Factors Affecting Extended Warranty Costs

Used car extended warranties, while offering peace of mind, come with varying price tags. Understanding the factors that influence these costs is crucial for making an informed decision. These factors range from the vehicle’s history to the specific coverage offered.

The cost of an extended warranty is not a fixed amount; instead, it’s a dynamic figure that adjusts based on a multitude of influencing variables. These variables are often interconnected and affect the overall cost, so considering them all is essential to making a budget-friendly and protective purchase.

Vehicle Age and Mileage

A significant determinant of extended warranty costs is the vehicle’s age and mileage. Older vehicles and those with higher mileage are statistically more likely to require repairs. This increased risk translates directly to higher premiums for extended warranty coverage. Warranty providers assess the wear and tear on components based on these factors. A newer, lower-mileage car carries a lower risk of expensive repairs in the near future, thus commanding a lower warranty cost.

Make and Model

The make and model of the vehicle also plays a pivotal role. Certain makes and models are known for specific mechanical vulnerabilities or higher maintenance costs. Warranties for these models often reflect these potential repair expenses, resulting in a higher cost for coverage. Data on historical repair patterns and component failure rates for different models influence the pricing.

Repair History

A vehicle’s repair history significantly impacts warranty costs. A car with a documented history of frequent repairs, especially for costly components, will likely have a higher warranty premium. Providers assess the likelihood of future repairs based on the vehicle’s past maintenance records. A vehicle with a clean repair history will usually qualify for a lower warranty cost.

Coverage Type

The type of coverage offered also affects the warranty cost. More comprehensive coverage, including parts and labor for a wider range of repairs, generally comes with a higher premium. The scope of coverage is directly linked to the total cost of the warranty. A warranty that covers only specific components will usually have a lower cost than a comprehensive warranty.

Deductible Amount

The deductible amount, the amount the buyer pays out-of-pocket before the warranty kicks in, directly influences the overall cost. A higher deductible results in a lower premium. The deductible amount and the associated costs are inversely proportional. A lower deductible will lead to a higher warranty cost.

Table: Average Warranty Costs by Vehicle Type

| Vehicle Type | Average Warranty Cost (USD) |

|---|---|

| Compact Cars | $500-$1500 |

| SUVs | $750-$2000 |

| Trucks | $1000-$2500 |

Table: Impact of Deductible Amount on Warranty Cost

| Deductible Amount (USD) | Estimated Warranty Cost (USD) |

|---|---|

| $100 | $1200-$1800 |

| $250 | $900-$1500 |

| $500 | $700-$1200 |

Types of Extended Warranties

Extended warranties for used cars offer varying levels of protection, allowing buyers to customize coverage based on their needs and budget. Understanding the different types available is crucial for making informed decisions. Different warranties cater to different mechanical components and potential issues, providing peace of mind against unexpected repair costs.

Powertrain Warranties

These warranties typically cover the engine, transmission, and other crucial drivetrain components. This type of coverage is often a popular choice for used car buyers, particularly those with concerns about the vehicle’s core mechanical systems. A powertrain warranty can significantly reduce the financial burden of expensive repairs to these critical parts.

- Coverage typically includes the engine, transmission, and associated components.

- Exclusions may include parts like alternators, starters, hoses, and belts, depending on the specific warranty terms.

- Examples include a 3-year/36,000-mile powertrain warranty or a 2-year/24,000-mile powertrain warranty.

Comprehensive Warranties

Comprehensive warranties offer broader protection than powertrain warranties, covering a wider range of vehicle components. This type of warranty often includes protection for the engine, transmission, and other critical systems, but also extends to additional components and systems like electrical systems, heating and cooling systems, and the vehicle’s interior components.

- These warranties can provide protection against a broader range of issues than powertrain-only coverage.

- Typical exclusions might include damage from accidents, neglect, or wear and tear that isn’t considered a mechanical issue.

- Examples include a 2-year/24,000-mile comprehensive warranty or a 1-year/12,000-mile comprehensive warranty.

Specific Component Warranties

These warranties focus on a particular system or component, like the electrical system or the air conditioning. These are frequently less expensive than comprehensive warranties, but offer more targeted protection. A buyer might choose this option if they have specific concerns about a particular component.

- Specific component warranties often have limited coverage and exclusions.

- Examples of specific component warranties could be a warranty on the vehicle’s electrical system, or a warranty specifically on the AC unit. This provides focused coverage for a particular component, but not for the whole car.

Table Summarizing Warranty Types

| Warranty Type | Coverage | Exclusions |

|---|---|---|

| Powertrain | Engine, transmission, and related drivetrain components | Alternators, starters, hoses, belts (varies by provider) |

| Comprehensive | Engine, transmission, electrical systems, cooling systems, and many other components | Accident damage, neglect, wear and tear (varies by provider) |

| Specific Component | A particular system or component (e.g., electrical system, AC) | Other systems and components, and damage due to non-specified causes |

Coverage Comparison

Understanding the specifics of extended warranty coverage is crucial for making an informed decision. Different providers offer varying levels of protection, and understanding these nuances can significantly impact the value of the warranty. This section details the differences in coverage between providers, illustrating how they handle specific repairs and comparing their terms and conditions.

Variations in Coverage Across Providers

Extended warranty coverage can vary considerably between providers. Factors such as the scope of repairs covered, the maximum payout amounts, and the duration of coverage all play a role in the overall protection offered. Some providers might prioritize comprehensive coverage, while others might focus on specific components or repair types. These differences in approach can directly influence the value proposition for a given consumer.

Example Repair Scenarios

To illustrate the differences, consider the following scenarios:

- Engine Replacement: Some warranties may cover the full cost of a new engine if the failure is due to a covered component. Other warranties may offer a significantly lower payout or may not cover engine replacements at all, particularly if the failure is due to wear and tear or neglect.

- Transmission Repair: A warranty might cover transmission repairs related to a manufacturing defect or a covered component. However, a warranty might exclude repairs for transmission problems caused by improper maintenance or excessive wear and tear.

- Electrical System Repairs: Some warranties explicitly exclude electrical system repairs, while others might cover repairs related to a specific component or circuit board failure.

Comparison Table of Warranty Terms and Conditions

The table below highlights the key differences in terms and conditions among three different extended warranty providers, focusing on engine replacement and transmission repairs. This provides a direct comparison for assessing the level of protection offered by each provider.

| Provider | Engine Replacement (Covered Conditions) | Transmission Repair (Covered Conditions) | Deductible | Maximum Payout |

|---|---|---|---|---|

| Warranty A | Manufacturing defects only | Manufacturing defects and certain wear and tear within the first 50,000 miles | $100 | $5,000 |

| Warranty B | Manufacturing defects and some mechanical failures | Manufacturing defects only | $250 | $10,000 |

| Warranty C | Manufacturing defects, mechanical failures, and certain wear and tear | Manufacturing defects and certain wear and tear within the first 100,000 miles | $50 | Unlimited (subject to policy terms) |

Claims Process and Resolution Times

The claims process and resolution time can significantly impact the overall user experience. Some providers offer streamlined online claim submission and efficient communication throughout the process. Others might have more complex procedures, leading to delays in receiving the necessary repairs. The claim resolution time is a critical factor in evaluating the effectiveness and efficiency of each warranty provider.

Negotiating Warranty Costs

Extended warranties for used cars can be a significant expense. Knowing how to negotiate effectively can save you money without sacrificing adequate coverage. This section details strategies for getting the best possible price on a used car extended warranty.

Negotiating a used car extended warranty is similar to negotiating the price of the vehicle itself. Understanding the value of the warranty, recognizing dealer tactics, and being prepared with alternative options are key to achieving a favorable outcome.

Strategies for Negotiating Warranty Costs

Effective negotiation hinges on a comprehensive understanding of the warranty’s value and your alternatives. Arm yourself with information about the vehicle’s condition, typical repair costs, and comparable warranties. Compare the offered warranty with independent options. This empowers you to make informed decisions and counter potential dealer pressure.

- Research comparable warranties: Before entering negotiations, thoroughly research comparable extended warranty plans from independent providers. Use online comparison tools to analyze coverage details, exclusions, and pricing. This research provides a benchmark for evaluating the dealer’s offer.

- Understand the vehicle’s history: Obtain the vehicle’s maintenance history and any pre-existing mechanical issues. This information helps assess the potential need for future repairs and adjust your negotiation strategy accordingly. If the vehicle has a history of significant mechanical problems, a lower-cost or more limited warranty might be sufficient.

- Prepare alternative options: Explore the possibility of purchasing a warranty from an independent provider. This gives you leverage during negotiations with the dealer. Knowing you have a viable alternative can strengthen your negotiating position.

- Be prepared to walk away: If the dealer’s offer is significantly higher than comparable options, be prepared to walk away. This demonstrates your resolve and commitment to getting a fair price. Dealers often adjust their pricing when faced with a potential loss of a sale.

Common Dealer Tactics

Dealers often employ specific strategies to encourage extended warranty purchases. Understanding these tactics helps you to counter them effectively. Be aware of high-pressure sales tactics and avoid making impulsive decisions.

- High-pressure sales tactics: Dealers might use aggressive sales tactics, such as limited-time offers or creating a sense of urgency, to pressure you into purchasing a warranty. Resist these tactics by calmly evaluating the warranty’s value and comparing it to other options.

- Bundling warranties with other services: Dealers may try to bundle the warranty with other services, such as roadside assistance or maintenance packages. Critically evaluate each component’s value and determine if the bundle offers a fair price compared to individual purchases.

- Misleading or vague descriptions: Dealers may use ambiguous or misleading language in warranty descriptions. Request clarification on specific coverage details, and ensure that all exclusions are clearly Artikeld. Do not hesitate to ask for a breakdown of the cost for each aspect of the warranty.

Reading the Fine Print

Thorough examination of the warranty’s fine print is crucial before making a purchase. Carefully scrutinize the terms and conditions, understanding the scope of coverage and potential exclusions.

- Identify exclusions: Look for exclusions and limitations. Many warranties exclude routine maintenance, wear and tear, or damage caused by specific actions. Understanding these exclusions helps you determine if the warranty provides adequate protection for your needs.

- Check the deductible: Determine the deductible amount. A higher deductible can significantly reduce the warranty’s overall cost, but it also increases your out-of-pocket expenses in case of a covered repair. Compare the deductible with the expected repair costs for the vehicle.

- Review the repair process: Ensure the warranty specifies the process for filing claims and obtaining repairs. Understanding this process avoids confusion and delays in case of a covered repair.

Risks and Benefits of Negotiating

Negotiating with warranty providers carries potential risks and rewards. Be aware of these considerations when making your decision.

- Potential for a better deal: Successful negotiation can result in a significantly lower warranty cost, saving you money on the overall purchase price. Negotiating with the dealer or an independent provider can lead to a more affordable warranty.

- Risk of a poor outcome: Negotiation can be unsuccessful if the dealer or warranty provider is unwilling to meet your terms. However, this risk is minimized by your thorough research and understanding of the market.

Cost vs. Value Analysis

Determining the true value of an extended car warranty requires a careful comparison of its cost to the potential savings it offers. While seemingly straightforward, this analysis necessitates a deep dive into the specific vehicle, its anticipated use, and the likelihood of incurring costly repairs. A simple cost-benefit analysis is often insufficient; understanding the nuances of the vehicle’s age, mileage, and maintenance history is crucial.

The decision to purchase an extended warranty is not a binary choice. It hinges on the interplay between the premium’s price and the probability of experiencing significant repair expenses. A sound approach considers not just the immediate cost but also the potential long-term financial implications.

Assessing the Value Proposition

A crucial aspect of evaluating an extended warranty lies in comparing its price to the potential cost of repairs. This analysis requires a comprehensive understanding of the vehicle’s age, mileage, and maintenance history. A newer vehicle with low mileage is less likely to require expensive repairs compared to a high-mileage older vehicle. This means a warranty might be more valuable for a high-mileage vehicle.

High-Mileage Vehicles and Extended Warranties

High-mileage vehicles often present a greater need for extended warranty coverage. As these vehicles age, the likelihood of needing expensive repairs increases. For example, a 100,000-mile vehicle might experience significant wear and tear on critical components like the transmission, engine, or electrical system, leading to costly repairs. A warranty could provide substantial financial protection in such situations.

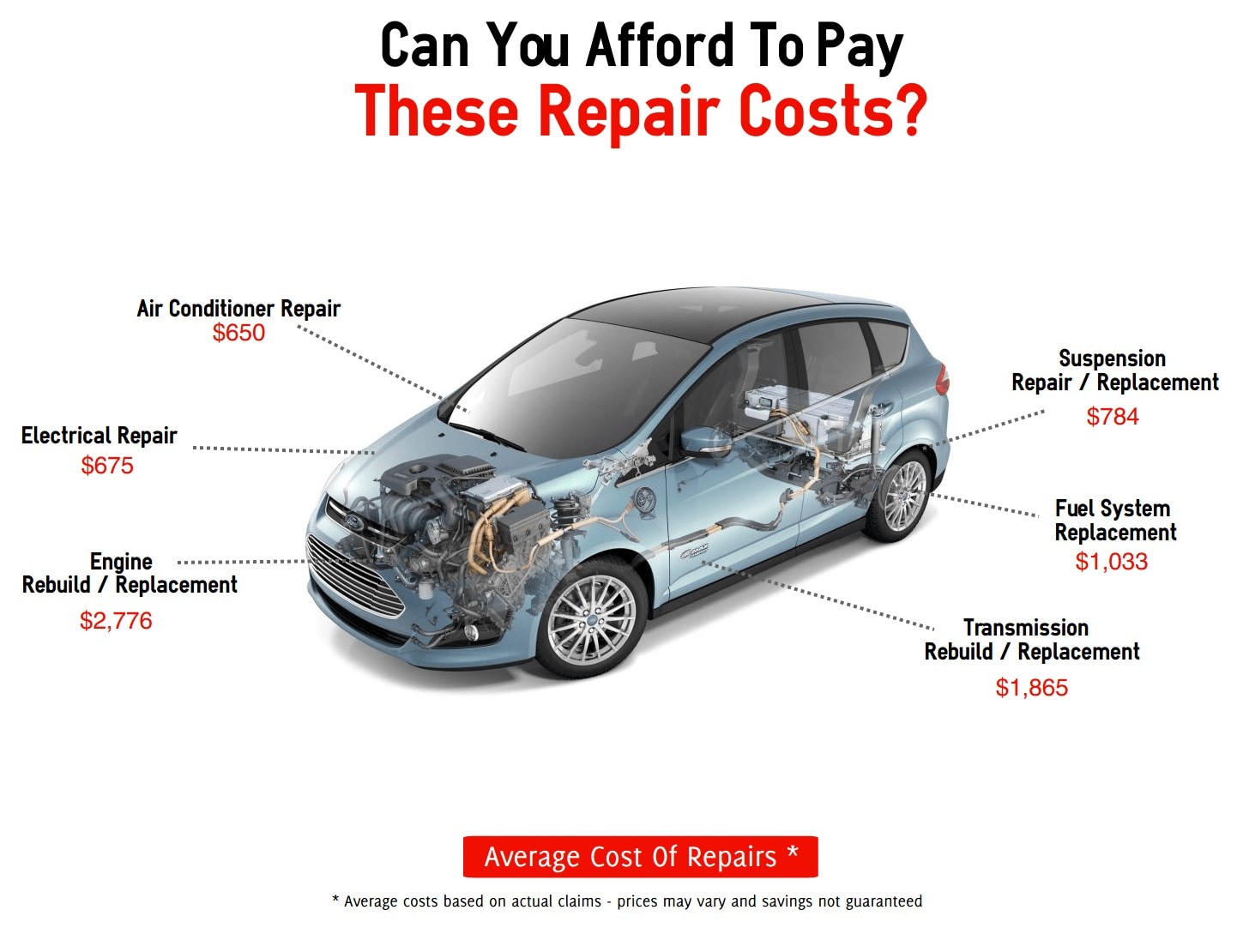

Expensive Repairs and Extended Warranties

Specific repairs, particularly those related to major components like the engine or transmission, can easily exceed the cost of a warranty. Consider a scenario where a high-end luxury vehicle requires a major engine rebuild. The cost of the repair could far exceed the price of a comprehensive warranty, making it a worthwhile investment. This is especially true for vehicles with high-value components, as well as those with a history of expensive repairs.

Situations Where Warranties May Not Be Worthwhile

Conversely, there are situations where the cost of an extended warranty outweighs its potential value. A well-maintained vehicle with low mileage, and a proven track record of minimal maintenance, may not require extensive repairs in the near future. In these cases, the cost of the warranty could be better allocated elsewhere. Consider a vehicle that has consistently undergone regular maintenance and shows no signs of significant wear and tear. Investing in an extended warranty in this case may not provide a substantial return on investment.

Cost-Benefit Comparison Table

| Vehicle System | Average Repair Cost (Over Time) | Typical Extended Warranty Cost | Potential Value (Yes/No/Maybe) |

|---|---|---|---|

| Engine | $3,000 – $10,000+ | $500 – $2,000 | Yes (Highly recommended) |

| Transmission | $2,000 – $5,000+ | $400 – $1,500 | Yes (Likely recommended) |

| Electrical System | $500 – $2,000 | $200 – $800 | Maybe (Consider mileage and vehicle age) |

| Brakes | $200 – $800 | $100 – $400 | No (Likely not worth it) |

Note: The table above provides a general overview. Specific costs vary based on the make, model, and condition of the vehicle. Furthermore, the warranty coverage and its limitations must be thoroughly reviewed.

Industry Trends

Used car extended warranties are experiencing evolving dynamics, influenced by inflation, repair costs, and technological advancements. Understanding these trends is crucial for both consumers and sellers in navigating the market and making informed decisions. This section explores the current landscape of extended warranty pricing and its future implications.

The used car market is complex, with factors like vehicle age, mileage, and condition directly impacting warranty costs. A key driver behind price fluctuations is the ongoing interplay of inflation and repair costs. These factors often create a ripple effect, influencing both the demand for warranties and the pricing strategies employed by dealerships and warranty providers.

Current Pricing Trends

Used car extended warranty pricing is demonstrably influenced by factors beyond simple vehicle age and mileage. Dealers and warranty providers often employ dynamic pricing strategies, adjusting costs based on market demand, repair frequency for specific vehicle models, and overall economic conditions. This adaptability reflects the need to balance profitability with consumer affordability.

Impact of Inflation and Repair Costs

Inflation significantly impacts the cost of repairs and maintenance. Increased labor costs and material prices directly translate to higher warranty payouts. This is especially evident in specific components or systems with complex repair procedures. For example, if the cost of a particular engine part doubles due to inflation, the corresponding warranty premiums also tend to rise to reflect this increased potential payout.

Role of Technology

Technology is revolutionizing the used car market and influencing warranty costs. Diagnostic tools, online repair forums, and even automated repair processes have an impact on the predictability of potential repairs. The increased availability of detailed repair information often leads to a more accurate assessment of potential future repair costs, enabling providers to adjust pricing more precisely. For instance, advanced diagnostic software can quickly pinpoint potential issues, reducing the need for extensive and expensive repairs.

Future of Extended Warranties

The future of extended warranties in the automotive market appears to be evolving towards greater customization and transparency. Consumers are increasingly seeking warranties that are tailored to their specific needs and driving habits. This trend is mirrored in the growing availability of usage-based insurance models, where premiums are adjusted based on driving patterns and mileage. As technology continues to advance, predictive maintenance models may become more common, allowing for proactive repair planning and potentially reducing unexpected warranty claims.

Tips for Consumers

Making an informed decision about a used car extended warranty requires careful consideration. It’s crucial to understand the potential benefits and drawbacks before committing to a purchase. Consumers should not feel pressured into buying a warranty, and instead, thoroughly evaluate the cost and value proposition.

Crucial Steps in Evaluating Used Car Extended Warranties

Thorough evaluation of used car extended warranties involves a series of steps to ensure the best possible outcome. First, understanding the specific coverage provided by different warranty options is paramount. A detailed review of the terms and conditions, including exclusions and limitations, is essential to avoid unforeseen issues down the road.

Checklist for Evaluating Warranty Options

This checklist provides a structured approach for evaluating various warranty options. A systematic evaluation process helps consumers avoid impulsive decisions and ensures a warranty aligns with their needs and budget.

- Identify your needs: Determine the specific repairs you anticipate needing over the warranty period. A thorough review of the car’s history report, including previous repairs, will help you predict potential future problems. Consider your driving habits and the car’s anticipated mileage. A higher mileage vehicle with a history of frequent repairs might warrant a more comprehensive warranty.

- Compare coverage options: Analyze the specific components covered by each warranty. Understand the deductibles, limitations, and exclusions associated with each option. Note the types of repairs included, such as engine or transmission repairs, and the specific circumstances under which these repairs are covered.

- Review the warranty provider’s reputation: Research the provider’s history and customer service reviews. Understanding the warranty provider’s track record in handling claims and their financial stability will provide confidence in the warranty’s reliability.

- Calculate the total cost: Consider the upfront cost of the warranty, as well as any potential future costs if claims are made. Estimate the total cost of ownership with and without the warranty over the expected period of coverage.

- Seek professional advice (optional): Consulting with a trusted mechanic or financial advisor can provide valuable insights. A professional can offer an objective assessment of the car’s condition and potential future repair needs.

Common Pitfalls to Avoid

Avoiding common pitfalls when purchasing a used car extended warranty is crucial for a successful and financially sound decision. Unnecessary purchases can lead to wasted money and frustration.

- Overspending on unnecessary coverage: Evaluate your actual needs and avoid purchasing warranties exceeding those requirements. A warranty that covers components you are unlikely to need might not be worthwhile.

- Failing to read the fine print: Thoroughly review all terms and conditions, including exclusions, limitations, and the claims process. Pay close attention to the definitions of covered repairs and the specifics of what is not covered.

- Ignoring the car’s condition: If the car has a history of significant problems, a warranty might not adequately address the underlying issues. Consider the potential cost of repairs that may exceed the warranty’s coverage.

- Purchasing a warranty without a thorough inspection: Ensure the car has been thoroughly inspected and that you have a clear understanding of its condition. Hidden issues can render a warranty ineffective.

Key Questions to Ask When Considering an Extended Warranty

This table summarizes the essential questions to ask when evaluating an extended warranty for a used car.

| Question | Explanation |

|---|---|

| What specific components are covered? | Clarify the scope of the warranty coverage, including engine, transmission, and other critical systems. |

| What are the exclusions and limitations? | Understand the specific circumstances under which repairs are not covered. |

| What is the deductible amount? | Determine the amount you will need to pay upfront for covered repairs. |

| What is the claims process? | Clarify the steps involved in filing a claim and obtaining repairs. |

| What is the warranty provider’s reputation? | Research the provider’s history, customer reviews, and financial stability. |