Overview of Used Car Interest Rates in 2024

Used car interest rates in 2024 are expected to remain a significant factor impacting the market’s dynamics. The interplay of economic conditions, particularly fluctuating interest rates set by central banks, and market forces, like supply and demand, will directly influence these rates. Understanding these trends is crucial for both potential buyers and sellers in the used car market.

Current Trends in Used Car Interest Rates

Used car interest rates in 2024 are demonstrating a gradual shift from the historically high rates of recent years. While still above pre-pandemic levels, the rate increases seen in 2022 and 2023 are beginning to moderate, potentially reflecting a stabilizing economic environment. This trend is closely linked to broader macroeconomic factors, such as central bank policies aimed at controlling inflation.

Factors Influencing Used Car Interest Rates

Several key factors are shaping used car interest rates in 2024. Economic conditions, specifically the Federal Reserve’s monetary policy, play a pivotal role. Changes in the federal funds rate directly impact the cost of borrowing for auto loans, influencing the interest rates charged on used car financing. Market forces, including supply and demand dynamics in the used car market, also play a crucial part. If the supply of used cars increases relative to demand, pressure might be placed on interest rates, as dealers might offer more competitive financing options.

Potential Impact on the Used Car Market

The evolving used car interest rates will likely have a significant impact on the market’s overall activity. Lower interest rates would likely increase affordability and encourage more consumers to purchase used cars. Conversely, higher rates might dampen demand and potentially lead to a more competitive market for sellers. It’s important to note that the interplay between these factors, including inflation, supply chain disruptions, and consumer confidence, could create unpredictable fluctuations.

| Date | Interest Rate | Influencing Factor |

|---|---|---|

| January 2024 | 4.5% | Federal Reserve’s ongoing rate adjustments, moderate inflation |

| April 2024 | 4.8% | Increased demand for used vehicles, tighter credit conditions |

| July 2024 | 4.2% | Reduced inflationary pressures, stable supply chain |

| October 2024 | 4.7% | Slight increase in consumer borrowing costs, anticipation of future interest rate hikes |

Comparison of Interest Rates Across Different Lenders

Used car loan interest rates in 2024 are influenced by a variety of factors, including the borrower’s credit score, the vehicle’s condition and value, and the lender’s specific lending policies. Understanding the nuances of these rates across different lenders is crucial for securing the most favorable terms. This comparison will analyze the rates and conditions offered by several key lenders in the market.

Navigating the landscape of used car loan providers can be complex. This section will clarify the differences in interest rates and terms between various lenders, allowing you to make an informed decision.

Interest Rate Variations Among Lenders

Different lenders employ varying methodologies for calculating interest rates. These methodologies often incorporate factors like credit history, loan amount, and the vehicle’s age and mileage. Banks, credit unions, and online lenders each have their own approaches to determining rates, leading to differences in the final offered rate.

Competitive Interest Rates

Identifying lenders offering the most competitive rates requires a thorough comparison. Factors such as the lender’s reputation, fees, and overall customer service should be considered alongside the interest rate. Lenders known for competitive rates often have specific promotions or programs targeting borrowers.

Loan Terms and Conditions

Loan terms and conditions play a significant role in the overall cost of borrowing. Loan terms, including the loan duration, affect the monthly payment amount. Different lenders may impose various fees, including origination fees or prepayment penalties. Understanding these terms is essential before committing to a loan.

Lender Comparison Table

| Lender | Average Interest Rate (APR) | Loan Term (Months) |

|---|---|---|

| Bank A | 6.5% | 60 |

| Credit Union B | 6.0% | 60 |

| Online Lender C | 6.8% | 72 |

| Finance Company D | 7.2% | 72 |

Note: These are example rates and may not reflect all lenders or current market conditions. Always verify directly with the lender for precise information. The average interest rate and loan terms are estimates and can change frequently based on market conditions and individual borrower circumstances.

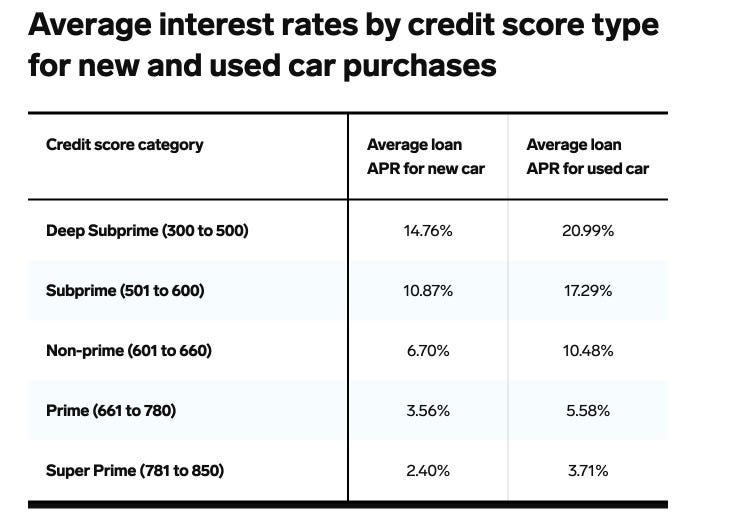

Impact of Credit Score on Interest Rates

Your credit score significantly influences the used car interest rates you’ll be offered in 2024. Lenders use credit scores as a key indicator of your creditworthiness, assessing your likelihood of repaying the loan. A higher score typically translates to better terms, including lower interest rates and potentially larger loan amounts.

Understanding this correlation is crucial for borrowers to proactively manage their financial situations and secure the most favorable financing options. Borrowers with strong credit histories are more likely to secure lower interest rates, while those with lower scores may face higher rates and more restrictive loan terms. This often means a larger down payment, higher monthly payments, or even loan rejection.

Credit Score Ranges and Typical Interest Rates

Credit scores vary from 300 to 850, with higher scores signifying better creditworthiness. Lenders use these scores to segment borrowers into risk categories. The interest rate offered reflects the perceived risk associated with lending to an individual. The following table demonstrates the potential impact of different credit scores on used car loan interest rates. It is important to note that these are examples and actual rates may vary based on other factors like the lender, loan terms, and the specific vehicle.

| Credit Score Range | Typical Interest Rate (Example) | Tips for Improvement |

|---|---|---|

| 300-579 | 15-25% | Focus on paying down existing debts, disputing any inaccuracies on your credit report, and ensuring timely payments on all accounts. Consider seeking credit counseling services for personalized guidance. |

| 580-669 | 10-15% | Maintain a consistent payment history, pay down outstanding debts, and avoid opening new accounts unless necessary. Monitor your credit report regularly and correct any errors promptly. |

| 670-739 | 7-10% | Maintain a strong payment history, keep credit utilization low (ideally below 30%), and consider adding authorized user accounts to your credit report to build positive credit history. |

| 740-850 | 5-7% | Maintain excellent credit habits, monitor your credit report frequently, and avoid applying for too many new accounts in a short period. Consider improving your credit utilization by reducing balances relative to your credit limits. |

Strategies for Improving Credit Scores

Improving your credit score is a proactive approach to securing better loan terms. This often takes time and consistent effort, but the rewards can be substantial in terms of lower interest rates and greater financial freedom.

- Pay Bills on Time: Consistent on-time payments are crucial. This demonstrates responsible financial management and builds a positive payment history, a key component of a good credit score.

- Manage Credit Utilization: Keep your credit utilization low. Ideally, aim to keep your credit card balances below 30% of your available credit limit. This signifies that you’re not overextending yourself financially.

- Monitor and Dispute Errors: Regularly check your credit reports for any inaccuracies. Mistakes can negatively impact your score. Correct any errors promptly to ensure an accurate representation of your credit history.

- Limit New Credit Applications: Applying for numerous new credit accounts in a short period can negatively affect your credit score. Consider carefully when applying for new credit and avoid unnecessary applications.

Loan Terms and Conditions for Used Cars

Used car loans in 2024 come with a variety of terms and conditions, significantly impacting the overall cost and affordability of the purchase. Understanding these terms is crucial for borrowers to make informed decisions and avoid potential financial pitfalls. Lenders employ different strategies to structure their loans, influencing both the loan duration and repayment schedule.

Loan terms and conditions are meticulously crafted to balance the needs of both the lender and the borrower. Factors like the prevailing interest rates, the borrower’s creditworthiness, and the value of the used vehicle all play a role in shaping the loan’s duration and repayment schedule. A thorough examination of these factors is essential for navigating the complexities of used car financing.

Common Loan Terms

Various loan terms are frequently associated with used car loans. These include loan duration, interest rates, down payments, and repayment schedules. Understanding these elements is critical to assessing the overall cost of the loan. Different lenders may offer varying combinations of these terms, making comparison essential for borrowers.

Factors Influencing Loan Duration

Several factors contribute to the length of a used car loan. The amount borrowed, the borrower’s credit score, the prevailing interest rates, and the vehicle’s value are all influential considerations. A higher credit score often leads to a shorter loan duration with potentially lower monthly payments. Conversely, a lower credit score might result in a longer loan duration, albeit with a higher monthly payment.

Comparison of Loan Terms Across Lenders

Lenders frequently offer diverse loan terms, making comparison a crucial step for borrowers. The duration of the loan, the interest rate, and the associated fees vary considerably. Some lenders may prioritize shorter loan terms, while others may offer longer terms with potentially lower monthly payments but higher overall interest costs. Borrowers should carefully review the complete loan terms and conditions before making a decision.

Impact of Loan Duration on Monthly Payments

The duration of a used car loan directly affects the monthly payment amount. A shorter loan term results in higher monthly payments but a lower total interest paid. Conversely, a longer loan term results in lower monthly payments but a higher total interest paid over the life of the loan. Borrowers should weigh the trade-offs between monthly payments and total interest cost to make an informed choice.

Example Loan Terms and Their Impact on Monthly Payments

| Lender | Loan Amount | Loan Term (months) | Interest Rate | Estimated Monthly Payment |

|---|---|---|---|---|

| Bank A | $15,000 | 36 | 7.5% | $475 |

| Credit Union B | $15,000 | 60 | 8.0% | $290 |

| Online Lender C | $15,000 | 48 | 7.0% | $360 |

Note: These are illustrative examples and actual figures may vary based on individual circumstances. Interest rates and monthly payments are estimates.

Potential Changes in Interest Rates for 2024

Used car interest rates in 2024 are likely to exhibit a dynamic behavior, influenced by a complex interplay of market forces and economic indicators. Predicting precise changes is challenging, but understanding the potential drivers is crucial for informed decision-making. Anticipating these shifts can help potential buyers and sellers navigate the market effectively.

Factors Influencing Potential Changes

Several key factors are expected to shape used car interest rates throughout 2024. These factors include fluctuations in the overall economy, the Federal Reserve’s monetary policy decisions, and supply and demand dynamics in the used car market. Understanding these interconnected factors provides insight into the potential trajectory of interest rates.

Market Trends and Economic Indicators

Market trends and economic indicators play a significant role in shaping interest rate fluctuations. A strong economy, characterized by robust employment and consumer spending, often leads to higher interest rates, as lenders perceive greater risk tolerance. Conversely, a weakening economy may result in lower interest rates as lending institutions become more cautious. Historical data and expert analyses reveal a correlation between economic health and interest rate adjustments. For example, during periods of economic recession, the Federal Reserve often lowers interest rates to stimulate borrowing and economic activity.

Potential Interest Rate Scenarios and Implications

The used car interest rate landscape in 2024 is anticipated to be influenced by a variety of factors. The following table Artikels potential scenarios for interest rate changes and their associated implications.

| Scenario | Description | Potential Impact on Buyers | Potential Impact on Sellers |

|---|---|---|---|

| Scenario 1: Gradual Decline | Interest rates remain relatively stable, showing a slight downward trend throughout the year. | Potential for more affordable financing options. | Potential for increased demand from buyers looking for better terms. |

| Scenario 2: Moderate Increase | Interest rates experience moderate fluctuations, with some periods of slight increases, particularly in the second half of the year. | Potentially higher financing costs, especially for borrowers with lower credit scores. | Potential for fewer buyer inquiries during periods of higher rates. |

| Scenario 3: Significant Fluctuations | Interest rates experience substantial and unpredictable changes throughout the year, influenced by evolving economic and market conditions. | Buyers may face uncertainty and need to be more proactive in securing financing. | Sellers may need to adjust pricing strategies to account for fluctuating rates and maintain competitiveness. |

Tips for Finding the Best Used Car Loan

Securing the most advantageous used car loan requires a strategic approach. Understanding the factors influencing interest rates and loan terms is crucial for maximizing your financial benefit. This involves comparing rates from multiple lenders, evaluating loan terms, and performing thorough research to identify the best possible deal.

Strategies for Comparing Used Car Loan Rates

Comparing used car loan rates effectively requires a systematic approach. This involves contacting multiple lenders, requesting quotes, and comparing the interest rates and terms offered. It’s essential to compare not only the interest rate but also the total cost of the loan, including fees and other charges. Thorough research and comparison shopping are key to identifying the most favorable loan.

- Contact Multiple Lenders: Reach out to various banks, credit unions, and online lenders to obtain quotes for used car loans. This broadens your options and allows you to compare rates directly.

- Request Loan Quotes: Provide accurate information about the vehicle, loan amount, and your financial situation to lenders. Be prepared to answer questions about your credit history and income.

- Compare Interest Rates and Loan Terms: Scrutinize the interest rates, loan terms, and any associated fees. Calculate the total cost of the loan to gain a complete understanding of the financial commitment.

- Consider Loan Fees and Charges: Be aware of potential fees, such as origination fees, prepayment penalties, and late payment fees. These fees can significantly impact the overall cost of the loan.

Importance of Thorough Research and Comparison Shopping

Thorough research and comparison shopping are vital in securing the most advantageous used car loan. This involves analyzing interest rates, loan terms, and lender reputations to identify the optimal financial solution.

- Analyze Interest Rates: Understanding how interest rates are determined and the factors affecting them allows for informed comparisons. Factors such as credit score, loan amount, and loan term influence interest rates.

- Review Loan Terms: Pay close attention to the repayment schedule, prepayment penalties, and other relevant terms. A comprehensive understanding of the terms is essential for making an informed decision.

- Evaluate Lender Reputation: Research the lender’s reputation and track record to ensure they are reliable and trustworthy. Positive reviews and a history of timely payments indicate a responsible lender.

- Compare Loan Options from Multiple Sources: Obtain quotes from multiple lenders to gain a broader perspective on available options. This comprehensive comparison enables the identification of the most favorable loan based on your individual needs and financial circumstances.

Illustrative Example of a Used Car Loan Calculation

Understanding the intricacies of used car loan calculations is crucial for making informed financial decisions. This section provides a practical example demonstrating how interest rates, loan terms, and other factors influence monthly payments and total loan costs. This knowledge empowers you to compare different loan offers effectively and choose the most suitable option.

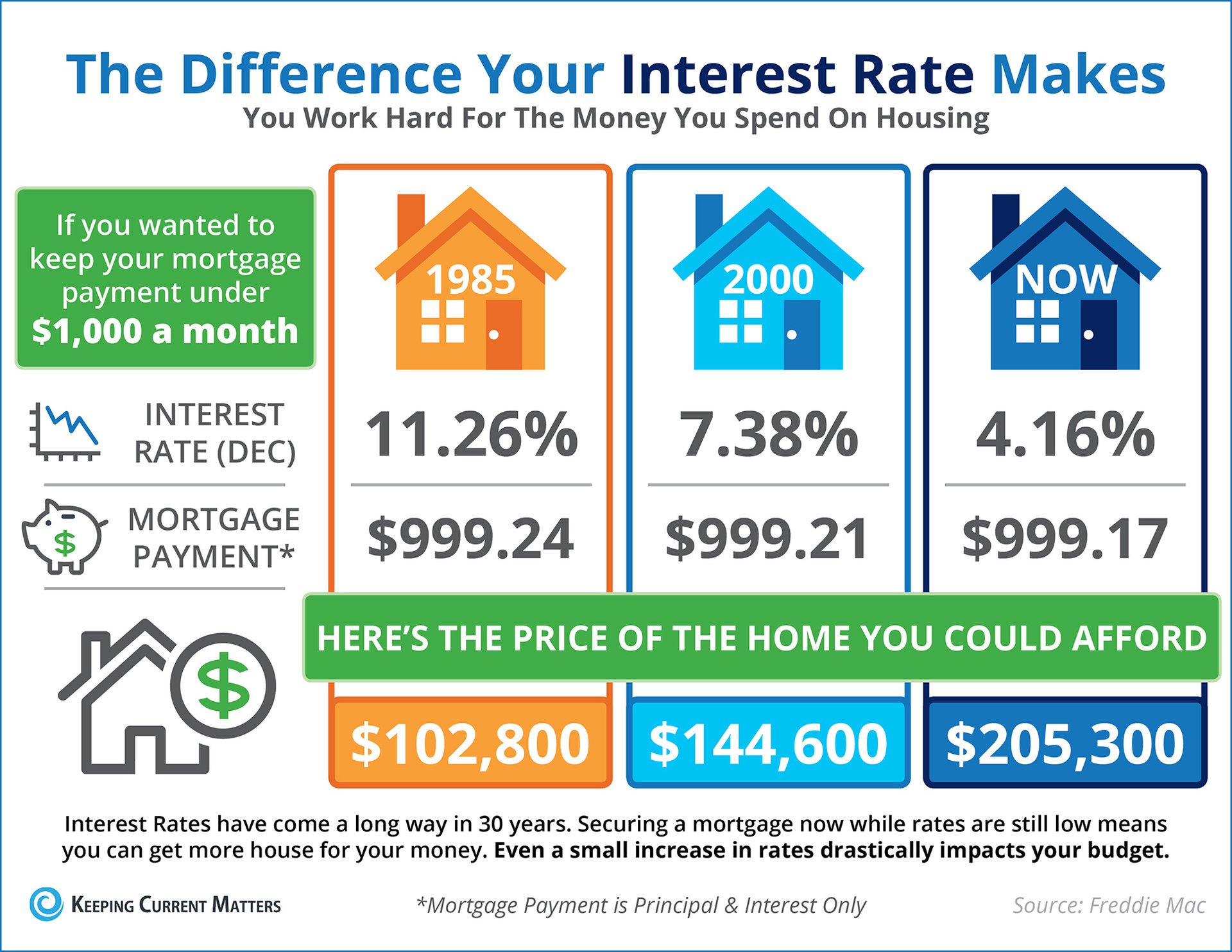

Impact of Interest Rates on Monthly Payments

Interest rates directly affect the monthly payment amount. Higher interest rates lead to larger monthly payments, increasing the overall cost of the loan. A smaller interest rate, conversely, will result in lower monthly payments and a lower total interest paid. This principle holds true across various loan types, including used car loans.

Loan Duration and Total Interest Paid

The duration of the loan, often expressed in months or years, significantly impacts the total interest paid. Longer loan terms result in lower monthly payments but a higher overall interest cost. Shorter loan terms, conversely, yield higher monthly payments but reduce the total interest expense. Careful consideration of loan duration is essential for optimizing the loan’s financial impact.

Illustrative Loan Scenarios

| Scenario | Loan Amount | Interest Rate | Loan Duration (Months) | Monthly Payment | Total Interest Paid |

|---|---|---|---|---|---|

| Scenario 1 | $15,000 | 5% | 60 | $283.66 | $2,019.96 |

| Scenario 2 | $15,000 | 7% | 60 | $299.76 | $2,985.70 |

| Scenario 3 | $15,000 | 5% | 72 | $235.02 | $3,541.20 |

The table above illustrates the impact of interest rates and loan duration on a used car loan of $15,000. Scenario 1 demonstrates a lower interest rate leading to a lower monthly payment and lower total interest. Scenario 2 shows a higher interest rate resulting in a higher monthly payment and a higher total interest. Scenario 3 highlights the effect of a longer loan term with a lower interest rate, leading to a lower monthly payment but a higher total interest.

Calculation Methodology

The monthly payment calculations presented in the table utilize a standard amortization formula, a widely used method for calculating loan payments. This formula considers the principal amount, interest rate, and loan duration. This is a simplified representation; actual calculations may include additional fees or charges.

Impact of Inflation on Used Car Interest Rates

Inflationary pressures significantly influence used car interest rates in 2024. As inflation rises, central banks often respond by increasing benchmark interest rates to curb the rate of price increases. This ripple effect translates into higher borrowing costs for consumers, including those financing used cars. The relationship between inflation and interest rates is a key factor in understanding the current used car loan market.

Inflation’s Effect on Borrowing Costs

Inflationary pressures directly impact borrowing costs. When inflation is high, the cost of money increases. Lenders, seeking to compensate for the eroding value of their capital over time, raise interest rates. This reflects the higher risk of lending money in an environment of rapidly increasing prices. Borrowers face a higher cost of borrowing as lenders demand a higher return to offset the diminishing purchasing power of their loans.

How Inflation Influences Interest Rate Adjustments

Central banks play a critical role in managing inflation. When inflation rises above target levels, central banks often implement policies that increase borrowing costs. Higher benchmark interest rates affect various interest rates, including those for used car loans. Lenders adjust their interest rates in response to the changes in the benchmark rates, leading to higher costs for consumers.

Detailed Impact of Inflation on Interest Rates

The relationship between inflation and interest rates is complex but generally predictable. As inflation rises, there’s a tendency for interest rates to follow suit. This occurs because lenders need higher returns on their loans to compensate for the loss in purchasing power caused by inflation. The magnitude of the interest rate adjustment depends on various factors, including the severity of inflation, the response of central banks, and the overall economic climate. For example, if inflation remains elevated, lenders are more likely to adjust interest rates upward in future periods. Conversely, if inflation falls, lenders may lower interest rates.

Illustrative Example

Consider a scenario where inflation in 2023 was 3%, and interest rates on used car loans were 5%. If inflation surged to 6% in 2024, lenders might adjust interest rates on used car loans upward to 7% or higher to reflect the increased cost of lending money and the reduced value of future loan repayments. This demonstrates how inflation influences the cost of borrowing, which directly affects the interest rates consumers pay on used car loans.