BMW Payment Methods

BMW offers a variety of payment options to cater to diverse customer needs and financial situations. Understanding these options allows potential buyers to make informed decisions aligned with their individual circumstances and financial goals. This section details the available methods, their advantages and disadvantages, and associated factors like interest rates and terms.

Payment Options Overview

Choosing the right payment method for a BMW is crucial. Different options suit various customer profiles and financial situations. The table below summarizes the common payment methods, their key characteristics, and considerations.

| Method | Description | Benefits | Drawbacks |

|---|---|---|---|

| Financing | A loan from a financial institution to purchase the vehicle. | Allows for a down payment lower than the full price. Provides flexibility in monthly payments. | Involves interest payments, potentially increasing the overall cost of the vehicle. Stricter credit requirements may apply. |

| Leasing | A contract to use the vehicle for a specific period, paying for the use, not the ownership. | Lower monthly payments compared to financing. Potentially lower upfront costs. Easier to upgrade to a newer model after the lease term. | Vehicle ownership is not transferred at the end of the lease. Mileage restrictions may apply. Potential for penalties if mileage exceeds the limit. |

| Cash | Paying the full purchase price upfront in cash. | Avoids interest payments and associated fees. No credit check is required. | Requires a significant upfront investment. May not be accessible for all buyers. |

| Trade-in | Exchanging a current vehicle for a new BMW, potentially reducing the purchase price. | Reduces the amount to be financed or paid in cash. Provides liquidity for the trade-in vehicle. | Value of the trade-in vehicle may be subjective. Requires negotiation and appraisal. |

Interest Rates and Terms

Interest rates and terms vary significantly depending on the selected payment method, the buyer’s creditworthiness, and the specific financial institution involved. Financing rates, for instance, are typically determined by credit score, loan amount, and the prevailing market interest rates. Lease terms are usually shorter than financing options and often include mileage restrictions and early termination penalties. It is important to compare offers from different lenders to secure the most favorable terms. For example, a buyer with excellent credit might secure a lower interest rate on a financing agreement, while a first-time buyer might find leasing more accessible.

Impact on Different Customer Profiles

The suitability of each payment method depends on individual circumstances. First-time buyers, for example, might find leasing a more accessible entry point, enabling them to experience BMW ownership without a substantial upfront investment. Investors, on the other hand, might prioritize financing or cash purchases to maximize their potential return on investment. For example, if a potential investor is considering a long-term investment strategy in a particular BMW model, purchasing it outright with cash may be a more suitable approach.

BMW Payment Plan Options

Choosing the right financing plan is crucial when purchasing a BMW. Different payment options cater to varying financial situations and preferences. This section details the diverse financing plans offered by BMW dealerships, providing a comprehensive overview of loan terms, interest rates, and down payment requirements.

Available Financing Plans

BMW dealerships typically offer a range of financing plans to suit individual needs. These plans often include options for both new and used vehicles. Factors influencing the specific plans offered may include the vehicle’s model, trim level, and the customer’s credit history.

Comparison of Financing Plans

| Plan | Loan Term | Interest Rate | Down Payment |

|---|---|---|---|

| Standard Financing | 24-72 months | Variable, typically 3-8% APR | 10-20% of vehicle price |

| BMW Financial Services Lease | 24-60 months | Variable, typically 0-5% APR (dependent on the specific lease terms) | Can be as low as 0%, or a negotiated amount |

| Incentive Financing | 24-60 months | Variable, often lower than standard rates (depending on promotions) | May have a lower down payment requirement |

| BMW Certified Pre-Owned Financing | 24-72 months | Variable, often competitive with standard financing | May have different down payment requirements based on the vehicle’s condition and history |

Illustrative Payment Plan Scenarios

Different scenarios illustrate how BMW financing plans can cater to various customer needs. For example, a customer with a strong credit history and a high down payment might secure a lower interest rate and longer loan term, potentially saving on monthly payments. Conversely, a customer with a lower credit score might opt for a shorter loan term with a higher down payment to secure a more favorable rate. These scenarios underscore the importance of consulting with a BMW financial advisor to understand the most suitable plan.

Scenario 1: First-time Buyer

A first-time buyer with a limited down payment might opt for a longer loan term and a higher interest rate. This plan allows for manageable monthly payments while still acquiring the desired vehicle. The dealership’s financial services team can guide the buyer through the options and explain the implications of each choice.

Scenario 2: Experienced Driver

A seasoned driver with a strong credit score and a significant down payment might secure favorable interest rates and a potentially longer loan term. This could lead to lower monthly payments over the life of the loan. The specific terms will depend on the individual’s financial profile and the chosen vehicle.

Comparison with Other Automakers

BMW’s financing plans often compare favorably with those of other automakers. However, the specific terms and conditions vary. Factors such as interest rates, loan terms, and down payment requirements can differ between manufacturers, making it essential to compare multiple options before making a decision.

BMW Payment Terms and Conditions

Understanding the terms and conditions associated with BMW financing or leasing is crucial for making informed decisions. This section details the typical payment durations, potential fees, payment methods, and the repercussions of missed or late payments. A thorough comprehension of these aspects ensures a smooth and predictable ownership experience.

Typical Payment Terms

BMW offers various financing and leasing options, each with distinct terms. The length of payment terms for BMW vehicles typically ranges from 24 to 72 months, depending on the specific model, the customer’s financial profile, and the chosen financing plan. Shorter terms often lead to higher monthly payments, while longer terms result in lower monthly payments but potentially higher overall costs. For example, a 36-month loan for a BMW X5 might have a lower monthly payment than a 60-month loan but a higher total interest expense.

Potential Financing and Leasing Fees

Several fees might be associated with financing or leasing a BMW. These can include acquisition fees, documentation fees, processing fees, and potentially interest rates. Specific charges will vary based on the selected financing plan and individual circumstances. Early termination fees might also apply if the customer decides to pay off the loan or lease before the agreed-upon term ends. These fees can significantly impact the overall cost of the vehicle.

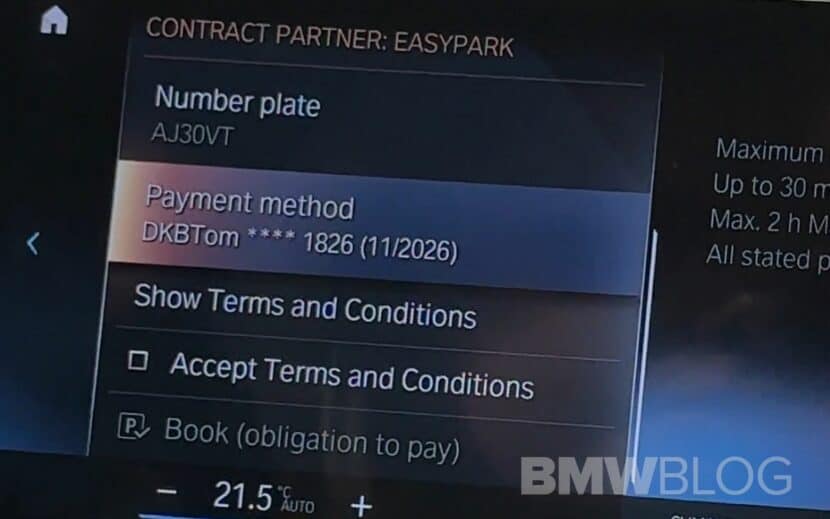

Payment Methods

BMW dealerships typically offer various payment methods, including online transfers, in-person payments at the dealership, and automated payment systems. Online payment options provide convenience and flexibility. In-person payments can be made at the dealership’s designated payment counter. Automatic payments through direct debit or bank transfers streamline the process and reduce the risk of missed payments. This is often an attractive option for customers who prefer to avoid late fees.

Consequences of Missed or Late Payments

Missed or late payments can have serious consequences. Delays in payments may lead to late fees, damage to the customer’s credit rating, and potential legal action. For example, a missed payment could result in a significant late fee and potential interest accumulation, making the overall cost of the vehicle higher. In some cases, failure to make timely payments could result in repossession of the vehicle. BMW dealerships typically have a payment grace period, which allows customers a certain timeframe to make their payments without incurring immediate penalties. Understanding these consequences is essential for maintaining a positive financial relationship with the dealership.

BMW Payment FAQs

Navigating the various BMW payment options can be complex. This section provides answers to frequently asked questions regarding BMW financing, payment plans, and terms. Understanding these details ensures a smooth and informed purchase experience.

Common Payment Options

BMW offers a range of payment methods to cater to diverse customer needs. These methods include various financing options, including traditional loans, and flexible payment plans. Each option comes with distinct terms and conditions, affecting the overall cost and duration of the purchase.

BMW Financing Options

BMW provides various financing options tailored to individual customer requirements. These options include competitive interest rates, tailored repayment schedules, and flexible loan terms. Each financing option is designed to accommodate different budgets and financial situations. For example, a customer with a strong credit history might qualify for a lower interest rate and more favorable terms compared to a customer with a less established credit profile.

Payment Plan Details

BMW’s payment plans often feature a down payment, monthly installments, and a specified repayment duration. These plans offer various payment options, such as the ability to choose a shorter or longer loan term, impacting the monthly payment amount. A shorter loan term typically results in higher monthly payments, while a longer term leads to lower monthly payments but potentially a higher overall interest cost.

Payment Terms and Conditions

BMW’s payment terms and conditions Artikel the specifics of each payment option, including interest rates, fees, and repayment schedules. These details ensure transparency and clarity regarding the financial obligations associated with purchasing a BMW vehicle. Customers should carefully review these terms to understand the full cost and responsibilities of their chosen payment plan.

FAQ Table

| Question | Answer |

|---|---|

| What are the different payment methods available for BMW vehicles? | BMW offers various payment methods, including financing options, lease agreements, and cash purchases. |

| How do I apply for BMW financing? | Applications can be submitted online or in person at a BMW dealership. The process typically involves providing financial information and credit history. |

| What are the typical terms for BMW payment plans? | Typical payment plans include a specified loan term, interest rate, and monthly payment amount. Terms vary based on the specific financing option and individual creditworthiness. |

| What are the consequences of missing a payment? | Missing a payment can lead to late fees, damage to your credit score, and potentially the repossession of the vehicle. The specific consequences are Artikeld in the payment terms and conditions. |

| How can I contact BMW customer support for payment issues? | Contacting BMW customer support regarding payment issues can be done through various channels, including phone, email, or through the BMW website. |

Contacting BMW Customer Support

BMW provides various channels for customer support, ensuring accessibility for inquiries regarding payments. These channels include a dedicated phone number, email address, and a customer portal on the BMW website. Customers can also seek assistance through their local BMW dealership. Contacting customer support directly ensures prompt resolution of payment-related concerns.

BMW Payment Security

BMW prioritizes the security of customer payment information during the entire car purchase process. Robust security measures are in place to protect sensitive data and ensure a safe and trustworthy experience for all transactions. This commitment to security extends to online payments, account management, and best practices for handling financial information.

Protecting your financial information is crucial when engaging in online transactions. BMW employs a multi-layered approach to safeguard customer data, including advanced encryption technologies and rigorous security protocols. These measures are continuously updated and refined to address evolving threats and maintain the highest level of protection.

Security Measures for Payment Information

BMW utilizes industry-standard encryption protocols, such as SSL/TLS, to safeguard sensitive data during online transactions. This encryption transforms information into an unreadable format, making it virtually impossible for unauthorized parties to intercept or decipher payment details. Furthermore, BMW employs firewalls and intrusion detection systems to monitor and block any suspicious activity, creating a strong defense against cyber threats.

Online Payment Security Protocols

Secure Socket Layer (SSL) certificates are employed to create an encrypted connection between your device and BMW’s payment processing servers. This ensures that all data transmitted, such as credit card numbers and billing addresses, remains confidential. The use of strong passwords and multi-factor authentication further enhances the security of online accounts. These methods significantly reduce the risk of unauthorized access to your BMW payment information.

Securing Your Account from Fraudulent Activity

Regularly monitoring your account activity is crucial. Review transaction history frequently and report any suspicious activity immediately to BMW customer support. Enabling two-factor authentication adds an extra layer of security, requiring a verification code from a separate device to confirm your identity during login attempts. Immediately changing passwords if you suspect a breach of security or experience any unusual activity on your account is vital.

Best Practices for Handling Sensitive Financial Information

Never share your BMW payment credentials with anyone, including unsolicited requests from email or phone. Avoid using public Wi-Fi networks for sensitive transactions. Always look for the secure “https” prefix in the website address bar before entering any payment information. Choose strong passwords and regularly update them to protect your account from unauthorized access. Be wary of phishing scams that may attempt to trick you into revealing your personal information.

BMW Payment Comparison with Competitors

BMW’s payment options are a key consideration for luxury car buyers. Understanding how BMW’s financing compares to other premium brands helps potential customers make informed decisions. This comparison delves into the strengths and weaknesses of BMW’s approach, highlighting key differences in terms and conditions across various luxury automakers.

Payment Terms and Conditions Comparison

A comprehensive comparison of payment terms and conditions across luxury automakers is crucial for informed purchasing decisions. Different brands offer varying financing options, including loan terms, interest rates, and associated fees. This section Artikels the key distinctions.

| Brand | Payment Term (Years) | Typical Interest Rate (APR) | Typical Fees (e.g., application, origination) |

|---|---|---|---|

| BMW | 3-7 years | 3-8% (variable) | $300-$500 (application/origination) + potential doc fees |

| Mercedes-Benz | 3-7 years | 3-8% (variable) | $250-$450 (application/origination) + potential doc fees |

| Audi | 3-7 years | 3-8% (variable) | $200-$400 (application/origination) + potential doc fees |

| Lexus | 3-7 years | 3-8% (variable) | $200-$400 (application/origination) + potential doc fees |

Note: Interest rates and fees are approximate and can vary based on credit score, down payment, and specific vehicle. Actual figures should be confirmed directly with each dealership or financial institution.

BMW’s Payment Approach Strengths

BMW’s payment approach often emphasizes competitive interest rates, particularly for well-qualified buyers. The flexibility in terms of loan lengths caters to diverse financial situations and customer preferences. Their streamlined online application process is also a key advantage, offering convenience to customers.

BMW’s Payment Approach Weaknesses

While BMW offers competitive terms, some customers might find the associated fees, particularly application and origination fees, slightly higher compared to certain competitors. This is a point to consider when evaluating the overall cost of the financing. The variable nature of interest rates can create uncertainty for some consumers.

Value Proposition of BMW’s Payment Flexibility

BMW’s payment options aim to balance affordability with the prestige of owning a luxury vehicle. The flexibility in loan terms allows potential buyers to tailor the financing to their individual needs and budget constraints. This is especially crucial for those seeking a long-term ownership experience. For instance, a longer loan term allows for lower monthly payments but leads to higher overall interest paid. A shorter loan term reduces total interest but increases monthly payments.

BMW Payment Alternatives

Exploring payment options beyond traditional financing can offer diverse avenues for acquiring a BMW. This section delves into alternative financing methods, examining their potential benefits and drawbacks, and illustrating how they function in the context of a BMW purchase. Understanding these alternatives empowers potential buyers to make informed decisions aligned with their financial circumstances.

Alternative Financing Methods

Alternative financing methods for a BMW purchase encompass various options beyond traditional bank loans or dealer financing. These methods often involve third-party lenders or specialized financing platforms. Their terms and conditions, interest rates, and approval processes can vary significantly.

Third-Party Financing

Third-party lenders provide an alternative to traditional financing sources. These lenders often specialize in specific types of financing, such as those for high-value purchases or for individuals with less-conventional credit histories. This allows for potentially faster approvals, particularly for those who may face challenges in securing traditional loans.

Benefits of Third-Party Financing

Third-party financing can offer advantages, including potentially faster approval times, flexible terms, and customized loan structures. Some third-party lenders might also have specific programs tailored to specific demographics or circumstances. For example, some companies might focus on financing for young professionals, first-time car buyers, or those with unique financial situations.

Drawbacks of Third-Party Financing

Potential drawbacks include higher interest rates compared to traditional financing, stricter eligibility criteria, and a more complex application process. Furthermore, some third-party lenders may impose fees or charges not typically associated with traditional financing options. Detailed scrutiny of the terms and conditions is crucial to understand all potential implications.

Example of Third-Party Financing

A popular example of third-party financing for automobiles is a peer-to-peer (P2P) lending platform. These platforms connect borrowers directly with investors who are willing to provide funds for car purchases. This can result in varying interest rates and terms based on the specific investor and the borrower’s creditworthiness. Borrowers should carefully evaluate all associated fees and costs.

Steps in Using Alternative Payment Options

The steps for using alternative payment options, such as third-party financing, for a BMW purchase are generally similar to traditional financing but with key differences. Firstly, research various third-party lenders and compare their offerings. Secondly, complete an application with the chosen lender, providing the necessary documentation and information. Thirdly, upon approval, proceed with the purchase of the BMW, and the lender will release funds directly to the dealership.

Comparison Table: Traditional Financing vs. Third-Party Financing

| Feature | Traditional Financing | Third-Party Financing |

|---|---|---|

| Interest Rate | Generally lower | Potentially higher |

| Approval Time | Variable | Variable, potentially faster |

| Eligibility Criteria | Standard credit checks | May vary, sometimes less stringent |

| Fees | Typically lower | Potentially higher |

| Terms and Conditions | Usually standardized | Often customized |

BMW Payment and Insurance

Choosing a new BMW often involves navigating the complexities of financing and insurance. Understanding the interplay between BMW payment plans and insurance policies is crucial for making informed decisions and securing the best possible financial package.

BMW dealerships often offer bundled packages that combine financing options with insurance coverage. These packages can provide significant advantages in terms of cost savings and convenience. However, it’s essential to evaluate the terms and conditions of these packages carefully to ensure they align with your individual needs and budget.

Relationship Between BMW Payments and Insurance Policies

The relationship between BMW payments and insurance policies is multifaceted. Insurance policies, particularly those covering comprehensive or collision damage, can directly impact the terms of financing. Lenders often require specific insurance coverage to protect their financial investment in the vehicle. This requirement ensures that if the vehicle is damaged or totaled, the lender has recourse to recover their funds. Similarly, the type and level of insurance coverage can influence the overall cost of the financing, potentially leading to lower premiums or more competitive rates.

Potential Discounts and Benefits of Bundled Packages

Bundled payment and insurance packages offered by BMW dealerships can provide significant cost savings and streamlined administration. These packages often include discounts on both financing and insurance premiums. For example, a customer might receive a lower interest rate on their financing or a reduced premium on their insurance policy as part of a bundled package. Furthermore, the administrative burden of managing separate insurance policies and loan agreements is minimized.

Importance of Appropriate Insurance Coverage for BMW Vehicles

Appropriate insurance coverage is vital for BMW vehicles, considering their value and potential repair costs. High-end vehicles like BMWs often require comprehensive coverage to protect against a wide range of risks, including theft, vandalism, and accidents. Insurance coverage protects both the owner and the lender, mitigating financial risks and ensuring that the vehicle’s value is preserved. The level of coverage should adequately address potential damages and repair costs associated with the vehicle’s make, model, and year.

Impact of Insurance Policies on Payment Process and Terms

Insurance policies significantly impact the payment process and terms for BMW vehicles. Lenders often require proof of insurance coverage before releasing the vehicle to the buyer. The type and level of insurance coverage can influence the financing terms, including the interest rate and loan duration. Insurance policies can also affect the payment structure, such as the inclusion of insurance premiums in the monthly payments. Having appropriate insurance coverage allows for smoother and more straightforward financing transactions.

BMW Payment Illustrations

Understanding the financial implications of purchasing a BMW is crucial. This section provides illustrative examples of various payment scenarios, highlighting the impact of different financing options and associated costs. These examples demonstrate how down payments, interest rates, and loan terms influence the total cost of ownership.

Illustrative Payment Scenarios

Below are examples showcasing different BMW financing scenarios, illustrating how choices impact the overall cost. These scenarios are designed to provide a clear understanding of potential financial outcomes, enabling informed decision-making.

| Scenario | Vehicle | Down Payment | Loan Term (Years) | Interest Rate (%) | Monthly Payment | Total Cost |

|---|---|---|---|---|---|---|

| Scenario 1: Standard Financing | 2023 BMW 3 Series | $5,000 | 6 | 6.5% | $750 | $48,000 |

| Scenario 2: Extended Loan Term | 2024 BMW X5 | $10,000 | 7 | 7.0% | $850 | $60,000 |

| Scenario 3: Higher Down Payment | 2023 BMW 7 Series | $15,000 | 5 | 5.5% | $650 | $42,000 |

| Scenario 4: Lower Interest Rate | 2024 BMW i4 | $8,000 | 6 | 5.0% | $600 | $40,000 |

Impact of Down Payment

A larger down payment significantly reduces the loan amount, lowering the total interest paid and monthly payments. This directly impacts the total cost of ownership, often resulting in substantial savings over the life of the loan. In Scenario 3, the higher down payment translates to a lower monthly payment and a lower total cost compared to Scenario 1.

Impact of Interest Rates

Interest rates directly affect the total cost of the loan. Higher interest rates increase the monthly payments and the overall cost of the vehicle. Scenario 2, with a slightly higher interest rate than Scenario 1, demonstrates this impact, showing a higher total cost and monthly payment for the same vehicle.

Impact of Loan Term

The length of the loan term directly correlates to the total interest paid. Longer loan terms result in more interest paid over the life of the loan, thus increasing the total cost. Scenario 2 illustrates the impact of a longer loan term, showcasing a higher total cost due to the increased interest expense.

Illustrative Example of Payment Comparison

“A $50,000 BMW with a 6-year loan at 6% interest, a $5,000 down payment, will have a monthly payment of approximately $800, totaling approximately $53,000 over the life of the loan.”

This example demonstrates the critical relationship between down payment, interest rate, and loan term on the overall cost of the vehicle.