- Top-Rated Home Insurance Providers in Colorado

- Types of Home Insurance Coverage in Colorado

- Factors Affecting Home Insurance Premiums in Colorado

- Understanding Insurance Policies and Clauses

- Choosing the Right Home Insurance Provider

- Illustrative Examples of Home Insurance Scenarios in Colorado

- End of Discussion

- FAQ Explained

Finding the best home insurance in Colorado can feel overwhelming, given the state’s diverse geography and potential for natural disasters like wildfires and hailstorms. This guide navigates the complexities of Colorado’s home insurance market, offering insights into top-rated providers, coverage options, and factors influencing premiums. We’ll explore key considerations to help you make an informed decision and secure the right protection for your valuable property.

Understanding your coverage needs is paramount. From dwelling protection and liability coverage to crucial add-ons like flood and earthquake insurance, we’ll clarify the nuances of different policy types and their implications. We’ll also delve into how factors such as location, home value, and credit score affect your premiums, equipping you with strategies to potentially lower your costs. Ultimately, this guide aims to empower you to choose a home insurance provider that best aligns with your specific circumstances and budget.

Top-Rated Home Insurance Providers in Colorado

Choosing the right home insurance provider is crucial for protecting your most valuable asset. Several factors influence the best choice, including coverage options, pricing, customer service, and financial stability. This section highlights five top-rated companies operating in Colorado, based on a combination of customer reviews and industry analyses. Remember that individual experiences may vary, and it’s always recommended to obtain multiple quotes before making a decision.

Top Five Home Insurance Companies in Colorado

The following table summarizes five highly-rated home insurance companies in Colorado. Note that rankings can fluctuate based on updated data and individual experiences. This information is intended as a starting point for your research.

| Company Name | Average Customer Rating | Number of Reviews | Key Features |

|---|---|---|---|

| State Farm | 4.5 stars | 10,000+ | Wide coverage options, competitive pricing, extensive agent network |

| Allstate | 4.4 stars | 8,000+ | Bundling discounts, various coverage levels, 24/7 claims service |

| Farmers Insurance | 4.3 stars | 7,000+ | Local agents, personalized service, strong financial stability |

| American Family Insurance | 4.2 stars | 6,000+ | Strong customer service reputation, various discounts, multiple policy options |

| Nationwide | 4.1 stars | 5,000+ | Comprehensive coverage, online tools and resources, financial strength |

Unique Selling Points of Top Colorado Home Insurance Providers

Understanding the unique strengths of each provider is vital for making an informed decision. Below, we highlight three distinct selling points for each of the top five companies. These are based on general industry perception and may not reflect every individual’s experience.

State Farm: 1. Extensive agent network across Colorado, providing easy access to local support. 2. Competitive pricing, particularly for bundled home and auto insurance. 3. Wide range of coverage options to cater to diverse needs.

Allstate: 1. Significant discounts available for bundling multiple insurance policies. 2. Multiple coverage levels to choose from, allowing customization to individual risk profiles. 3. 24/7 claims service for immediate assistance in case of emergencies.

Farmers Insurance: 1. Emphasis on personalized service from local agents who understand the specific needs of Colorado homeowners. 2. Strong financial stability, ensuring claims are paid reliably. 3. Focus on building long-term relationships with customers.

American Family Insurance: 1. Excellent customer service reputation consistently highlighted in reviews. 2. Offers various discounts, helping to lower premiums. 3. Provides multiple policy options beyond home insurance, such as auto, life, and renters insurance.

Nationwide: 1. Comprehensive coverage options that go beyond basic protection. 2. User-friendly online tools and resources for managing policies and filing claims. 3. Excellent financial strength rating, indicating a high level of solvency.

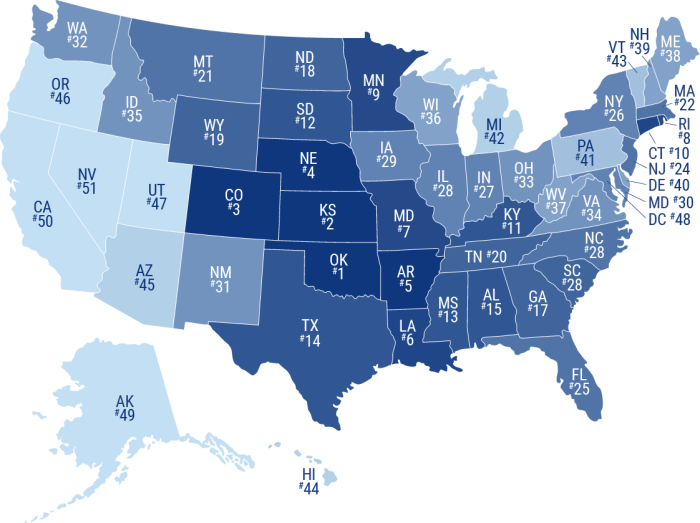

Geographic Reach of Home Insurance Companies in Colorado

Each company’s reach varies across Colorado. While many offer statewide coverage, some may have stronger presences in certain regions. It’s advisable to contact the companies directly to confirm their service areas and availability in your specific location.

State Farm and Allstate boast extensive networks across the entire state, ensuring widespread accessibility. Farmers Insurance, while also present statewide, might have a slightly denser network in more populated areas like Denver and Colorado Springs. American Family Insurance and Nationwide have a significant presence in Colorado but may have more limited reach in some rural areas compared to the larger national players.

Types of Home Insurance Coverage in Colorado

Choosing the right home insurance policy in Colorado requires understanding the various coverage options available. This ensures your property and personal belongings are adequately protected against unforeseen circumstances. Different policies offer varying levels of protection, and selecting the appropriate coverage depends on individual needs and the specific risks associated with your property’s location.

Protecting your home and belongings is crucial, and a comprehensive home insurance policy provides several key coverage types. These coverages work together to safeguard your investment and financial well-being in the event of damage or loss. Understanding these components is essential for making an informed decision when purchasing a policy.

Dwelling Coverage

Dwelling coverage protects the physical structure of your home, including attached structures like garages and decks. This coverage typically pays for repairs or rebuilding costs in the event of damage from covered perils, such as fire, wind, or hail. The amount of dwelling coverage you need should reflect the current replacement cost of your home, not its market value. This is because rebuilding costs can often exceed a home’s market value, particularly in areas with high construction costs or specialized materials. For example, a home valued at $500,000 might require $600,000 or more to rebuild after a significant event.

Liability Coverage

Liability coverage protects you from financial responsibility if someone is injured on your property or if you accidentally damage someone else’s property. This coverage can help pay for medical bills, legal fees, and settlements resulting from such incidents. For instance, if a guest slips and falls on your icy walkway and sustains injuries, liability coverage would help cover their medical expenses and potential legal costs. The amount of liability coverage you choose should reflect the potential severity of such incidents and your risk tolerance.

Personal Property Coverage

Personal property coverage protects your belongings inside your home, such as furniture, electronics, clothing, and jewelry. This coverage typically covers loss or damage from covered perils. It’s important to consider the replacement cost of your belongings, as the insurance payout will typically reflect this cost, not the item’s depreciated value. For example, if a fire destroys your valuable antique furniture, personal property coverage would help replace it with similar items at current market prices. It’s wise to create a detailed home inventory to accurately assess your personal property’s value and ensure adequate coverage.

Other Coverages

Several other coverages are commonly included in home insurance policies, such as loss of use (additional living expenses if your home becomes uninhabitable), medical payments to others (covering medical costs for guests injured on your property), and tree and shrub coverage. These additional coverages add a layer of comprehensive protection to your overall policy.

Coverage Limits Comparison

| Coverage Type | Typical Minimum Coverage Limit | Typical Maximum Coverage Limit | Factors Affecting Limits |

|---|---|---|---|

| Dwelling | $100,000 | Variable, often up to the full replacement cost | Home size, location, construction materials, and market conditions |

| Liability | $100,000 | $500,000 or more | Risk assessment, personal assets, and individual needs |

| Personal Property | 50% of dwelling coverage | Variable, often up to the full replacement cost | Value of belongings, personal inventory, and policy options |

Additional Coverage Considerations in Colorado

Given Colorado’s geographic features, including mountainous terrain and susceptibility to wildfires and flooding, it’s crucial to consider additional coverage options. Flood insurance is not typically included in standard home insurance policies and must be purchased separately through the National Flood Insurance Program (NFIP) or private insurers. Similarly, earthquake insurance is often an optional add-on, given the risk of seismic activity in certain parts of the state. For example, homeowners in areas prone to wildfires should strongly consider purchasing additional coverage to protect against losses from these events. This proactive approach can significantly mitigate financial risks associated with these natural hazards.

Factors Affecting Home Insurance Premiums in Colorado

Several key factors influence the cost of home insurance in Colorado, creating a complex equation that determines your individual premium. Understanding these factors can empower you to make informed decisions and potentially save money on your insurance. These factors interact in various ways, so a higher value in one area doesn’t always directly translate to a proportionally higher premium.

Several interconnected elements contribute significantly to the final cost. Your home’s characteristics, your personal history, and even the location of your property all play a role.

Location

The location of your home is a primary determinant of your insurance premium. Areas prone to wildfires, floods, or other natural disasters will generally command higher premiums due to the increased risk. For example, homes situated in the foothills near Boulder, while offering stunning views, may face higher premiums than those located in less geographically hazardous areas of Denver. Similarly, properties near bodies of water or in areas with a history of severe weather events will likely see increased costs. Insurance companies carefully assess the risk profile of each location, using historical data and predictive modeling to establish pricing.

Home Value and Coverage Amount

The value of your home directly impacts your premium. A more expensive home requires a higher coverage amount, naturally leading to a higher premium. This is because the insurance company’s potential payout in the event of a total loss is greater. The level of coverage you choose – whether you opt for replacement cost or actual cash value – also affects the cost. Replacement cost coverage, which aims to rebuild your home to its current value, is typically more expensive than actual cash value, which considers depreciation.

Credit Score

Surprisingly, your credit score can significantly influence your home insurance premium. Insurers often use credit scores as an indicator of risk. A higher credit score generally suggests a lower risk profile, potentially leading to lower premiums. This is based on the assumption that individuals with good credit are more likely to be responsible and manage their finances effectively, reducing the likelihood of late payments or disputes. The exact impact of credit score varies among insurance companies.

Claims History

Your claims history plays a significant role in determining your premium. Filing multiple claims, especially for significant events, can significantly increase your premiums. Insurers view frequent claims as an indication of higher risk, reflecting the increased probability of future claims. Maintaining a clean claims history is crucial for keeping your premiums manageable. Conversely, a long history without claims can potentially lead to lower premiums or discounts.

Building Materials and Construction

The materials used in your home’s construction and the overall quality of construction significantly impact your insurance premium. Homes built with fire-resistant materials, such as brick or concrete, often receive lower premiums than those constructed primarily of wood. Similarly, homes built with modern, more resilient construction techniques may also be viewed as less risky and therefore attract lower premiums. Older homes, particularly those lacking modern safety features, may face higher premiums.

Strategies to Lower Home Insurance Premiums

Homeowners can employ several strategies to potentially lower their insurance premiums. These actions demonstrate responsible homeownership and mitigate potential risks.

- Improve your credit score: A higher credit score can lead to lower premiums.

- Implement home safety measures: Installing security systems, smoke detectors, and fire-resistant roofing materials can reduce risk and potentially lower premiums.

- Increase your deductible: Choosing a higher deductible means you’ll pay more out-of-pocket in the event of a claim, but it can result in lower premiums.

- Bundle your insurance policies: Combining your home and auto insurance with the same company can often result in discounts.

- Shop around and compare quotes: Different insurance companies have different pricing structures, so comparing quotes from multiple providers is essential.

- Maintain a clean claims history: Avoid filing unnecessary claims to maintain a positive claims history.

- Consider discounts: Many insurers offer discounts for features like fire-resistant materials, security systems, or being a long-term customer.

Understanding Insurance Policies and Clauses

A thorough understanding of your Colorado home insurance policy is crucial for protecting your financial investment. Knowing what’s covered, what’s excluded, and the claims process can significantly impact your experience in the event of damage or loss. This section will detail the typical components of a standard policy, highlight common exclusions and limitations, and Artikel the claims process.

Typical Components of a Colorado Home Insurance Policy

Standard Colorado home insurance policies typically include several key components. These components define the scope of coverage and the insurer’s responsibilities. The specific details can vary between insurers and policy types, so reviewing your policy documents carefully is essential. Key components usually include dwelling coverage (protecting the structure of your home), other structures coverage (covering detached structures like garages or sheds), personal property coverage (protecting your belongings), loss of use coverage (providing temporary living expenses if your home becomes uninhabitable), and liability coverage (protecting you from lawsuits due to accidents on your property). Additionally, many policies include medical payments coverage for injuries sustained on your property, regardless of fault.

Common Exclusions and Limitations

It’s important to understand that home insurance policies don’t cover everything. Many policies exclude certain types of damage or losses. Common exclusions include damage caused by floods, earthquakes, and acts of war. Specific exclusions can vary, so it is critical to read your policy carefully. Limitations may also apply to the amount of coverage for specific items or types of damage. For example, there might be sublimits on jewelry or valuable collectibles. Understanding these exclusions and limitations will help you manage your risk and consider supplemental coverage if needed. For example, flood insurance is typically purchased separately from a standard homeowner’s policy.

The Home Insurance Claims Process in Colorado

Filing a claim can seem daunting, but understanding the process can ease the stress. The first step is to contact your insurance company as soon as possible after the damage occurs. Report the incident and provide relevant details. Many insurers have online portals or phone lines dedicated to claims reporting. Following this initial report, you will likely be assigned an adjuster who will assess the damage. It’s crucial to cooperate fully with the adjuster, providing all necessary documentation and access to your property. The adjuster will determine the extent of the damage and the amount of coverage applicable to your claim. Once the assessment is complete, the insurance company will issue a settlement offer. You may need to provide receipts and documentation to support your claim. Remember, maintaining detailed records of your possessions (including photos or videos) is highly recommended. This can significantly expedite the claims process and ensure accurate valuation of damaged items. Disputes may arise, and if a settlement is unsatisfactory, you may wish to explore mediation or other dispute resolution options.

Choosing the Right Home Insurance Provider

Selecting the right home insurance provider in Colorado is crucial for securing adequate protection and peace of mind. The best provider for you will depend on your specific needs, budget, and risk profile. Careful consideration of several factors, including coverage options, customer service, and pricing, is essential before making a decision.

Understanding the nuances of different providers and their services can significantly impact your overall experience. While price is often a primary concern, equally important is the quality of customer service you’ll receive should you need to file a claim.

Customer Service Experiences of Major Providers

Customer service experiences can vary significantly among major home insurance providers in Colorado. Direct comparison of reported experiences is difficult due to the subjective nature of reviews and the varying circumstances under which claims are filed. However, analyzing online reviews and industry reports provides some insight.

- Company A: Generally receives positive feedback for prompt claim processing and helpful customer service representatives. However, some negative reviews cite difficulties in reaching representatives during peak hours.

- Company B: Often praised for its user-friendly online portal and readily available customer support via phone and email. Negative comments occasionally mention longer-than-average wait times for claim settlements.

- Company C: Known for its competitive pricing, but customer service reviews are mixed, with some praising its efficiency and others reporting difficulties with communication and claim resolution.

Importance of Carefully Reading Policy Documents

Before committing to a home insurance policy, meticulously reviewing the policy documents is paramount. This seemingly tedious step is crucial to understanding your coverage, exclusions, and responsibilities. Overlooking crucial details can lead to unexpected financial burdens in the event of a claim.

Pay close attention to the following:

- Coverage limits: Ensure the coverage limits for dwelling, personal property, and liability are sufficient to protect your assets.

- Exclusions: Familiarize yourself with what is not covered by the policy, such as flood or earthquake damage (often requiring separate policies).

- Deductibles: Understand the amount you’ll have to pay out-of-pocket before the insurance coverage kicks in.

- Premium payment options: Review payment schedules and available payment methods.

Thoroughly understanding your policy is your best defense against unexpected costs and disputes.

Step-by-Step Guide to Comparing Quotes and Selecting a Policy

Comparing quotes and selecting the best home insurance policy involves a systematic approach. This ensures you make an informed decision based on your individual needs and budget.

- Assess your needs: Determine the level of coverage you require for your home and belongings. Consider factors like the value of your home, personal possessions, and potential liabilities.

- Obtain multiple quotes: Contact several reputable home insurance providers in Colorado and request quotes. Be sure to provide consistent information to each provider for accurate comparisons.

- Compare coverage details: Don’t just focus on price; compare the specific coverage offered by each provider. Look for discrepancies in coverage limits, deductibles, and exclusions.

- Review customer reviews and ratings: Check online reviews and ratings to gauge customer satisfaction with each provider’s claims handling and customer service.

- Read the policy documents carefully: Before making a final decision, carefully review the policy documents of your top choices to fully understand the terms and conditions.

- Select the best policy: Choose the policy that offers the best balance of coverage, price, and customer service, aligning with your specific needs and budget.

Illustrative Examples of Home Insurance Scenarios in Colorado

Understanding how different home insurance policies react to specific events is crucial for Colorado homeowners. This section provides illustrative examples of common scenarios, highlighting potential coverage and claims processes. Remember, specific coverage amounts and payouts depend on individual policy details and the extent of the damage.

Hailstorm Damage in Denver

A severe hailstorm pummels a Denver home, causing significant damage to the roof, siding, and windows. The homeowner has a standard homeowner’s insurance policy with a $1,000 deductible and $500,000 dwelling coverage. The damage assessment reveals $25,000 in repairs needed for the roof, $10,000 for siding replacement, and $5,000 for window repairs. The insurance company would likely cover the cost of repairs minus the deductible. Thus, the payout would be $35,000 ($40,000 total damage – $1,000 deductible – $4,000 for the portion exceeding the policy limit, assuming a policy limit applies). If the homeowner had chosen higher coverage limits, more of the damage would be covered. Comprehensive coverage would also cover damage to personal belongings inside the home caused by the storm. For instance, if hail broke several windows causing water damage to furniture, this would be covered under the personal property portion of the policy. Additional living expenses, if the home becomes uninhabitable due to the damage, could also be covered under the policy.

Wildfire Near Boulder

A wildfire breaks out near Boulder, and a homeowner’s house is threatened. The homeowner, possessing a policy with wildfire coverage, evacuates as the fire approaches. The house sustains partial damage to the exterior, including scorched siding and a damaged fence. The fire also damages some landscaping and outdoor furniture. The assessment reveals $15,000 in exterior repairs, $3,000 in landscaping restoration, and $2,000 in replacement costs for the outdoor furniture. The insurance company would likely cover these costs, again subject to the deductible and any policy limits. If the house were completely destroyed, the policy’s dwelling coverage would be applied to rebuild the home. Additional living expenses, to cover temporary housing and other necessities, would also be covered while the home is being repaired or rebuilt. It’s important to note that the extent of wildfire coverage can vary significantly between policies; some may have specific exclusions or limitations.

Plumbing Leak Causing Water Damage

A plumbing leak in a bathroom causes significant water damage to the flooring, walls, and some personal belongings. The homeowner has a standard policy. The water damage assessment shows $8,000 in repairs to the flooring and walls, and $2,000 in damage to furniture and personal belongings. The insurance company would likely cover these costs, minus the deductible. The claims process would involve filing a claim with the insurance company, providing documentation of the damage (photos, repair estimates), and potentially undergoing an inspection by the insurance adjuster. The payout would depend on the policy’s coverage limits and deductible. If the leak was caused by a pre-existing condition, like old pipes, and the homeowner failed to report or address it, the claim may be partially or fully denied, depending on policy details and the insurer’s assessment of the situation. Furthermore, policies often have sub-limits for specific types of damage, so it is vital to review the policy carefully.

End of Discussion

Securing adequate home insurance in Colorado requires careful consideration of numerous factors. By understanding the various coverage options, influencing premium factors, and the claims process, you can make a well-informed decision. Remember to compare quotes from multiple reputable providers, read policy documents thoroughly, and choose a company with excellent customer service. Protecting your home is a significant investment, and having the right insurance provides essential peace of mind.

FAQ Explained

What is the average cost of home insurance in Colorado?

The average cost varies greatly depending on location, home value, coverage, and individual risk factors. It’s best to obtain personalized quotes from multiple insurers.

How long does it take to get a home insurance quote?

Most insurers provide online quotes instantly, while others may require a few days for a full assessment.

Can I bundle my home and auto insurance in Colorado?

Yes, many insurers offer discounts for bundling home and auto insurance policies.

What is the difference between actual cash value and replacement cost coverage?

Actual cash value (ACV) covers the current market value of your property, minus depreciation. Replacement cost coverage pays to rebuild or replace your property at today’s costs.