Understanding the Factors Affecting Used Car Value

Determining the worth of a used car involves a complex interplay of various factors. A thorough understanding of these elements is crucial for both buyers and sellers to ensure a fair and informed transaction. Factors such as age, mileage, condition, and market demand all contribute to the overall price.

Age of the Vehicle

The age of a vehicle is a significant determinant of its value. Generally, newer vehicles command higher prices than older ones. Depreciation, the decline in a car’s value over time, is a natural process. The rate of depreciation varies based on the make and model, but typically, older cars lose value more rapidly than newer ones. This decline is often steep in the first few years of ownership. This means a 2015 model of a popular car will likely be more expensive than a 2010 model, and a 2005 model will be less expensive than either of those.

Mileage

Mileage is another critical factor. High mileage often indicates increased wear and tear on the vehicle, potentially leading to more frequent repairs and reduced value. A car with low mileage is typically perceived as having lower wear and tear, and thus maintains its value better than one with high mileage. However, low mileage does not guarantee a high price if the car is significantly older or in poor condition. For example, a 2000 model car with 20,000 miles might be worth less than a 2000 model car with 100,000 miles if the former has visible signs of neglect or damage.

Vehicle Condition

The condition of a vehicle encompasses its mechanical, exterior, and interior aspects. A well-maintained car with no visible damage, properly functioning components, and a clean interior will usually fetch a higher price. Conversely, a car with significant mechanical issues, visible dents or scratches, or a worn-out interior will likely sell for less. A vehicle’s overall condition directly reflects its potential for future maintenance costs and reliability.

Make and Model

The make and model of a car significantly influence its resale value. Some makes and models are more desirable than others due to factors like reputation, features, and performance. Luxury cars or those with unique features generally have higher resale values than more common models. Furthermore, a specific model’s popularity or perceived prestige in the market plays a pivotal role.

Comparison of Similar Models from Different Years

Comparing similar models from different years helps to visualize the impact of age on value. A 2023 Honda Civic will generally command a higher price than a 2018 Honda Civic, all other factors being equal. However, the specific condition, mileage, and features of each vehicle need to be carefully considered.

Impact of Factors on Resale Value

| Make | Model | Year | Mileage | Condition | Estimated Value |

|---|---|---|---|---|---|

| Toyota | Camry | 2018 | 50,000 | Excellent | $20,000 |

| Toyota | Camry | 2013 | 100,000 | Good | $15,000 |

| Honda | Civic | 2022 | 25,000 | Excellent | $22,000 |

| Honda | Civic | 2017 | 75,000 | Fair | $18,000 |

This table provides a simplified illustration of how different factors contribute to the estimated value of used cars. The values are approximate and may vary based on specific market conditions and the particular vehicle’s features.

Researching Market Trends and Pricing

Knowing the current market value is crucial for accurately assessing a used car’s worth. This involves understanding the factors influencing pricing beyond the car’s condition. Market trends, encompassing factors like supply and demand, economic conditions, and seasonal fluctuations, significantly impact used car values. Thorough research into current pricing data is essential for informed decision-making, whether you’re buying or selling.

Understanding the interplay between supply, demand, and economic factors is paramount to evaluating a used car’s fair market value. For example, a surge in demand for a particular model due to limited availability can significantly inflate its price. Conversely, an economic downturn might lead to a decline in used car values as potential buyers are more hesitant to make large purchases.

Identifying Resources for Used Car Pricing Data

Various online platforms offer insights into current used car pricing. These resources provide valuable data points, allowing for informed estimations of a car’s worth. Accurately assessing market trends and pricing requires leveraging reliable sources of data. Recognizing the strengths and limitations of different resources will enhance the evaluation process.

Online Platforms Providing Used Car Value Insights

Numerous online platforms provide data on used car values. These include major automotive websites, specialized used car marketplaces, and independent valuation tools. Each platform employs its own methodologies for gathering and presenting data, influencing the accuracy of its valuations.

Comparing and Contrasting Pricing Methodologies

Different online resources employ varying methodologies for determining used car values. Some use algorithms based on historical sales data, while others incorporate factors like mileage, condition, and market demand. Analyzing the pricing methodologies of different platforms is crucial for a comprehensive understanding of their accuracy and potential biases. Comparing the methodologies helps to identify the most reliable and trustworthy resources for evaluating used car values.

Examples of Market Trends Influencing Used Car Values

Market trends significantly impact used car values. For instance, a shortage of certain models due to production issues or high demand from specific demographics can drive up prices. Conversely, a downturn in the economy might result in lower demand and thus lower prices for used cars. Understanding how these trends influence the market is vital for accurate valuations.

Analyzing Local Market Prices Using Online Tools

Using online tools to analyze local market prices allows for a more specific and accurate valuation. Most online resources allow users to filter by specific location, making it possible to identify current prices for similar used cars in a particular region. This targeted approach enhances the precision of the valuation.

Comparison of Online Resources and Pricing Methodologies

| Online Resource | Pricing Methodology | Strengths | Limitations |

|---|---|---|---|

| Carfax | Combines historical sales data with current market trends, considering factors like mileage and condition. | Well-established reputation; comprehensive data; generally reliable. | May not reflect localized market fluctuations; pricing might be based on national averages. |

| Edmunds | Utilizes a combination of market analysis, expert opinions, and sales data to generate valuations. | Provides expert insights; offers detailed reports. | Pricing might be influenced by editorial preferences; may not be as focused on specific local markets. |

| Kelley Blue Book (KBB) | Employs a proprietary algorithm considering various factors like condition, mileage, and trim level to generate market-based valuations. | Widely recognized and trusted; uses extensive data; updated regularly. | Might not capture rapid changes in local markets; relies on a complex algorithm, potentially leading to some inaccuracies. |

Evaluating a Specific Used Car

Determining the fair market value of a used car requires a thorough assessment of its condition and features. This involves a meticulous inspection beyond simply looking at the advertised price. Understanding the specifics of the vehicle’s history, mechanical health, and aesthetic appeal is crucial to making an informed decision.

A comprehensive evaluation process, combining market research with a detailed physical inspection, provides the most accurate valuation. A careful examination of the car’s condition, coupled with research on comparable vehicles, helps buyers establish a realistic price.

Inspecting the Vehicle’s Exterior

Thorough exterior inspection is essential for identifying potential issues. Begin by scrutinizing the paint, noting any scratches, dents, or signs of previous repairs. Assess the condition of the body panels, searching for rust, corrosion, or damage. Check the tires for wear and tear, tread depth, and overall condition. Pay attention to the glass for cracks or chips.

Assessing the Vehicle’s Interior

The interior condition often reflects the car’s overall treatment. Evaluate the upholstery for wear, stains, or tears. Examine the dashboard for any cracks, damage, or missing components. Note the condition of the carpeting and any signs of moisture damage. Check the functionality of all interior controls, including the air conditioning, heating, and audio systems.

Evaluating the Vehicle’s Mechanical Condition

Mechanical issues are a significant factor in used car valuation. Conduct a test drive to assess the engine’s performance, transmission operation, and braking system. Listen for unusual noises or vibrations. Examine the fluids (oil, coolant, brake fluid) for proper levels and condition. Look for leaks, which can indicate underlying mechanical problems.

Checking the Vehicle’s History Report

A vehicle history report provides valuable insights into the car’s past. It reveals any accidents, repairs, or outstanding liens. A comprehensive report can highlight potential problems, reducing the risk of hidden issues. These reports are crucial for understanding the vehicle’s overall history and potential value.

Conducting a Detailed Inspection Checklist

Thorough inspection is crucial to avoid potential issues. A checklist provides a structured approach to inspecting the car’s various components. By systematically checking each item, you can identify potential problems and avoid costly repairs later.

- Exterior: Inspect paint, body panels, tires, glass, and any signs of damage or repairs.

- Interior: Assess upholstery, dashboard, carpeting, and the functionality of all interior controls.

- Mechanical: Perform a test drive to evaluate engine performance, transmission operation, braking, and suspension.

- Fluid Levels: Check the levels of oil, coolant, brake fluid, and power steering fluid for proper levels and condition.

- History Report: Obtain a comprehensive vehicle history report to identify accidents, repairs, and outstanding liens.

- Documentation: Review all vehicle documentation, including the maintenance records.

- Test Drive: Evaluate acceleration, braking, and handling. Listen for unusual noises or vibrations.

Negotiating the Price

Successfully negotiating a fair price for a used car requires a strategic approach. This involves understanding the car’s market value, researching comparable sales, and employing effective negotiation techniques. A well-prepared buyer can significantly reduce the price and secure a deal that benefits both parties.

A significant portion of the used car purchase process revolves around negotiation. The right approach can save you hundreds or even thousands of dollars, while a poor one can leave you overpaying. Armed with knowledge about market values and negotiation tactics, you can confidently navigate the process.

Researching Comparable Sales in the Area

Understanding local market trends is crucial for determining a fair offer. Thorough research on comparable used cars in your area, with similar years, models, mileage, and condition, will provide a baseline for your negotiation. This includes considering factors like dealer markups and private seller discounts.

- Utilize online car listings (e.g., Kelley Blue Book, Edmunds, Autotrader) to identify recently sold vehicles in your region.

- Consider variations in pricing based on the seller’s type (e.g., private seller vs. dealer).

- Compare features and specifications to ensure apples-to-apples comparisons.

- Note any discrepancies in the pricing of comparable vehicles to understand the market’s range.

Knowing the Car’s Market Value Before Negotiating

Before approaching a seller, thoroughly research the market value of the car. Knowing the fair price empowers you to make a reasonable offer and counter any inflated demands. Tools like Kelley Blue Book (KBB) and Edmunds provide valuable insights into market values.

- Consult reliable online resources for used car valuations.

- Use the car’s specific features, condition, and mileage to refine your valuation.

- Account for the car’s age, model, and trim level.

- Understand that the market value is a starting point, and negotiation will often involve adjustments.

Effective Negotiation Techniques

Effective negotiation involves a blend of confidence, respect, and a willingness to compromise. Avoid aggressive tactics, but be assertive in presenting your case.

- Start with a well-researched offer that reflects the car’s market value.

- Be prepared to justify your offer based on your research.

- Listen actively to the seller’s perspective and address their concerns.

- Be prepared to walk away if the negotiation becomes unproductive.

Presenting Your Offer and Counter-Offers

Clearly presenting your offer and counter-offers is crucial for a smooth negotiation. Be polite, professional, and prepared to support your position with facts.

- Present your offer in writing, outlining the price, terms, and any conditions.

- Be prepared to provide supporting documentation (e.g., comparable sales data).

- Actively listen to the seller’s counter-offer and respond thoughtfully.

- Be prepared to compromise and adjust your offer if necessary.

Example Negotiation Table

| Negotiation Point | Your Offer | Dealer’s Counter-Offer | Final Agreement |

|---|---|---|---|

| Asking Price | $18,500 | $19,000 | $18,750 |

| Trade-in Value | $3,000 | $2,500 | $2,750 |

| Additional Fees | None | Document Fee $150 | Document Fee waived |

Considering Financing Options and Costs

Purchasing a used car often involves financing. Understanding the available options, associated costs, and potential terms is crucial for making an informed decision. This section details various financing avenues, interest rates, and the complete cost of ownership, helping you budget effectively.

Financing a used vehicle presents a wide array of options, each with its own set of benefits and drawbacks. Careful consideration of these factors is essential to ensuring the purchase aligns with your financial goals and circumstances.

Available Financing Options

Different financing options cater to varying financial situations and preferences. Lenders offer diverse choices, including traditional auto loans, loans from credit unions, and even dealer financing. Each option presents distinct characteristics in terms of interest rates, terms, and associated costs.

- Traditional Auto Loans: These loans are typically offered by banks, credit unions, and other financial institutions. They often require a credit check and may come with fixed or variable interest rates. The interest rate is often influenced by your credit score, the loan amount, and the loan term.

- Credit Union Loans: Credit unions, often serving specific communities or professions, frequently offer competitive interest rates, particularly for members with a history of responsible financial management. Terms and conditions may vary based on the specific credit union.

- Dealer Financing: Dealerships often provide in-house financing options. These loans may have specific terms and rates tailored to the dealership, but the process might be faster and more convenient.

Interest Rates and Terms

Interest rates and loan terms directly impact the total cost of the loan. Understanding these factors allows for a more precise calculation of the overall expense.

- Interest Rates: Interest rates vary significantly based on factors like credit score, loan amount, and the prevailing market conditions. A higher credit score generally leads to a lower interest rate, reducing the overall cost of borrowing. A fixed interest rate remains constant throughout the loan term, while a variable rate fluctuates based on market conditions.

- Loan Terms: Loan terms dictate the repayment period. Longer terms usually result in lower monthly payments but increase the overall interest paid over the life of the loan. Conversely, shorter terms entail higher monthly payments but reduce the total interest accrued.

Potential Costs of Ownership

Beyond the loan itself, other expenses accompany the purchase of a used car.

- Taxes: Sales taxes vary by state and local jurisdiction. Consult local tax authorities for the current rates applicable to your region.

- Fees: Documentation fees, title transfer fees, and other administrative charges are often associated with the purchase. Dealers typically itemize these fees upfront.

- Registration: Registration fees and associated costs for the vehicle vary by jurisdiction. These are usually payable annually or biennially.

Pros and Cons of Financing Options

Each financing option presents advantages and disadvantages.

| Financing Option | Pros | Cons |

|---|---|---|

| Traditional Auto Loans | Widely available, flexible terms | Potentially higher interest rates, stringent credit requirements |

| Credit Union Loans | Competitive interest rates, often better terms for members | Limited availability, potential application processing time |

| Dealer Financing | Convenient, potentially faster processing | Higher interest rates compared to traditional loans, limited flexibility in terms |

Calculating Total Cost of Ownership

To accurately assess the total cost of ownership, include the loan amount, interest accrued, taxes, fees, and registration costs.

Total Cost of Ownership = Loan Amount + Interest Paid + Taxes + Fees + Registration Costs

Example: A used car costs $15,000. A 4-year loan at 6% interest with $100 in taxes, $50 in fees, and $150 in registration results in a total cost of ownership exceeding $15,300. This example illustrates the significance of factoring in all associated costs.

Alternative Valuation Methods

Beyond online resources and dealer valuations, alternative methods provide a broader perspective on used car worth. These methods, like private appraisals and auction values, can offer insights that complement traditional approaches, potentially leading to a more comprehensive understanding of a vehicle’s true market value. Understanding these methods allows buyers to make more informed decisions and potentially secure a better deal.

Using multiple valuation methods allows for a more comprehensive and accurate assessment of a used car’s worth. Combining online research with alternative methods such as private appraisals or auction values can provide a more balanced and nuanced understanding of the market value, which is essential for buyers and sellers alike. This comprehensive approach can highlight potential discrepancies or unusual market trends.

Private Party Appraisals

Private appraisals, conducted by certified appraisers, offer independent assessments of a vehicle’s condition and market value. These appraisals are often commissioned for insurance purposes, financing, or for determining a fair market value in a specific context.

Finding reputable appraisers is crucial. Online directories and professional organizations specializing in automotive appraisals can provide a list of qualified individuals. Look for appraisers with experience and certifications, ideally ones specializing in the make and model of the vehicle in question. Checking reviews and testimonials can help validate their credibility and experience.

Used Car Auctions

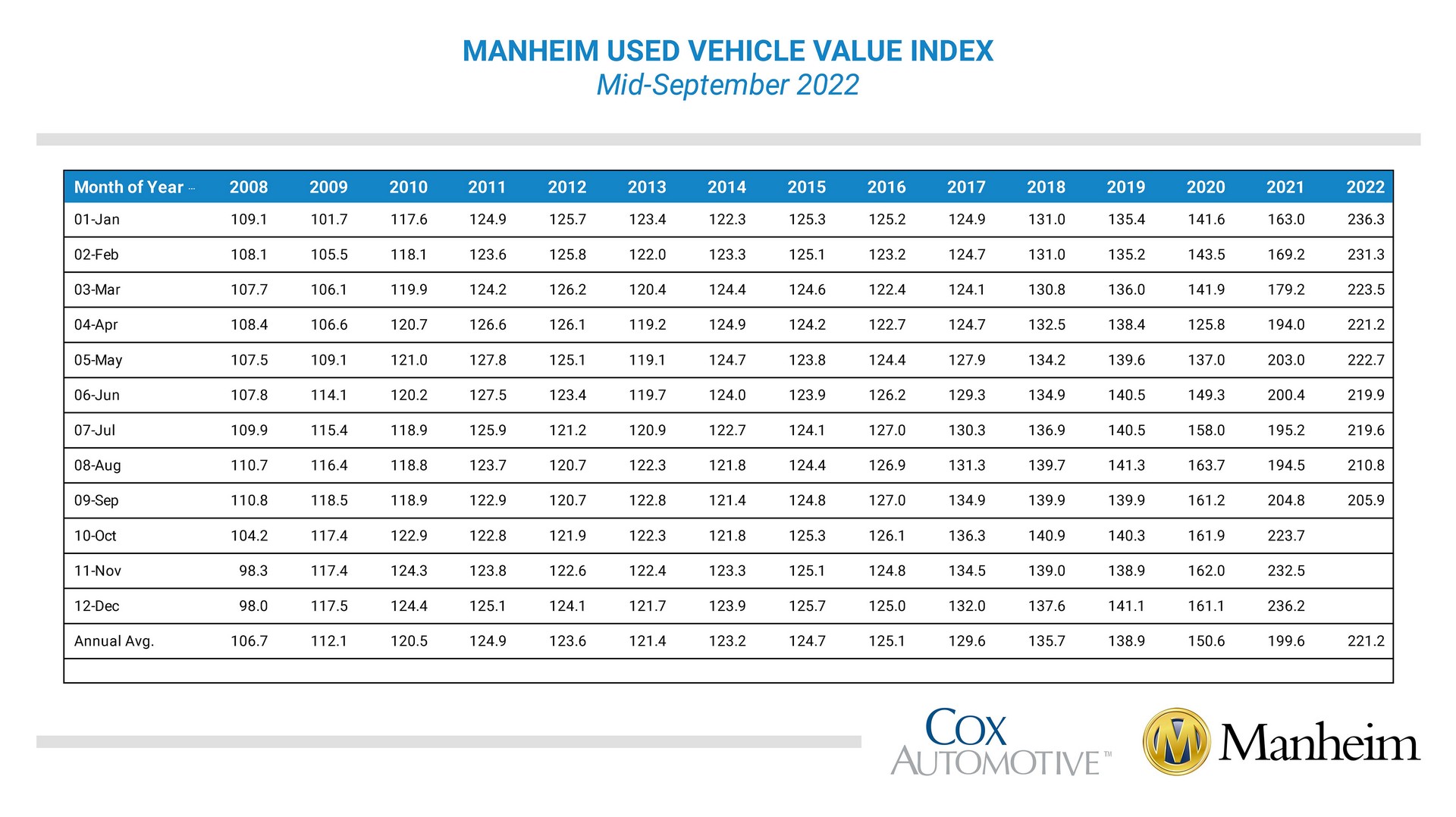

Used car auctions can significantly influence pricing, offering insights into competitive market values. These auctions often feature vehicles with varying levels of mileage, condition, and features. Attending auctions or researching auction results for similar vehicles provides a perspective on current market demand and competitive pricing. Examples include online auctions like those conducted by Manheim, Copart, and others, and local auctions, which may specialize in specific types of vehicles. The presence of multiple buyers and sellers at auctions can create a dynamic pricing environment, potentially reflecting the true market value.

Comparison of Valuation Methods

The accuracy and reliability of different valuation methods vary. Online resources provide a starting point for market trends but lack the personalized assessment of private appraisals. Private appraisals offer a more detailed and nuanced perspective, but they come at a cost. Auction values can offer a snapshot of market competitiveness, but they are influenced by various factors like auction format and vehicle condition. It is crucial to understand the limitations of each method and utilize a combination of sources to form a comprehensive picture.

Obtaining a Private Appraisal

Obtaining a private appraisal typically involves providing the appraiser with detailed information about the vehicle, including the year, make, model, mileage, condition (exterior and interior), and any notable features. The appraiser will conduct a thorough inspection and consider market trends to arrive at an accurate valuation. Some appraisers might require specific documentation or photographs. Be prepared to pay a fee for the appraisal service.

Summary of Valuation Methods

| Valuation Method | Pros | Cons |

|---|---|---|

| Online Resources | Accessibility, broad market overview | Lack of personalized assessment, potential inaccuracies |

| Dealer Valuation | Convenience, immediate assessment | Potential for bias, limited market perspective |

| Private Appraisal | Detailed assessment, independent perspective | Cost, time-consuming |

| Used Car Auctions | Market snapshot, competitive pricing | Auction-specific dynamics, potential for varying conditions |