contract aligns with local consumer protection laws and avoids potential pitfalls.

- Detailed Review of Documents: Scrutinize all documents related to the financing offer, paying close attention to the fine print and hidden fees. Don’t hesitate to ask clarifying questions about any ambiguous clauses.

- Independent Financial Assessment: Evaluate the terms of the loan using a reputable online loan calculator or comparing with other financing options from different lenders to determine if the offer is competitive.

Practical Tips for Buyers

Navigating the “0 down” used car market requires careful consideration beyond just the initial price. Understanding the intricacies of financing, the nuances of the used car market, and the potential pitfalls is crucial for a smooth and successful purchase. This section provides practical guidance for buyers to ensure a positive outcome.

Evaluating a Used Car Before Committing

Thorough pre-purchase inspection is paramount. A comprehensive evaluation goes beyond just a visual inspection. Buyers should investigate the car’s history, including any prior accidents, repairs, or maintenance issues. This vital step minimizes the risk of hidden problems and unexpected expenses down the line. Researching comparable models and their current market values is essential for establishing a fair price.

- Inspect the vehicle’s exterior and interior: Look for signs of damage, wear, and tear. Note any discrepancies between the seller’s description and the physical condition. Pay particular attention to the paint, body panels, and interior materials. A detailed visual inspection is crucial for detecting potential problems.

- Examine the vehicle’s mechanical components: A trained mechanic should be consulted for a thorough mechanical inspection. This will identify any underlying issues that might not be apparent during a cursory examination. Test-driving the vehicle is also essential to gauge its performance and identify any unusual noises or vibrations.

- Check the vehicle’s service history: Request service records and maintenance logs from the previous owner. A well-maintained vehicle with a documented service history is more likely to be reliable.

- Investigate the car’s title and ownership history: Verify the vehicle’s title and ownership history to ensure it’s clear of liens or encumbrances. Any discrepancies could lead to legal complications.

Negotiating “0 Down” Financing Offers

Negotiation is a key element of securing favorable financing terms. Comprehending the terms and conditions of the “0 down” financing offer is critical. Be prepared to compare different financing options from various lenders to secure the best possible interest rate and loan terms.

- Understand the interest rate and repayment schedule: Thoroughly examine the interest rate and the repayment schedule to determine the overall cost of the loan. Compare different interest rates offered by various lenders to find the most advantageous option.

- Inquire about prepayment penalties and fees: Be aware of any prepayment penalties or fees associated with the loan. Understanding these details is essential for long-term financial planning.

- Seek clarification on any unclear aspects: If any aspects of the financing offer are unclear, seek clarification from the lender. This will help to avoid misunderstandings and ensure that all terms are fully comprehended.

- Compare financing offers from multiple lenders: Compare financing offers from multiple lenders to secure the best possible interest rate and loan terms. This will allow you to make an informed decision and select the most suitable option.

Ensuring a Legally Sound Purchase

Legal compliance is critical for a smooth transaction. Buyers must ensure the purchase agreement complies with all applicable laws and regulations.

- Review the purchase agreement thoroughly: Carefully review all terms and conditions of the purchase agreement. Understand the responsibilities of both the buyer and the seller.

- Verify the legality of the seller: Verify the seller’s legitimacy and the legality of the vehicle’s sale. Consult with legal professionals if necessary.

- Consult with legal professionals if needed: Seeking legal advice is highly recommended to ensure that the purchase is legally sound. This will minimize potential risks.

- Obtain the necessary documents: Ensure that all necessary documents, such as the title and registration, are properly executed and transferred to the buyer’s name.

Importance of Independent Valuations

Independent valuations are critical to establishing a fair market price for the used car. This is especially important when financing the vehicle with a “0 down” payment.

- Obtain valuations from multiple sources: Seek valuations from reputable sources, including independent appraisers and online valuation tools, to get a comprehensive understanding of the car’s market value.

- Compare the valuation with the seller’s price: Compare the obtained valuation with the seller’s asking price to assess the fairness of the transaction.

- Utilize online resources and professional appraisals: Leverage online resources and professional appraisals for a comprehensive understanding of the car’s value in the current market.

- Use valuation resources to negotiate a fair price: Employ valuations to support your negotiating position and ensure a fair and mutually beneficial agreement.

Comparison of Used Car Inspection Methods

Different methods provide varying levels of detail and expertise. Choosing the right inspection method is crucial for identifying potential issues.

| Inspection Method | Description | Pros | Cons |

|---|---|---|---|

| Visual Inspection | A basic examination of the vehicle’s exterior and interior. | Quick and inexpensive. | Doesn’t uncover hidden problems. |

| Mechanical Inspection | A detailed assessment of the vehicle’s mechanical components. | Identifies potential mechanical issues. | More expensive and time-consuming. |

| Professional Inspection | A comprehensive inspection by a certified mechanic or appraiser. | Thorough and detailed assessment. | Most expensive and time-consuming. |

Visual Representation of “0 Down” Options

Understanding the “0 down” financing option for used cars requires a clear visualization of the financial implications. This section will detail how to present the total cost of ownership for a vehicle purchased with 0 down financing, compare it to a 10% down payment scenario, and highlight the key pros and cons. A comprehensive understanding of these factors empowers consumers to make informed decisions.

Visual Representation of Financing Offers

A bar chart effectively illustrates the difference between “0 down” financing and a down payment. The x-axis would represent the financing options (0 down, 10% down, etc.). The y-axis would represent the total cost of the vehicle. Separate bars could be used to illustrate the monthly payment amounts and the total interest paid over the loan term. This visual comparison would immediately highlight the difference in total cost and monthly payments between the various financing options.

Total Cost of Ownership

Demonstrating the total cost of ownership is crucial for evaluating “0 down” offers. This includes not just the purchase price but also the interest accrued over the loan term. A detailed breakdown, presented in a table format, allows for a clear comparison of the total costs and monthly payments associated with different down payment scenarios.

Comparison Table: 0 Down vs. 10% Down Payment

| Feature | 0 Down Financing | 10% Down Payment |

|---|---|---|

| Purchase Price | $15,000 | $15,000 |

| Down Payment | $0 | $1,500 |

| Loan Amount | $15,000 | $13,500 |

| Loan Term | 60 months | 60 months |

| Interest Rate | 7.5% | 7.0% |

| Monthly Payment | $300 | $270 |

| Total Interest Paid | $3,600 | $2,700 |

| Total Cost of Ownership | $18,600 | $16,200 |

This table illustrates a hypothetical scenario. Actual costs will vary based on individual circumstances, including the specific vehicle, interest rates, and loan terms.

Pros and Cons of 0 Down Financing

Understanding the advantages and disadvantages of “0 down” financing is critical. This assessment provides a balanced perspective to assist consumers in making informed choices.

- Pros: Lower initial out-of-pocket cost, potentially greater accessibility to vehicle ownership for those with limited savings. This can be particularly attractive for those with limited financial resources, enabling them to own a vehicle sooner.

- Cons: Higher total cost of ownership due to accumulated interest over the loan term, potentially higher monthly payments, and increased risk of default if not managed properly. A higher total cost over the loan term, due to interest payments, is a significant consideration for consumers.

Types of Warranties with 0 Down Deals

“Warranties offered with ‘0 down’ deals can vary significantly. Lenders or dealerships may offer extended warranties, typically for a fee, beyond the manufacturer’s standard coverage. These can be valuable additions to the buyer’s protection, but consumers should carefully evaluate the terms and conditions.”

- Manufacturer’s Warranty: Standard coverage offered by the vehicle manufacturer, varying in duration and scope. This is often a key component of the vehicle’s value and reliability, providing protection against certain mechanical issues.

- Extended Warranties: Optional add-ons that often provide additional coverage beyond the manufacturer’s warranty. These are usually available from dealerships or third-party providers, at a cost, and provide further protection against breakdowns and repairs.