Toyota Car Insurance Overview

Toyota vehicles are popular for their reliability and performance, and securing the right insurance coverage is crucial for protecting your investment. Understanding the various types of coverage, factors influencing premiums, and potential price differences between models empowers you to make informed decisions. This overview will detail the key aspects of Toyota car insurance.

Common Types of Coverage

Toyota car insurance typically includes liability coverage, which protects you from financial responsibility if you cause an accident and injure someone else or damage their property. Comprehensive coverage extends beyond liability, safeguarding your vehicle from perils like theft, vandalism, and weather damage. Collision coverage pays for damages to your Toyota if it’s involved in an accident, regardless of who is at fault. Uninsured/Underinsured Motorist (UM/UIM) coverage protects you if you’re involved in an accident with a driver lacking adequate insurance.

Factors Influencing Premiums

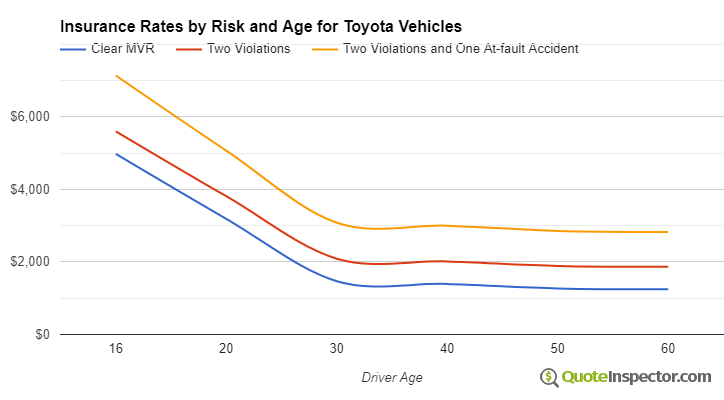

Several factors influence the cost of Toyota car insurance. Your driving record, including any accidents or traffic violations, significantly impacts premiums. Your location plays a role, as some areas have higher rates due to higher accident frequency or theft rates. Your age, gender, and credit history also contribute to the calculation of your premium. The vehicle’s make, model, and safety features (like anti-theft systems or airbags) are often considered.

Differences in Insurance Costs Between Models

Insurance premiums for Toyota models can vary. Factors such as the vehicle’s value, safety features, and theft risk contribute to these differences. For example, a high-performance Toyota sports car might have a higher premium than a more economical model due to its higher value and potential for theft.

Toyota Insurance Packages Comparison

| Coverage Type | Description | Estimated Cost |

|---|---|---|

| Liability Only | Basic coverage for bodily injury and property damage liability. | $500 – $1,500 annually |

| Comprehensive | Protects your vehicle from various perils, including theft, vandalism, fire, and weather damage. | $200 – $600 annually |

| Collision | Covers damage to your Toyota in an accident, regardless of fault. | $250 – $750 annually |

| Full Coverage (Comprehensive & Collision) | Combines comprehensive and collision coverage for comprehensive protection. | $700 – $2,000 annually |

| Uninsured/Underinsured Motorist (UM/UIM) | Protects you if you’re involved in an accident with an uninsured or underinsured driver. | $100 – $300 annually |

Note: Estimated costs are a range and may vary significantly based on individual circumstances.

Comparing Toyota Insurance with Other Brands

Insurance premiums for vehicles vary significantly across different brands. Understanding the factors influencing these differences is crucial for making informed decisions about auto insurance. This section delves into the average costs, contributing factors, and claims experiences associated with insuring Toyota vehicles compared to other popular brands.

Average Insurance Costs

The average cost of insuring a Toyota vehicle often falls within a competitive range compared to other popular brands. Numerous factors, however, influence the final premium amount, making direct comparisons challenging. These factors include the specific model, trim level, safety features, and driver demographics.

Factors Affecting Insurance Rates

Several key elements contribute to the variation in insurance premiums between brands, including Toyota. Vehicle safety ratings play a critical role. Higher safety ratings typically translate to lower insurance premiums due to a reduced risk of accidents. The vehicle’s repair costs also impact the insurance rate. Vehicles with more expensive parts or complex repair procedures might have higher premiums. Finally, driver history, location, and coverage options are additional factors that contribute to the overall cost of insurance.

Claims Experience

Toyota vehicles have a generally positive reputation for reliability and durability, contributing to a relatively lower claim frequency compared to some other brands. However, like any vehicle, they can be involved in accidents. The claim experience also depends on the specific model, driver behavior, and the severity of the accident.

Reliability and Safety Ratings

Toyota vehicles consistently rank highly in reliability studies and safety ratings. This strong performance often results in lower insurance premiums. However, specific models and trim levels may vary in safety features and reliability. Consumers should research specific models to understand their safety and reliability ratings to get a better picture of their insurance costs.

Comparison Table

| Brand | Average Cost | Safety Rating | Claim Frequency |

|---|---|---|---|

| Toyota | $1,500 – $2,500 annually (based on average data for a Camry) | Generally high, consistently ranking well in independent safety tests. | Lower than average, depending on the model and driver. |

| Ford | $1,600 – $2,800 annually (based on average data for a F-150) | Good, varies based on model and features. | Moderate, varies based on model and driver. |

| Honda | $1,400 – $2,300 annually (based on average data for a Civic) | Very good, consistently ranking well in safety tests. | Lower than average, depending on the model and driver. |

| Chevrolet | $1,500 – $2,700 annually (based on average data for a Silverado) | Good, varies based on model and features. | Moderate, varies based on model and driver. |

Note: Average costs are estimations and can vary greatly depending on individual circumstances. These figures are approximations and should not be considered definitive.

Coverage Details and Options

Understanding the different coverage options available for your Toyota car insurance is crucial for ensuring adequate protection and minimizing financial risks. This section delves into the specifics of standard coverages, optional add-ons, and how these choices impact your premium.

Comprehensive and collision coverage are common add-ons that safeguard your vehicle against damages caused by external factors and accidents, respectively. Choosing the right coverage level and deductible is a personal decision that depends on your budget, driving habits, and the value of your vehicle.

Standard Coverages

Standard Toyota insurance policies typically include liability coverage, which protects you financially if you cause an accident and are legally responsible for damages to another person or their property. Uninsured/underinsured motorist protection is also often included, safeguarding you in the event of an accident involving a driver without sufficient insurance. These fundamental protections are a part of most base policies and provide a basic level of financial security.

Optional Add-on Coverages

Beyond the standard coverages, several optional add-ons can enhance your protection. Comprehensive coverage protects your vehicle against perils like vandalism, fire, hail, and theft. Collision coverage, on the other hand, covers damages resulting from an accident, regardless of fault. These add-ons offer a higher degree of protection but come with increased costs.

Factors to Consider When Choosing Add-on Coverage

Several factors influence the decision to opt for comprehensive or collision coverage. The value of your vehicle plays a significant role. A more expensive vehicle might warrant comprehensive coverage to protect its investment. Driving habits are also important; drivers with a history of accidents or who live in high-risk areas might benefit from more comprehensive protection. Finally, your budget should be considered, as optional add-ons increase the overall cost of the insurance policy.

Impact of Deductibles

Deductibles are the amounts you pay out-of-pocket before your insurance coverage kicks in. Lower deductibles mean less out-of-pocket expense in case of a claim but result in higher premiums. Higher deductibles reduce your monthly premium but require a larger payment from you in the event of a claim. The optimal deductible choice depends on your financial situation and willingness to assume risk. For example, if you anticipate fewer claims, a higher deductible might be more suitable.

Impact on Policy Cost

The inclusion of optional coverages directly impacts the final cost of your insurance policy. Comprehensive and collision coverage, for instance, significantly increase the premium. The chosen deductible also affects the premium, with lower deductibles leading to higher premiums. It’s essential to weigh the level of protection offered by different coverage options against their associated costs. This balance between protection and affordability is key to selecting the appropriate insurance policy.

Optional Coverages and Costs

| Coverage | Description | Cost Impact |

|---|---|---|

| Comprehensive Coverage | Protects against damage from perils like vandalism, fire, hail, and theft. | Increased premium |

| Collision Coverage | Covers damage to your vehicle in an accident, regardless of fault. | Increased premium |

| Uninsured/Underinsured Motorist Protection | Provides coverage if you are involved in an accident with an at-fault driver who lacks sufficient insurance. | May increase or decrease premium depending on the policy. |

| GAP Insurance | Covers the difference between the actual cash value of your vehicle and the outstanding loan balance in case of a total loss. | Increased premium |

Insurance Claims Process

Filing an insurance claim for your Toyota vehicle can be a straightforward process if you understand the steps involved and the required documentation. This section details the claim process, from initiating the claim to receiving compensation, offering a comprehensive overview for Toyota vehicle owners.

Understanding the claim process empowers you to navigate the procedure effectively and expedite the settlement. A clear understanding of the documentation needed, the typical timeframe for processing, and the communication methods available will greatly ease the claim process.

Claim Initiation

The initial step in the claims process involves notifying your insurance provider about the incident. This typically involves reporting the accident or damage to the vehicle through the designated channels, which may include a phone call, online portal, or a physical visit to the provider’s office. Prompt reporting is crucial for initiating the claim process and ensuring timely assessment.

Required Documents

A successful claim requires providing the necessary documentation to support your claim. These documents typically include the following:

- Proof of Ownership: This could include your vehicle registration or title.

- Insurance Policy Documents: Your insurance policy details are necessary for verifying coverage and policy limits.

- Incident Report: A detailed police report or an accident report from the involved parties.

- Medical Records (if applicable): If injuries were sustained, medical records are required for coverage of medical expenses.

- Photographs/Videos of Damage: High-quality photographs or videos of the damage to your Toyota vehicle are crucial for assessing the extent of the damage and for claim approval.

- Repair Estimates: Quotes from an authorized repair shop or a qualified mechanic for the estimated repair costs.

Claim Processing Timeframe

The timeframe for processing a claim varies depending on several factors, such as the complexity of the damage, the availability of required documents, and the insurance provider’s internal procedures. Generally, the process can take from a few days to several weeks. A streamlined claim process, supported by complete documentation, is likely to expedite the claim approval. For example, a minor fender bender might be processed within a week, whereas a major accident involving extensive repairs could take longer.

Communication Methods

Effective communication with your insurance provider is key during the claim process. Different communication channels, such as phone calls, emails, or online portals, can be used. These methods allow for efficient and transparent communication throughout the process, ensuring all parties are on the same page. Choose the method most suitable for your needs and available time.

Claim Process Flowchart

Steps in Claim Process

- Notify Insurance Provider

- Gather Required Documents

- Submit Claim Form

- Assessment of Damage

- Approval/Disapproval of Claim

- Settlement and Repair

- Finalization of Claim

Insurance Discounts and Savings

Securing the best possible rates on your Toyota car insurance is crucial for managing your financial resources effectively. Understanding the various discounts and savings strategies available can significantly reduce your insurance premiums. This section explores different avenues for achieving cost-effective insurance coverage.

Understanding the factors influencing your insurance premiums is key to identifying potential savings. Factors like your driving record, vehicle features, and lifestyle choices play a significant role in determining your insurance rate. By proactively managing these factors, you can potentially reduce your insurance costs.

Available Discounts for Toyota Car Insurance

Toyota car insurance often offers a range of discounts tailored to specific situations. These discounts can vary depending on the insurer, but some common examples include discounts for safe driving, accident-free driving records, anti-theft devices, and bundled insurance packages. Utilizing these discounts can lead to substantial savings on your overall insurance costs.

Impact of Safe Driving Practices

Safe driving practices demonstrably influence insurance premiums. Insurers often reward drivers who demonstrate responsible and cautious driving habits. For instance, consistent adherence to speed limits, avoiding aggressive driving, and utilizing defensive driving techniques can positively impact your insurance rates. These practices not only improve safety on the roads but also contribute to a lower insurance premium.

Examples of Saving Money on Toyota Car Insurance

Numerous strategies can lead to savings on Toyota car insurance. Installing anti-theft devices, such as alarm systems or tracking systems, can help deter theft and often result in discounted premiums. Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, may also yield cost savings. Similarly, taking a defensive driving course can demonstrate a commitment to safe driving practices, leading to potentially lower insurance rates.

Driver History and Insurance Rates

Your driving history plays a significant role in determining your insurance rates. A clean driving record, free from accidents and violations, is often rewarded with lower premiums. Conversely, a history of accidents or traffic violations may lead to higher premiums. Maintaining a responsible driving record is essential for securing the most favorable insurance rates.

Savings Strategies for Toyota Car Insurance

- Safe Driving Practices: Consistently following traffic laws, maintaining a safe following distance, and avoiding aggressive driving behaviors can lead to significant savings.

- Anti-theft Devices: Installing and maintaining anti-theft devices such as alarms or tracking systems can help deter theft, which often results in reduced insurance premiums.

- Defensive Driving Courses: Completing a defensive driving course demonstrates a commitment to safe driving practices and may qualify you for a discount on your insurance premiums.

- Bundled Insurance: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, often results in a combined discount.

- Discounts for Students/Young Drivers: Young drivers often qualify for specific discounts. Some insurers may offer discounted rates for students with good academic records.

- Claims-Free History: Maintaining a history of no claims or accidents is essential for securing the most favorable insurance rates.

Insurance for Different Types of Toyota Vehicles

Insuring a Toyota vehicle involves more than just the brand name; factors like vehicle type, model, and usage significantly impact insurance premiums. Understanding these nuances is crucial for securing the right coverage at a competitive price. This section delves into the variations in insurance costs for different Toyota models, highlighting the key considerations for each type of vehicle.

Insurance premiums for Toyota vehicles, like other makes, are influenced by various factors, including the vehicle’s make, model, safety features, and the driver’s profile. The type of vehicle, whether a sedan, SUV, or truck, plays a significant role in determining the insurance cost.

Comparing Insurance Costs for Different Toyota Vehicle Types

Insurance premiums for Toyota vehicles vary based on the vehicle type. Sedans typically have lower premiums compared to SUVs and trucks, due to factors such as their smaller size, lower weight, and often less powerful engines. This difference in cost often reflects the potential for lower damage in an accident, and in some cases, reduced fuel consumption, which impacts insurance costs indirectly.

Factors Affecting Insurance Premiums for Specific Toyota Models

Several factors influence the insurance premium for specific Toyota models. Safety features, such as airbags, anti-lock brakes, and electronic stability control, are crucial considerations. Higher safety ratings often correlate with lower insurance premiums. The model year also plays a role, with newer models incorporating advanced safety technology, potentially impacting the cost. Engine size and horsepower, though not always directly correlated, can influence insurance costs, as more powerful vehicles might be perceived as having a higher risk of damage. Furthermore, the vehicle’s overall value, and any customization or modifications, also contribute to the calculation of insurance premiums.

Insurance Implications of Purchasing a Used Toyota

Purchasing a used Toyota can have varying implications for insurance. The age and mileage of the vehicle significantly affect the premium. Older models might have fewer safety features, which can translate into higher premiums. The vehicle’s overall condition and any pre-existing damage or repairs also affect the insurance cost. Furthermore, the market value of the used Toyota will be a major factor, as insurance often reflects the replacement cost.

Insurance Differences for Electric Toyota Vehicles

Insurance coverage for electric Toyota vehicles, such as the RAV4 Prime or the upcoming models, might differ slightly from traditional gasoline-powered vehicles. While some factors like safety features and driver profiles remain the same, the unique characteristics of electric vehicles, including battery technology and potential risks associated with the battery pack, might influence the insurance premium. In some cases, insurance companies may view electric vehicles as having a lower accident risk due to their lighter weight and improved safety features.

Average Insurance Costs for Various Toyota Vehicle Types

| Vehicle Type | Average Cost | Key Considerations |

|---|---|---|

| Sedans (e.g., Camry, Corolla) | $1,000-$1,500 annually | Generally lower due to smaller size and weight |

| SUVs (e.g., RAV4, Highlander) | $1,200-$2,000 annually | Higher than sedans, influenced by size and potential for damage |

| Trucks (e.g., Tacoma, Tundra) | $1,500-$2,500 annually | Highest premiums due to size, weight, and potential for damage; often more expensive to repair. |

Note: These are approximate average costs and can vary significantly based on individual circumstances. Factors like driver history, location, and specific vehicle model will influence the final premium.