Understanding the average cost of home insurance in Tennessee is crucial for homeowners and prospective buyers alike. Factors such as location, property features, coverage choices, and individual risk profiles significantly influence premiums. This guide delves into the complexities of Tennessee home insurance costs, providing insights into average premiums across various cities, different coverage types, and strategies for securing affordable protection.

We’ll explore the key factors driving insurance costs, examine the variations in premiums across different regions of the state, and offer practical tips for navigating the insurance market. From understanding policy terms to comparing quotes effectively, we aim to empower Tennessee residents with the knowledge needed to make informed decisions about their home insurance.

Factors Influencing Home Insurance Costs in Tennessee

Several factors interact to determine the cost of home insurance in Tennessee. Understanding these factors can help homeowners make informed decisions about their coverage and potentially reduce their premiums. These factors range from readily controllable aspects, such as coverage levels, to less controllable aspects like location and credit score.

Location

Geographic location significantly impacts home insurance premiums in Tennessee. Areas prone to natural disasters, such as tornadoes, floods, or wildfires, will generally command higher premiums due to the increased risk. For example, homes situated in areas with a history of significant tornado activity will likely face higher premiums than those in less vulnerable regions. Proximity to fire hydrants and the quality of local fire departments also play a role; better fire protection translates to lower premiums. Coastal areas, while beautiful, are also susceptible to hurricanes and storm surges, leading to increased insurance costs.

Home Features

The characteristics of your home itself heavily influence insurance costs. The age of your home, its construction materials (brick is generally considered safer than wood), the presence of security systems (alarms and monitored security systems), and the type of roofing material all contribute to the risk assessment. Homes with updated electrical systems and plumbing are generally viewed as less risky. Similarly, features that mitigate fire risk, such as fire-resistant materials and properly maintained chimneys, can result in lower premiums. The size of your home also matters; larger homes generally cost more to insure.

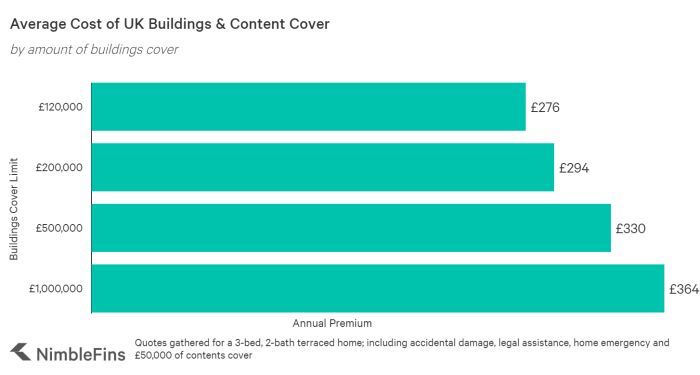

Coverage Levels

The amount of coverage you choose directly affects your premium. Higher coverage limits mean higher premiums, but also greater protection in case of a significant loss. It’s crucial to find a balance between adequate protection and affordability. Consider the replacement cost of your home and its contents when determining your coverage levels. Different coverage options, such as dwelling coverage, personal liability coverage, and additional living expenses coverage, all contribute to the overall premium. Choosing a higher deductible will generally lower your premium, but you’ll pay more out-of-pocket in the event of a claim.

Individual Risk Profiles

Insurance companies consider various aspects of your personal risk profile when calculating premiums. Your claims history is a significant factor. A history of filing claims, especially multiple claims, will likely lead to higher premiums, reflecting an increased perceived risk. Similarly, your credit score is often used as an indicator of risk; individuals with higher credit scores typically receive lower premiums. This is because a good credit score suggests responsible financial behavior, which is often correlated with lower insurance claims.

Impact of Credit Scores and Claims History

Insurance companies in Tennessee, like many others across the country, utilize credit-based insurance scores to assess risk. A higher credit score generally translates to lower premiums, reflecting a lower perceived risk of claims. Conversely, a poor credit history may lead to significantly higher premiums. Similarly, a history of filing insurance claims, especially frequent or large claims, will increase your premiums. Insurers view this as an indicator of a higher risk profile, leading to a higher premium to offset potential future claims.

| Factor | Impact on Premium | Example | Mitigation Strategy |

|---|---|---|---|

| Location (High-Risk Area) | Higher | Home in a flood plain | Consider flood insurance |

| Home Age & Construction | Higher (older homes, wood) | Older home with wood siding | Home improvements (e.g., new roof) |

| Coverage Level | Higher (higher limits) | $500,000 dwelling coverage vs. $300,000 | Adjust coverage to needs |

| Credit Score | Higher (lower score) | Credit score below 600 | Improve credit score |

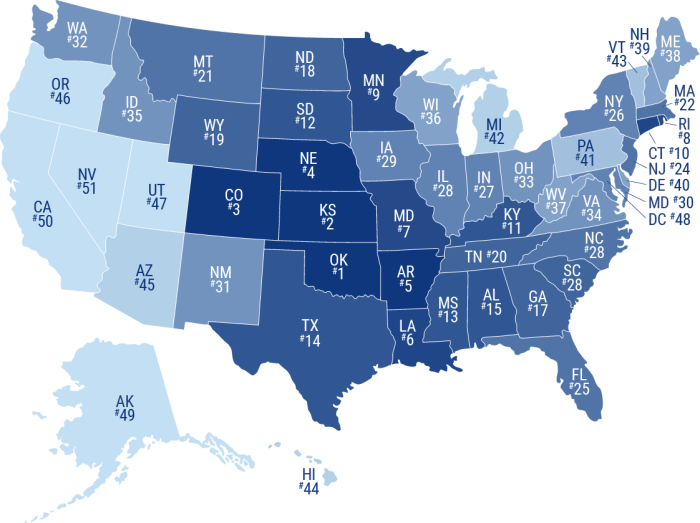

Average Home Insurance Premiums Across Tennessee Cities

Home insurance costs in Tennessee can vary significantly depending on location. Several factors contribute to these differences, including property values, crime rates, the frequency of natural disasters, and the level of competition among insurance providers. Understanding these variations is crucial for Tennessee residents seeking the best value for their home insurance.

Analyzing average premiums across major Tennessee cities provides a clearer picture of these cost differences. While precise figures fluctuate based on the specific insurer and policy details, general trends can be observed. The data presented below represents an aggregation of publicly available information and industry reports, offering a reasonable estimate of average costs.

Average Premiums in Major Tennessee Cities

The following table compares estimated average annual home insurance premiums in four major Tennessee cities: Nashville, Memphis, Knoxville, and Chattanooga. It’s important to note that these are averages and individual premiums will vary based on factors specific to each property and policyholder.

| City | Estimated Average Annual Premium | Factors Influencing Cost | Data Source Notes |

|---|---|---|---|

| Nashville | $1,500 – $1,800 | Higher property values, increased risk of severe weather events (storms, flooding). Competitive insurance market. | Data compiled from various online insurance comparison websites and industry reports, averaging multiple sources to account for fluctuations. |

| Memphis | $1,200 – $1,500 | Generally lower property values compared to Nashville, but higher crime rates in certain areas can impact premiums. | Similar methodology to Nashville, focusing on publicly available data and industry averages. |

| Knoxville | $1,300 – $1,600 | Moderate property values and a relatively lower risk of severe weather events compared to Nashville. | Data collected using the same methodology as the other cities, prioritizing publicly available information. |

| Chattanooga | $1,400 – $1,700 | Similar to Knoxville, with moderate property values and a relatively lower risk profile, though proximity to mountainous areas might influence certain premiums. | Data collected using the same methodology as the other cities, prioritizing publicly available information. |

Regional Variations and Contributing Factors

The data reveals a range in average premiums across these cities. Nashville tends to have higher premiums due to higher property values and the increased risk of severe weather events, such as tornadoes and flooding. Memphis, while having generally lower property values, can experience higher premiums in certain neighborhoods due to higher crime rates. Knoxville and Chattanooga generally fall in between, reflecting moderate property values and relatively lower risk profiles.

It’s crucial to remember that these are estimates. The actual cost of home insurance will vary based on factors specific to the individual property, including its age, size, construction materials, security features, and the homeowner’s claims history. The availability and competitiveness of insurance providers in a specific area also play a significant role.

Types of Home Insurance Coverage in Tennessee

Choosing the right home insurance policy in Tennessee involves understanding the different types of coverage available. These coverages protect your property and financial well-being in various scenarios, from minor damage to significant losses. It’s crucial to select a policy that adequately addresses your specific needs and risk profile. This section will Artikel the key types of coverage, their limits, costs, and examples of when they prove beneficial.

Understanding the various components of a Tennessee home insurance policy is vital for securing adequate protection. While costs vary based on factors like location, property value, and coverage limits, a clear grasp of each component empowers you to make informed decisions.

Dwelling Coverage

Dwelling coverage protects the physical structure of your home, including attached structures like garages and porches. This is typically the most significant portion of your home insurance policy. Coverage limits are usually expressed as a percentage of your home’s replacement cost, not its market value. For example, a $200,000 home might have a dwelling coverage limit of $160,000, reflecting the cost to rebuild it. This coverage would be beneficial in the event of damage from fire, windstorms, hail, or other covered perils. In a scenario where a tornado causes significant damage to your roof and exterior walls, dwelling coverage would help pay for repairs or reconstruction.

Liability Coverage

Liability coverage protects you financially if someone is injured on your property or if you accidentally damage someone else’s property. This coverage extends to medical expenses, legal fees, and potential settlements. Limits are typically expressed in dollar amounts, such as $100,000 or $300,000 per occurrence. Consider a scenario where a guest slips and falls on your icy driveway, suffering a broken leg. Your liability coverage would help cover their medical bills and any legal costs associated with the incident. Higher liability limits generally result in higher premiums but offer greater financial protection.

Personal Property Coverage

Personal property coverage protects your belongings inside your home, including furniture, clothing, electronics, and other personal items. This coverage usually has a limit, often expressed as a percentage of your dwelling coverage. For instance, if your dwelling coverage is $160,000, your personal property coverage might be capped at $80,000. This coverage is essential in situations such as a fire or burglary. If a fire destroys most of your furniture and electronics, personal property coverage would help replace these items. It’s important to note that some policies offer additional coverage for specific high-value items, which might require separate endorsements and additional premiums.

Other Important Coverages

Several other types of coverage can enhance your home insurance policy in Tennessee. These are often offered as add-ons or endorsements.

- Loss of Use: This coverage provides temporary living expenses if your home becomes uninhabitable due to a covered peril, such as a fire or flood. This could cover hotel costs, meals, and other temporary living expenses.

- Medical Payments to Others: This coverage helps pay for medical expenses of others injured on your property, regardless of who is at fault. This can help avoid a more extensive liability claim.

- Additional Living Expenses: Similar to Loss of Use, this covers additional expenses incurred while your home is being repaired after a covered loss.

The importance of understanding these coverages cannot be overstated. While additional coverage increases premiums, it also significantly increases your protection against unforeseen circumstances. Choosing the right policy depends on your individual circumstances and risk tolerance.

Finding Affordable Home Insurance in Tennessee

Securing affordable home insurance in Tennessee requires a proactive approach and understanding of various strategies. By carefully comparing options, making informed choices, and negotiating effectively, homeowners can significantly reduce their premiums without compromising essential coverage. This section Artikels practical steps and techniques to achieve cost-effective home insurance.

Comparing Quotes from Multiple Insurers

Obtaining quotes from several insurance providers is crucial for finding the best rates. Different companies use varying assessment methods and offer different coverage options at different price points. Using online comparison tools can streamline this process, allowing you to input your details once and receive multiple quotes simultaneously. Remember to compare not only the premium but also the level of coverage offered by each policy. A slightly higher premium might be justified if it provides significantly better protection.

Increasing Deductibles

A higher deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, generally translates to lower premiums. Carefully consider your financial situation and risk tolerance before increasing your deductible. While a higher deductible lowers your monthly payment, it also means you’ll have to pay more in the event of a claim. It’s a trade-off between immediate cost savings and potential future expenses. For example, increasing your deductible from $500 to $1000 could result in a noticeable reduction in your premium.

Improving Home Security

Implementing home security measures can significantly impact your insurance premium. Features like security systems, smoke detectors, and fire-resistant roofing materials demonstrate to insurers that you’re taking proactive steps to mitigate risk. Many companies offer discounts for installing these safety features. For instance, a professionally monitored security system could earn you a 5-10% discount on your annual premium.

Negotiating Lower Premiums

Don’t hesitate to negotiate with your insurance provider. Loyalty discounts are often available for long-term customers, while bundling home and auto insurance with the same company frequently results in substantial savings. Point out your excellent claims history (if applicable) and any safety upgrades you’ve made to your home. Being polite but firm in your negotiations can often yield positive results.

Benefits of Bundling Home and Auto Insurance

Bundling your home and auto insurance policies with the same insurer is a common strategy for reducing overall costs. Insurance companies often offer significant discounts for bundling, as it simplifies their administrative processes and reduces risk. This discount can be substantial, potentially saving you hundreds of dollars annually. The exact discount will vary depending on the insurer and your specific circumstances.

Obtaining Home Insurance Quotes: A Step-by-Step Guide

- Gather necessary information: Compile details about your home, including its age, square footage, location, and any upgrades or renovations. Also, gather information about your existing coverage (if any) and claims history.

- Use online comparison tools: Several websites allow you to compare quotes from multiple insurers simultaneously. Input your information once, and the site will provide various options.

- Contact insurers directly: While online tools are convenient, contacting insurers directly can provide a more personalized experience and allow you to ask specific questions about coverage options.

- Review quotes carefully: Compare not only the premium but also the coverage details. Ensure the policy adequately protects your home and belongings.

- Choose a policy and finalize the purchase: Once you’ve selected a policy, provide the necessary documentation and payment information to complete the purchase.

Understanding Your Home Insurance Policy in Tennessee

Understanding your Tennessee home insurance policy is crucial for protecting your most valuable asset. A thorough understanding of its terms, conditions, and claims process can prevent significant financial hardship in the event of unforeseen circumstances. This section will clarify key aspects of a typical policy, empowering you to make informed decisions.

Key Terms and Conditions

Standard home insurance policies in Tennessee, like those nationwide, include several key terms and conditions. These terms define the coverage provided, the responsibilities of both the insurer and the insured, and the circumstances under which a claim may be filed. Common terms include the “policy period,” specifying the dates of coverage; the “deductible,” the amount you pay out-of-pocket before the insurance coverage begins; and the “coverage limits,” the maximum amount the insurer will pay for a covered loss. Other important conditions may relate to specific exclusions, such as flood or earthquake damage (often requiring separate policies), and the requirement to maintain reasonable security measures to prevent loss. The policy will also Artikel the process for notifying the insurer of a claim and cooperating with their investigation.

The Claims Process

Filing a claim typically involves several steps. First, you must promptly notify your insurance company of the damage or loss. This notification usually involves a phone call and possibly a written report. Next, the insurance company will typically send an adjuster to assess the damage and determine the extent of the covered loss. You will need to provide documentation, such as photos, receipts, and repair estimates. The adjuster will then prepare a report, which the insurance company will use to determine the amount they will pay. This process can take several weeks or even months depending on the complexity of the claim. Remember to keep detailed records of all communication and documentation throughout the claims process.

Covered and Excluded Situations

A standard Tennessee home insurance policy typically covers losses from events such as fire, wind damage, hail, vandalism, and theft. It also usually covers liability if someone is injured on your property. However, many policies exclude losses from events like floods, earthquakes, and acts of war. Certain types of damage, such as gradual wear and tear or damage caused by neglect, are also typically excluded. For example, a tree falling on your house during a windstorm is likely covered, but damage from a tree slowly rotting and falling is usually not. Similarly, damage from a burst pipe due to a sudden freeze is usually covered, but damage from a slow leak due to poor maintenance is generally excluded.

Policy Structure Illustration

Imagine the policy as a book divided into several sections. The first section, the “declarations page,” summarizes key information like your name, address, coverage amounts, and policy period. The second section, the “insuring agreement,” details what the insurer promises to cover. The third section, the “conditions,” Artikels your responsibilities as the policyholder, such as paying premiums and cooperating with investigations. The fourth section, the “exclusions,” lists events or damages that are not covered. Finally, there may be an “endorsements” section, which includes any added coverage, such as earthquake or flood insurance, purchased separately. Each section is crucial for understanding your rights and responsibilities. Think of it as a layered approach, with the declarations page providing the overview, the insuring agreement defining the core coverage, the conditions setting the rules, the exclusions defining the limitations, and endorsements adding specific extra protections.

Closure

Securing adequate home insurance in Tennessee requires careful consideration of various factors and a thorough understanding of available coverage options. By comparing quotes, understanding your risk profile, and leveraging strategies for cost savings, you can find a policy that provides comprehensive protection without breaking the bank. Remember to regularly review your policy and adjust coverage as needed to reflect changes in your circumstances and property value.

Key Questions Answered

What is the cheapest type of home insurance in Tennessee?

The cheapest type depends on individual circumstances. Higher deductibles generally lead to lower premiums, but this requires a larger upfront payment in case of a claim. Basic coverage levels will also be less expensive than comprehensive plans.

How often can I change my home insurance policy in Tennessee?

You can typically change your policy at the end of your current policy term. Some insurers may allow mid-term changes, but this may involve penalties.

Do I need flood insurance in Tennessee?

Flood insurance is typically not included in standard homeowners insurance policies. Given Tennessee’s susceptibility to flooding in certain areas, purchasing separate flood insurance is highly recommended, especially in flood-prone zones.

What is the role of my credit score in determining my home insurance premium?

In many states, including Tennessee, insurers consider credit scores as a factor in determining risk and therefore premiums. A higher credit score generally translates to lower premiums.