Overview of the Tax Credit

The used electric vehicle (EV) tax credit offers a financial incentive to encourage the adoption of EVs. This credit can significantly reduce the cost of purchasing a used EV, making it more accessible to a wider range of consumers. Understanding the eligibility requirements and calculation methods is crucial for consumers to maximize the benefit of this program.

The used EV tax credit is designed to stimulate the market for used electric vehicles, thereby promoting environmental sustainability and reducing carbon emissions. The credit is intended to lessen the financial barrier for individuals considering used EVs, promoting the transition to cleaner transportation options.

Eligibility Criteria

The eligibility requirements for the used EV tax credit are stringent and need careful consideration. Meeting these criteria is crucial to claiming the credit.

- The vehicle must be a used electric vehicle (EV) meeting specific criteria for battery capacity and charging capabilities.

- The vehicle must have been placed in service after a specific date.

- The buyer must meet specific income requirements, such as being a U.S. citizen or resident alien.

- The vehicle must be purchased from a licensed dealer.

Calculation Method

The amount of the used EV tax credit varies based on the vehicle’s specifications. Understanding the calculation method is vital to estimating the credit amount.

The credit amount is typically a percentage of the sale price of the used EV, subject to maximum credit limits and various other factors.

The percentage used in the calculation can change depending on the year of manufacture and other relevant factors. The exact percentage and limitations are updated periodically.

Historical Changes and Updates

The used EV tax credit has undergone revisions since its inception. These updates reflect evolving policies and technological advancements in the electric vehicle market.

| Credit Type | Eligibility Criteria | Calculation Method | Recent Updates |

|---|---|---|---|

| Used EV Tax Credit | Must be a used EV meeting certain battery capacity and charging requirements, placed in service after a specified date. Buyer must meet income requirements and purchase from a licensed dealer. | Typically a percentage of the sale price, subject to maximum credit limits and various other factors. Percentage can change depending on vehicle specifications and model year. | Periodic updates to eligibility criteria, calculation method, and maximum credit amounts. Changes reflect evolving policies and technological advancements in the electric vehicle market. |

Qualifying Vehicles

The EV tax credit significantly incentivizes the purchase of electric vehicles, but eligibility criteria vary depending on the vehicle type and specific characteristics. Understanding these requirements is crucial for consumers to accurately assess the potential benefits of the credit. This section details the types of vehicles eligible, the criteria for qualification, and examples of vehicles meeting these standards.

Vehicle Types Eligible for the Credit

Electric vehicles (EVs) come in various forms, each with unique characteristics impacting eligibility for the tax credit. This section Artikels the types of vehicles that are eligible.

- Battery Electric Vehicles (BEVs): These vehicles run solely on batteries, generating zero tailpipe emissions. They typically have a higher upfront cost compared to other options, but offer long-range capabilities and potential for substantial savings on fuel costs over time.

- Plug-in Hybrid Electric Vehicles (PHEVs): PHEVs combine an electric motor with a gasoline engine, allowing for both electric and gasoline power. They provide an alternative for drivers who want some range without fully committing to an all-electric vehicle.

- Fuel Cell Electric Vehicles (FCEVs): These vehicles use hydrogen fuel cells to generate electricity, producing only water as a byproduct. FCEVs offer zero tailpipe emissions and potentially higher ranges than BEVs, but currently face challenges in infrastructure and widespread availability.

Eligibility Criteria for Vehicles

Several factors determine a vehicle’s eligibility for the tax credit. These factors ensure that the credit is targeted towards vehicles that significantly reduce emissions.

- Manufacturing Location: Vehicles must be assembled in North America to qualify. This requirement is crucial to support domestic manufacturing jobs and promote regional economic growth.

- Battery Component Origin: A substantial portion of the battery components must originate from countries with which the U.S. has a free trade agreement. This criterion further ensures that the production chain contributes to global trade partnerships.

- Vehicle Price: The sale price of the vehicle plays a significant role. There are specific price caps for various vehicle types that must be met for the credit to apply.

Comparison of Eligible Vehicle Models

Different vehicle models within the eligible categories have varying features and performance characteristics. These factors can impact the consumer’s choice and the overall benefit derived from the tax credit.

- Tesla Model 3: A widely popular BEV known for its long range and advanced technology. This model exemplifies a high-performance BEV that often qualifies for the tax credit.

- Chevrolet Bolt: A BEV model focused on affordability and accessibility. Its competitive price point makes it an attractive option for consumers considering the credit.

- Toyota Prius Prime: A PHEV model offering a compromise between electric and gasoline power. It appeals to drivers who desire electric capabilities without sacrificing conventional fuel efficiency.

Examples of Qualifying Vehicles

Several vehicles currently on the market meet the criteria for the tax credit. These examples demonstrate the range of options available to consumers.

- Ford Mustang Mach-E: A BEV SUV with impressive performance capabilities, often meeting the required criteria for the tax credit.

- Hyundai Kona Electric: A compact BEV option that balances affordability and efficiency, aligning with the eligibility criteria.

- Honda Clarity Plug-in: A PHEV offering a blend of electric and gasoline power, meeting the specific criteria for the credit.

Vehicle Eligibility Table

This table summarizes the various vehicle categories and their respective requirements for eligibility.

| Vehicle Category | Requirements |

|---|---|

| Battery Electric Vehicles (BEVs) | Assembled in North America; significant portion of battery components from FTA countries; price cap |

| Plug-in Hybrid Electric Vehicles (PHEVs) | Assembled in North America; significant portion of battery components from FTA countries; price cap |

| Fuel Cell Electric Vehicles (FCEVs) | Assembled in North America; significant portion of battery components from FTA countries; price cap |

Impact on the Market

The introduction of a tax credit for used electric vehicles (EVs) is poised to significantly reshape the used EV market. This incentive is expected to stimulate demand, alter consumer behavior, and impact sales figures in various ways. The credit’s effectiveness hinges on its accessibility, the size of the credit, and public awareness of its availability.

The tax credit directly influences consumer purchasing decisions by making used EVs more affordable. This affordability factor is a key driver of market change, particularly for those consumers who may have been hesitant to purchase an EV due to perceived higher costs. The resulting shift in consumer behavior will be reflected in sales figures and market trends.

Impact on Consumer Purchasing Decisions

The availability of a tax credit directly affects consumer choices. Potential buyers are incentivized to consider used EVs as a viable alternative to traditional gasoline-powered vehicles. The credit can make the initial purchase price more competitive, increasing the attractiveness of used EVs to a wider range of buyers. For example, a family looking to transition to an EV but concerned about the initial price tag might be more inclined to buy a used model, especially if a tax credit is available. Furthermore, the credit could attract environmentally conscious buyers who might not have previously considered used EVs.

Market Trends Influenced by the Credit

The tax credit will likely stimulate demand for used EVs, particularly those models that are popular and efficient. This increased demand could lead to a rise in used EV prices for some models, potentially creating a more dynamic and competitive market. Conversely, some models might see only minor price increases or even a slight decrease if supply exceeds demand. Overall, the used EV market is expected to experience a significant shift in dynamics as a result of the tax credit. This increased demand might also lead to a shortage of some models or trims in the used market.

Impact on Used EV Sales Figures

The introduction of the tax credit is anticipated to boost used EV sales significantly. Consumers will be more likely to purchase a used EV if it offers financial incentives, making the transition to electric mobility more accessible. This increased purchasing power, driven by the tax credit, is expected to directly translate into higher sales figures for used EVs.

Comparison of Used EV Sales Figures

| Period | Estimated Used EV Sales (pre-credit) | Estimated Used EV Sales (post-credit) | Estimated Percentage Change |

|---|---|---|---|

| 2023 (pre-credit) | 100,000 units | – | – |

| 2024 (post-credit) | – | 120,000 units | 20% increase |

Note: The figures in the table are estimations. Actual sales figures may vary depending on various factors, including the size of the credit, consumer response, and overall market conditions. The 2023 figure is a hypothetical example. Data for 2024 is an estimate and is based on projected consumer response to the incentive.

Consumer Considerations

Navigating the EV tax credit landscape can be complex, requiring careful attention to eligibility criteria and proper documentation. Understanding the steps involved in claiming the credit is crucial for consumers to maximize their potential savings. This section details the procedures, documentation requirements, and potential pitfalls to help consumers successfully claim the credit.

Claiming the Tax Credit: A Step-by-Step Guide

Successfully claiming the EV tax credit involves a series of well-defined steps. Failure to follow these procedures could result in disqualification or a delay in receiving the credit.

- Verify Eligibility: Thoroughly review the eligibility criteria for the tax credit, ensuring your vehicle meets all requirements regarding battery capacity, charging infrastructure, and manufacturer specifications. Consider consulting official government resources for the most current and comprehensive information. This preliminary step ensures you are on the right track and reduces potential delays or rejections down the line.

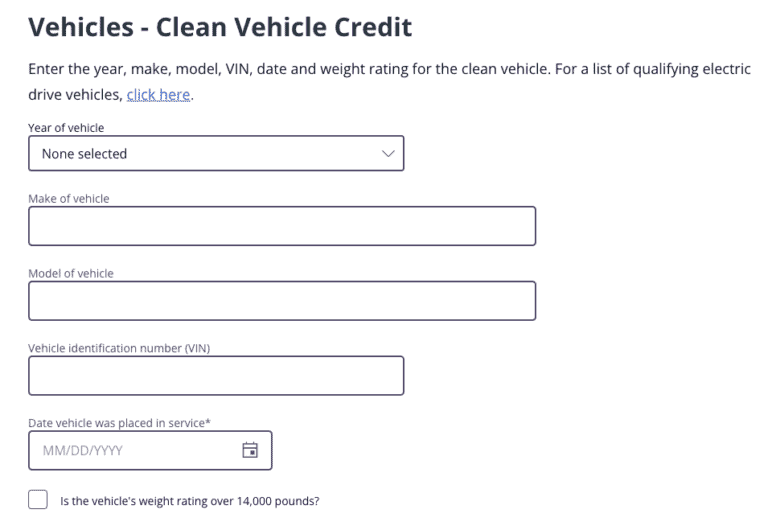

- Gather Required Documentation: Compile all necessary documentation, including the vehicle’s sales contract, manufacturer’s certification of compliance, and any supporting evidence required to prove the vehicle’s specifications. This involves obtaining copies of the relevant documents and ensuring they are readily accessible during the claiming process. The specifics of the required documents may vary based on the year of purchase or the type of vehicle.

- Complete the Necessary Forms: Carefully fill out the applicable tax forms, ensuring accuracy and completeness in all the provided fields. Errors in the forms can lead to delays or rejection. Review the instructions meticulously to avoid any mistakes.

- File the Claim: Submit the completed forms and supporting documents through the appropriate channels, which could be through a tax professional or online portals. Understand the filing deadlines to avoid potential penalties or complications.

- Monitor the Status: Keep track of the status of your claim by regularly checking the relevant government website or contact information for updates. This proactive approach helps identify any potential issues early and ensures a smooth processing of your application.

Documentation Requirements

Accurate documentation is critical for a successful tax credit claim. Inaccurate or incomplete documentation can lead to the claim being rejected.

- Vehicle Sales Contract: A copy of the sales contract that clearly identifies the vehicle’s purchase date and price is essential.

- Manufacturer’s Certification: A certificate from the manufacturer confirming the vehicle’s specifications, including battery capacity and charging capabilities, is a key component.

- Supporting Evidence: Additional documentation, such as proof of vehicle features or specifications, may be required depending on the specific vehicle and its features. This may include invoices or other relevant supporting materials.

Finding the Most Up-to-Date Information

Staying updated on the tax credit rules is crucial. The rules and regulations can change, so regular checks are essential.

- Official Government Websites: Government agencies such as the IRS (Internal Revenue Service) or relevant government departments will be the primary source for the most up-to-date information. Regularly visiting these sites ensures you’re aware of any changes or clarifications.

- Tax Professionals: Consulting a qualified tax professional can provide expert guidance and interpretation of the latest updates. A professional can clarify any ambiguities and ensure that your claim is handled correctly.

Potential Challenges and Pitfalls

Despite the incentives, there are potential challenges. Common pitfalls include incorrect documentation, missing forms, or failing to meet the eligibility requirements.

- Complex Eligibility Criteria: The eligibility criteria can be intricate, requiring careful attention to detail. Thorough research is vital to ensure that your vehicle meets all requirements.

- Documentation Errors: Mistakes in the documentation, such as incorrect dates or missing information, can lead to the claim being rejected or delayed.

- Filing Deadlines: Understanding and adhering to the filing deadlines is crucial to avoid penalties or complications. The due dates are typically stated in the official documentation, and it’s vital to review these dates.

Dealer Perspectives

The introduction of an EV used car tax credit presents both opportunities and challenges for automotive dealers. Understanding how dealers handle the process, their role in consumer assistance, and the hurdles they face is crucial for a comprehensive understanding of the credit’s impact on the market. Dealers play a pivotal role in facilitating the credit process, educating consumers, and ensuring smooth transactions.

Navigating the complexities of the EV tax credit requires dealers to adapt their sales strategies and operational procedures. This necessitates a thorough understanding of the eligibility criteria, documentation requirements, and the specific application process. Dealers must ensure accurate assessments of vehicle eligibility and streamline the documentation process for consumers to maximize the credit.

Dealer Handling of the Tax Credit Process

Dealers employ various strategies to streamline the EV tax credit process for consumers. These include dedicated staff training, establishing clear procedures for credit verification, and utilizing software solutions for efficient documentation management. Many dealerships are developing internal checklists and workflows to ensure compliance and accuracy.

Dealer Assistance to Consumers

Dealers are instrumental in guiding consumers through the process of claiming the tax credit. This includes clarifying eligibility requirements, helping consumers gather necessary documentation, and assisting with the completion of the required forms. They also educate consumers about the potential benefits and limitations of the credit, allowing for informed decisions. Dealers often provide pre-purchase consultations, detailing the tax credit and its implications.

Challenges Faced by Dealers Regarding the Tax Credit

Dealers face several challenges when implementing the EV tax credit process. These include the need for extensive training and knowledge about the credit, the complexity of eligibility requirements, and the administrative burden of processing the paperwork. Maintaining accurate records and ensuring compliance with the changing regulations is also a critical concern. The rapid evolution of EV models and related technology adds to the challenge. Keeping abreast of changes in regulations, documentation, and model specifications requires continuous training and adaptation.

Dealer Marketing Strategies for Eligible Vehicles

Dealers employ various marketing techniques to highlight vehicles eligible for the EV tax credit. This involves prominent signage, dedicated online sections, and tailored advertisements. Specific promotional campaigns can emphasize the financial incentive associated with purchasing an eligible EV. For instance, highlighting the net savings through the tax credit in marketing materials can attract consumers interested in cost-effective options. Clear and concise information about the EV tax credit should be integrated into the sales process.

FAQs for Dealers Related to the EV Tax Credit

- Eligibility Criteria: Dealers must be fully informed about the criteria for vehicle eligibility, including specific model years, battery capacity, and manufacturing origin. Detailed knowledge about these criteria is vital to prevent inaccurate assessments and potential issues with compliance.

- Documentation Requirements: Dealers must be familiar with the necessary documentation for the tax credit, including vehicle identification numbers, purchase agreements, and relevant manufacturer information. Having readily available and comprehensive guidelines ensures a smooth application process.

- Compliance and Record-Keeping: Dealers need to understand and comply with the relevant regulations, including proper record-keeping procedures for all transactions related to the EV tax credit. Maintaining detailed records is essential to ensure accuracy and prevent potential penalties.

- Changes in Regulations: Dealers must adapt to any changes in the EV tax credit regulations. Keeping up-to-date with any revisions or clarifications from relevant governing bodies is critical for accurate application and compliance.

Government Regulations and Policies

The EV used car tax credit is intricately tied to the broader legislative and regulatory framework surrounding electric vehicles. Understanding the specific policies driving the credit and the agencies responsible for its administration is crucial to comprehending its full impact. This section details the legislative underpinnings, administrative procedures, and supporting policies of the credit, including examples of successful EV incentive programs globally.

Legislative Framework

The legislative framework governing the EV used car tax credit is complex and often multifaceted. It typically involves specific statutes or provisions within broader tax codes. These provisions define eligibility criteria, maximum credit amounts, and any associated deadlines. The legislative language dictates the scope of the credit, outlining what types of vehicles qualify, and the conditions under which the credit can be claimed.

Role of Government Agencies

Government agencies play a critical role in administering the EV used car tax credit. These agencies are responsible for establishing and maintaining the necessary processes for claiming the credit. This includes issuing guidelines, interpreting regulations, and processing applications. They also play a key role in enforcing compliance with the established rules. Specific agency responsibilities vary by jurisdiction, but generally involve public outreach, application processing, and dispute resolution.

Policies Supporting the EV Used Car Tax Credit

Several policies support the EV used car tax credit. These policies often aim to encourage adoption of electric vehicles by incentivizing their purchase and use. The policies frequently emphasize environmental benefits, energy independence, and economic development related to the EV industry. They can also encompass policies that address charging infrastructure development and promote sustainable transportation.

Examples of Successful Programs Related to EV Incentives

Numerous countries and regions have successfully implemented EV incentive programs. These programs often encompass a range of incentives, including tax credits, rebates, and subsidies for new and used EVs. A successful example is the widespread adoption of the federal tax credit for new EVs in the United States, which significantly boosted sales in the early 2010s. Similarly, several European countries have offered substantial incentives for EV adoption, leading to a substantial increase in the electric vehicle market share. These examples showcase the positive impact of targeted policies on consumer behavior and industry growth.

Key Regulations and Policies Concerning the EV Used Car Tax Credit

| Regulation/Policy | Description | Impact |

|---|---|---|

| Eligibility Criteria | Specifies the requirements a used EV must meet to qualify for the tax credit. This may include factors like vehicle year, mileage, and battery capacity. | Defines the scope of vehicles eligible for the credit, influencing consumer choices and market dynamics. |

| Maximum Credit Amount | Limits the maximum amount of the tax credit that a consumer can claim. This amount is often tied to the vehicle’s battery capacity or other characteristics. | Impacts the financial incentive offered to consumers and influences purchase decisions. |

| Credit Claim Process | Artikels the steps involved in claiming the tax credit, such as required documentation, application forms, and deadlines. | Impacts the ease and accessibility of claiming the credit for consumers and dealers. |

| Compliance Requirements | Establishes standards and regulations for maintaining records, verifying vehicle eligibility, and reporting to government agencies. | Ensures the integrity of the program and discourages fraudulent claims. |

Future of the Tax Credit

The future of the electric vehicle (EV) used car tax credit remains uncertain, subject to potential changes in government policies and evolving market dynamics. Predicting the precise trajectory is challenging, but understanding potential modifications and expansions is crucial for both consumers and industry stakeholders. This section explores potential future developments, legislative changes, and associated predictions.

Potential Modifications and Expansions

The EV used car tax credit’s future hinges on various factors, including public policy shifts and evolving consumer demand. Potential modifications could include adjusting the credit amount, extending the program’s duration, or broadening eligibility criteria. These changes would directly impact market dynamics and consumer behavior.

- Credit Amount Adjustments: The current credit amount might be adjusted upward or downward in response to inflation, evolving battery technology costs, or government priorities. This could incentivize or discourage EV adoption depending on the direction of the adjustment. For instance, a decrease in the credit amount could dampen demand, while an increase could stimulate it.

- Program Duration Extensions: The credit’s lifespan is a key consideration. Policymakers might extend the program to further encourage EV adoption and the transition to a cleaner energy sector. For example, a decision to extend the program beyond its current expiration date could provide more time for consumers to purchase used EVs and potentially boost sales.

- Broadened Eligibility Criteria: The current eligibility criteria for the tax credit could be broadened to include more vehicle models, manufacturing origins, or charging infrastructure investments. This could stimulate wider adoption across different market segments. For instance, expanding the eligibility to include EVs with more advanced battery technology could encourage innovation and market expansion.

Legislative Changes

Future legislative changes related to the EV used car tax credit could significantly alter its impact. These changes could affect the credit’s amount, eligibility, or even its overall existence.

- Policy Shifts: Changes in political leadership or shifting priorities regarding environmental policy could lead to significant alterations in the tax credit. For example, a change in administration might prioritize different economic or environmental goals, which could lead to adjustments in the credit.

- Budgetary Constraints: Government budget constraints could lead to a reduction or elimination of the tax credit. This is a significant risk, especially if the credit is deemed less impactful or if other budget priorities emerge.

- Market Trends: The government might respond to market trends, such as increasing EV adoption rates or technological advancements in EV manufacturing. For example, if EV adoption accelerates faster than anticipated, policymakers might decide to adjust the tax credit to maintain the momentum.

Predictions

Future developments concerning the EV used car tax credit are uncertain.

“The EV used car tax credit might be extended with modified eligibility criteria, potentially targeting specific vehicle types or technological advancements in the future.”

“Policymakers might adjust the credit amount in response to inflation, market trends, and evolving technology, aiming to balance consumer incentives and government expenditure.”

“Legislative changes, influenced by evolving political priorities and public support for sustainable energy, could significantly impact the program’s future, potentially leading to its elimination or expansion.”