Securing the right auto and home insurance is crucial for financial protection. This guide delves into the process of identifying the best-rated policies, considering factors beyond simple price comparisons. We’ll explore how rating agencies assess insurers, examine key policy features, and provide practical advice for navigating the complexities of insurance selection.

Understanding coverage limits, deductibles, and the nuances of different policy types is paramount. We’ll equip you with the knowledge to make informed decisions, ensuring your assets and well-being are adequately protected against unforeseen circumstances. This involves researching reputable providers, comparing quotes effectively, and carefully reviewing policy documents to avoid unexpected pitfalls.

Defining “Best Rated”

Determining the “best rated” auto and home insurance providers requires a multifaceted approach, going beyond simple advertising claims. A truly comprehensive evaluation considers several key factors, ensuring a balanced assessment of insurer performance and customer experience. This analysis prioritizes objective data and established rating methodologies to provide consumers with a clear and informed perspective.

The criteria for determining “best rated” encompass customer satisfaction, financial stability, and the efficiency of the claims process. High customer satisfaction scores indicate a positive experience with policy management, customer service responsiveness, and ease of filing claims. Financial strength ratings assess the insurer’s ability to meet its obligations, providing confidence that claims will be paid promptly. Finally, a smooth and efficient claims settlement process ensures minimal disruption and stress for policyholders during difficult times.

Reputable Rating Agencies and Methodologies

Several reputable rating agencies utilize rigorous methodologies to evaluate insurance companies. These agencies collect data from various sources, including customer surveys, financial statements, and regulatory filings. Their assessments provide valuable insights into the relative strengths and weaknesses of different insurers. Examples of prominent rating agencies include A.M. Best, Moody’s, Standard & Poor’s, and J.D. Power. Each agency employs a unique scoring system, but generally, higher scores indicate better financial stability and customer satisfaction. For instance, A.M. Best uses a letter rating system, while J.D. Power uses numerical scores based on customer surveys.

Comparative Analysis of Rating Systems

Different rating systems have strengths and weaknesses. A.M. Best’s focus on financial strength provides a reliable measure of an insurer’s long-term viability. However, it may not fully capture customer satisfaction aspects. Conversely, J.D. Power’s customer satisfaction surveys offer valuable insights into the policyholder experience but might not reflect the insurer’s overall financial health. A balanced assessment should consider ratings from multiple agencies to gain a comprehensive understanding of an insurer’s performance. Moody’s and Standard & Poor’s offer financial strength ratings similar to A.M. Best, providing additional perspectives and cross-referencing opportunities.

Comparison of Rating Agencies

| Agency Name | Criteria Used | Weighting of Criteria (Illustrative) | Data Source |

|---|---|---|---|

| A.M. Best | Financial strength, underwriting performance, claims handling, operational efficiency | Financial strength (50%), Operational efficiency (30%), Customer satisfaction (20%) | Financial statements, regulatory filings, industry surveys |

| J.D. Power | Customer satisfaction with claims process, policy servicing, and overall experience | Claims satisfaction (40%), Policy servicing (30%), Overall satisfaction (30%) | Customer surveys |

| Moody’s | Financial strength, liquidity, capitalization, and overall creditworthiness | Financial strength (60%), Liquidity (25%), Capitalization (15%) | Financial statements, regulatory filings, market analysis |

Auto Insurance Features and Best Practices

Choosing the right auto insurance policy can feel overwhelming, but understanding the key features and best practices can simplify the process and ensure you have the protection you need. This section will delve into the specifics of comprehensive auto insurance, helping you make informed decisions about your coverage.

Comprehensive auto insurance policies offer a range of protections beyond the basic requirements. Understanding these features is crucial for securing your financial well-being in the event of an accident or unforeseen circumstances.

Key Features of Comprehensive Auto Insurance

Comprehensive auto insurance goes beyond the minimum liability coverage mandated by most states. It typically includes liability coverage, collision coverage, comprehensive coverage, and potentially additional options like uninsured/underinsured motorist coverage and medical payments coverage. Let’s explore these in detail. Liability coverage protects you financially if you cause an accident resulting in injuries or property damage to others. Collision coverage covers damage to your vehicle resulting from a collision, regardless of fault. Comprehensive coverage protects against damage to your vehicle caused by non-collision events, such as theft, vandalism, fire, or weather-related incidents. Uninsured/underinsured motorist coverage provides protection if you’re involved in an accident with an uninsured or underinsured driver. Medical payments coverage helps pay for medical expenses for you and your passengers, regardless of fault. The specific inclusions and limits vary between insurance providers and policies.

Understanding Coverage Limits and Deductibles

Coverage limits define the maximum amount your insurance company will pay for a specific type of claim. For example, a liability limit of 100/300/100 means your insurer will pay up to $100,000 for injuries to one person, $300,000 for injuries to multiple people in a single accident, and $100,000 for property damage. Deductibles are the out-of-pocket expenses you must pay before your insurance coverage kicks in. A higher deductible typically results in lower premiums, while a lower deductible means higher premiums but less out-of-pocket expense in case of a claim. Choosing the right balance between coverage limits and deductibles is a crucial aspect of effective insurance planning. For example, someone with a newer, more expensive car might opt for a lower deductible to minimize out-of-pocket costs in the event of an accident, even if it means paying slightly higher premiums.

Comparison of Auto Insurance Coverages

| Coverage Type | Description | Example |

|---|---|---|

| Liability | Covers injuries and damages you cause to others. | You rear-end another car, causing $5,000 in damages and $10,000 in medical bills for the other driver. Your liability coverage would pay for these costs. |

| Collision | Covers damage to your vehicle in an accident, regardless of fault. | You hit a deer, causing $2,000 in damage to your car. Your collision coverage would pay for the repairs. |

| Comprehensive | Covers damage to your vehicle from non-collision events. | A tree falls on your car during a storm, causing $3,000 in damage. Your comprehensive coverage would pay for the repairs. |

| Uninsured/Underinsured Motorist | Covers injuries and damages caused by an uninsured or underinsured driver. | You are hit by a driver who doesn’t have insurance. This coverage would help pay for your medical bills and vehicle repairs. |

Best Practices for Choosing an Auto Insurance Policy

Choosing the right auto insurance policy involves careful consideration of several factors. It’s important to compare quotes from multiple insurers to ensure you’re getting the best value for your money.

- Compare quotes from multiple insurers: Shop around and compare prices and coverage options from at least three different companies.

- Review your driving record: A clean driving record often translates to lower premiums.

- Consider your vehicle’s value: The value of your car influences the cost of collision and comprehensive coverage.

- Evaluate your needs and risk tolerance: Determine the level of coverage that best suits your financial situation and comfort level.

- Understand your policy’s terms and conditions: Carefully read the policy documents before signing.

- Maintain a good credit score: Your credit score can impact your insurance premiums in many states.

- Bundle your insurance: Combining auto and home insurance with the same company can often lead to discounts.

Home Insurance Coverage and Considerations

Securing adequate home insurance is crucial for protecting your most valuable asset. A comprehensive policy safeguards your financial well-being in the event of unforeseen circumstances, such as fire, theft, or natural disasters. Understanding the various components of a home insurance policy and the factors influencing its cost is essential for making an informed decision.

Essential Components of a Comprehensive Home Insurance Policy

A comprehensive home insurance policy typically includes several key components designed to cover a wide range of potential risks. These components work together to provide holistic protection for your property and personal belongings. Understanding these elements allows homeowners to tailor their coverage to their specific needs and budget.

Factors Influencing Home Insurance Premiums

Several factors significantly influence the cost of your home insurance premiums. These factors are assessed by insurance companies to determine the level of risk associated with insuring your property. A higher perceived risk generally translates to higher premiums.

| Factor | Impact on Premium | Example |

|---|---|---|

| Location | Higher risk areas (e.g., areas prone to hurricanes, wildfires, or earthquakes) typically result in higher premiums. | A home in a coastal area with a history of hurricanes will likely have higher premiums than a similar home in an inland location. |

| Home Value | The higher the value of your home, the more expensive the insurance will be, as the potential payout in case of damage is greater. | A $500,000 home will generally have higher premiums than a $250,000 home, all other factors being equal. |

| Coverage Level | Choosing higher coverage limits (e.g., higher dwelling coverage) will result in higher premiums. | Opting for replacement cost coverage instead of actual cash value coverage will lead to higher premiums but better protection. |

| Deductible | A higher deductible (the amount you pay out-of-pocket before insurance coverage kicks in) will typically result in lower premiums. | A $1,000 deductible will generally result in lower premiums than a $500 deductible. |

Comparison of Different Types of Home Insurance Coverage

Home insurance policies typically offer various types of coverage, each designed to protect specific aspects of your property and liability. Understanding these differences is key to choosing the right level of protection.

| Coverage Type | Description | Benefits | Exclusions |

|---|---|---|---|

| Dwelling Coverage | Covers damage to the physical structure of your home (walls, roof, foundation, etc.). | Protects against damage from covered perils (fire, wind, hail, etc.). | Typically excludes damage caused by normal wear and tear, neglect, or intentional acts. |

| Personal Property Coverage | Covers your belongings inside your home (furniture, clothing, electronics, etc.). | Protects against loss or damage to personal items from covered perils. | May exclude valuable items (jewelry, art) unless specifically scheduled. May have limits on certain types of property. |

| Liability Coverage | Protects you against lawsuits if someone is injured on your property or if you cause damage to someone else’s property. | Provides financial protection against legal costs and judgments. | Typically excludes intentional acts and business-related activities. |

| Additional Living Expenses (ALE) | Covers temporary living expenses if your home becomes uninhabitable due to a covered peril. | Helps cover hotel costs, meals, and other temporary living expenses. | Usually has limits on the duration and amount of coverage. |

Finding and Comparing Insurance Providers

Finding the best auto and home insurance requires diligent research and comparison shopping. Don’t settle for the first quote you receive; take the time to explore various providers and policies to ensure you’re getting the best coverage at the most competitive price. This process involves utilizing various resources and understanding the nuances of policy documents.

Choosing the right insurance provider involves more than just looking at the price. You need to consider the level of coverage, the reputation of the company, and the ease of working with their customer service team. A lower premium might seem attractive initially, but inadequate coverage could leave you financially vulnerable in the event of an accident or disaster.

Online Comparison Tools and Resources

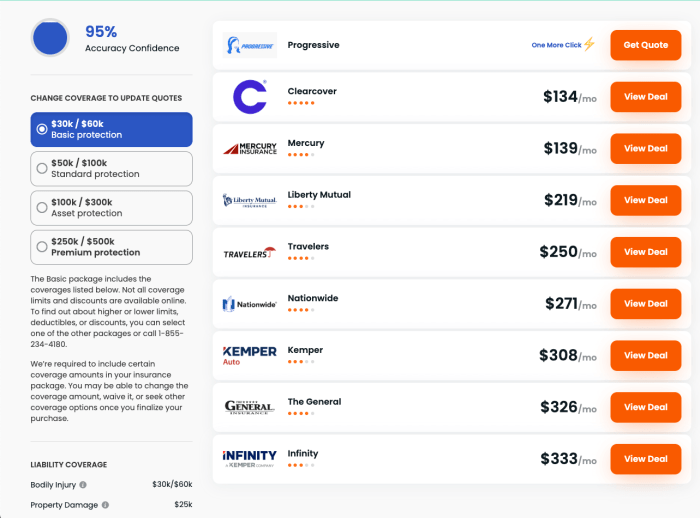

Many websites specialize in comparing insurance quotes from multiple providers simultaneously. These tools typically require you to input your personal information and details about your vehicle and home. They then generate a list of potential policies, allowing you to compare premiums, deductibles, and coverage options side-by-side. Reputable comparison sites often include user reviews and ratings, providing additional insights into customer experiences with different insurance companies. Remember to check the site’s privacy policy to ensure your data is handled securely. Examples of such sites include (but are not limited to) those specializing in insurance comparisons, and some general comparison shopping sites that include insurance among their offerings.

Reading Policy Documents

Before committing to any insurance policy, thoroughly review the policy document. This document Artikels the specific terms and conditions of your coverage, including what is and isn’t covered, your responsibilities, and the procedures for filing a claim. Pay close attention to the definitions of key terms, exclusions, and limitations. Understanding the fine print can prevent unexpected costs and disputes down the line. For example, a policy might cover damage from a fire but exclude damage caused by flooding, unless you have purchased a separate flood insurance rider.

Obtaining Quotes from Multiple Providers

Obtaining quotes is a straightforward process. First, gather the necessary information: your driver’s license and vehicle information for auto insurance, and your home’s address, value, and details about its construction for home insurance. Then, visit the websites of several insurance providers, or utilize online comparison tools. Fill out the quote request forms accurately and completely. You should receive quotes within a short period (often immediately for online quotes). Compare the quotes carefully, paying attention to the overall cost, coverage details, and customer reviews before making a final decision. Remember to ask questions if anything is unclear. For instance, you can inquire about discounts for bundling auto and home insurance, or for safety features in your vehicle or home security systems.

Understanding Policy Documents and Fine Print

Navigating the often-complex world of insurance policies requires a thorough understanding of their terms and conditions. Failing to grasp the nuances of your policy can lead to unexpected costs and inadequate coverage when you need it most. This section will illuminate key aspects of policy documents to help you make informed decisions.

Understanding policy exclusions and limitations is crucial. These sections detail situations or circumstances where your insurance coverage will not apply. Ignoring these exclusions can result in significant out-of-pocket expenses in the event of a claim. For instance, a standard homeowner’s policy might exclude flood damage, requiring a separate flood insurance policy for adequate protection. Similarly, auto insurance policies often exclude coverage for damage caused by wear and tear or intentional acts.

Policy Language and Common Misunderstandings

Insurance policy language can be dense and filled with jargon. This often leads to misunderstandings and misinterpretations. Common errors include misreading deductibles, failing to understand the difference between liability and collision coverage, and overlooking limitations on specific types of claims. For example, believing that comprehensive coverage covers all damages, when in fact it excludes certain types of wear and tear or damage caused by specific events not explicitly covered, is a frequent misconception. Another common misunderstanding involves the difference between actual cash value (ACV) and replacement cost coverage for home insurance. ACV compensates for the depreciated value of an item, while replacement cost covers the full cost of replacing it with a new item.

Examples of Unexpected Outcomes Due to Policy Details

Several scenarios illustrate how seemingly minor details in insurance policies can have significant financial consequences. Imagine a homeowner with a policy that limits liability coverage to $100,000. If they are held liable for a $200,000 accident on their property, they would be responsible for the remaining $100,000. Similarly, an auto insurance policy with a high deductible can leave the policyholder with a substantial out-of-pocket expense after an accident. Another example could involve a renter’s insurance policy that excludes coverage for valuable items unless they are specifically listed on a schedule. Failing to schedule high-value electronics or jewelry could result in a significant loss if those items are damaged or stolen.

Key Terms and Phrases in Auto and Home Insurance Policies

It is essential to familiarize yourself with the key terminology used in your insurance policies. Understanding these terms will empower you to make informed decisions and avoid costly surprises.

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in.

- Premium: The regular payment you make to maintain your insurance coverage.

- Liability Coverage (Auto): Pays for damages or injuries you cause to others in an accident.

- Collision Coverage (Auto): Pays for damage to your vehicle, regardless of fault.

- Comprehensive Coverage (Auto): Pays for damage to your vehicle from events other than collisions, such as theft or vandalism.

- Actual Cash Value (ACV) (Home): The current market value of your property, minus depreciation.

- Replacement Cost (Home): The cost to replace your property with new, similar items.

- Liability Coverage (Home): Protects you from financial responsibility for injuries or damages to others on your property.

- Exclusion: A specific event or circumstance not covered by your insurance policy.

- Umbrella Policy: Provides additional liability coverage beyond your auto and home insurance policies.

Illustrative Scenarios

Real-world examples can highlight the importance of comprehensive auto and home insurance policies. Understanding these scenarios can help you appreciate the value of adequate coverage and the potential financial devastation avoided through proper insurance planning. The following examples illustrate situations where insurance proved invaluable.

Comprehensive Auto Insurance: A Crucial Investment

Imagine Sarah, a young professional, involved in a serious car accident. She lost control of her vehicle on a rain-slicked road, colliding with a parked car and subsequently hitting a brick wall. Her vehicle sustained significant damage, requiring extensive repairs, exceeding $15,000. The parked car also suffered considerable damage, estimated at $8,000. Furthermore, Sarah sustained moderate injuries, requiring medical treatment, physiotherapy, and time off work, resulting in lost wages. Her comprehensive auto insurance policy covered the cost of vehicle repairs, the damage to the other vehicle, her medical expenses, and a portion of her lost wages. Without this coverage, Sarah would have faced potentially crippling financial burdens. The policy’s collision and liability coverage, alongside her medical payments coverage, significantly mitigated the financial impact of this unfortunate event.

Homeowner’s Insurance: A Lifeline After a Natural Disaster

Consider the case of the Miller family, whose home was severely damaged during a devastating hurricane. The hurricane brought torrential rains and strong winds, causing widespread flooding and significant structural damage to their property. The roof was partially ripped off, windows were shattered, and the interior suffered extensive water damage. The estimated cost of repairs and replacement of damaged property reached $70,000. Their homeowner’s insurance policy covered the majority of these costs, including the roof repair, window replacement, and the remediation of water damage. The policy’s additional living expenses coverage also assisted the Millers in covering temporary housing and other essential expenses while their home was being repaired, preventing them from facing financial ruin. The insurance company’s swift response and efficient claims processing ensured the family could focus on recovery rather than financial stress.

Last Word

Choosing the best auto and home insurance involves careful consideration of various factors, from financial strength ratings to the specific coverage you need. By understanding the criteria used by rating agencies, comparing policy features, and thoroughly reviewing policy documents, you can confidently select a policy that offers comprehensive protection and peace of mind. Remember, proactive research and informed decision-making are key to securing the best possible insurance coverage.

Commonly Asked Questions

What is a deductible?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Lower deductibles mean lower monthly premiums but higher upfront costs in case of a claim.

How often should I review my insurance policies?

It’s recommended to review your policies annually, or whenever there’s a significant life change (e.g., marriage, new home, new car).

Can I bundle my auto and home insurance?

Yes, many insurers offer discounts for bundling auto and home insurance policies together.

What is the difference between liability and collision coverage?

Liability coverage protects you if you cause an accident, while collision coverage protects your vehicle in an accident regardless of fault.