Defining “0 Down Used Car”

The phrase “0 down used car” signifies a used vehicle purchase requiring no upfront payment from the buyer. This typically involves a financing arrangement where the buyer’s initial payment is zero. This approach to car buying can be attractive to those with limited cash on hand but it’s essential to understand the implications and associated terms.

Understanding the nuances of “0 down” is crucial for potential buyers. While seemingly advantageous, the absence of an initial deposit often translates into higher monthly payments or longer loan terms compared to traditional financing models. This necessitates careful consideration of the overall cost and affordability of the purchase.

Interpretations of “0 Down”

The term “0 down” in the context of used car purchases primarily refers to a financing option where the buyer’s initial payment is zero. This often means the buyer finances the entire purchase price. However, there might be hidden costs or fees that are included in the financed amount. Understanding these aspects is crucial to making an informed decision.

Characteristics of 0 Down Used Cars

Vehicles advertised as “0 down” frequently feature attractive financing packages designed to attract buyers. These packages typically include:

- High loan amounts: The financing often covers the full price of the vehicle, making it easier for buyers to acquire a vehicle.

- Longer loan terms: To accommodate the higher loan amounts, financing terms are often extended, which might result in higher overall interest costs.

- Higher interest rates: Since the loan amount is substantial and the down payment is minimal, lenders may charge a higher interest rate to compensate for the increased risk.

- Hidden fees: While the initial payment might be zero, it’s essential to scrutinize the fine print for potential additional fees, such as acquisition fees, documentation fees, or prepayment penalties.

Comparison with Other Financing Options

Compared to other used car financing options, “0 down” financing can lead to higher monthly payments and a longer loan term. Options like a down payment with a traditional loan often result in lower monthly payments and potentially a shorter loan term. The choice depends on individual financial circumstances and the willingness to manage higher monthly payments over a longer period. Traditional loans with a down payment provide a tangible equity stake in the vehicle immediately.

Features and Benefits of 0 Down Deals

The primary feature of a “0 down” used car deal is the ease of acquiring a vehicle with minimal upfront cash. This can be particularly appealing to individuals with limited funds or those seeking a quick purchase. However, it’s vital to weigh the benefits against the potential drawbacks, such as higher monthly payments and longer loan terms.

Types of Financing for Used Cars

| Financing Type | Description |

|---|---|

| 0 Down | Financing the entire purchase price with no upfront payment. |

| Traditional Loan (with down payment) | A standard loan with a portion of the purchase price paid upfront as a down payment. |

| Lease | A contractual agreement to use the vehicle for a specified period, with payments covering the use and maintenance costs. |

| Personal Loan | A loan from a financial institution specifically for purchasing a vehicle, often with a fixed interest rate and repayment schedule. |

Each financing option has its own implications for monthly payments, loan terms, and overall cost. A careful comparison is necessary to determine the best fit for individual financial situations.

Market Analysis

The “0 down” used car market presents a compelling opportunity for both buyers and sellers. Understanding its dynamics, including popularity, demand, and pricing trends, is crucial for navigating this segment effectively. This analysis explores the intricacies of this market segment, focusing on factors driving demand and shaping pricing strategies.

The “0 down” used car market is experiencing significant growth, driven by the increasing affordability it offers to potential buyers. This approach to financing can make the purchase more accessible to a wider range of individuals, creating a dynamic and potentially lucrative segment for dealerships and individual sellers alike.

Popularity and Demand

The demand for “0 down” used cars is consistently high, especially among first-time car buyers and those with limited financial resources. This affordability factor often outweighs the potentially higher interest rates or longer loan terms associated with traditional financing methods. Recent data suggests a steady rise in searches and purchases related to this type of financing option, indicating a growing preference for this purchase model.

Prevalence of “0 Down” Promotions

“0 down” promotions are a common tactic in the used car market, particularly during periods of economic uncertainty or high interest rates. Dealerships frequently utilize these promotions to attract buyers and increase sales volume. However, the prevalence varies geographically and depends on factors like local economic conditions and competitive pricing strategies.

Demographics of Buyers

Buyers interested in “0 down” used cars often fall into specific demographic categories. This includes first-time car buyers, those with limited credit history, or individuals seeking a more immediate and less complex purchase process. Data shows a concentration of these buyers among younger generations and those with lower average incomes. They often prioritize immediate possession over long-term financial commitments.

Geographic Variations

The availability and popularity of “0 down” deals show significant geographic variations. Regions with higher unemployment rates or lower average incomes tend to see a greater prevalence of these offers. The supply of suitable vehicles and competitive pricing within the region also influence the availability of such deals.

Average Prices of “0 Down Used Cars”

| Region | Average Price (USD) |

|---|---|

| Northeast US | $15,000 |

| Midwest US | $12,500 |

| South US | $13,000 |

| West Coast US | $18,000 |

Note: This table provides an approximate representation. Actual prices may vary based on specific model year, make, and condition of the vehicle.

Factors Influencing Pricing

The pricing of “0 down” used cars is influenced by a complex interplay of factors. These include the vehicle’s age, mileage, condition, make, and model, as well as the current market demand for the specific vehicle. Furthermore, the dealership’s overhead, profit margins, and prevailing economic conditions in the area all contribute to the final price.

“Pricing strategies often reflect the balance between attracting buyers with the ‘0 down’ incentive and maintaining a reasonable profit margin.”

Financing Options and Terms

Navigating the world of used car purchases, especially those with “0 down” financing, requires a deep understanding of the available financial instruments. This section delves into the various financing options, common terms, and potential pitfalls associated with such deals. Comprehending these factors is crucial for consumers to make informed decisions and avoid unforeseen financial burdens.

Understanding the intricacies of “0 down” financing is vital for potential buyers. While it can make a vehicle more accessible, hidden costs and unfavorable terms can quickly erode the savings. This section clarifies the different financing avenues and the critical aspects to scrutinize before signing any agreement.

Available Financing Programs

Numerous financial institutions offer financing options for used cars, each with its own set of terms and conditions. Banks, credit unions, and online lenders often compete to attract customers with attractive rates and flexible payment plans. This competition can result in diverse financing programs, making comparisons critical.

Common Terms and Conditions

A critical aspect of “0 down” financing is the understanding of associated terms and conditions. These plans often come with specific stipulations, such as loan durations, interest rates, and prepayment penalties. It’s vital to carefully review all documentation before committing to any agreement.

Interest Rates and Loan Durations

Interest rates play a significant role in the overall cost of the loan. Higher interest rates mean a higher total cost of borrowing. Loan duration, conversely, dictates the length of the repayment period. Shorter loan durations usually result in higher monthly payments, while longer durations result in lower monthly payments but a higher total cost over the loan term. This interplay of factors directly impacts the affordability and long-term financial implications of the purchase. For instance, a 0% interest rate, while tempting, may not always be the best option if it comes with a longer loan term and hidden fees.

Comparison of Financing Programs

The market offers diverse financing programs for “0 down” used cars, each with unique characteristics. Comparing these programs is essential to identify the best option for individual needs. Factors like interest rates, loan terms, and fees should be thoroughly evaluated to ensure the chosen program aligns with financial goals. A thorough comparison, encompassing these factors, is crucial to avoid hidden costs and ensure a financially sound decision.

Potential Risks and Benefits

“0 Down” financing, while seemingly attractive, comes with inherent risks and benefits. One key benefit is the immediate access to a vehicle, a significant advantage for those needing a car quickly. However, the lack of a down payment can lead to higher interest rates and longer loan terms, increasing the overall cost of the vehicle. Carefully weighing these pros and cons is essential to avoid potential financial pitfalls. A clear understanding of these potential risks is vital to making an informed decision.

Pros and Cons of Financing Options

| Financing Option | Pros | Cons |

|---|---|---|

| Bank Loan | Established reputation, potentially lower interest rates | Stricter eligibility criteria, potentially longer application process |

| Credit Union Loan | Competitive rates, personalized service, often better terms for members | Limited availability in some areas, potential for lower interest rates for members only |

| Online Lender | Faster application process, wider range of options, potentially lower rates | Higher risk of predatory lending, lack of personal touch, potentially more hidden fees |

Careful evaluation of these factors is critical in making an informed decision.

Consumer Considerations

Zero-down used car deals can seem enticing, promising a quick and easy way to acquire a vehicle. However, these offers often come with hidden complexities that potential buyers need to carefully evaluate. Understanding the factors influencing purchase decisions, potential pitfalls, and the importance of meticulous research is crucial for a successful and financially sound transaction.

Navigating the “0 down” landscape requires a proactive approach, encompassing thorough research, realistic expectations, and a deep understanding of the terms and conditions. This section will Artikel essential considerations for consumers considering a zero-down used car purchase.

Factors Influencing Purchase Decisions

Consumers are often drawn to the immediate gratification and perceived affordability of zero-down deals. The allure of owning a car without an upfront payment can be particularly compelling, especially for those with limited financial resources. Additionally, the potential to avoid the burden of a large initial deposit may sway individuals towards this option. However, it is important to remember that “0 down” does not always equate to a “better” deal.

Potential Pitfalls and Challenges

One major pitfall of zero-down used car deals is the potential for higher overall costs over time. While the upfront payment is eliminated, the financing terms often include higher interest rates, extended loan periods, or additional fees. This can lead to a significantly larger total cost of ownership compared to a traditional purchase with a down payment. Furthermore, the absence of an initial deposit may encourage a consumer to overspend on the vehicle.

Importance of Thorough Research and Due Diligence

Thorough research is essential before committing to any “0 down” used car deal. Potential buyers should research the fair market value of similar vehicles, considering factors such as year, make, model, mileage, and condition. A detailed inspection of the vehicle’s condition, including the engine, transmission, body, and interior, is paramount. Utilizing online resources and consulting with trusted mechanics or dealerships is recommended to ensure a thorough evaluation.

Tips for Negotiating a Fair Price

Negotiating a fair price on a zero-down used car is crucial. Understanding the vehicle’s market value, identifying any potential issues, and comparing offers from different sellers are key elements. Being prepared to walk away from a deal if the terms are unfavorable is equally important. Researching competitors’ pricing and considering factors like dealer fees and add-ons is essential to achieving a fair agreement.

Reviewing the Fine Print of Financing Agreements

Understanding the intricacies of the financing agreement is critical. Buyers should scrutinize the interest rate, loan term, monthly payments, and any hidden fees. It is advisable to compare interest rates from multiple lenders and carefully evaluate the total cost of the loan. A comprehensive understanding of the fine print is critical to avoid costly surprises down the line.

Questions to Ask Before Committing

Before committing to a “0 down” used car deal, potential buyers should ask the following crucial questions:

- What is the total cost of the loan, including interest and fees?

- What is the interest rate and the loan term?

- Are there any hidden fees or charges associated with the financing?

- What is the vehicle’s history, including any accidents or damage?

- What is the vehicle’s current market value, considering its condition and mileage?

- What are the terms and conditions of the loan repayment plan?

- Are there any prepayment penalties or early termination fees?

- What is the process for resolving any issues or disputes related to the vehicle or financing?

By carefully considering these factors and asking pertinent questions, consumers can make informed decisions and avoid potential pitfalls when purchasing a “0 down” used car.

Market Trends and Future Outlook

The “0 down” used car market is experiencing dynamic shifts, driven by evolving consumer preferences, economic fluctuations, and technological advancements. Understanding these trends is crucial for both buyers and sellers navigating this competitive landscape. This analysis examines current trends, predicts future developments, and assesses the influence of external factors on the market’s trajectory.

The market is becoming increasingly sophisticated, with consumers demanding greater transparency and control over the financing process. This trend is reflected in a rise in online platforms offering competitive financing options and detailed vehicle history reports. The emphasis on user experience and data-driven decision-making is reshaping the entire buying process.

Current Trends in the Market

The current market is characterized by a growing preference for online research and transparent financing options. Buyers are increasingly leveraging online tools to compare prices, research vehicle history, and explore various financing options. This shift towards digital channels highlights the importance of a robust online presence for both dealerships and individual sellers. Furthermore, the demand for certified pre-owned vehicles is steadily increasing, indicating a growing consumer desire for quality assurance and peace of mind.

Predicted Future Developments

The future of the “0 down” used car market will likely be shaped by several key factors. Technological advancements in financing platforms will play a significant role. Expect to see the integration of AI and machine learning to provide personalized financing options tailored to individual buyer profiles. Moreover, the rise of electric vehicles will undoubtedly influence the market, as consumers seek affordable options for electric transportation. This will potentially lead to specialized financing schemes designed for EV purchases, offering incentives and competitive rates. The rise of subscription models for vehicles may also emerge as a new financing option for this market.

Impact of Economic Factors

Economic conditions exert a considerable influence on the “0 down” used car market. Periods of economic uncertainty often lead to increased demand for affordable used vehicles, as consumers seek cost-effective transportation options. Conversely, economic prosperity might drive up used car prices, making “0 down” financing less attractive. Interest rate fluctuations directly affect the cost of borrowing, which consequently impacts the affordability and accessibility of “0 down” financing options. Changes in employment rates and consumer confidence levels will also influence demand.

Influence of Emerging Technologies

Emerging technologies are revolutionizing the financing of “0 down” used cars. Digital platforms are streamlining the entire process, from vehicle research to financing applications. Secure online payment systems and advanced credit scoring algorithms are making the process more efficient and transparent. The integration of blockchain technology could further enhance the security and transparency of vehicle history records, providing greater confidence to potential buyers. Innovative technologies will also affect the market by facilitating seamless communication between buyers and sellers.

Innovative Approaches to “0 Down” Financing

Several innovative approaches to “0 down” financing are emerging. Dealerships are increasingly partnering with fintech companies to offer customized financing plans. This includes incorporating flexible payment options, such as buy-now-pay-later schemes and interest-free financing periods. The introduction of subscription-based vehicle ownership models is also gaining traction. This approach allows consumers to access vehicles without the traditional financial commitment of a loan.

Predicted Changes in the “0 Down” Used Car Market Over the Next 5 Years

| Factor | Predicted Change | Supporting Evidence |

|---|---|---|

| Online Research & Transparency | Increased reliance on online platforms for research and transparent financing options. | Growing trend of consumers using online tools for comparisons and information gathering. |

| Technological Advancements in Financing | Integration of AI, machine learning, and blockchain for personalized and secure financing. | Examples include AI-driven credit scoring and secure online payment systems. |

| Economic Conditions | Fluctuations in demand based on economic cycles, impacting price and availability. | Past economic downturns have shown increased demand for affordable used vehicles. |

| Electric Vehicle Adoption | Potential rise in specialized financing options for electric vehicles. | Growing popularity of electric vehicles and associated incentives. |

| Subscription Models | Increased adoption of subscription-based vehicle ownership models. | Subscription models are gaining traction in other industries, and this trend could expand into the automotive sector. |

Illustrative Examples

Zero-down used car deals, while attractive, require careful consideration. Understanding the specifics of financing, advertising, and potential pitfalls is crucial to making an informed decision. This section provides practical examples to illustrate various aspects of these deals.

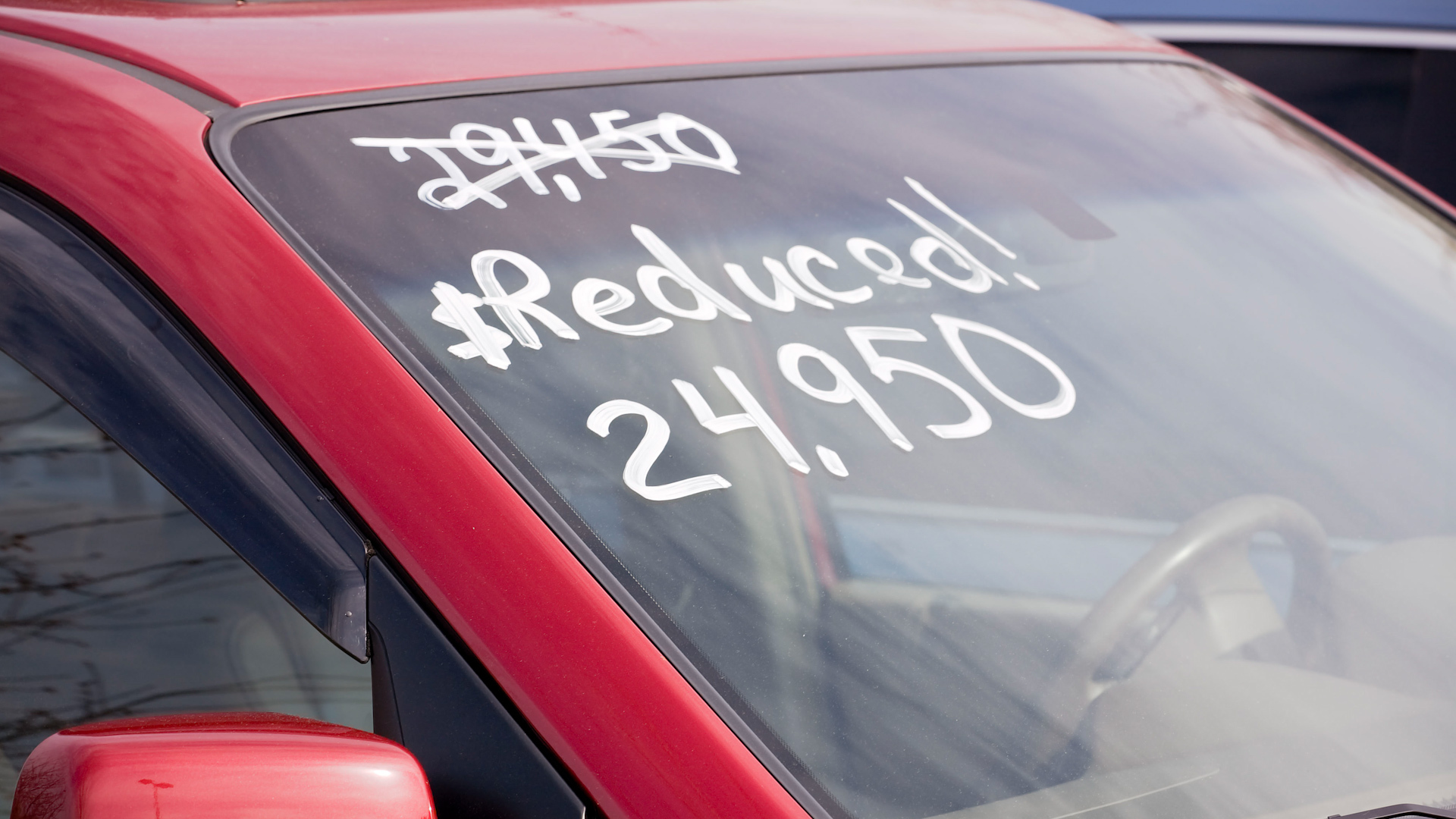

Typical “0 Down” Advertisement

A common “0 down” used car advertisement emphasizes the upfront cost savings. It might highlight a low monthly payment and use phrases like “drive home today with no money down!” or “0% financing available!” The advertisement will typically include details about the vehicle’s make, model, year, mileage, and any special features. Crucially, the advertisement will often omit important details like interest rates, terms, or hidden fees. A responsible consumer should scrutinize the fine print and inquire about any additional costs.

Different “0 Down” Financing Options

Various financing options are available for “0 down” used cars. These can include traditional loans from banks or credit unions, dealer financing, or even specialized financing programs for specific demographics. A bank loan typically involves a credit check and established credit history. Dealer financing often comes with specific terms and conditions, potentially higher interest rates or hidden fees.

Case Studies of Successful and Unsuccessful Transactions

Successful transactions often involve meticulous research and a thorough understanding of the financing terms. Consumers who compare interest rates, fees, and total costs before committing are more likely to secure a favorable deal. Unsuccessful transactions frequently stem from neglecting to fully understand the terms of the agreement or the overall cost of borrowing. Failing to factor in the total cost of ownership, including potential repair costs, is a common pitfall.

Sample “0 Down” Financing Agreement

Sample Financing Agreement – ABC Motors

Vehicle: 2018 Honda Civic

Purchase Price: $15,000

Down Payment: $0

Loan Amount: $15,000

Interest Rate: 7.5% APR

Loan Term: 60 months

Monthly Payment: $300.00

Total Interest Paid: $3,500.00

Total Cost of Loan: $18,500.00

Additional Fees: Documentation Fee ($100), Acquisition Fee ($200)

This sample agreement highlights the key elements of a “0 down” financing agreement. Always review the complete agreement before signing.

Monthly Payment Calculation Scenario

Consider a “0 down” used car purchase with a $16,000 vehicle. A 60-month loan at an 8% interest rate would result in a monthly payment of approximately $320. However, this calculation doesn’t account for potential additional fees or taxes. Detailed calculations are essential to determine the true cost.

Comparison Table of “0 Down” Deals

| Dealership | Vehicle | Price | Interest Rate | Loan Term | Monthly Payment | Total Cost |

|---|---|---|---|---|---|---|

| ABC Motors | 2020 Toyota Camry | $20,000 | 7.9% | 60 months | $400 | $23,000 |

| XYZ Auto | 2019 Ford Fusion | $18,000 | 8.5% | 72 months | $350 | $23,500 |

| Prime Motors | 2022 Hyundai Sonata | $22,000 | 7.2% | 60 months | $420 | $24,500 |

This table demonstrates the variance in pricing and terms across different dealerships. The total cost of the loan should be the primary focus. Always compare interest rates, loan terms, and additional fees.