Understanding the cost of home insurance in Iowa is crucial for responsible homeowners. Premiums vary significantly across the state, influenced by factors ranging from location and property characteristics to individual risk profiles and coverage choices. This guide delves into the average costs, key influencing factors, and strategies for securing affordable and comprehensive home insurance in Iowa.

From comparing quotes and understanding coverage types to navigating Iowa’s insurance regulations, we aim to equip you with the knowledge necessary to make informed decisions about protecting your most valuable asset. We’ll explore the impact of everything from your home’s age and construction to your credit score and claims history on your premium. This comprehensive overview will empower you to find the best insurance coverage at the most competitive price.

Average Home Insurance Costs in Iowa

Home insurance premiums in Iowa, like in other states, vary considerably. Several factors contribute to the final cost, making it difficult to give a single definitive figure. However, understanding the key influences allows for a more informed perspective on what homeowners can expect to pay.

Average Home Insurance Costs in Iowa: Statewide Overview

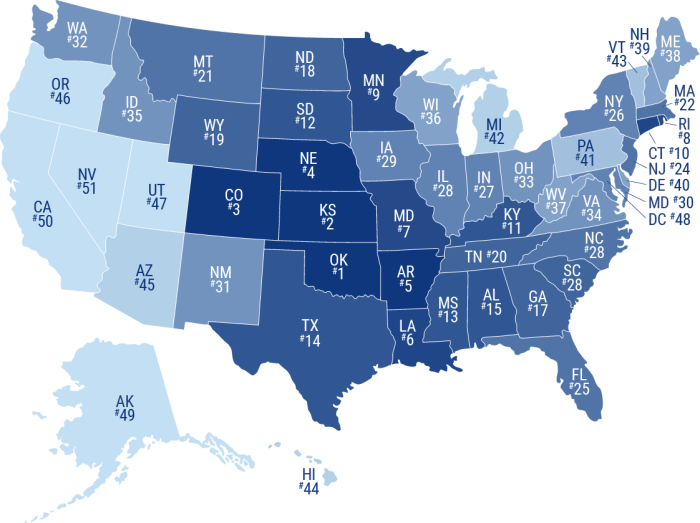

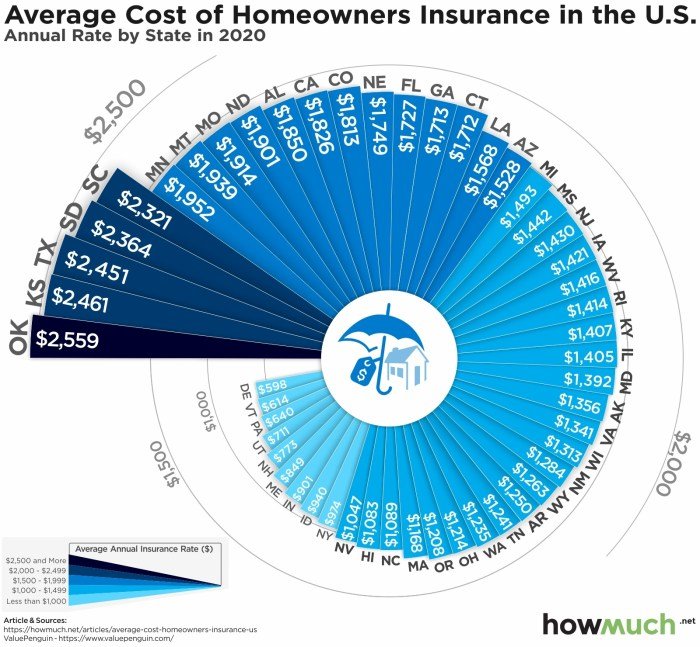

Annual home insurance premiums in Iowa typically range from $800 to $2,000. This broad range reflects the significant impact of several variables. Location plays a crucial role; homes in areas prone to severe weather, such as those susceptible to tornadoes or flooding, generally command higher premiums. The level of coverage selected also significantly influences the cost. Comprehensive policies offering broader protection against various risks will naturally be more expensive than basic coverage. The age and condition of the home, the presence of security systems, and the homeowner’s claims history are other factors that insurers consider when determining premiums.

Average Home Insurance Costs Across Major Iowa Cities

The following table offers a comparison of average annual home insurance premiums across several major Iowa cities. It’s important to remember that these are averages, and individual premiums can vary significantly based on the factors discussed above. The data presented here is illustrative and should not be considered a definitive guide for pricing in any specific location. Precise pricing requires an individual quote from an insurance provider.

| City | Average Annual Premium | Range of Premiums | Influencing Factors |

|---|---|---|---|

| Des Moines | $1,200 | $900 – $1,500 | Higher property values, potential for hail damage, proximity to the Des Moines River. |

| Cedar Rapids | $1,100 | $800 – $1,400 | Flood risk in certain areas, average property values, crime rates. |

| Iowa City | $1,000 | $750 – $1,250 | Generally lower property values compared to Des Moines, lower flood risk than Cedar Rapids. |

| Sioux City | $950 | $700 – $1,200 | Wind damage potential, proximity to the Missouri River, property values. |

Factors Affecting Home Insurance Premiums in Iowa

Several key factors influence the cost of home insurance in Iowa, impacting the premiums homeowners pay annually. Understanding these factors can help you make informed decisions about your coverage and potentially save money. This section will delve into the specifics of these influential elements.

Home Age and Construction Materials

The age of your home and the materials used in its construction significantly impact your insurance premium. Older homes, particularly those lacking modern safety features like updated electrical systems or plumbing, are generally considered higher risk and therefore more expensive to insure. This is because older structures are more susceptible to damage from various perils. Conversely, homes built with fire-resistant materials, such as brick or stone, tend to command lower premiums than those constructed with wood framing. The quality of construction also plays a role; a well-maintained home with a solid foundation will likely be cheaper to insure than a poorly maintained one. For example, a meticulously maintained 1920s brick home might receive a lower rate than a poorly maintained, recently constructed wood-frame home.

Coverage Levels

The amount of coverage you choose directly affects your premium. Higher coverage levels for liability, dwelling, and personal property naturally lead to higher premiums. Liability coverage protects you financially if someone is injured on your property. Dwelling coverage protects the structure of your home, while personal property coverage protects your belongings. Choosing higher limits for each of these will increase your premium but provide greater financial protection in the event of a significant loss. For instance, increasing your dwelling coverage from $200,000 to $300,000 will likely result in a higher premium, but it will offer more comprehensive protection against damage to your home.

Claims History and Credit Score

Your claims history is a significant factor in determining your insurance rates. A history of filing multiple claims, especially for preventable incidents, will likely lead to higher premiums. Insurers view frequent claims as an indicator of higher risk. Similarly, your credit score often plays a role, with those possessing lower credit scores often facing higher premiums. This is because a poor credit score can be correlated with a higher likelihood of claims. Insurance companies use sophisticated models to assess risk, and both claims history and credit score are key components of these models. Maintaining a good credit score and avoiding unnecessary claims can help keep your premiums lower.

Natural Disaster Risk

Iowa faces various natural disasters, most notably tornadoes and hail. The risk of these events varies across the state, impacting insurance premiums accordingly. Areas with a higher historical frequency of tornadoes or severe hailstorms will generally have higher insurance premiums than areas with lower risks. For example, a home located in a region known for frequent tornado activity will likely have a higher premium compared to a home in a region with a lower incidence of such events. This reflects the increased risk that insurers assume in these high-risk zones.

Factors Significantly Affecting Insurance Costs

Several factors significantly influence home insurance costs in Iowa. Understanding these can help you better manage your insurance expenses.

- Location of the home (risk of natural disasters, crime rates)

- Home’s age and construction materials

- Coverage levels selected (liability, dwelling, personal property)

- Claims history

- Credit score

Finding Affordable Home Insurance in Iowa

Securing affordable home insurance in Iowa requires a proactive approach to comparing quotes, understanding policy features, and negotiating effectively with insurers. By employing several strategies, homeowners can significantly reduce their premiums without compromising necessary coverage.

Effective Comparison of Insurance Quotes

Comparing home insurance quotes effectively involves more than simply looking at the bottom line. Consumers should meticulously review policy details, comparing coverage limits, deductibles, and exclusions across multiple providers. This ensures that the “cheapest” option genuinely provides the level of protection needed. Consider using online comparison tools, but always verify the information directly with the insurance company. Don’t hesitate to contact multiple agents – each may offer different policy options or discounts.

Benefits of Higher Deductibles

Increasing your deductible—the amount you pay out-of-pocket before your insurance coverage kicks in—is a proven method for lowering your premiums. A higher deductible signifies a lower risk to the insurance company, resulting in a lower premium. However, it’s crucial to carefully consider your financial situation before significantly increasing your deductible. Ensure you can comfortably afford the higher out-of-pocket expense in the event of a claim. For example, increasing a $500 deductible to $1000 could result in a noticeable premium reduction, but you need to be prepared to cover that extra $500 in the case of a covered loss.

Savings Through Bundling Home and Auto Insurance

Many insurance companies offer discounts for bundling home and auto insurance policies. This practice leverages the convenience and efficiency of managing both policies with a single provider. The resulting discount can be substantial, often exceeding the savings achieved by increasing deductibles alone. For instance, a homeowner might save 10-15% or more by combining their policies. This discount is a significant incentive to consider consolidating your insurance needs with one company.

Negotiating with Insurance Providers

Negotiating with insurance providers can yield surprising results. Highlight your positive claims history (or lack thereof), any home security upgrades (alarm systems, reinforced doors), or other risk-reducing measures you’ve taken. Be prepared to shop around and use competing quotes as leverage. Explain your commitment to finding the best value and express your willingness to switch providers if a better deal isn’t offered. Polite and informed negotiation can often lead to reduced premiums.

Step-by-Step Guide to Obtaining Multiple Quotes

Obtaining multiple home insurance quotes is a straightforward process.

- Identify Your Needs: Determine the level of coverage you require, considering factors like the value of your home, personal belongings, and liability concerns.

- Use Online Comparison Tools: Several websites allow you to input your information and receive quotes from multiple insurers simultaneously.

- Contact Insurance Agents Directly: Reach out to insurance agents in your area or those representing companies you’re interested in. Discuss your needs and request personalized quotes.

- Compare Quotes Carefully: Review each quote thoroughly, paying close attention to coverage limits, deductibles, and exclusions. Don’t focus solely on price; ensure the coverage is appropriate.

- Negotiate with Your Preferred Provider: Once you’ve identified a preferred provider, don’t hesitate to negotiate for a better rate, using competing quotes as leverage.

Types of Home Insurance Coverage in Iowa

Choosing the right home insurance policy in Iowa involves understanding the various coverage options available. A standard policy typically bundles several types of protection, each designed to address specific risks. It’s crucial to carefully review the policy details to ensure your coverage adequately protects your home and belongings.

Dwelling Coverage

This is the most fundamental part of your home insurance policy. Dwelling coverage protects the physical structure of your house, including attached structures like garages and porches, against damage from covered perils such as fire, wind, hail, and vandalism. The amount of dwelling coverage you need should reflect the cost to rebuild your home, not necessarily its current market value. Factors like building materials and construction costs in your area influence this amount. For instance, rebuilding a home in a high-demand area with specialized materials will likely be more expensive than rebuilding a similar home in a less desirable location.

Liability Coverage

Liability coverage protects you financially if someone is injured on your property or if you accidentally damage someone else’s property. This coverage pays for medical bills, legal fees, and settlements resulting from such incidents. For example, if a guest slips and falls on your icy walkway and suffers injuries, liability coverage would help cover their medical expenses and any legal costs associated with the claim. The amount of liability coverage you choose should reflect the potential costs associated with a significant liability claim.

Personal Property Coverage

This section of your policy covers your personal belongings within your home, such as furniture, clothing, electronics, and jewelry. It typically provides coverage for loss or damage due to the same perils covered under dwelling coverage. However, coverage limits usually apply, and certain items, like high-value jewelry or collections, might require separate endorsements for adequate protection. For example, if a fire damages your furniture and electronics, personal property coverage would help replace them, up to the policy limits.

Common Exclusions in Standard Home Insurance Policies

Standard home insurance policies typically exclude coverage for certain types of damage or events. Understanding these exclusions is vital to avoid unexpected costs. Common exclusions include damage caused by floods, earthquakes, and acts of war. Other common exclusions might include damage from gradual wear and tear, insect infestations, or faulty workmanship. Many of these exclusions can be addressed through the purchase of separate endorsements or riders.

Endorsements and Riders for Specialized Coverage

Endorsements and riders add specific coverage to your standard policy. They address potential risks not fully covered by a basic policy. For example, you might need a flood insurance endorsement if your home is in a flood-prone area, or a scheduled personal property endorsement for valuable items like jewelry or antiques. These additions tailor your policy to your specific needs and circumstances, providing broader protection where necessary.

Comparison of HO-3, HO-4, and HO-6 Policies

Different types of homeowner’s insurance policies offer varying levels of coverage. An HO-3 policy (Special Form) is the most common type, offering broad coverage for dwelling and personal property damage, except for specifically excluded perils. An HO-4 policy (Tenant’s Form) is designed for renters, covering personal property but not the building itself. An HO-6 policy (Condominium Form) covers personal property and the interior of a condominium unit, but typically excludes the building’s exterior and common areas. The choice of policy depends heavily on your living situation and ownership structure.

| Coverage Type | Typical Inclusions | Potential Exclusions | Policy Type Example |

|---|---|---|---|

| Dwelling | Damage from fire, wind, hail, vandalism | Floods, earthquakes, wear and tear | HO-3, HO-6 |

| Liability | Medical bills, legal fees for injuries on your property | Intentional acts, business-related liabilities | HO-3, HO-4, HO-6 |

| Personal Property | Loss or damage to belongings due to covered perils | Floods, earthquakes, certain valuable items (without endorsement) | HO-3, HO-4, HO-6 |

| Additional Living Expenses (ALE) | Temporary housing costs if your home is uninhabitable due to a covered peril | Expenses exceeding policy limits, extended stays not directly related to covered damage | HO-3, HO-4, HO-6 |

Understanding Iowa’s Insurance Regulations

Navigating the world of home insurance can be complex, but understanding Iowa’s regulatory framework can empower consumers to make informed decisions and protect their interests. The Iowa Insurance Division plays a crucial role in ensuring fair practices and consumer protection within the state’s insurance market.

The Iowa Insurance Division is the state agency responsible for overseeing the insurance industry. Its primary function is to regulate and monitor insurance companies operating within Iowa’s borders, ensuring they comply with state laws and regulations designed to protect consumers. This includes setting minimum standards for coverage, reviewing insurance rates for reasonableness, and investigating complaints against insurers. They strive to maintain a stable and competitive insurance market that benefits both consumers and insurers.

The Process for Filing a Complaint Against an Insurance Company in Iowa

Iowa residents who have disputes with their insurance companies have several avenues for redress. The Iowa Insurance Division provides a straightforward process for filing complaints. Consumers can submit complaints online through the Division’s website, by mail, or by phone. The Division then investigates the complaint, contacting both the consumer and the insurance company to gather information and attempt to resolve the issue. If mediation fails, the Division may take further action, including issuing a cease and desist order or referring the matter to the Iowa Attorney General’s office. Detailed instructions and forms are available on the Iowa Insurance Division’s official website.

Consumer Rights and Protections Under Iowa Law Regarding Home Insurance

Iowa law provides several key protections for home insurance consumers. These include the right to receive clear and accurate policy information, the right to fair claim handling practices, and the right to appeal decisions made by insurance companies. Specifically, Iowa’s insurance regulations prohibit unfair or deceptive practices by insurance companies, ensuring that consumers are treated fairly and honestly throughout the insurance process. Consumers are also protected against discriminatory practices in the pricing and availability of insurance. For example, insurers cannot unfairly deny coverage based on factors unrelated to risk.

Resources Available to Iowa Residents Seeking Help with Insurance Issues

Several resources are available to assist Iowa residents facing insurance-related problems. Beyond the Iowa Insurance Division, consumers can seek assistance from consumer advocacy groups, legal aid organizations, and private attorneys specializing in insurance law. Many of these organizations offer free or low-cost consultations and can provide guidance on navigating the complexities of insurance disputes. The Iowa Insurance Division’s website also offers a wealth of information, including frequently asked questions, publications, and links to other helpful resources. The website serves as a central hub for consumers to access information and resolve their concerns.

Conclusion

Securing affordable yet comprehensive home insurance in Iowa requires careful planning and understanding of the various factors influencing premiums. By comparing quotes, understanding coverage options, and leveraging strategies like bundling and increasing deductibles, Iowa homeowners can effectively manage their insurance costs while ensuring adequate protection. Remember to regularly review your policy and adapt it to your changing needs to maintain optimal coverage and affordability.

Expert Answers

What is the cheapest type of home insurance in Iowa?

The cheapest type depends on your individual risk profile and needs. Policies with higher deductibles generally cost less, but you’ll pay more out-of-pocket in case of a claim. Basic coverage levels also tend to be cheaper than comprehensive options.

How often can I change my home insurance provider?

You can typically switch providers at any time, although there might be penalties for canceling a policy early. It’s best to shop around annually to compare rates and coverage options.

Does my credit score affect my home insurance premium in Iowa?

Yes, in many cases, insurers consider credit scores as an indicator of risk. A higher credit score usually translates to lower premiums.

What should I do if I disagree with my insurance company’s decision?

Contact the Iowa Insurance Division to file a complaint. They will investigate your case and help mediate a resolution.