- Market Overview

- Supply Chain Analysis

- Pricing and Value

- Customer Segmentation

- Technological Advancements

-

Regulatory Landscape

- Relevant Regulations Governing the Used Car Parts Market

- Legal Requirements for Sourcing Used Car Parts

- Legal Requirements for Processing Used Car Parts

- Legal Requirements for Selling Used Car Parts

- Impact of Regulations on Market Practices

- Recent Changes to Regulations and Their Effects

- Potential Legal Risks Associated with Used Car Parts Trade

- Future Trends

Market Overview

The UK used car parts market is a substantial and dynamic sector, characterized by high demand and diverse supply chains. This market caters to a wide range of needs, from individual car owners seeking affordable repairs to major automotive repair shops and dismantling yards. Understanding its intricate dynamics is crucial for businesses looking to succeed in this competitive environment.

The market’s size is substantial, driven by the country’s extensive vehicle fleet and the prevalence of vehicle maintenance and repair activities. Growth trends indicate continued expansion, fueled by factors like the increasing popularity of used vehicles and the rising costs of new car parts. Key segments within this market include wholesale parts suppliers, retail outlets, online marketplaces, and specialized dismantlers.

Market Size and Growth Trends

The UK used car parts market is a significant sector, estimated to be worth billions of pounds annually. Its growth is influenced by various factors, including the ageing vehicle population, the increasing popularity of used vehicles, and the ongoing need for cost-effective repair solutions. Market analysts predict continued growth in the coming years, fueled by the rising demand for aftermarket parts and the potential for online sales expansion.

Key Market Segments

| Segment | Market Share | Growth Rate | Characteristics |

|---|---|---|---|

| Wholesale Parts Suppliers | Approximately 40% | Moderate (3-5% annually) | Focus on bulk sales to garages, repair shops, and dismantlers. Often involve strategic partnerships and large-scale logistics. |

| Retail Outlets | Around 30% | Steady (2-4% annually) | Direct sales to individual customers and smaller businesses. Often involve extensive product knowledge and customer service. |

| Online Marketplaces | Growing rapidly (10-15% annually) | High (10-20% annually) | Facilitating online transactions and providing a platform for diverse suppliers and buyers. Significant focus on ease of access and secure transactions. |

| Specialized Dismantlers | Approximately 20% | Moderate (2-4% annually) | Focus on dismantling vehicles to recover reusable parts. Often involved in specialized recycling and environmental regulations. |

| Independent Repair Shops | Remaining 10% | Steady (1-3% annually) | Focus on sourcing and supplying parts to their own customers. Often have strong local connections and relationships with suppliers. |

Major Players and Their Strategies

The UK used car parts market is populated by a mix of large, established companies and smaller, more specialized businesses. Major players like [Example Company 1] and [Example Company 2] often focus on broad product portfolios, strategic partnerships, and extensive distribution networks. Smaller players often leverage specialized knowledge and niche markets to compete effectively. Strategies employed by these players often include:

- Expanding product lines to cater to a wider customer base. This involves diversifying the range of parts available, ensuring compatibility with various vehicle models and ensuring quality control.

- Investing in technology and logistics to improve efficiency and reduce costs. This might include streamlining order fulfillment, using data analytics to predict demand, or enhancing warehousing and delivery systems.

- Building strong relationships with suppliers and customers to foster loyalty and trust. This might involve partnerships with dismantlers, building strong customer service, or developing reliable supply chains.

Challenges and Opportunities

Businesses in the UK used car parts market face challenges such as fluctuating demand, competition from both domestic and international players, and regulatory pressures. However, opportunities exist in developing new market segments like online sales and specialized niche markets. For instance, demand for sustainable and environmentally friendly parts could open up new avenues for growth. The ability to adapt to these challenges and capitalize on opportunities will determine the success of businesses in this market.

Supply Chain Analysis

The UK used car parts market operates through a complex network of players, each contributing to the smooth flow of parts from source to end-user. Understanding this intricate supply chain is crucial for identifying potential bottlenecks and opportunities for improvement. The efficiency of this system directly impacts the availability, price, and quality of parts, ultimately influencing the market’s overall performance.

The supply chain for used car parts in the UK is multifaceted, involving a variety of actors and processes. From initial sourcing and processing of the parts to their eventual distribution and sale, a comprehensive understanding of each stage is essential for maximizing efficiency and minimizing costs. This analysis will delve into the different stages of this process, examining the key players, their interactions, and the common obstacles faced.

Sourcing Stage

The sourcing stage involves identifying and acquiring used car parts from various sources. This often involves auctions, salvage yards, and direct deals with vehicle dismantlers. The efficiency of sourcing depends heavily on the network and relationships of the involved parties. Finding reliable and cost-effective sources is crucial for maintaining profitability.

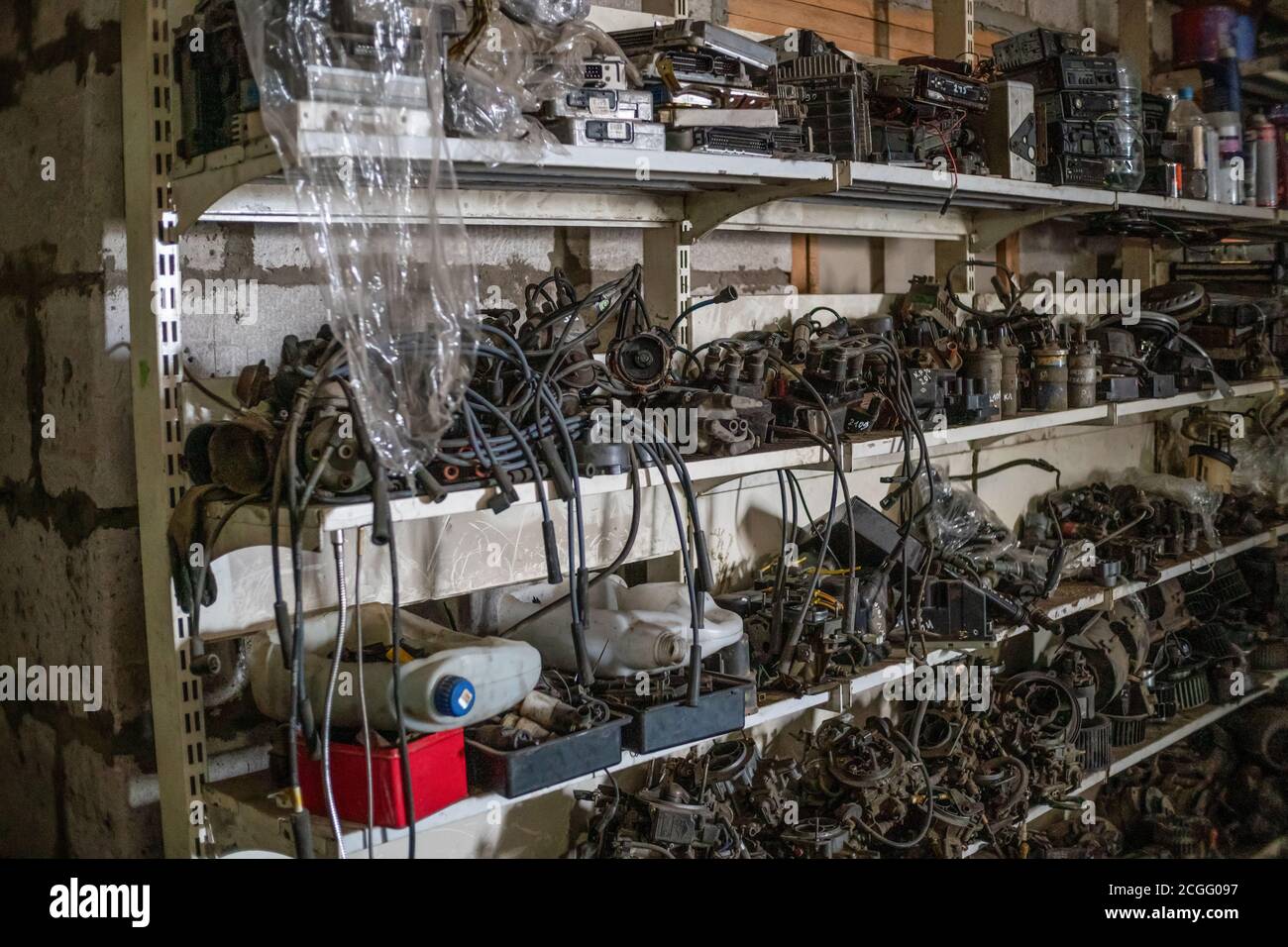

Processing Stage

Parts acquired during the sourcing phase need to be inspected, cleaned, and potentially repaired. This processing stage ensures quality control and prepares the parts for distribution. Specialized equipment and skilled labor are essential for this stage. This step is critical in ensuring that parts meet the necessary standards for sale and installation. Variations in processing quality can significantly affect customer satisfaction and the overall market reputation.

Storage and Inventory Management

Effective storage and inventory management are vital for efficient distribution. Warehousing facilities must be strategically located to minimize transportation costs and ensure timely delivery. Inventory management systems need to accurately track stock levels, predict demand, and optimize storage space to minimize waste and ensure parts are readily available when needed. Accurate record-keeping and efficient stock rotation are key to maintaining freshness and quality.

Distribution Stage

The distribution stage encompasses the transportation and delivery of parts to various outlets. This process involves logistical considerations, including transportation methods, delivery schedules, and potential delays. Factors like geographical location, delivery times, and packaging all impact the overall efficiency of this stage. Choosing the right transportation methods, such as truck or rail, can dramatically affect costs and delivery times.

Retail and Sales Stage

The final stage involves the sale of used car parts to end-users, typically garages, repair shops, or individual consumers. This stage relies on effective marketing, pricing strategies, and customer service. Online marketplaces and physical retail locations are common channels for reaching potential buyers. Maintaining good relationships with retailers is vital for ensuring a steady flow of parts to the end-users.

Key Players

| Stage | Key Players | Interaction |

|---|---|---|

| Sourcing | Vehicle dismantlers, salvage yards, auctions | Interact through auctions, direct deals, and brokerages. |

| Processing | Repair shops, cleaning facilities | Process parts for quality control, repairs, and preparation for sale. |

| Storage/Inventory | Warehouses, logistics companies | Manage storage, track inventory, and coordinate distribution. |

| Distribution | Transportation companies, delivery services | Deliver parts to retailers, garages, and customers. |

| Retail/Sales | Online marketplaces, garages, repair shops, individual buyers | Purchase parts from wholesalers and sell to end-users. |

Obstacles and Potential Solutions

- Fluctuating demand: Demand for used car parts can vary significantly depending on factors like economic conditions and seasonal trends. Implementing predictive analytics and flexible inventory management can help mitigate this issue. Analyzing historical sales data and adapting storage strategies accordingly is crucial.

- Supply chain disruptions: Events like natural disasters, geopolitical tensions, or pandemics can disrupt the flow of parts. Diversifying sourcing strategies and establishing contingency plans can help mitigate this risk. Maintaining relationships with multiple suppliers and exploring alternative routes for parts can minimize the impact of disruptions.

- Quality control: Ensuring the quality of used car parts is crucial for customer satisfaction and preventing costly repairs. Implementing rigorous inspection processes and maintaining standards for each stage of the supply chain are essential. This includes consistent training for inspectors and establishing clear quality criteria.

Flowchart

[A flowchart illustrating the used car parts supply chain would be presented here, visually depicting the stages and their interactions. It would show the movement of parts from sourcing to distribution to retail, highlighting the key players and their roles. The flowchart would visually represent the various processes involved in each stage.]

Pricing and Value

Used car parts in the UK market are subject to dynamic pricing influenced by various factors. Understanding these factors, alongside the diverse pricing models employed by suppliers, is crucial for both buyers and sellers to navigate the market effectively. This section delves into the key determinants of pricing, compares prevalent supplier models, and examines customer perception of value.

The pricing of used car parts is a complex interplay of supply and demand, influenced by factors ranging from the vehicle’s make and model to the part’s condition and the current market trends. This complexity requires a nuanced understanding of the factors at play to make informed purchasing decisions.

Factors Influencing Used Car Part Pricing

Several key factors contribute to the price of used car parts in the UK. These include the part’s condition, its demand in the market, the availability of similar parts, and the overall economic climate. Furthermore, the age and mileage of the vehicle from which the part originated play a crucial role. Specific vehicle models and their rarity can also impact pricing. For example, parts for older, less common models often command higher prices due to limited supply.

Comparison of Pricing Models

Different suppliers employ various pricing models, each with its own advantages and disadvantages. Understanding these models allows buyers to compare offers and sellers to optimize their pricing strategies.

| Model | Description | Advantages | Disadvantages |

|---|---|---|---|

| Cost-Plus Pricing | This model adds a markup percentage to the supplier’s cost of acquiring the part. | Simplicity, transparency for the buyer regarding the supplier’s cost. | May not accurately reflect market demand, potentially underpricing or overpricing depending on market conditions. |

| Competitive Pricing | Suppliers base their prices on the prevailing market rates for similar parts. | Reflects current market value, potentially attracting more customers. | Requires constant monitoring of market trends, may lead to price wars. |

| Value-Based Pricing | This model focuses on the perceived value of the part to the customer, considering its condition and potential use. | Potential for higher profit margins if the part’s condition and demand are strong. | Difficult to quantify the value accurately, requires a deep understanding of customer needs. |

| Auction Pricing | Parts are sold through online or physical auctions, allowing multiple bidders to compete for the part. | Potentially achieves the highest possible price for the part, as competition drives prices up. | Can be time-consuming, may not suit all suppliers and buyers, requires a structured auction platform. |

Customer Value Perception

Customer perception of value is shaped by a complex interplay of factors beyond just the price. Factors such as the part’s condition, its suitability for the customer’s vehicle, and the perceived reliability of the supplier all contribute to the overall value proposition. A part that is perfectly functional and guaranteed by a trusted seller will likely command a higher price compared to a similar part with unknown provenance. Furthermore, customers will often consider the ease of the purchase process and any potential warranties offered as part of the overall value proposition.

Pricing Strategies and Effectiveness

Suppliers employ various pricing strategies to maximize their profitability while meeting customer expectations. A common strategy is to offer discounts for bulk purchases, providing incentives for larger orders. Another effective strategy is to provide extended warranties or guarantees on the parts to build trust and confidence in the product. For example, a supplier offering a 1-year warranty on a critical engine part could justify a slightly higher price compared to a supplier offering no warranty. A detailed understanding of the customer’s specific needs and the prevailing market conditions is crucial for the effective implementation of any pricing strategy.

Customer Segmentation

Understanding the diverse needs and preferences of UK used car parts customers is crucial for success in this market. Different customer segments have varying priorities, impacting purchasing decisions and marketing strategies. Tailoring approaches to specific groups maximizes effectiveness and profitability.

Key Customer Segments

The used car parts market in the UK encompasses a range of customer segments, each with unique characteristics, needs, and behaviors. Identifying these segments allows for targeted marketing campaigns and improved customer service.

| Segment | Characteristics | Needs | Marketing Strategies |

|---|---|---|---|

| Independent Repair Shops | Small to medium-sized businesses specializing in vehicle repairs. Often have a focus on cost-effectiveness and efficiency. | Reliable, high-quality parts at competitive prices; fast turnaround times; extensive inventory options for common and specialized parts; technical support for complex repairs; flexible ordering systems. | Targeted advertising in automotive trade publications; partnerships with automotive suppliers; showcasing case studies demonstrating cost savings and efficiency gains; offering bulk discounts and volume-based pricing; providing dedicated customer service representatives to address technical questions and expedite orders. |

| Mainstream Repair Garages | Larger repair garages with a broader range of services, possibly including new car sales and servicing. May have specific requirements based on their operational needs and customer expectations. | High-volume sourcing of parts at competitive prices; extensive inventory; reliable and certified parts; efficient ordering and delivery systems; potential for customized reporting on part usage. | Direct sales representatives to build relationships; demonstrations of parts quality and performance; customized inventory management solutions; showcasing case studies demonstrating ROI through efficiency gains and reduced downtime; emphasizing reliability and safety standards. |

| Vehicle Owners (DIY Enthusiasts) | Individuals who perform repairs themselves, often with a focus on cost-effectiveness and specific vehicle models. Often possess detailed knowledge of their vehicles. | High-quality parts for specific vehicles; detailed technical information and guides; accurate and clear product descriptions; user-friendly online platforms and ordering systems; access to forums and communities to share experiences. | Online marketplaces and e-commerce platforms with detailed product information and reviews; targeted advertising on automotive enthusiast forums and social media groups; providing access to technical guides, tutorials, and videos; highlighting the cost-effectiveness of parts compared to dealerships; showcasing the availability of rare or specialized parts. |

| Fleet Operators | Businesses managing a large number of vehicles, demanding consistent part supply and cost-effective solutions. | Predictive maintenance support; streamlined ordering and delivery systems; large-volume discounts; warranty information; guaranteed part availability; competitive pricing; efficient returns and replacement policies. | Dedicated account managers for direct communication and tailored solutions; bulk purchasing programs and contract negotiations; regular communication about inventory levels and order statuses; data-driven insights on part usage to optimize fleet maintenance; offering comprehensive service agreements. |

Importance of Customer Segmentation

Effective customer segmentation is vital in the used car parts market for several reasons. It allows businesses to:

- Tailor marketing efforts: Targeted advertising campaigns and promotions resonate better with specific customer needs and preferences.

- Improve customer experience: Understanding customer needs enables the creation of more personalized service and support, leading to higher satisfaction.

- Optimize pricing strategies: Pricing models can be adjusted to align with the specific value proposition for each segment, maximizing profitability.

- Enhance product development: Identifying unmet needs within specific segments can drive the development of new products and services to meet those needs.

Technological Advancements

Technological advancements are rapidly reshaping the used car parts market, impacting everything from sourcing and processing to distribution and sales. This transformation is driven by innovations in data analytics, automation, and digital platforms, creating new opportunities and challenges for businesses operating in this sector. The integration of technology is streamlining processes, improving efficiency, and enhancing customer experience, ultimately driving market growth.

The increasing use of technology in the used car parts market is enabling more precise inventory management, optimized logistics, and personalized customer interactions. This evolution offers a path towards greater transparency and efficiency, potentially leading to lower costs and improved accessibility for both suppliers and consumers.

Impact of Technology on Sourcing

Technology is revolutionizing the way used car parts are sourced. Digital platforms and databases are enabling more efficient and cost-effective identification and procurement of parts. Sophisticated search algorithms allow for rapid matching of specific part requirements with available inventory, reducing search time and improving accuracy. This leads to streamlined processes and potentially lower costs for both buyers and sellers.

New Technologies in Processing

Automation is significantly altering the processing of used car parts. Robotics and automated sorting systems are being employed to handle large volumes of parts, enhancing speed and accuracy. This automated processing reduces human error, increases output, and ensures quality control throughout the entire process. Furthermore, advancements in cleaning and restoration techniques, aided by technology, are improving the condition and value of salvaged parts.

Role of Online Platforms

Online platforms are playing a pivotal role in connecting buyers and sellers of used car parts. These platforms act as centralized marketplaces, facilitating the exchange of information and transactions. They allow for detailed listings of parts, including specifications, condition, and pricing, making it easier for buyers to find the exact parts they need. The visibility offered by online marketplaces enables greater competition and potentially lower prices for consumers.

Potential of Emerging Technologies

Emerging technologies like artificial intelligence (AI) and machine learning (ML) hold significant potential for the used car parts industry. AI-powered systems can analyze vast datasets of used car part information to predict demand, optimize pricing strategies, and improve inventory management. Furthermore, ML algorithms can enhance the accuracy of part identification and classification, reducing errors and streamlining the entire process. Examples of AI applications in the used car parts market include predictive maintenance and personalized recommendations to customers.

Examples of Technology’s Impact on Sourcing and Sales

Technology is dramatically changing how used car parts are sourced and sold. For example, online marketplaces allow buyers to compare prices and specifications across multiple suppliers in real-time. Furthermore, data analytics tools provide insights into market trends, enabling suppliers to better forecast demand and adjust their inventory accordingly. This data-driven approach fosters greater transparency and efficiency in the entire supply chain.

Regulatory Landscape

The UK used car parts market operates within a complex regulatory framework designed to ensure consumer safety, protect the environment, and maintain fair trading practices. Understanding these regulations is crucial for businesses operating in this sector, as compliance is essential for long-term success and avoiding legal issues. This section details the key aspects of the regulatory landscape impacting the used car parts industry in the UK.

Relevant Regulations Governing the Used Car Parts Market

The used car parts market in the UK is governed by a multitude of regulations, primarily concerning product safety, environmental protection, and consumer rights. These regulations extend across various government departments and agencies, impacting sourcing, processing, and sales of used parts. This comprehensive approach aims to minimize risks associated with the use of potentially unsafe or non-compliant parts.

Legal Requirements for Sourcing Used Car Parts

Compliance with legal requirements for sourcing used car parts is paramount. These requirements cover the provenance of parts, ensuring they are legally obtained and not stolen or salvaged from vehicles involved in accidents or with fraudulent histories. Verification processes are often required to establish the legitimacy of the parts’ origin.

- Vehicle Identification Numbers (VIN): Verification of VINs is crucial to track the history of the vehicle from which the part originated. This process helps prevent the use of parts from vehicles involved in accidents or with other issues that could compromise safety. Incorrect or forged VINs lead to significant legal repercussions.

- Import Regulations: If parts are sourced internationally, strict import regulations apply, requiring documentation and compliance with specific standards and safety criteria. Failure to adhere to these rules can result in penalties and import restrictions.

- Licensing and Permits: Depending on the type of business and scale of operations, licensing and permits may be required for sourcing, processing, and selling used car parts. These licenses ensure compliance with local regulations and legal frameworks.

Legal Requirements for Processing Used Car Parts

Processing used car parts, including cleaning, repair, or refurbishment, also has specific legal requirements. These ensure the parts meet the necessary safety standards for their intended use. Compliance with environmental regulations is also critical, covering the disposal of waste materials generated during the processing of parts.

- Safety Standards: Processing must adhere to established safety standards to ensure the parts’ structural integrity and functionality, preventing risks to consumers. This includes adhering to standards for materials and assembly.

- Environmental Regulations: Strict environmental regulations are in place regarding the disposal of waste generated during the processing of parts. Compliance with regulations regarding recycling and waste management is critical to avoid environmental penalties.

- Health and Safety Regulations: Processing facilities must comply with health and safety regulations to protect workers and prevent accidents during the handling, cleaning, and repair of parts. This includes the provision of safety equipment and training.

Legal Requirements for Selling Used Car Parts

Selling used car parts involves adherence to regulations concerning labeling, pricing, and warranties. This includes providing accurate information about the parts’ condition, origin, and intended use to consumers. Misrepresentation or failure to comply with labeling requirements can lead to legal action.

- Accurate Labeling: Clear and accurate labeling is essential, providing details about the part’s condition, specifications, and any potential limitations. Misleading or incomplete labeling can result in legal challenges.

- Pricing Transparency: Transparency in pricing is crucial to avoid allegations of unfair practices. Pricing should be justified by the part’s condition, demand, and market value.

- Warranties and Guarantees: Depending on the part and the sale agreement, warranties or guarantees may be required. These should be clearly stated and adhered to, ensuring consumer rights are protected.

Impact of Regulations on Market Practices

Regulations significantly impact market practices by influencing sourcing methods, processing techniques, and pricing strategies. Compliance costs can be substantial, especially for businesses operating on a large scale. These costs must be factored into business models to ensure profitability.

Recent Changes to Regulations and Their Effects

Several recent changes in environmental regulations have influenced the used car parts industry. These changes have impacted sourcing and disposal methods, necessitating adaptations in business operations. Examples include stricter guidelines for recycling and waste management, impacting processing and disposal costs.

Potential Legal Risks Associated with Used Car Parts Trade

Potential legal risks in the used car parts trade include misrepresentation of parts, non-compliance with safety standards, and breaches of consumer protection laws. Ensuring thorough due diligence in sourcing, processing, and selling is essential to mitigate these risks. Proper documentation and record-keeping are vital to defend against potential legal challenges.

Future Trends

The UK used car parts market is poised for significant transformations driven by evolving consumer preferences, technological advancements, and regulatory pressures. These shifts will impact businesses across the supply chain, demanding adaptability and innovation to remain competitive. Understanding these future trends is crucial for strategic planning and investment decisions.

The used car parts market will continue to experience substantial growth, driven by the increasing number of older vehicles on the road and the rising demand for cost-effective repair solutions. This will be further amplified by the growing trend of vehicle electrification, which presents both opportunities and challenges for the sector.

Predicted Trends in the UK Used Car Parts Market

The market is expected to experience growth fueled by factors like vehicle longevity and the increasing demand for sustainable solutions. Technological advancements will drive efficiency and transparency in the sourcing and distribution of parts.

Potential Impacts of Trends on Businesses

Businesses will need to adapt to changing consumer expectations by offering a wider range of sustainable and technologically advanced used car parts. This includes investing in digital platforms for improved inventory management, customer service, and supply chain visibility. Efficient logistics and streamlined processes will be critical to success.

Role of Sustainability in the Used Car Parts Industry

The used car parts industry has the potential to play a vital role in the circular economy. Businesses can achieve this by promoting the reuse and recycling of parts, focusing on environmentally friendly sourcing practices, and reducing their overall carbon footprint. For example, some companies are already exploring the use of recycled materials in the manufacturing of replacement parts.

Anticipated Advancements in the Sourcing and Distribution of Used Car Parts

The sourcing and distribution of used car parts will become more sophisticated, leveraging digital tools and data analytics. Improved tracking and traceability systems will enhance transparency and efficiency throughout the supply chain. Furthermore, online marketplaces and collaborative platforms will connect suppliers and buyers more effectively, increasing accessibility and reducing lead times. Examples include online platforms for used parts, and AI-driven systems for predicting and ordering parts based on demand.

Emerging Technologies Revolutionizing the Used Car Parts Industry

Several technologies hold the potential to transform the used car parts market. These include:

- Artificial Intelligence (AI): AI can analyze large datasets to predict demand for specific parts, optimize pricing strategies, and improve inventory management. AI can also automate the process of identifying compatible parts for different vehicles, enhancing efficiency and reducing errors.

- Blockchain Technology: Blockchain can enhance transparency and traceability throughout the supply chain, ensuring the authenticity and quality of parts. This can help reduce fraud and build consumer trust. Examples include verifiable records of a part’s history, origin, and quality.

- 3D Printing: While not widespread yet, 3D printing could offer bespoke solutions for specialized parts, reducing reliance on traditional manufacturing methods. This is particularly relevant for rare or discontinued parts.