Understanding the Market

The used car market is a dynamic landscape, shaped by evolving consumer preferences, economic conditions, and innovative financing options. Understanding these trends is crucial for both buyers and sellers navigating this sector. This analysis delves into the current state of the used car market, focusing specifically on the growth of 0% financing options and the factors driving this demand.

The used car market is significantly impacted by the interplay of factors including supply chain disruptions, consumer demand for specific models, and the availability of financing. The introduction of 0% financing options has demonstrably affected the buying process and is a key driver of current market trends.

Current State of the Used Car Market

The used car market has experienced significant fluctuations in recent years, with prices varying based on model, year, and condition. Inventory levels have fluctuated, impacting both supply and demand. The overall trend points towards a market increasingly influenced by financing options, with 0% financing playing a key role in attracting buyers.

Factors Influencing Demand for Used Car 0% Financing

Several factors contribute to the rising demand for used car 0% financing. Increased competition among dealerships and the need to attract buyers are significant drivers. The ease of qualifying for this type of financing, often with minimal or no down payment requirements, is another key factor, especially for consumers with limited access to traditional financing. Additionally, the potential to avoid interest payments and secure a more affordable monthly payment is a significant draw for many prospective buyers.

Differences in Financing Options for Used vs. New Cars

Financing options for used cars often differ from those for new cars. Used car financing frequently involves higher interest rates compared to new cars, reflecting the risk associated with a pre-owned vehicle. The term lengths available for used car financing may also be shorter. This is because the vehicle’s value is depreciated, meaning the loan amount is relative to the asset’s diminished value. Furthermore, used car dealerships often offer 0% financing deals to compete with new car dealerships, thus creating unique incentives for used car purchases.

Role of Interest Rates and Economic Conditions on Used Car Financing

Interest rates significantly influence the affordability of used car loans. Lower interest rates generally lead to more affordable monthly payments, boosting demand for used car financing. Conversely, rising interest rates can make used car financing less attractive. Economic conditions, such as job security and consumer confidence, also play a role. During periods of economic uncertainty, buyers may be more cautious, potentially affecting the demand for used car financing. For example, during the 2008 recession, used car sales and financing slowed due to reduced consumer confidence and increased borrowing costs.

Comparison of Financing Terms and Conditions

| Lender | Interest Rate | Loan Term | Down Payment | Additional Fees |

|---|---|---|---|---|

| Bank A | 0% (with specific conditions) | 36-60 months | 10-20% | Origination fee, processing fee |

| Credit Union B | 0.99% – 1.99% | 36-72 months | 5-15% | Application fee, admin fee |

| Dealership C | 0% (with specific conditions) | 24-60 months | 0% (in some cases) | Dealer documentation fees |

Note: Financing terms and conditions are subject to change and vary based on the individual borrower’s creditworthiness and the specific vehicle. This table is a simplified representation of possible options and does not constitute financial advice. Always consult with a lender for personalized loan options.

Consumer Perspective

Consumers are increasingly drawn to used car 0% financing options, driven by a desire for affordability and ease of purchase. This interest stems from a complex interplay of financial pressures, desire for specific vehicle models, and perceived value propositions. Understanding the motivations, expectations, and potential pitfalls of these deals is crucial for both consumers and sellers.

Motivations and Expectations of Consumers

Consumers seeking 0% financing for used cars often prioritize affordability and immediate ownership. They are frequently seeking to avoid the perceived high cost of interest payments associated with traditional financing options. This desire is often fueled by a desire to reduce the total cost of the vehicle, even if it means a longer loan term. Furthermore, some consumers may have a specific vehicle in mind and view 0% financing as a way to secure it. The perceived value proposition of a zero-interest loan often outweighs the potential disadvantages.

Advantages of 0% Financing

0% financing offers a clear advantage in that it eliminates the interest component of the loan. This translates to a lower total cost of ownership for the vehicle over the loan term compared to traditional financing with interest. It can also simplify the decision-making process for consumers, as the monthly payment amount is predictable and straightforward. For example, a consumer might be able to afford a vehicle with a higher price tag due to the elimination of interest costs.

Disadvantages of 0% Financing

A potential drawback is the often-extended loan term associated with 0% financing. While the monthly payments might be lower, the total amount paid over the loan’s life could potentially exceed the cost of a loan with a higher interest rate, particularly for longer loan terms. Additionally, some dealers might offer 0% financing with hidden fees or add-ons.

Common Misconceptions

A common misconception is that 0% financing is always the best option for any consumer. This isn’t necessarily the case. The actual total cost of the loan needs to be considered, factoring in the loan term and potential fees, in order to make an informed decision. Another misconception is that 0% financing is only available for low-value vehicles. In reality, it’s often offered on a wider range of vehicles depending on the dealer and market conditions.

Factors Influencing Consumer Choice

Several factors influence a consumer’s choice in used car financing options. These include the total price of the vehicle, the loan term offered, the associated fees (e.g., origination fees, documentation fees), and the consumer’s own financial situation. The overall interest rate, even if it’s zero percent, should not be the sole determining factor. For instance, a consumer with a strong credit score might have better options for obtaining a loan with a slightly higher interest rate but a shorter term.

Pros and Cons of 0% Financing vs. Other Options

| Feature | 0% Financing | Traditional Financing |

|---|---|---|

| Interest Rate | 0% | Variable or fixed rate |

| Monthly Payments | Potentially lower, but potentially longer term | Higher initially, potentially shorter term |

| Total Cost | Potentially higher due to longer term, but lower monthly payment | Lower overall cost, potentially higher monthly payment |

| Loan Term | Typically longer | Typically shorter |

| Fees | Potential for hidden fees or add-ons | Potentially lower upfront fees |

The table above highlights a crucial comparison. Consumers should carefully weigh the potential benefits and drawbacks of each option before committing to a specific financing plan.

Dealer Practices

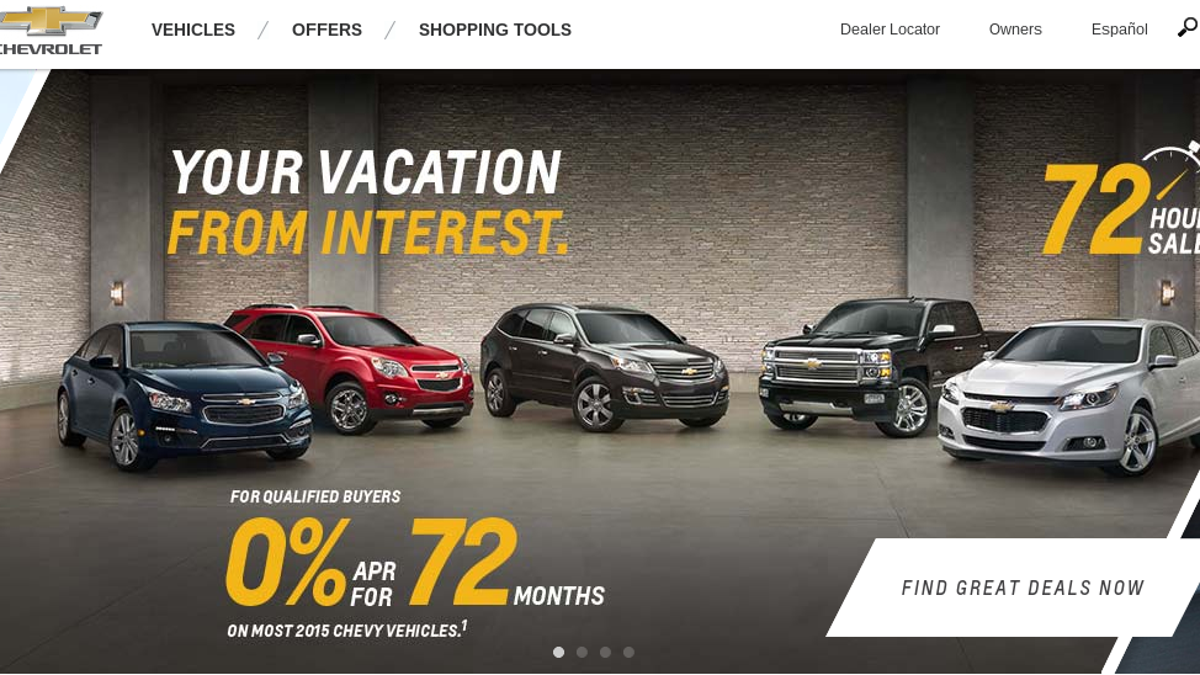

Dealerships employ various strategies to leverage 0% financing offers for used cars, recognizing their crucial role in attracting customers. Understanding these tactics is essential for both consumers and dealerships to navigate the used car market effectively. The competitive landscape necessitates innovative approaches to maximize the impact of these attractive financing options.

Dealerships often leverage 0% financing offers as a powerful tool to entice customers, recognizing its significant influence on purchase decisions. This tactic allows dealerships to position themselves as providers of exceptional value, differentiating themselves from competitors and driving sales volume.

Marketing and Promotion Strategies

Dealerships employ multifaceted marketing strategies to promote 0% financing offers. These include targeted advertising campaigns, online promotions, and partnerships with financial institutions. Utilizing digital platforms, such as social media and search engine optimization, is vital in reaching a wider audience. Furthermore, strategic partnerships with financial institutions can provide additional resources and credibility, enhancing the appeal of the financing options.

Common Strategies to Attract Customers

Dealerships employ various strategies to attract customers, emphasizing the advantages of 0% financing. These include highlighting the reduced monthly payments, showcasing the long-term savings, and emphasizing the value proposition compared to other financing options. They frequently showcase the affordability and accessibility of these deals through visual representations, like monthly payment calculators and detailed financial comparisons.

Role of Incentives and Promotions

Incentives and promotions play a pivotal role in attracting customers. Dealerships often bundle 0% financing with other attractive offers, such as extended warranties or free maintenance packages. These bundled offers increase the perceived value for customers, making the financing option more appealing. Targeted promotions during specific periods, like holidays or seasonal sales, are also frequently implemented.

Examples of Dealer Financing Packages

| Financing Package | Down Payment | Monthly Payment (Example) | Loan Term | Vehicle Price |

|---|---|---|---|---|

| 0% Financing for 36 months | $2,000 | $250 | 36 months | $8,000 |

| 0% Financing for 48 months | $1,500 | $200 | 48 months | $9,600 |

| 0% Financing with Trade-in | $1,000 | $175 | 60 months | $12,000 |

Note: These are examples and actual figures may vary based on individual circumstances, interest rates, and loan terms.

Potential Risks and Challenges

Dealerships face potential risks and challenges when offering 0% financing on used cars. These include the possibility of incurring significant losses if the financing terms are too favorable. The challenge lies in balancing customer acquisition with maintaining profitability. High demand for financing deals can also lead to higher vehicle turnover, potentially increasing the risk of financing default.

Financial Institutions

Financial institutions play a crucial role in facilitating used car 0% financing. They act as intermediaries, bridging the gap between car dealerships and consumers seeking affordable financing options. Understanding their lending practices, criteria, and processes is essential for both buyers and sellers in the used car market.

Lending Practices of Financial Institutions

Financial institutions employ various lending practices tailored to their risk assessment strategies. These practices often include evaluating the creditworthiness of the borrower, the condition and value of the used car, and the prevailing market conditions. Institutions often utilize established formulas and algorithms to calculate loan amounts, interest rates, and terms. Some institutions may also consider the borrower’s down payment amount, their employment history, and their credit history when determining eligibility.

Criteria for Assessing Used Car Financing Applications

Financial institutions use a multifaceted approach to assess used car financing applications. The primary criteria involve evaluating the borrower’s creditworthiness, which includes checking credit history, income verification, and debt-to-income ratio. They also assess the vehicle’s value and condition. This involves conducting a physical inspection of the car, researching comparable used vehicles in the market, and considering factors like mileage, accident history, and maintenance records. Appraisals and vehicle history reports are often crucial components in this process.

Securing 0% Financing for Used Cars

The process for securing 0% financing for used cars typically involves a series of steps. Dealerships typically act as intermediaries, submitting the application to the chosen financial institution. This application often includes detailed information about the borrower and the vehicle, including financial statements, employment verification, and a vehicle inspection report. The lender reviews this information, conducts its own assessment, and makes a decision based on the pre-established criteria. A pre-approval process is often in place to expedite the process for qualified borrowers.

Different Types of Financing Options

Several financing options are available from different financial institutions. These can include traditional loans with varying interest rates, and promotional 0% financing options, often for a limited time. Some lenders offer specialized programs for specific demographics or credit profiles. For example, some institutions might partner with specific dealerships or have specific promotional offers tied to a specific time frame.

Requirements and Documentation for 0% Financing Applications

| Requirement | Documentation |

|---|---|

| Borrower’s Identity Verification | Driver’s license, passport, Social Security card |

| Proof of Income | Pay stubs, tax returns, W-2 forms |

| Credit History | Credit report (often obtained through a credit bureau) |

| Vehicle Appraisal | Vehicle inspection report, title and registration |

| Vehicle History Report | Information from a reputable source, such as Carfax or similar |

| Down Payment (if required) | Proof of funds for the down payment |

The table above provides a general overview of the requirements and associated documentation. Specific requirements and documentation may vary depending on the financial institution and the specific terms of the financing agreement.

Customer Experience

The customer experience surrounding used car 0% financing is critical for both dealerships and consumers. A positive experience fosters loyalty and repeat business, while a negative one can damage reputation and lead to lost sales. Understanding the nuances of this process, from initial inquiry to final purchase, is paramount to maximizing success for all parties involved.

The customer journey for used car 0% financing typically involves several key stages, from initial research and interest to final purchase and post-purchase support. Transparency and clear communication throughout each stage are vital to building trust and mitigating potential concerns. Navigating the complexities of financing can be challenging for consumers, and dealerships need to proactively address these issues to ensure a positive and rewarding experience.

Customer Journey for 0% Financing

The journey begins with a customer’s initial interest in a used car. This could stem from online research, dealership visits, or recommendations. A streamlined process, including clear online information about available financing options and easy-to-understand loan terms, is essential to capture initial interest. From there, the process continues with a personalized consultation and a comprehensive evaluation of the customer’s financial situation. This includes assessing creditworthiness, verifying income, and confirming eligibility for 0% financing. Finally, the customer completes the necessary paperwork, signs the loan documents, and takes possession of the vehicle. The post-purchase phase involves ongoing communication, addressing any concerns, and providing excellent customer service.

Importance of Transparency and Communication

Transparency in the financing process is crucial for building trust and ensuring customer satisfaction. Clear and concise explanations of the financing terms, including interest rates, fees, and loan conditions, are vital. Open communication throughout the process, through regular updates and prompt responses to inquiries, minimizes uncertainty and fosters a positive customer experience. This involves proactive communication regarding any potential delays or changes to the loan approval process.

Potential Challenges for Customers

Customers seeking 0% financing for used cars may encounter various challenges. A lack of clear information about eligibility criteria and loan terms can create confusion. Potential credit issues or insufficient documentation may impede the loan approval process. Furthermore, unrealistic expectations about the financing process or a perceived lack of transparency from the dealership or lender can create negative experiences. Delays in the approval process, coupled with a lack of communication from the dealer or lender, can also be a major source of frustration.

Best Practices for Dealerships and Lenders

Dealerships and lenders can implement best practices to enhance the customer experience. Offering clear and concise information about financing options on their websites and in-store materials is crucial. Providing pre-approval options for customers allows them to understand their financing capacity before committing to a purchase. Employing a dedicated customer service representative throughout the entire process can provide personalized guidance and address customer concerns promptly. Regular updates on the loan approval status and proactive communication about any potential issues are also essential. Providing a dedicated point of contact for customers to ask questions and address concerns ensures smooth transaction progression.

Flowchart of the 0% Financing Process

Note: This flowchart provides a visual representation of the steps involved in obtaining used car 0% financing. The actual process may vary depending on individual circumstances and dealership policies.

| Step | Description |

|---|---|

| 1. Initial Inquiry | Customer expresses interest in a used car and 0% financing. |

| 2. Pre-Approval Assessment | Dealer or lender assesses customer creditworthiness and eligibility for 0% financing. |

| 3. Loan Application | Customer completes loan application and provides necessary documentation. |

| 4. Loan Approval/Declinature | Lender approves or declines the loan application, notifying the customer. |

| 5. Loan Agreement | Customer and lender sign loan agreement, outlining terms and conditions. |

| 6. Vehicle Purchase | Customer completes the purchase of the vehicle. |

| 7. Post-Purchase Support | Dealer provides ongoing support and addresses any post-purchase concerns. |

Future Trends

The used car 0% financing market is dynamic, responding to evolving consumer preferences, technological advancements, and regulatory shifts. Predicting its future trajectory requires analyzing these factors and anticipating potential disruptions. Understanding the forces shaping this market is crucial for both consumers and dealers seeking to navigate the changing landscape.

Potential Emerging Trends

The used car 0% financing market is likely to see increased integration with other financial products and services. This could include bundling financing with extended warranties or other add-ons. Further, digital platforms will likely play an increasingly important role in connecting buyers and sellers, potentially streamlining the financing process and reducing paperwork. Consumers increasingly value seamless, online experiences, and this trend is likely to extend to the financing aspect of purchasing a used car.

Technological Advancements

Technological advancements are poised to significantly impact the used car financing process. For example, AI-powered platforms can analyze vast datasets of used car valuations, loan applications, and market trends to assess risk more accurately and quickly than traditional methods. This increased automation could lead to faster approval times and reduced administrative costs. Further, blockchain technology could potentially enhance transparency and security in the financing process. This is evident in other industries, where blockchain is being utilized to ensure secure and verifiable transactions.

Regulatory Changes

Regulatory changes at both the federal and state levels could influence the used car 0% financing market. Regulations concerning consumer protection, lending practices, and the disclosure of financing terms will likely continue to evolve. For instance, increased scrutiny of interest rates and fees could lead to more transparent financing options for consumers. Changes in lending regulations could also impact the availability and terms of 0% financing offers.

New Financing Options

Several new financing options for used cars may emerge in the future. These options could include subscription-based financing models, allowing consumers to pay a monthly fee for access to a used vehicle. Another emerging trend is the integration of peer-to-peer lending platforms for used cars, allowing individuals to invest in used car loans. Additionally, the use of fractional ownership models for luxury or high-value used vehicles is another possibility, enabling greater access to these assets for a wider range of consumers.