Understanding homeowners insurance costs is crucial for responsible homeownership. This guide delves into the multifaceted factors influencing premiums, from location and home features to coverage options and personal financial history. We’ll explore strategies for securing affordable coverage while ensuring adequate protection for your most valuable asset.

Navigating the world of homeowners insurance can feel overwhelming, with numerous variables affecting the final price. This comprehensive guide aims to simplify the process by providing a clear understanding of the key factors at play, enabling you to make informed decisions and secure the best possible coverage for your needs and budget.

Factors Influencing Homeowners Insurance Costs

Understanding the factors that determine your homeowners insurance premiums is crucial for budgeting and making informed decisions. Several key elements significantly impact the cost of your policy, and knowing these can help you find the best coverage at a price you can afford. This section will explore the most influential factors, providing clarity and examples to aid your comprehension.

Top Five Factors Influencing Home Insurance Premiums

The cost of homeowners insurance is influenced by a complex interplay of factors. However, some stand out as having the most significant impact on your premium. The following table summarizes these top five factors.

| Factor | Description | Impact on Cost | Example |

|---|---|---|---|

| Location | Geographic location, including proximity to fire hazards, crime rates, and natural disaster zones. | Higher risk areas lead to higher premiums. | A home in a wildfire-prone area will cost significantly more to insure than a similar home in a low-risk area. |

| Home Value | The estimated replacement cost of your home and its contents. | Higher value homes require higher coverage and thus higher premiums. | A $500,000 home will have a higher premium than a $200,000 home, all other factors being equal. |

| Coverage Amount | The level of coverage you choose for your home and belongings. | Higher coverage amounts result in higher premiums. | Choosing a higher deductible will lower your premium, but you’ll pay more out-of-pocket in case of a claim. |

| Credit Score | Your credit history is often used by insurers to assess your risk profile. | A higher credit score typically results in lower premiums. | Individuals with excellent credit scores often qualify for discounts and lower rates. |

| Claim History | Your past claims history, both in frequency and severity. | More frequent or larger claims will lead to higher premiums. | Filing multiple claims in a short period can result in a significant premium increase. |

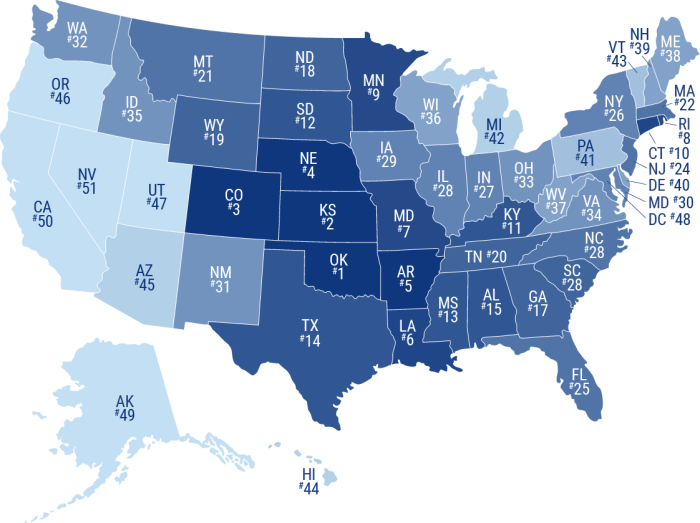

The Role of Location in Determining Insurance Costs

Geographic location is a primary driver of homeowners insurance costs. Insurers assess risk based on various location-specific factors. Homes situated in areas prone to natural disasters, such as hurricanes, earthquakes, or wildfires, command higher premiums due to the increased likelihood of significant damage. Similarly, areas with high crime rates or a history of significant property damage will generally have higher insurance costs. For instance, a home in a coastal region vulnerable to hurricanes will have substantially higher premiums compared to an identical home located inland. Conversely, a rural home far from fire hydrants and emergency services may face higher premiums than a similar urban home with readily available emergency response.

Influence of Home Features on Insurance Costs

Several features of your home directly impact insurance premiums. The age of your home is a significant factor; older homes often require more maintenance and may have outdated building materials, increasing the risk of damage and thus the insurance cost. The construction materials used in your home also influence premiums; homes constructed with fire-resistant materials like brick or stone tend to receive lower premiums than those built with wood. Security systems, such as alarms and monitored security, can significantly reduce premiums as they deter burglaries and reduce the risk of theft. Finally, the type of roof significantly impacts insurance costs; roofs made of durable materials like tile or metal generally result in lower premiums than those made of asphalt shingles, due to their greater longevity and resistance to damage.

Understanding Coverage Options and Their Costs

Choosing the right homeowners insurance policy involves understanding the various coverage options available and how they impact your premiums. This section will clarify the differences between common policy types, the relationship between coverage limits and cost, and the added expense and benefits of supplemental coverages. Making informed decisions in this area can significantly affect your financial protection and overall insurance costs.

Homeowners Insurance Policy Types and Their Premiums

Different homeowners insurance policies offer varying levels of protection. Understanding these differences is crucial for selecting a policy that adequately covers your needs without unnecessary expense. The most common types are HO-3 and HO-5.

- HO-3 (Special Form): This is the most common type of homeowners insurance. It provides open-peril coverage for your dwelling and other structures, meaning it covers damage from almost any cause except those specifically excluded in the policy (e.g., floods, earthquakes). Personal property is covered on a named-peril basis, meaning it only covers damage from specific listed events. HO-3 policies generally offer a good balance of coverage and affordability.

- HO-5 (Comprehensive Form): This policy offers broader coverage than an HO-3. It provides open-peril coverage for both your dwelling and personal property, meaning it protects against almost any cause of damage unless specifically excluded. While offering superior protection, HO-5 policies typically come with higher premiums.

The key difference lies in the breadth of personal property coverage. An HO-3 policy only covers specific perils for personal belongings, while an HO-5 covers all but explicitly excluded perils. This difference directly impacts the premium; the broader coverage of an HO-5 naturally results in a higher cost. For example, an HO-3 policy might cost $1,200 annually, while a comparable HO-5 policy for the same property could cost $1,500. The exact difference varies depending on location, coverage amounts, and other factors.

Coverage Limits and Their Impact on Premiums

The amount of coverage you choose directly affects your premium. Higher coverage limits mean you’ll receive more money if your property is damaged, but you’ll also pay more for your insurance. Conversely, lower coverage limits result in lower premiums but leave you less financially protected in the event of a significant loss.

For example, if you choose a dwelling coverage limit of $300,000, your premium will likely be higher than if you choose a limit of $250,000. The increase might seem small on a percentage basis, but the difference in payout in the event of a major loss could be substantial. It’s essential to find a balance between affordable premiums and sufficient coverage to rebuild your home and replace your belongings. Carefully assess your property’s value and your financial capacity to rebuild to determine the appropriate coverage limit.

Additional Coverage Options and Costs

Many homeowners choose to add supplemental coverage to their basic policy to protect against specific risks not included in standard policies. These add-ons come with additional costs but offer valuable peace of mind.

| Coverage Type | Cost (Example) | Benefits |

|---|---|---|

| Flood Insurance | $500 – $2,000+ annually (depending on location and risk) | Protects against damage from flooding, a peril often excluded from standard homeowners insurance. |

| Earthquake Insurance | Varies widely based on location and risk; can be significant | Covers damage caused by earthquakes, another peril typically excluded from standard policies. Earthquake zones will see higher costs. |

| Personal Liability Umbrella Policy | $150 – $300+ annually | Provides additional liability coverage beyond what’s included in your basic homeowners policy, protecting you from lawsuits. |

The costs of these additional coverages vary significantly based on factors like your location, the value of your property, and the specific coverage amounts you select. For example, flood insurance in a high-risk flood zone will be considerably more expensive than in a low-risk area. It is crucial to weigh the potential costs against the potential for loss in your specific location and circumstances.

Finding Affordable Homeowners Insurance

Securing affordable homeowners insurance is a crucial aspect of homeownership. Understanding the factors influencing premiums and employing effective strategies can significantly reduce your annual costs. This section will explore practical methods for finding and maintaining affordable coverage.

Finding the most affordable homeowners insurance requires a proactive approach. By implementing a combination of strategies, you can substantially lower your premiums while ensuring adequate protection for your home and belongings.

Strategies for Reducing Homeowners Insurance Costs

Several strategies can help you lower your homeowners insurance premiums. These methods involve proactive steps you can take to improve your property’s safety and manage your insurance profile effectively.

- Improve your home’s security: Installing security systems, including burglar alarms and smoke detectors, can significantly reduce your premiums. Many insurers offer discounts for these upgrades. For example, a professionally monitored alarm system might earn you a 5-10% discount.

- Increase your deductible: Choosing a higher deductible means you’ll pay more out-of-pocket in the event of a claim, but it will lower your premiums. Carefully weigh the potential cost of a higher deductible against the premium savings. A higher deductible, say from $500 to $1000, could result in a noticeable decrease in your annual premium.

- Bundle your insurance policies: Many insurers offer discounts if you bundle your homeowners insurance with other policies, such as auto insurance. This is a simple way to leverage savings by consolidating your coverage with a single provider.

- Shop around and compare quotes: Don’t settle for the first quote you receive. Obtain multiple quotes from different insurers to compare coverage options and premiums. This is crucial to ensure you’re getting the best value for your money.

- Maintain a good credit score: Your credit score is a significant factor in determining your insurance premiums. A higher credit score often translates to lower premiums. Improving your credit score can lead to substantial savings over time.

- Consider a claims-free history: Avoid filing small claims, as this can impact your future premiums. Only file claims for significant damages, as minor incidents can negatively affect your rate over the long term.

Obtaining Multiple Quotes from Different Insurers

The process of obtaining multiple quotes is straightforward but requires dedicated effort. Comparing policies and premiums from different insurers is essential to ensure you’re getting the best deal for your needs.

Start by identifying several reputable insurance companies in your area. You can use online comparison tools or contact insurance agents directly. Provide each insurer with consistent information about your property and coverage needs. Carefully review each quote, paying close attention to the coverage details and the premium amounts. Don’t just focus on the price; ensure the coverage adequately protects your home and possessions. A lower premium might not be worth it if the coverage is insufficient.

Impact of Credit Score and Claims History on Insurance Premiums

Both credit score and claims history significantly influence insurance premiums. Insurers use these factors to assess risk. A higher credit score generally indicates lower risk, leading to lower premiums. Conversely, a poor credit score might result in higher premiums. Similarly, a history of frequent claims suggests a higher risk profile, potentially leading to increased premiums or even policy cancellation.

Imagine two homeowners with similar properties and coverage needs. Homeowner A has an excellent credit score and a claims-free history, while Homeowner B has a poor credit score and a history of several claims. Homeowner A is likely to receive significantly lower premiums than Homeowner B, reflecting the lower perceived risk. This highlights the importance of maintaining a good credit score and avoiding unnecessary claims.

Illustrative Examples of Average Costs

Understanding the average cost of homeowners insurance requires considering several factors, and these costs can vary significantly depending on location, property characteristics, and coverage choices. The examples below illustrate how these factors influence premiums in different regions of the United States.

Let’s examine the average homeowners insurance cost for three distinct suburban homes located in different states: California, Texas, and Florida. These examples are illustrative and based on general market trends; actual costs will vary depending on specific circumstances.

Average Costs in Three States

Consider three similar homes, all approximately 2,000 square feet, with three bedrooms and two bathrooms. The homes are all relatively new, constructed within the last 10 years. However, their locations and specific characteristics introduce variations in cost.

California Home (Suburban Sacramento): This home, located in a moderately high-risk fire zone, might see an average annual premium of $2,500 to $3,500. The higher cost reflects the increased risk of wildfires and the higher value of homes in the area. The age of the home and its proximity to fire-prone areas contribute significantly to the premium.

Texas Home (Suburban Austin): This home, situated in a less risky area with lower property values than California, might have an average annual premium of $1,500 to $2,200. The lower cost is due to a lower risk of natural disasters and generally lower property values compared to California. The age and construction type of the home, assuming it’s similar to the others, also plays a role.

Florida Home (Suburban Orlando): This home, in a hurricane-prone region, might have an average annual premium of $2,000 to $3,000. The higher cost is due to the increased risk of hurricane damage. While the home itself might be relatively new, the location and potential for severe weather events drive up the cost.

Visual Comparison of Costs by Size and Age

To visualize the impact of home size and age on insurance costs, imagine a bar graph. The horizontal axis represents home size (in square feet), ranging from 1,000 to 3,000 square feet. The vertical axis represents the average annual insurance premium. Separate bars would represent homes of different ages (e.g., less than 10 years old, 10-20 years old, and over 20 years old) for each home size.

The graph would show a general upward trend: larger homes generally have higher premiums, and older homes, due to increased potential for wear and tear, also tend to have higher premiums than newer homes. The exact premium amount for each category will be affected by the location, and the construction materials.

Impact of Home Age and Construction Type

The age and construction type of a home significantly influence insurance costs. Older homes, regardless of size, generally command higher premiums due to increased vulnerability to damage and potential for outdated safety features. Similarly, the type of construction materials affects the cost. Homes constructed with more fire-resistant or durable materials may receive lower premiums than those built with more susceptible materials.

- Older Homes (Over 20 years): Higher premiums due to increased risk of wear and tear, outdated systems, and potential for needing more extensive repairs.

- Newer Homes (Less than 10 years): Lower premiums due to generally better condition, modern safety features, and lower risk of significant damage.

- Brick Construction: Often lower premiums due to superior fire resistance compared to wood-framed homes.

- Wood-Frame Construction: Potentially higher premiums due to increased vulnerability to fire and wind damage compared to brick or other fire-resistant materials.

Final Thoughts

Securing affordable yet comprehensive homeowners insurance requires careful consideration of various factors and proactive planning. By understanding the key influences on premiums, comparing quotes from multiple insurers, and implementing cost-saving strategies, homeowners can protect their investment while managing their expenses effectively. Remember, the right coverage is paramount; this guide empowers you to make informed choices to achieve that balance.

Commonly Asked Questions

What is the average homeowners insurance deductible?

Homeowners insurance deductibles vary widely, typically ranging from $500 to $2,000. Higher deductibles generally result in lower premiums.

How often can I file a claim?

The frequency with which you can file claims depends on your insurer and the specifics of your policy. Frequent claims can negatively impact your future premiums.

Does bundling home and auto insurance save money?

Yes, many insurers offer discounts for bundling home and auto insurance policies. This can lead to significant savings on your overall premiums.

Can I get homeowners insurance without a credit check?

While some insurers may consider applications without a credit check, it’s less common. A good credit score generally leads to lower premiums.