Overview of California’s Used Car EV Tax Credit

California’s used electric vehicle (EV) tax credit program offers financial incentives to encourage the adoption of cleaner transportation. This program aims to boost the state’s transition to electric vehicles by making them more accessible to consumers. Understanding the program’s specifics, eligibility criteria, and the value of the credit is crucial for potential buyers.

Eligibility Requirements

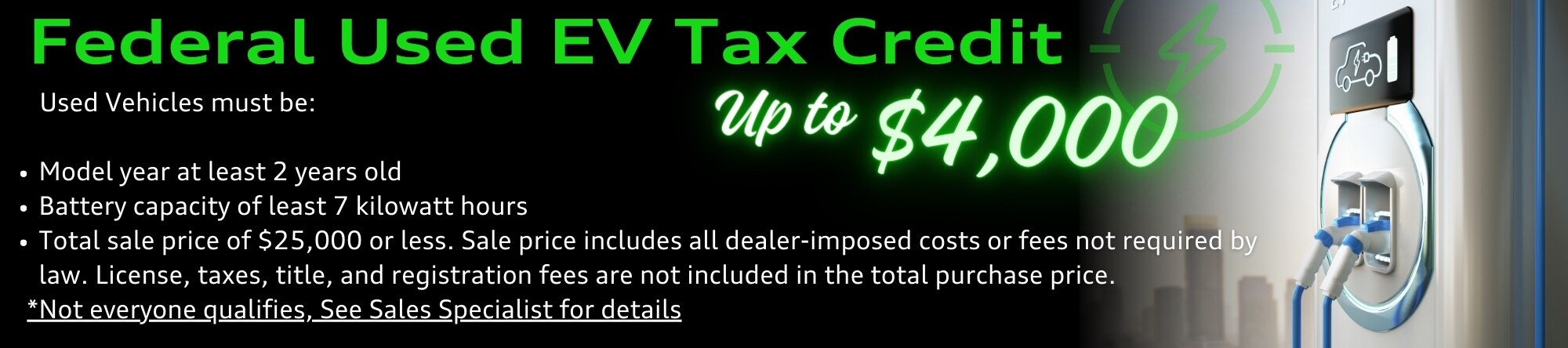

The eligibility criteria for California’s used EV tax credit are designed to target specific vehicles and owners. These criteria ensure the credit benefits those who genuinely contribute to the state’s sustainability goals. Strict guidelines for vehicle specifications and owner qualifications are essential to the program’s effectiveness. Meeting these requirements is critical for claiming the credit.

- The vehicle must be a used electric vehicle, including battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). The vehicle must have been manufactured and certified as an EV in accordance with California’s regulations.

- The vehicle’s manufacturer must be certified by the California Air Resources Board (CARB) as having met specific emission standards.

- The vehicle must be purchased from a licensed California dealer or through a verified private party transaction. All necessary paperwork and documentation must be submitted for validation.

- The buyer must be a California resident and meet specific income guidelines. This ensures that the credit targets eligible residents of the state.

Maximum Credit Amount and Calculation

The maximum amount of the used EV tax credit varies depending on factors like the vehicle’s model year and the applicable credits for the given time frame. A standardized calculation method ensures fairness and transparency in the credit distribution process.

The credit amount is typically a percentage of the vehicle’s sale price, with a cap to prevent excessive benefits.

The exact percentage and cap can fluctuate based on legislative updates and changes to the program. For example, in 2023, the maximum credit might be 2,500 USD, but the calculation would be based on the vehicle’s sale price, manufacturer’s specifications, and any applicable state incentives. The precise formula for determining the credit amount is available on the official California government website.

Eligible Electric Vehicle Types

California’s used EV tax credit program covers a range of electric vehicle types, each designed to promote sustainable transportation.

- Battery electric vehicles (BEVs): These vehicles rely solely on batteries for power, producing zero tailpipe emissions. Examples include Tesla Model 3s, Nissan Leafs, and Chevrolet Bolts.

- Plug-in hybrid electric vehicles (PHEVs): These vehicles combine an internal combustion engine with an electric motor, allowing for some electric-only operation. Examples include the Toyota Prius Prime and the Honda Clarity Plug-in.

Historical Changes in the Program

The used EV tax credit program in California may have undergone modifications over time. Changes to the program reflect evolving goals and priorities in promoting electric vehicle adoption.

| Year | Change Description |

|---|---|

| 2023 | Updated eligibility criteria and maximum credit amounts. Changes were made to better accommodate evolving vehicle technologies and market conditions. |

| 2022 | Increased the maximum credit amount, making EVs more accessible to consumers. |

| 2021 | Initiated the program with a focus on stimulating EV adoption and reducing carbon emissions. |

Impact on the Used Car Market

The introduction of a used car EV tax credit in California is poised to significantly reshape the state’s used vehicle market. This incentive, designed to encourage the adoption of electric vehicles, is expected to impact both demand and pricing dynamics, potentially altering the overall landscape of the used car industry.

The tax credit’s impact on the used car market will likely be multifaceted, influencing the price of used electric vehicles, shifting demand patterns, and presenting both challenges and opportunities for dealerships. Understanding these effects is crucial for navigating the evolving market conditions.

Potential Price Impacts on Used Electric Vehicles

The tax credit is projected to increase demand for used electric vehicles (EVs). This increased demand, absent a corresponding increase in supply, could lead to price appreciation for certain models. Conversely, a significant influx of used EVs entering the market could potentially temper price increases or even lead to price decreases, depending on the magnitude of the supply increase. Factors such as the vehicle’s age, mileage, condition, and specific model will influence the price adjustments. Historically, similar incentives in other markets have shown varying effects on used EV pricing, demonstrating the complexity of the relationship.

Effect on Demand for Used EVs versus Gasoline-Powered Vehicles

The tax credit is anticipated to boost demand for used EVs considerably. Consumers seeking to reduce their environmental footprint and potentially save money on fuel costs will likely be drawn to the incentive. This shift in demand could potentially decrease demand for used gasoline-powered vehicles, particularly those with lower fuel efficiency ratings. The magnitude of this shift will depend on several factors, including the size of the tax credit, the availability of used EVs, and consumer preferences.

Impact on Car Dealerships

The introduction of a used car EV tax credit will likely create both challenges and opportunities for car dealerships. Dealers will need to adapt to the changing demand landscape, potentially requiring investments in expanding their inventory of used EVs. Additionally, they may face challenges in accurately assessing the value of used EVs, particularly those eligible for the tax credit. However, dealerships could also capitalize on the increased demand for used EVs by positioning themselves as specialists in this growing market segment. The successful adaptation of dealerships will depend on their ability to effectively manage inventory, assess pricing, and provide accurate information about the tax credit to potential customers.

Potential Influence on Overall Used Car Market Trends

The tax credit is expected to contribute to the overall evolution of the used car market in California. The increased demand for used EVs could lead to a more balanced market, with both gasoline-powered and electric vehicles being traded. The long-term implications on the overall market will depend on several factors, including the longevity of the tax credit, the overall supply of used EVs, and consumer adoption patterns. It is likely that the shift towards electric vehicles will continue, potentially leading to a more environmentally friendly used car market in the long run.

Comparison with Other States’ Programs

California’s used car EV tax credit program presents a unique approach to incentivizing electric vehicle adoption. Understanding how it stacks up against similar programs in other states is crucial for assessing its effectiveness and potential impact on the broader EV market. This comparison highlights both the advantages and disadvantages of California’s approach, offering a more comprehensive picture of the state’s initiative.

California’s program, while ambitious, is not the only state offering incentives for used EVs. Comparing its features with those of other states provides a valuable benchmark for understanding its position within the national landscape and the overall trajectory of EV adoption.

Eligibility Criteria Comparison

California’s used car EV tax credit has specific eligibility criteria related to vehicle year, battery capacity, and manufacturer. Other states may have differing standards, potentially including requirements for vehicle mileage, model year, or specific EV types. This variation in eligibility criteria can significantly impact the pool of eligible vehicles and the overall effectiveness of the incentive program.

Credit Amount Comparison

The amount of the tax credit in California can vary depending on factors such as the vehicle’s year, battery capacity, and manufacturer. Other states may have fixed credit amounts or tiered systems based on different vehicle specifications. These variations in credit amounts directly affect the financial incentive for consumers and can influence their purchasing decisions.

Application Process Comparison

California’s application process for the used car EV tax credit likely involves specific documentation and submission requirements. Other states may have different processes, some potentially simpler or more complex than California’s. Understanding the application procedures in other states provides insight into the administrative burdens faced by consumers and the efficiency of the programs.

Table: Comparison of Used EV Tax Credit Programs Across States

| State | Eligibility Criteria | Credit Amount | Application Process |

|---|---|---|---|

| California | Vehicle year, battery capacity, manufacturer | Variable, based on vehicle specifications | Likely involves specific documentation and submission requirements |

| [State 2] | [Eligibility details] | [Credit amount details] | [Application process details] |

| [State 3] | [Eligibility details] | [Credit amount details] | [Application process details] |

Note: Data for [State 2] and [State 3] are hypothetical examples and should be replaced with actual data from specific states. Information should be gathered from official state government websites or reliable sources.

Similarities and Differences

A commonality across many state programs is the aim to stimulate EV adoption. Differences lie in the specific criteria used for eligibility, the amount of the credit, and the application process. These variations often reflect different state priorities and resources.

Potential Implications for Consumers

The differences in eligibility criteria, credit amounts, and application processes across states can significantly impact consumers’ choices. Consumers in states with more generous programs might be more inclined to purchase used EVs. Conversely, those in states with less supportive programs may face a higher barrier to entry.

Potential for National Standardization

National standardization of EV tax credits could streamline the process for consumers and businesses, promoting a more uniform approach to EV adoption across the country. This standardization would reduce confusion and make it easier for consumers to compare incentives across states. It could also foster a more robust and predictable market for used EVs.

Potential Challenges and Considerations

California’s used EV tax credit presents exciting opportunities for consumers and the used car market. However, potential challenges must be addressed to ensure the program’s success and equitable application. These hurdles encompass consumer access, administrative efficiency, and the risk of fraudulent activity. Navigating these challenges will be crucial for the program’s long-term effectiveness.

Consumer Application Challenges

The application process for the tax credit will likely involve multiple steps and documentation requirements. Complexity in navigating these procedures could pose a significant barrier for some consumers, particularly those unfamiliar with the application process or lacking digital literacy. Further, potential variations in state-specific tax codes and regulations across different counties in California could create further confusion. For example, an individual in a rural area might face greater logistical challenges in accessing necessary information or completing the paperwork compared to someone in an urban area.

Administrative Burden

Implementing the used EV tax credit will undoubtedly place a strain on administrative resources. The state will need to establish a robust system for processing applications, verifying eligibility, and issuing credits. This could involve significant investment in personnel, technology, and infrastructure. Potential backlogs and delays in processing applications could also discourage participation and create frustration among eligible consumers. For instance, if the application process is not streamlined, the system could overwhelm the existing resources, leading to significant delays in processing and payment.

Fraud and Abuse Potential

The potential for fraud and abuse is a critical concern in any government incentive program. Fraudulent claims could undermine the program’s integrity and divert funds from legitimate recipients. False documentation, misrepresentation of vehicle history, or inflated valuations could all lead to misallocation of funds. This could necessitate rigorous verification procedures and potentially involve third-party verification services. The program needs robust measures to prevent fraudulent activities, including thorough checks of vehicle history reports and possibly requiring a detailed inspection by authorized professionals.

Solutions to Address Challenges

Addressing these challenges requires a multi-faceted approach. Simplified application forms and online portals can make the process more accessible to a wider range of consumers. Investing in robust verification tools, such as partnerships with trusted third-party verification services, could mitigate fraud risk. Furthermore, transparent communication and clear guidelines on eligibility criteria will increase consumer understanding and confidence. Providing readily available support channels, such as dedicated phone lines or online FAQs, will help address questions and concerns.

Frequently Asked Questions (FAQs)

- What documentation is required to claim the tax credit? Applicants will need to provide proof of vehicle ownership, purchase date, vehicle identification number (VIN), and potentially other supporting documentation. This may include sales receipts, titles, and any relevant maintenance records. A complete list of requirements will be available on the official program website.

- How long will it take to receive the tax credit? Processing times will vary based on the volume of applications and the efficiency of the verification procedures. The program website will post an estimated timeframe, and updates will be available on the status of the application.

- What are the penalties for submitting fraudulent claims? Submitting false information or misrepresenting facts could lead to penalties, including fines and potential legal action, in accordance with California state laws.

- Where can I find more information about the program? The official California government website and designated program pages will be the primary sources for up-to-date information, frequently asked questions, and relevant details.

Future of the Program

The California used car EV tax credit program, while currently offering significant incentives, is likely to undergo adjustments in the coming years. Predicting the precise nature of these changes requires careful consideration of evolving economic conditions, political landscapes, and technological advancements. This section explores potential modifications to the program, focusing on areas like application improvements, expanded accessibility, and the influence of external factors.

Potential Program Modifications

The California used car EV tax credit program’s future is subject to a variety of potential adjustments. These changes may reflect adjustments in market conditions, legislative priorities, or public response to the program’s effectiveness.

Application Process Improvements

The current application process for the California used car EV tax credit program might be streamlined. Improvements could include online portals for application submission and approval, automated verification processes, and more readily available FAQs and support resources. This can enhance the overall user experience and efficiency. The adoption of a more user-friendly online system could reduce processing times and increase public engagement. Examples of other states’ EV tax credit programs can provide valuable insights for improvement. For instance, if a state successfully integrates a digital application system, this could be emulated in California.

Increasing Program Accessibility

To ensure wider participation and address equity concerns, the program could be designed to be more accessible. This could involve extending the eligibility criteria to include a broader range of income levels or making financial assistance more readily available for low-income individuals and families. Expanding the available resources for education and financial assistance could make the program more approachable. Furthermore, the availability of financial counseling and education resources could greatly improve access and affordability for all participants.

Influence of Political and Economic Factors

California’s political climate and economic conditions play crucial roles in shaping the future of the program. Changes in government policies, such as shifts in environmental regulations or economic downturns, may influence the program’s funding or eligibility criteria. For example, during economic recessions, tax credits for electric vehicles may receive higher priority to stimulate the economy. Also, increased consumer interest in electric vehicles might lead to modifications in eligibility criteria.

Possible Future Scenarios

| Scenario | Description | Impact |

|---|---|---|

| Increased Funding | The state legislature allocates additional funding to the program, expanding eligibility and increasing the credit amount. | More individuals and families can afford electric vehicles, boosting the used car market and electric vehicle adoption. |

| Targeted Eligibility Adjustments | The program focuses on specific demographics or vehicle types, like electric trucks or those from underrepresented manufacturers. | This can help address specific market needs and encourage diverse vehicle options, potentially spurring local economic development. |

| Reduced Credit Amount | The credit amount decreases due to budget constraints or a shift in priorities. | Reduced incentives may impact the used car market’s immediate growth, but the overall adoption of electric vehicles may still increase in the long term. |

| Increased Application Complexity | Additional documentation or verification requirements are introduced to combat fraud or abuse. | Increased administrative burden could deter some potential applicants. |