Deprecated: mb_convert_encoding(): Handling HTML entities via mbstring is deprecated; use htmlspecialchars, htmlentities, or mb_encode_numericentity/mb_decode_numericentity instead in /home/u432513765/domains/gamboahinestrosa.info/public_html/wp-content/themes/raylight-master-theme/functions.php on line 501

Securing affordable home insurance is a crucial step in responsible homeownership. Finding the right balance between cost and comprehensive coverage can feel overwhelming, but understanding the key factors influencing premiums empowers you to make informed decisions. This guide navigates the complexities of cheap home insurance rates, providing actionable strategies to reduce expenses without sacrificing essential protection.

We’ll explore how various factors—from your home’s features and location to your credit score and claims history—impact your insurance costs. Learn how to compare policies, negotiate rates, and leverage strategies for long-term savings. Ultimately, the goal is to equip you with the knowledge and tools necessary to find the best home insurance policy that fits your budget and protects your most valuable asset.

Understanding “Cheap Home Insurance Rates”

Securing affordable home insurance is a priority for many homeowners. Understanding the factors that influence your premium is key to finding the best value. This involves examining your home’s characteristics, your location, and your personal risk profile. By carefully considering these elements, you can significantly reduce your insurance costs without sacrificing essential coverage.

Factors Influencing Home Insurance Costs

Several interconnected factors determine the cost of your home insurance. These include the value of your home, its construction materials, the presence of security systems, your claims history, and the location of your property. Insurance companies assess risk based on these factors, and higher-risk profiles typically result in higher premiums. For instance, a home built with fire-resistant materials will generally command a lower premium than a home constructed of more flammable materials. Similarly, a home equipped with a sophisticated security system may qualify for discounts.

Impact of Home Features on Premiums

Different aspects of your home directly impact your insurance rate. A home with a newer roof, for example, might receive a lower premium than a home with an aging roof needing replacement. The presence of a swimming pool, while adding value to your home, also increases the risk of accidents and therefore potentially raises your premiums. Similarly, homes in areas prone to natural disasters, such as wildfires or hurricanes, will likely have higher premiums. Conversely, energy-efficient features like updated insulation or solar panels might qualify you for discounts.

Tips for Lowering Home Insurance Expenses

Several strategies can help lower your home insurance costs without compromising your coverage. Maintaining a good credit score is crucial, as many insurers consider this a significant factor in risk assessment. Bundling your home and auto insurance with the same provider often leads to significant savings. Increasing your deductible, while requiring a larger upfront payment in case of a claim, can significantly reduce your monthly premium. Regular home maintenance, including preventative measures like roof inspections and plumbing checks, can demonstrate responsible homeownership and potentially lead to lower rates. Shopping around and comparing quotes from multiple insurers is also essential for finding the best deal.

Impact of Location on Insurance Rates

Your home’s location significantly influences your insurance premiums. Areas with high crime rates, a history of natural disasters, or a high frequency of insurance claims will typically have higher premiums. For example, homes located in coastal areas prone to hurricanes or flooding will generally have higher premiums than those situated inland. Similarly, homes in areas with a high incidence of theft or vandalism will command higher rates. Conversely, homes in safer, more stable neighborhoods may qualify for lower premiums.

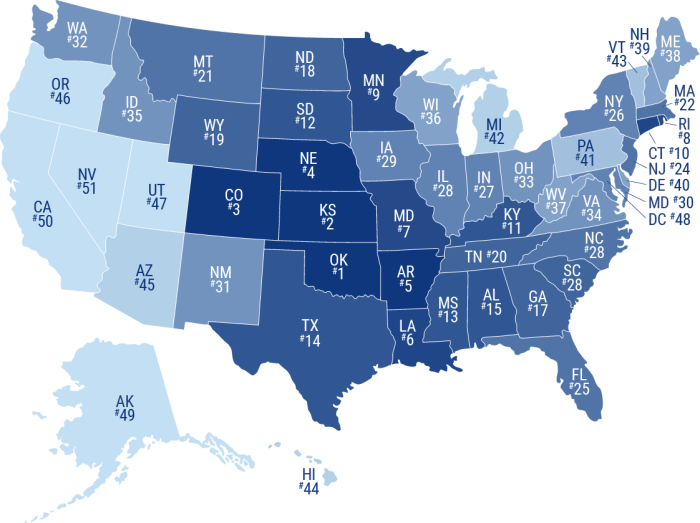

Average Home Insurance Costs Across Different States

The following table presents a comparison of average home insurance costs across several states. These figures are estimates and may vary based on several factors including the specific location within a state, the type of home, and the level of coverage. Note that these are average costs and individual premiums may differ significantly.

| State | Average Annual Premium | State | Average Annual Premium |

|---|---|---|---|

| California | $1,500 | Florida | $2,000 |

| Texas | $1,200 | New York | $1,800 |

| Illinois | $1,000 | Pennsylvania | $1,300 |

Finding Affordable Home Insurance

Securing affordable home insurance requires a strategic approach involving careful research, comparison shopping, and a thorough understanding of policy details. By understanding your needs and exploring various options, you can significantly reduce your premiums without compromising essential coverage. This section will guide you through the process of finding the best home insurance rates for your circumstances.

Reputable Insurance Providers and Competitive Rates

Several reputable insurance providers consistently offer competitive rates. These companies often leverage advanced technology and efficient operations to offer lower premiums while maintaining robust coverage. Factors influencing pricing include location, home value, coverage level, and individual risk profiles. It’s crucial to compare quotes from multiple insurers to identify the most favorable options. Examples of well-known providers include State Farm, Allstate, Geico, and Progressive, though local or regional insurers might offer even more competitive rates depending on your location. It’s recommended to check online reviews and ratings before committing to any provider.

Comparison of Home Insurance Policy Types

Homeowners insurance policies are categorized into different forms, each offering varying levels of coverage. The most common types include HO-3 (Special Form), HO-4 (Renters), and HO-6 (Condominium). An HO-3 policy provides comprehensive coverage for your home and belongings, protecting against a broad range of perils, excluding specifically named exclusions. An HO-4 policy, designed for renters, covers personal property against loss or damage. An HO-6 policy is tailored for condominium owners, covering personal belongings and structural damage to the unit itself, but typically excluding the building’s exterior. The choice of policy depends on your specific needs and ownership status. Carefully review the policy details to understand the extent of coverage provided by each type.

Bundling Home and Auto Insurance: Benefits and Drawbacks

Bundling home and auto insurance with the same provider often leads to significant discounts. Insurers reward customer loyalty and streamline administrative processes, resulting in lower premiums for both policies. However, bundling might limit your options if you find a better rate for one policy with a different insurer. The potential savings from bundling should be weighed against the flexibility of choosing separate insurers for optimal pricing on each policy. For example, if you find a significantly lower auto insurance rate with a different company, the savings might outweigh the bundled discount.

Understanding Policy Details and Deductibles

Understanding your policy’s details, including coverage limits and deductibles, is paramount. The deductible represents the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally lead to lower premiums, but require greater financial responsibility in the event of a claim. Conversely, lower deductibles result in higher premiums but offer more immediate financial protection. It’s crucial to choose a deductible that aligns with your financial capacity and risk tolerance. Carefully review your policy’s declarations page and coverage details to fully grasp the extent of your protection.

Step-by-Step Guide for Obtaining Multiple Quotes

Obtaining multiple quotes is a straightforward process. First, gather necessary information about your home, including its value, location, and features. Second, visit the websites of several reputable insurance providers and use their online quote tools. Third, complete the quote request forms accurately and completely. Fourth, compare the quotes you receive, paying close attention to coverage details, premiums, and deductibles. Finally, choose the policy that best suits your needs and budget. Remember to contact insurers directly if you have questions or require clarification on any aspects of the quotes.

Policy Coverage and Considerations

Securing cheap home insurance is only half the battle; understanding your policy’s coverage is equally crucial. A seemingly low premium might leave you vulnerable if you don’t have the right protection. This section details the various coverage options, claim processes, and common exclusions to help you make informed decisions.

Standard Coverage Options

Home insurance policies typically include several key coverage areas. Dwelling coverage protects the physical structure of your home against damage from covered perils (like fire or wind). Personal property coverage protects your belongings inside your home. Liability coverage protects you financially if someone is injured on your property or you damage someone else’s property. Additional living expenses coverage helps cover temporary housing and living costs if your home becomes uninhabitable due to a covered event.

Situations Requiring Specific Coverage

Consider the following scenarios to illustrate the importance of specific coverages: A burst pipe causing significant water damage to your home highlights the necessity of dwelling coverage. A theft of valuable jewelry underscores the importance of adequate personal property coverage with potentially higher limits for specific items. If a guest is injured on your property, liability coverage becomes crucial to protect you from potential lawsuits. A fire forcing you from your home temporarily demonstrates the value of additional living expenses coverage.

Assessing Home and Belongings Value

Accurately assessing your home’s and belongings’ value is vital for adequate insurance. For your home, you can use a recent appraisal, a comparative market analysis of similar properties in your area, or online home valuation tools as starting points. Remember to factor in any recent renovations or improvements. For personal belongings, a detailed inventory, ideally with photos and receipts, is recommended. Consider using a home inventory app or spreadsheet to organize this information. Categorize items by value and consider replacing high-value items like jewelry or electronics with higher coverage limits. Remember that inflation impacts replacement costs, so regular reviews of your coverage are recommended.

Filing a Claim and the Claims Process

Filing a claim typically involves contacting your insurance company immediately after an incident. You’ll need to provide details about the event, including date, time, and circumstances. The company will then assign an adjuster to investigate the claim and assess the damages. You may need to provide documentation, such as photos, receipts, and police reports. The adjuster will determine the extent of coverage and the amount of compensation. The process can take time, depending on the complexity of the claim. Be prepared to provide thorough and accurate information to expedite the process.

Common Exclusions in Home Insurance Policies

Understanding common exclusions is vital. A list of typical exclusions includes:

- Damage caused by floods or earthquakes (usually requires separate flood or earthquake insurance).

- Damage caused by normal wear and tear.

- Damage caused by intentional acts.

- Damage caused by neglect or lack of maintenance.

- Losses due to war or nuclear events.

- Certain types of insect or pest infestations.

It’s crucial to review your specific policy document for a complete list of exclusions.

Impact of Individual Factors on Rates

Your individual characteristics significantly influence the price you pay for home insurance. Insurers assess risk based on various factors, and understanding these factors can help you manage your premiums. This section details how personal attributes and choices impact your insurance costs.

Credit Score Influence on Premiums

Credit scores are a significant factor in determining home insurance premiums. Insurers often view a lower credit score as an indicator of higher risk. This is because individuals with poor credit history may be more likely to file claims or have difficulty paying premiums. For example, a person with a credit score below 600 might face significantly higher premiums compared to someone with a score above 750. The exact impact varies by insurer and state, but the correlation is consistently observed. Improving your credit score can lead to substantial savings on your home insurance.

Claims History and Rate Determination

Your claims history is a crucial factor in determining your insurance rates. Filing multiple claims, particularly for significant events, indicates a higher risk profile to insurance companies. Each claim filed increases your risk score, leading to higher premiums in subsequent years. Conversely, a clean claims history, demonstrating responsible homeownership, often results in lower premiums and potentially even discounts. For instance, someone with no claims in the past five years might qualify for a discount, whereas someone with two or more significant claims might face a considerable rate increase.

Home Security Features and Insurance Costs

Installing home security features can demonstrably lower your insurance premiums. Features such as alarm systems, security cameras, and reinforced doors and windows reduce the likelihood of burglaries and vandalism. Insurers recognize this reduced risk and offer discounts to homeowners who invest in these security measures. The discount amount varies depending on the specific features installed and the insurer’s policy, but it can represent a considerable saving over the long term. For example, a comprehensive security system might earn a 10-20% discount on premiums.

Lifestyle Choices Affecting Insurance Premiums

Certain lifestyle choices can also influence your home insurance rates. For instance, smokers may face higher premiums than non-smokers due to an increased risk of house fires. Similarly, homeowners engaging in high-risk activities, such as owning multiple dangerous pets or storing flammable materials improperly, might see increased premiums. These factors are assessed by insurers as indicators of potential risks, and higher risks translate to higher premiums. A homeowner with a history of reckless behavior might find themselves paying substantially more than someone with a more cautious lifestyle.

Visual Representation of Risk Factors and Insurance Costs

Imagine a pie chart. The largest segment represents the base cost of insurance, covering standard risks. Smaller segments represent various risk factors. A large segment might represent the homeowner’s credit score, showing a substantial influence on the total cost. Smaller segments would depict claims history, security features (positive or negative impact depending on presence and quality), and lifestyle choices. The size of each segment reflects its proportional contribution to the overall premium. A homeowner with a good credit score, no claims history, robust security, and a safe lifestyle would have a smaller pie chart, indicating a lower overall premium. Conversely, a homeowner with several risk factors would have a larger pie chart reflecting higher costs.

Long-Term Savings Strategies

Securing affordable home insurance isn’t just about finding the cheapest policy upfront; it’s about implementing long-term strategies to minimize expenses over the years. By proactively managing your insurance needs and leveraging available options, you can significantly reduce your overall costs and protect your financial well-being. This section details several methods for achieving substantial long-term savings on your home insurance premiums.

Increasing Deductibles

Raising your deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, is a common method to lower your premiums. A higher deductible means lower monthly or annual payments, as the insurance company assumes less risk. However, it’s crucial to weigh the potential savings against your ability to afford a larger upfront payment in the event of a claim. For example, increasing your deductible from $500 to $1000 could result in a 10-20% reduction in your premium, depending on your insurer and coverage. Carefully consider your financial situation and emergency fund before making this decision.

Maintaining a Good Credit Score

Insurance companies often use credit scores as an indicator of risk. Individuals with good credit scores are generally perceived as lower-risk policyholders, leading to lower premiums. Improving your credit score involves responsible financial management, including paying bills on time, keeping credit utilization low, and maintaining a diverse credit history. A higher credit score can translate into significant savings over the life of your insurance policy. For instance, a person with a credit score above 750 might qualify for a discount of 15-25% compared to someone with a lower score.

Loyalty Programs

Many insurance companies offer loyalty programs that reward long-term policyholders with discounts or other benefits. These programs often incentivize customers to renew their policies year after year, leading to cumulative savings. Loyalty programs can include discounts on premiums, bundled services, or access to exclusive customer support. By staying with a reputable insurer and consistently meeting their requirements, you can reap the rewards of these programs and maintain lower insurance costs over time.

Bundling Policies

Combining your home insurance with other types of insurance, such as auto or renters insurance, from the same company often results in significant discounts. Insurers frequently offer bundled packages at a lower overall price than purchasing each policy separately. This strategy is particularly effective for those who already have multiple insurance needs, allowing them to streamline their coverage and reduce their expenses. The exact discount will vary by insurer and the specific policies bundled.

Flowchart for Securing Affordable Home Insurance

[Diagram description: A flowchart illustrating the steps to secure the most affordable home insurance policy. It begins with “Assess your needs and risk tolerance,” branching to “Compare quotes from multiple insurers,” followed by “Evaluate policy coverage and deductibles,” then “Check for discounts and loyalty programs,” and finally, “Choose the most suitable policy and maintain good credit.” Each step is connected with arrows indicating the flow of the process. The final step emphasizes ongoing maintenance of good credit and active engagement with loyalty programs to maintain long-term savings.]

Conclusive Thoughts

Successfully navigating the world of cheap home insurance rates requires careful planning and proactive engagement. By understanding the factors influencing premiums, comparing policies diligently, and employing long-term savings strategies, you can secure affordable coverage without compromising protection. Remember, securing the right insurance isn’t just about finding the lowest price; it’s about finding the best value—a policy that provides peace of mind and financial security.

FAQ Section

What is a deductible, and how does it affect my premium?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally lead to lower premiums, as you’re accepting more financial responsibility.

How often should I review my home insurance policy?

It’s advisable to review your policy annually, or whenever significant changes occur (e.g., home improvements, changes in coverage needs).

Can I get home insurance if I have a poor credit score?

While a poor credit score can impact your premiums, you can still obtain home insurance. However, expect higher rates than those with excellent credit. Consider improving your credit score over time to potentially secure better rates.

What happens if I file a claim and my insurer denies it?

If your claim is denied, carefully review the reasons provided by your insurer. You may have grounds to appeal the decision, potentially with the help of an insurance professional or legal counsel.