Overview of Used Car Tax Credit

The used car tax credit is a financial incentive designed to stimulate the used car market and potentially encourage environmentally friendly transportation choices. It aims to make used cars more affordable and accessible to consumers, potentially reducing reliance on newer, more polluting vehicles. This credit, while varying in form and scope across different jurisdictions, provides a tangible benefit to buyers and sellers.

This overview will delve into the core principles behind used car tax credits, examining eligibility criteria and common misconceptions. Understanding these nuances is crucial for both consumers and policymakers.

Definition of Used Car Tax Credit

A used car tax credit is a reduction in the amount of tax owed by a buyer of a used car. This reduction can take the form of a direct monetary rebate, a deduction on the purchase price, or a reduction in the sales tax. The specific form and value of the credit can differ significantly depending on the jurisdiction and the circumstances of the sale.

Purpose and Goals of the Used Car Tax Credit

The primary purpose of a used car tax credit is to boost demand for used vehicles. By making used cars more attractive, the credit aims to reduce the overall environmental impact of transportation by encouraging the purchase of pre-owned, often more fuel-efficient vehicles. This, in turn, can stimulate the used car market, fostering economic activity within the sector. It also promotes accessibility, making vehicles more affordable for a broader range of consumers.

Types of Used Cars Qualifying for the Credit

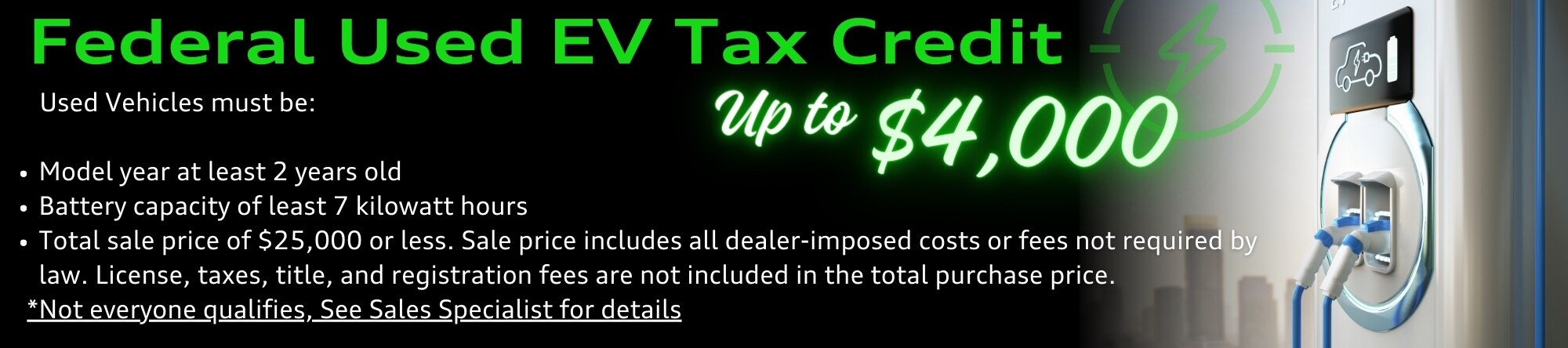

Eligibility for a used car tax credit often depends on specific criteria, such as the vehicle’s age, mileage, or environmental performance. Criteria may include:

- Vehicle Age: The credit may be available for used vehicles of a certain age, such as those manufactured within a specific timeframe. This timeframe is determined by the issuing body.

- Mileage Restrictions: Some credits may restrict the mileage of the vehicle to ensure the car is in good working order.

- Emission Standards: The credit may be more generous for used vehicles meeting certain emission standards. This is a significant factor in promoting environmentally friendly transportation options.

- Specific Vehicle Types: Certain used vehicle types may qualify. For example, the credit might be targeted at electric vehicles or hybrid vehicles.

Common Misconceptions about the Used Car Tax Credit

A common misconception is that the credit is universally available. Eligibility often hinges on specific conditions and factors, such as the vehicle’s age, mileage, and environmental performance.

- Availability: The credit is not uniformly available across all jurisdictions or situations. Specific conditions must be met.

- Amount: The amount of the credit can vary significantly depending on the jurisdiction, the vehicle, and its condition.

- Eligibility: Eligibility requirements differ by jurisdiction. One must verify the specific requirements for the region in which the vehicle is being purchased.

Comparison of Different Types of Used Car Tax Credits (Illustrative Example)

While a comprehensive comparison table is complex due to the varying nature of tax credits across jurisdictions, an illustrative example could highlight differences:

| Criteria | Credit A | Credit B |

|---|---|---|

| Vehicle Age | Manufactured within the last 10 years | Manufactured within the last 5 years |

| Mileage | Up to 100,000 miles | Up to 50,000 miles |

| Emission Standards | Must meet current EPA standards | Must meet Euro 6 standards |

| Amount | $500 | $1,000 |

Note: This table is an illustrative example and does not represent any specific existing tax credit program. Actual programs may differ significantly.

Eligibility Requirements

Understanding the eligibility criteria for the used car tax credit is crucial for potential recipients. This section Artikels the specific requirements, including income limitations, geographic restrictions, and necessary documentation. Navigating these guidelines ensures a smooth application process and maximizes the benefit of the credit.

Income Limitations

The used car tax credit often comes with income limitations. These restrictions ensure the credit benefits those most in need of financial assistance. These limitations are typically tied to annual household income and may vary based on the specific program. For example, some programs may have a maximum income level for eligibility, while others might use a sliding scale, adjusting the credit amount based on income. These income restrictions are vital to target the intended beneficiaries of the tax credit.

Geographic Restrictions

In some cases, the used car tax credit may have geographic limitations. These restrictions could be tied to specific regions, states, or even counties. These geographic limitations might be based on factors such as the availability of affordable used vehicles in the area or the need to support local dealerships.

Documentation Requirements

Proper documentation is essential to claim the used car tax credit successfully. Providing accurate and complete documentation is critical to ensure the application is processed smoothly. This typically involves verifying the vehicle’s age, condition, and purchase date. Supporting documents might include the vehicle’s title, sales contract, and proof of purchase. Thorough documentation ensures the credit is claimed correctly and avoids potential delays or rejection.

Table of Eligibility Criteria

| Criterion | Description |

|---|---|

| Income | Must meet specific annual household income limits as defined by the program. Income restrictions often vary. |

| Vehicle Age | The vehicle must meet minimum age requirements, which usually are set by the tax code or program rules. |

| Vehicle Condition | The vehicle must meet specified condition standards, typically including mechanical functionality. |

| Geographic Location | In some cases, eligibility may be restricted to specific regions or states. |

| Documentation | Supporting documents like the vehicle title, sales contract, and proof of purchase are necessary. |

Credit Calculation and Amount

The used car tax credit provides financial assistance to eligible buyers, reducing the overall cost of purchasing a used vehicle. Understanding the calculation process is crucial for determining the exact amount of the credit. This section details the steps involved and factors influencing the credit amount, illustrated with examples and a hypothetical scenario.

Factors Influencing Credit Amount

The amount of the used car tax credit varies depending on several key factors. These factors are crucial to understanding the credit’s potential value for each individual situation.

- Vehicle’s Original MSRP (Manufacturer’s Suggested Retail Price): The original MSRP of the vehicle plays a significant role in determining the maximum credit amount. Higher MSRP vehicles typically lead to higher credit potential. This is a critical factor because it directly relates to the vehicle’s initial market value.

- Vehicle’s Condition and Age: The credit amount might be affected by the vehicle’s condition and age. Vehicles in excellent condition, particularly newer models, may qualify for a larger credit amount compared to older or less well-maintained ones. This is a reflection of the vehicle’s current market value, which is determined by its condition and age.

- Buyer’s Income: In some instances, the buyer’s income might be considered as a factor in determining the credit amount. However, this is not always the case. This factor could be part of the eligibility criteria.

- State-specific regulations: Specific regulations in certain states might impose additional criteria or modify the calculation process. These regulations should be verified by the buyer or relevant authorities. This is crucial for ensuring compliance with local laws.

Calculation Process

The used car tax credit calculation is typically based on a percentage of the vehicle’s original MSRP. The exact percentage can vary depending on the program and the vehicle’s age and condition. A step-by-step process is Artikeld below.

- Determine the vehicle’s original MSRP: This is the price at which the vehicle was initially listed for sale by the manufacturer. Finding this information may involve checking manufacturer documentation or online resources.

- Establish the applicable percentage: The percentage of the MSRP that qualifies for the credit is based on factors such as the vehicle’s age, condition, and the specific program rules. This information can be found in the program guidelines.

- Calculate the credit amount: Multiply the vehicle’s original MSRP by the applicable percentage to arrive at the maximum credit amount. For example, if the MSRP is $20,000 and the applicable percentage is 10%, the credit amount would be $2,000.

Credit Amount = Original MSRP × Applicable Percentage

Example Scenarios

The following table demonstrates how the credit amount changes based on different scenarios.

| Scenario | Original MSRP | Applicable Percentage | Credit Amount |

|---|---|---|---|

| New vehicle, high MSRP | $30,000 | 15% | $4,500 |

| Used vehicle, moderate MSRP | $15,000 | 10% | $1,500 |

| Used vehicle, lower MSRP | $10,000 | 5% | $500 |

Hypothetical Example

John wants to purchase a used car with an original MSRP of $18,000. The applicable percentage for this vehicle’s age and condition is 8%. Following the steps Artikeld above:

1. Original MSRP = $18,000

2. Applicable Percentage = 8%

3. Credit Amount = $18,000 × 0.08 = $1,440

In this scenario, John would receive a used car tax credit of $1,440.

Application Process and Deadlines

Applying for the used car tax credit requires careful adherence to the prescribed steps and deadlines. Understanding the necessary documentation and potential issues can streamline the process and ensure a smooth application. This section details the application procedure, including required forms, deadlines, and potential roadblocks.

The application process for the used car tax credit is designed to be straightforward, but navigating the specific requirements and timelines is crucial for successful claims. Failure to submit the necessary documentation or meet the deadlines could result in rejection of the application. This section provides a comprehensive guide to ensure a seamless application process.

Application Steps

The used car tax credit application typically involves several steps. First, gather all the required documentation, which includes proof of purchase, vehicle details, and supporting income information. Next, complete the application form accurately, ensuring all fields are filled with the correct information. Finally, submit the application electronically or via mail by the specified deadline. A clear understanding of these steps is essential to avoid delays or errors.

Required Forms and Documents

The specific forms and documents needed for the used car tax credit application vary depending on the jurisdiction. Generally, the application form itself is the most crucial document, requiring details about the vehicle, purchaser, and supporting income. Supporting documents such as proof of purchase, vehicle identification number (VIN), and income verification are usually required. These documents serve as evidence to support the claim. A checklist of required documents can help avoid missing crucial information.

- Proof of Purchase: This could include a sales receipt or bill of sale. A copy of the vehicle registration is also frequently required to verify the ownership and date of purchase. It is essential to obtain these documents directly from the seller or the relevant authority.

- Vehicle Identification Number (VIN): The VIN uniquely identifies the vehicle and is critical for verification. Ensure the VIN is correctly transcribed on the application form.

- Income Verification: Depending on the program, proof of income, such as pay stubs or tax returns, may be needed to demonstrate eligibility. These documents should be readily available and accurate.

- Other Supporting Documents: Depending on the specific program, other documents such as proof of residency or disability status may be required.

Application Deadlines

Deadlines for applying for the used car tax credit are critical and vary depending on the specific program. These deadlines are often published by the relevant government agencies and should be carefully noted. Meeting these deadlines is essential to avoid disqualification. It is recommended to check the official website of the issuing agency for the most up-to-date information.

Flowchart of Application Process

[A flowchart illustrating the application process would be placed here. The flowchart would visually guide the applicant through the steps, from gathering documents to submitting the application. A detailed description of each step within the flowchart is essential for clarity. This illustration would be a valuable visual aid for the user.]

Potential Issues and Solutions

Several potential issues can arise during the application process, ranging from missing documentation to incorrect information. These issues can be addressed effectively with careful planning and proactive measures.

- Missing Documents: If crucial documents are missing, contact the issuing agency promptly to request an extension or alternative methods of providing the required information.

- Incorrect Information: Carefully review the application form and supporting documents for accuracy. Corrections should be made promptly, and if there are discrepancies, contact the relevant agency for guidance.

- Late Submissions: If the deadline is approaching, prioritize completing the application as quickly as possible and submit it as soon as possible. Contact the issuing agency in advance to confirm the status of the application and to request an extension, if applicable.

- Technical Difficulties: If applying online, ensure a stable internet connection and troubleshoot any technical issues promptly. Contact the issuing agency for assistance if necessary.

Recent Changes and Updates

The used car tax credit, a program designed to stimulate the used car market and potentially reduce consumer costs, has seen various adjustments over time. These modifications often reflect evolving economic conditions, legislative priorities, and changing interpretations of the program’s guidelines. Understanding these recent changes is crucial for both consumers seeking to utilize the credit and businesses involved in the used car market.

Legislative Actions Affecting the Credit

Recent legislative actions, such as the passage of the Economic Growth and Tax Relief Reconciliation Act of 2001, have had significant impacts on the used car tax credit. These legislative changes frequently alter the eligibility criteria, the amount of the credit, and the application process. For example, amendments to the original legislation may have introduced new restrictions or expanded eligibility to certain demographics or types of vehicles. Understanding these legislative shifts is critical for accurate credit calculations and applications.

Interpretations of Rules and Regulations

Changes in the interpretation of the rules and regulations surrounding the used car tax credit are another important aspect to consider. The Internal Revenue Service (IRS), responsible for administering the program, might issue updated guidance or clarification notices that alter the understanding and application of the rules. These interpretations might specify details concerning the definition of “used” vehicles, acceptable documentation requirements, or procedures for claiming the credit. These changes can have a direct impact on whether or not an individual or business qualifies for the credit.

Comparison with Similar Programs

Comparing the used car tax credit to other similar programs, such as the new car tax credit, provides valuable context. Both programs aim to stimulate the market for vehicles, but they may have different eligibility requirements, credit amounts, and application processes. A comprehensive analysis of these differences helps to clarify the nuances of each program. For instance, the new car tax credit might have a higher credit amount or different restrictions on vehicle age, while the used car tax credit focuses on making used vehicles more affordable.

Long-Term Implications of Recent Changes

Recent changes to the used car tax credit have potential long-term implications for the market. These impacts might affect the pricing of used vehicles, influencing consumer behavior and potentially creating an environment of increased competition. For example, changes in eligibility requirements could disproportionately affect certain demographics, potentially widening the gap between those who can access the credit and those who cannot. Examining these potential long-term effects is essential for a complete understanding of the program’s overall impact.

Resources and Support

Navigating the intricacies of the used car tax credit can be simplified with access to reliable resources and support. Understanding the eligibility criteria, calculation methods, and application procedures is crucial for a smooth experience. This section provides comprehensive guidance, connecting you with essential information and support channels.

Accessing the correct resources and assistance is key to maximizing the benefits of the used car tax credit. Having access to accurate and up-to-date information, as well as support networks, ensures a streamlined application process and potentially minimizes any obstacles encountered.

Reliable Websites and Resources

Various government agencies and independent websites offer detailed information about the used car tax credit. These resources provide comprehensive details about eligibility requirements, application procedures, and calculation methods.

- The official website of the relevant government agency administering the used car tax credit is an essential starting point. This site typically houses the most current information, application forms, and frequently asked questions.

- Independent websites dedicated to consumer finance and tax credits provide valuable summaries and explanations of the program. These sites often offer detailed analyses of the eligibility criteria and calculation methods, making it easier to understand the process.

- Consumer advocacy groups or non-profit organizations specializing in financial literacy may offer guidance and support regarding the used car tax credit. These groups often provide helpful tips and resources for navigating the process.

Contact Information for Agencies

Direct communication with relevant government agencies can address specific queries and provide personalized assistance. Having direct contact information allows for faster resolutions to potential issues.

- The contact information for the relevant government agency administering the used car tax credit is readily available on their official website. This information may include email addresses, phone numbers, and online chat support options, enabling quick communication for specific questions.

- Contacting a tax professional specialized in tax credits can provide tailored advice. A professional can clarify complex aspects of the used car tax credit and ensure compliance with applicable regulations. They can also assist with preparing the necessary paperwork.

Support Groups and Online Communities

Connecting with other individuals experiencing a similar situation can provide valuable support and insights. Online forums or support groups offer a platform to share experiences and seek help.

- Online forums and discussion groups dedicated to consumer finance or tax credits can be a valuable source of information. These platforms provide a space for users to ask questions, share experiences, and learn from each other’s experiences regarding the used car tax credit.

- Social media groups or online communities focused on specific topics related to the used car tax credit offer valuable support. These groups can offer support, advice, and a shared experience in navigating the complexities of the credit.

Government Assistance Programs

Government assistance programs might offer supplementary support to individuals eligible for the used car tax credit. These programs can provide financial aid to lower-income individuals.

- Specific government assistance programs related to vehicle purchases might offer combined benefits. For instance, programs designed to support low-income individuals or those facing financial hardship might offer subsidies or financial incentives for used vehicle purchases.

- Low-income individuals might find assistance through programs offering grants or subsidies for vehicle purchases. These initiatives could be coupled with the used car tax credit to provide substantial support for the purchase.

Table of Helpful Resources

| Resource Type | Description | Link (Example) |

|---|---|---|

| Government Agency Website | Official site for the used car tax credit | [Insert Example Link Here] |

| Consumer Finance Website | Independent site summarizing the tax credit | [Insert Example Link Here] |

| Consumer Advocacy Group | Non-profit organization providing guidance | [Insert Example Link Here] |

| Tax Professional | Expert advice on tax credits | [Insert Example Link Here] |

Illustrative Examples of Eligibility

Understanding the eligibility criteria for the used car tax credit is crucial for potential recipients. This section provides real-world examples to illustrate various scenarios, considering factors like vehicle specifications, income levels, and geographic location. These examples aim to clarify the requirements and help individuals determine if they qualify for the credit.

Vehicle Specifications Meeting Eligibility

The used car tax credit typically targets vehicles meeting specific environmental standards and age guidelines. A 2018 Honda Civic, for example, with a clean title and documented mileage under 100,000 miles, is likely to meet the eligibility criteria. Conversely, a 2005 model of the same car would likely not qualify due to age limitations. Specific vehicle models, years, and emission standards play a vital role in qualifying for the credit.

Impact of Income Levels on Credit Amount

Income levels significantly influence the amount of the tax credit. A single taxpayer with a modified adjusted gross income (MAGI) of $50,000, for instance, might receive a higher credit compared to someone with an income exceeding the applicable limit. The IRS guidelines on MAGI will determine the exact percentage of the credit that the individual is eligible for. This directly correlates to the credit amount.

Geographic Location and Eligibility Implications

Geographic location can affect the availability of certain incentives or programs related to the used car tax credit. For example, states with robust environmental initiatives may offer supplementary incentives for purchasing vehicles that meet stringent emission standards. This means that a buyer in a state with these incentives may see a greater overall benefit from the credit, than someone in a state without them.

Hypothetical Scenarios

| Scenario | Vehicle | Income | Location | Eligibility |

|---|---|---|---|---|

| 1 | 2020 Toyota Prius | $45,000 (Single Filers) | California | Likely eligible, as the Prius meets emission standards, and the income falls within the income guidelines. |

| 2 | 2015 Ford F-150 | $80,000 (Married Filing Jointly) | Texas | Possibly ineligible, as the income might exceed the income limits for the credit. |

| 3 | 2018 Nissan Leaf | $65,000 (Head of Household) | New York | Likely eligible, as the vehicle’s age and emission standards meet the criteria, and the income is within the limit. |

| 4 | 2010 Chevrolet Volt | $75,000 (Single Filers) | Florida | Possibly ineligible, as the vehicle’s age might be a factor in meeting the eligibility criteria. |

Illustrative Example: Specific Car Models

“The tax credit is designed to encourage the purchase of more fuel-efficient vehicles, helping reduce environmental impact.”

Consider a buyer purchasing a 2021 Kia Niro EV. This model typically qualifies for the tax credit due to its electric powertrain. Similarly, a 2022 Honda Insight, meeting specific mileage and condition requirements, would likely qualify. Specific models and years within the eligible categories are crucial to eligibility.

Impact of Income and Location

“Income levels play a crucial role in determining the amount of the tax credit.”

The tax credit is often calculated as a percentage of the vehicle’s purchase price. A higher income typically leads to a lower credit amount or no credit at all. A buyer’s location may influence the credit’s value through potential state or local incentives, but the federal guidelines are consistent nationwide. The exact amount of the credit will vary based on the income and specific vehicle.