Understanding the Concept of 0% Financing on SUVs

Zero percent financing on SUVs presents a compelling proposition for potential buyers. It essentially allows you to purchase a vehicle with no interest payments for a specific period, typically ranging from 12 to 60 months. This can lead to significant savings compared to traditional financing options, especially if you plan to hold onto the vehicle for the duration of the promotional period. However, understanding the nuances of these offers is crucial to making an informed decision.

0% financing deals are often presented as attractive, low-cost alternatives to traditional financing. However, these offers are not always the best option, as they may come with hidden costs or restrictions. A careful evaluation of the terms and conditions, including the total cost of the vehicle and potential penalties for early payoff, is essential before committing.

Typical Terms and Conditions

0% financing offers often come with specific terms and conditions. These typically include a predetermined loan duration, a set interest rate (in this case, 0%), and possible restrictions on the type of SUV. Crucially, these offers frequently have strict requirements for creditworthiness and the length of the financing period. Dealers may also impose restrictions on trade-in values or specific model years. The exact terms will vary based on the dealership and the specific offer.

Comparison with Other Financing Options

Compared to traditional financing options, 0% financing offers a compelling advantage of eliminating interest payments for a set period. However, traditional financing allows for greater flexibility in loan terms and may potentially offer lower monthly payments depending on creditworthiness and the chosen loan duration. Consideration of factors like the length of the financing period, your credit score, and the total cost of the vehicle are crucial for a comprehensive comparison. Different financing options, including those with variable interest rates, may provide more flexibility for long-term financing needs. Traditional financing might also offer more negotiating room for terms and conditions.

Potential Benefits and Drawbacks

The key benefit of 0% financing is the elimination of interest charges for the duration of the promotional period. This can result in lower monthly payments compared to traditional financing, especially if the promotional period aligns with your budget. However, a significant drawback is that these offers often come with stricter terms and conditions. The actual savings might be offset by factors such as higher total costs due to added fees, or limited choices in models and features. Additionally, if you need to sell the vehicle before the promotional period ends, you might face penalties for early payoff.

Factors Influencing Availability

The availability of 0% financing deals is influenced by several key factors. These factors include the current economic climate, the manufacturer’s promotional strategies, and the dealership’s financial position. Furthermore, the specific model of the SUV and its popularity in the market can also play a role in the availability of such deals. The dealer’s need to move inventory or incentivize sales are also key factors. For example, during periods of high inventory, dealerships may offer more 0% financing deals to clear out their stock.

Identifying Different Types of SUV Financing Deals

Navigating the world of SUV financing can feel like deciphering a complex code. Understanding the various types of deals available, from introductory offers to limited-time promotions, is crucial for securing the best possible terms. Different financing structures often come with distinct eligibility requirements and interest rates, impacting the overall cost of the vehicle.

Various financing deals exist, catering to different customer needs and market conditions. These offers are designed to attract buyers and incentivize sales, often varying in their duration and application criteria. Identifying the specifics of each deal is essential to avoid costly pitfalls.

Different Types of 0% Financing Offers

Several types of 0% financing deals are common in the automotive industry. These deals often include introductory offers, which are designed to attract new customers, or limited-time promotions aimed at clearing inventory or boosting sales during specific periods.

Comparison of Financing Deal Terms

Comparing the terms of different financing deals is critical for informed decision-making. Introductory offers, while tempting with their zero-percent interest, may have a shorter duration than a longer-term promotional offer. Furthermore, the eligibility criteria may vary significantly, requiring specific credit scores or down payment amounts. Limited-time promotions, while offering a potentially lower overall cost, are often tied to specific models or inventory.

Distinguishing Genuine 0% Financing from Low-Interest Financing

Genuine 0% financing means the borrower pays no interest on the loan for the duration of the financing term. Financing with a very low interest rate, on the other hand, still incurs interest charges, although at a minimal rate. This distinction is critical, as the total cost of the vehicle can differ significantly depending on the chosen financing structure. It’s vital to carefully review the fine print of each offer to avoid confusion and ensure you’re making the best financial choice.

Table of Key Features of SUV Financing Types

| Financing Type | Financing Period | Interest Rate | Eligibility Criteria |

|---|---|---|---|

| Introductory Offer | Typically 12-24 months | 0% | Often includes specific credit score requirements, down payment amounts, or limited to specific models. |

| Limited-Time Promotion | Variable, often 36-60 months | 0% or very low (e.g., 0.9%) | May require a specific timeframe for purchase, or limited to particular inventory. |

| Standard Financing | Variable (e.g., 36, 48, 60 months) | Variable (typically ranging from 2% to 8%) | Standard lender criteria apply. |

Careful review of the fine print and understanding of the terms are paramount to making an informed decision. A comprehensive understanding of the financing details is crucial to avoid any unforeseen financial implications.

Exploring Eligibility Criteria for 0% Financing

Securing 0% financing on an SUV often hinges on demonstrating financial responsibility and meeting specific criteria. Lenders meticulously assess applicants to mitigate risk and ensure the loan’s repayment. This process involves evaluating various aspects of a borrower’s financial profile.

Eligibility for 0% financing isn’t a guaranteed outcome, and the specifics can vary among lenders. Understanding the requirements beforehand can help applicants make informed decisions and increase their chances of approval.

Common Eligibility Requirements

A key element in obtaining 0% financing for an SUV is meeting the lender’s criteria for creditworthiness. This includes, but is not limited to, factors like credit history, income, and down payment. A strong credit history, stable income, and a substantial down payment are usually preferred.

Impact of Credit History

A borrower’s credit history is a crucial factor. A positive credit history, evidenced by timely payments on past debts, signifies a responsible financial track record. Lenders assess credit scores, payment history, and the overall health of credit accounts. A higher credit score generally translates to a better chance of approval for favorable financing terms, including 0% financing. Conversely, a poor credit history may significantly hinder approval or lead to higher interest rates, even if 0% financing is offered.

Impact of Income

Lenders scrutinize a borrower’s income to assess their ability to repay the loan. A stable income stream, demonstrated through pay stubs, tax returns, or other verifiable income documentation, is essential. The lender needs to determine if the borrower’s income can comfortably accommodate the monthly payments associated with the SUV loan. The income-to-debt ratio is also considered, reflecting the proportion of income allocated to debt obligations.

Impact of Down Payment

A larger down payment often bolsters the loan application, showcasing the borrower’s financial commitment. A higher down payment reduces the loan amount, decreasing the lender’s risk and potentially improving the chances of approval. It also can enable the borrower to qualify for a more favorable interest rate, potentially influencing the likelihood of securing 0% financing.

Underwriting Process

The underwriting process for 0% financing deals is a multi-faceted evaluation of the borrower’s financial profile. This process involves verifying the applicant’s identity, credit history, income, and the value of the collateral (the SUV). The lender carefully scrutinizes the provided documentation to ensure accuracy and assess the overall risk associated with the loan.

Example: Credit History Impact

A borrower with a credit score of 750 and a consistent history of on-time payments is more likely to be approved for 0% financing than a borrower with a score of 650 and a history of late payments.

Example: Income Impact

A borrower with a consistent, high income and a low debt-to-income ratio will likely have a greater chance of approval for 0% financing than a borrower with a fluctuating income and a high debt-to-income ratio.

Example: Down Payment Impact

A borrower making a 20% down payment is more likely to be approved for 0% financing compared to one making a 5% down payment. This is because a higher down payment reduces the lender’s risk exposure.

Analyzing the Market Trends of 0% Financing on SUVs

The automotive market is dynamic, and 0% financing offers on SUVs are subject to constant shifts. Understanding these trends is crucial for both consumers seeking the best deals and dealerships aiming to maximize sales. This analysis delves into the current market trends surrounding 0% financing for SUVs, examining the driving factors, historical comparisons, and recent examples.

Current Market Trends

Current market trends indicate a fluctuating availability of 0% financing deals on SUVs. While these deals are still offered, their frequency and duration vary significantly across different manufacturers and models. Dealerships often employ targeted campaigns for specific models or during specific periods, such as holidays or seasonal promotions.

Factors Driving Trends

Several factors influence the availability and duration of 0% financing deals. Manufacturer incentives, such as new model launches or promotional campaigns, play a significant role. Seasonal promotions, especially during the holiday shopping season, often trigger increased 0% financing offers to boost sales. Economic conditions also impact these trends. During periods of low interest rates, manufacturers may offer 0% financing to attract buyers. Furthermore, competitive pressures within the SUV market influence the frequency of these deals.

Comparison with Historical Data

Comparing current trends with historical data reveals variations in the duration and scope of 0% financing offers. In the past, 0% financing deals were more common, often lasting for extended periods. Today, they are frequently shorter-term, often linked to specific incentives or limited-time campaigns. This change may be attributed to fluctuating interest rates, manufacturer strategies, and consumer demand patterns.

Recent Promotions and Offers

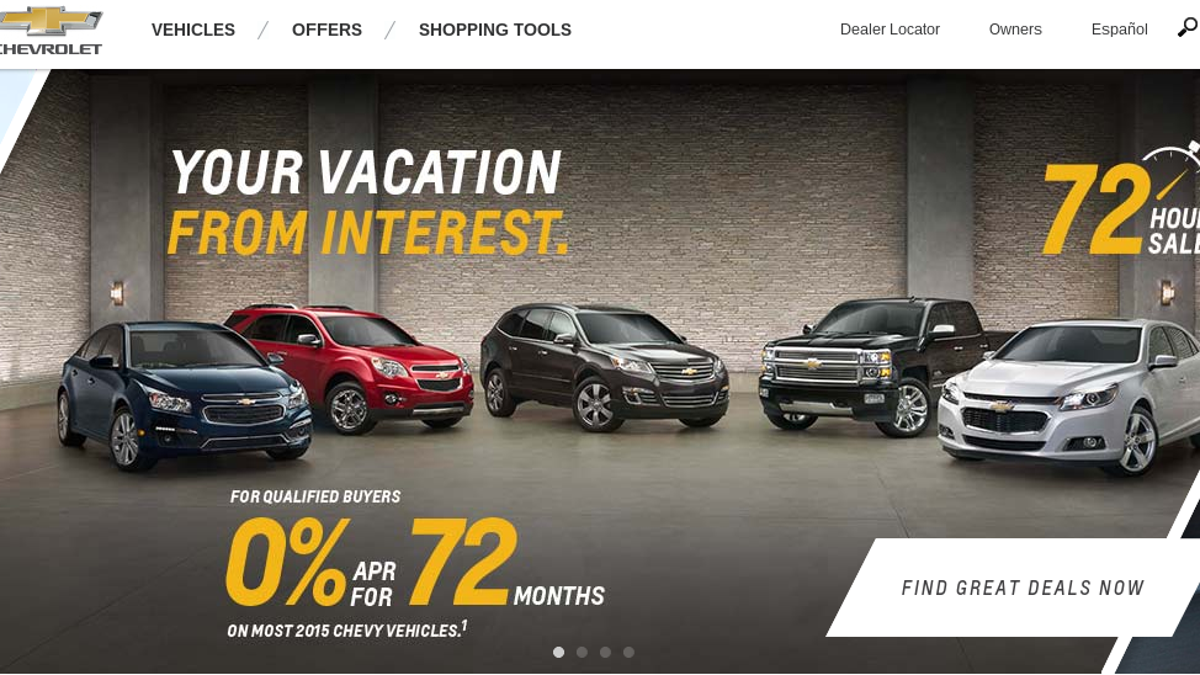

Recent examples of 0% financing offers on SUVs include campaigns by specific manufacturers offering financing for a limited time on select models. These promotions are often announced through various marketing channels, including online advertisements, dealership websites, and direct mail campaigns. These offers often involve specific terms, such as the duration of the financing or the minimum down payment required.

Examples of Recent Promotions

To illustrate, a recent promotional campaign from a major SUV manufacturer offered 0% financing for 60 months on select models. Another campaign focused on a particular SUV model, offering 0% financing for 36 months on models equipped with specific features. These examples highlight the varied approaches and limited-time nature of current 0% financing deals.

Assessing the Value Proposition of 0% Financing

Zero percent financing on SUVs presents a compelling offer, often enticing potential buyers. This seemingly effortless path to vehicle ownership, however, requires a careful evaluation of the long-term financial implications. Understanding how 0% financing influences decisions and its potential drawbacks is crucial before making a purchase.

Influence on Consumer Purchase Decisions

0% financing significantly impacts consumer decisions. The elimination of interest payments makes the monthly payments appear lower than with traditional financing options. This perceived affordability often leads to the selection of a more expensive vehicle than a consumer might otherwise choose, or the purchase of a vehicle that doesn’t perfectly align with their long-term needs. The immediate gratification of owning a vehicle, coupled with the perceived savings, can outweigh a thorough analysis of the overall cost.

Long-Term Financial Implications

While 0% financing initially seems advantageous, the long-term financial implications can be substantial. The absence of interest might encourage consumers to overextend their budgets, leading to potentially higher overall costs in the future. The absence of interest payments might result in the purchase of a more expensive vehicle than necessary. This can affect future financial goals like saving for a down payment on a house or retirement. The lack of interest payments can be offset by additional fees, such as origination fees, documentation fees, or even higher interest rates if the loan terms are later altered or extended. Careful consideration of the total cost of ownership is vital.

Upfront Costs Comparison

| Financing Option | Upfront Costs |

|---|---|

| 0% Financing | Potential for higher upfront costs if the purchase price is elevated due to the lure of no interest. Also, origination fees, documentation fees, or dealer-added extras might be present. |

| Traditional Loan | Typically includes interest payments and loan origination fees. The interest rate directly impacts the total cost of the loan. |

| Lease | Lower upfront costs due to the smaller portion of the vehicle’s value being financed. However, the total cost of ownership may be higher over the lease term compared to a loan, depending on the vehicle’s residual value and mileage. |

This table highlights the potential differences in upfront costs across various financing options. The upfront costs of 0% financing can be comparable to or higher than traditional financing, depending on the vehicle’s price and the seller’s additional fees.

Total Cost of Ownership Comparison

Comparing the total cost of ownership (TCO) for vehicles financed with 0% interest to those financed with traditional loans requires a comprehensive analysis. The apparent savings from 0% financing can be illusory. While the monthly payments might be lower initially, the total amount paid over the loan term might still be comparable to or even exceed that of a traditional loan with a lower interest rate. In cases where the vehicle depreciates quickly, the perceived savings from 0% financing might not outweigh the costs of the higher purchase price.

A key factor in TCO comparison is understanding the vehicle’s depreciation rate. A vehicle that loses value rapidly might not justify the higher purchase price, even with 0% financing.

The TCO comparison is highly dependent on factors like the vehicle’s market value, the interest rate of the traditional loan, and the loan term. The perceived benefits of 0% financing might not translate into substantial long-term savings. A thorough evaluation of the total cost of ownership, considering the vehicle’s expected lifespan and potential resale value, is essential for informed decision-making.

Highlighting the Risks and Pitfalls of 0% Financing

While 0% financing on SUVs can seem like a fantastic deal, it’s crucial to understand the potential downsides. A seemingly attractive offer might mask hidden costs and risks that could significantly impact your financial well-being. Careful consideration and thorough research are paramount to avoid unforeseen difficulties.

Zero percent financing often lures consumers with the promise of immediate gratification. However, the lack of interest payments might not be the only factor to consider.

Potential for Increased Total Cost

Understanding the true cost of an SUV is essential when considering 0% financing. The apparent lack of interest payments might lead to a longer loan term, resulting in more total interest paid compared to a loan with a higher interest rate but a shorter term. This longer term exposes you to a higher risk of unexpected events, like job loss or significant financial changes, which could make the loan challenging to manage.

Hidden Costs and Fees

Beyond the stated purchase price, additional costs like documentation fees, processing fees, and taxes often apply. These fees, while seemingly minor, can significantly increase the overall cost of the vehicle. Dealerships may also include add-on products or services with inflated prices. A thorough review of all associated costs is critical. Always obtain a detailed breakdown of all fees and charges before signing any documents.

Impact of Unexpected Expenses

Life throws curveballs, and unforeseen expenses are inevitable. A medical emergency, job loss, or car repair can strain your budget. A longer loan term associated with 0% financing can make managing unexpected expenses significantly more difficult. Evaluate your financial situation and ability to handle potential unforeseen circumstances before committing to a financing agreement.

Importance of Thorough Research and Comparison

Don’t rush into a deal. Thoroughly research and compare financing options from different lenders. Obtain multiple quotes and analyze the terms and conditions carefully. Compare not only the advertised interest rate but also the total cost of ownership, including loan terms, fees, and potential penalties. Consider the long-term implications of each option before making a decision.

Illustrating Real-World Examples of 0% Financing Offers

Zero percent financing offers on SUVs are a popular tool for auto dealerships and manufacturers to attract buyers. These deals often present a compelling value proposition, but understanding the specifics is crucial for making an informed decision. Understanding the terms and conditions, as well as the potential impact on the overall vehicle price, is essential to maximizing the benefits of such offers.

Real-World Example Scenarios

A recent example saw a local dealership offering 0% financing on a popular mid-size SUV. The offer was valid for 60 months and required a down payment of 10%. The deal included a comprehensive maintenance package, further incentivizing the purchase. This demonstrates how 0% financing deals can be tailored to specific models and buyer demographics.

Specific Terms and Conditions

Crucial details in 0% financing offers include the financing duration, required down payment, and any associated fees. A 0% financing deal might be attractive, but the total cost of ownership over the loan period should still be assessed carefully. This analysis is vital for a sound financial decision.

Impact on Vehicle Price

While 0% financing may seem like a free offer, it often indirectly affects the overall vehicle price. Dealerships might adjust the sticker price of the SUV to compensate for the loss of interest income. This price adjustment may not always be immediately apparent.

Comparative Analysis of 0% Financing Offers

| Dealership/Manufacturer | SUV Model | Financing Duration (Months) | Down Payment (%) | Additional Incentives | Impact on Vehicle Price (Estimated) |

|---|---|---|---|---|---|

| Acme Motors | Explorer | 60 | 10 | Extended warranty, roadside assistance | +2% |

| Bravo Auto Group | Renegade | 48 | 5 | Free first oil change | +1.5% |

| Centurion Cars | Trailblazer | 72 | 15 | Interior upgrade package | +3% |

The table above provides a comparative view of 0% financing offers from different sources. Note the variation in terms and conditions across dealerships and the potential impact on the vehicle’s price. Careful comparison is essential for finding the most favorable deal.

Designing a Checklist for Evaluating 0% Financing Offers

Navigating the world of auto financing, especially 0% financing deals, requires careful consideration. Consumers often face a barrage of attractive offers, but hidden costs and fine print can significantly impact the overall value proposition. This checklist empowers buyers to thoroughly evaluate 0% financing options, ensuring they make an informed decision.

A comprehensive checklist is essential when considering 0% financing for an SUV. It allows consumers to meticulously compare different financing options, identify potential pitfalls, and ultimately secure the best possible deal. By understanding the terms and conditions, buyers can avoid unforeseen expenses and ensure the financing aligns with their financial goals.

Key Criteria for Evaluating 0% Financing Offers

Careful analysis of the deal’s specifics is crucial before committing. The following criteria are essential for evaluating 0% financing offers for SUVs:

- Loan Term: Understanding the duration of the loan is vital. A shorter term typically means lower overall interest paid, but may result in higher monthly payments. A longer term might reduce monthly payments but increases the total interest over the life of the loan. Comparing loan terms to other financing options, including those with low, fixed interest rates, helps determine the most cost-effective solution.

- APR (Annual Percentage Rate): While a 0% APR sounds appealing, be aware that some 0% financing offers have hidden fees or additional charges that can inflate the actual cost of the loan. Thorough investigation of the fine print, especially any potential balloon payments, is essential. Scrutinizing the APR against other financing options with fixed interest rates is crucial for comprehensive analysis.

- Down Payment Requirements: A lower down payment might seem enticing, but it could significantly increase the total loan amount and the overall cost of financing. Analyzing down payment options against the overall budget and considering potential risks associated with a higher loan amount is essential.

- Trade-in Value Assessment: If trading in a vehicle, ensure the trade-in appraisal is fair and accurate. Comparing the appraisal with online market values and independent appraisals can help prevent undervaluation. This process ensures the trade-in value is fairly reflected in the financing offer.

- Hidden Fees and Charges: Be vigilant about any additional fees beyond the advertised financing rate. These could include origination fees, documentation fees, or prepayment penalties. Carefully reviewing the complete financing agreement and identifying all potential charges is crucial for accurate financial planning.

Reviewing the Fine Print and Understanding Terms

Thorough scrutiny of the financing agreement’s fine print is critical. Understanding all terms and conditions is vital to avoid potential issues down the road. This includes examining the following aspects:

- Prepayment Penalties: Certain financing agreements may impose penalties for paying off the loan early. Understanding these penalties is crucial for making informed financial decisions. If prepayment penalties exist, analyze their impact on the overall cost of the loan.

- Late Payment Fees: Review the late payment penalties associated with the financing agreement. This will help determine the financial consequences of missed payments. Understand the severity of these fees to maintain financial stability.

- Accrued Interest Calculation: Ensure you understand how interest accrues and is calculated throughout the loan term. Understanding the specific interest calculation method is crucial to predict the total cost of financing.

- Default Penalties: Review the financial penalties for defaulting on the loan. This includes any potential repossession fees or legal costs associated with defaulting on the loan. Assess the risks associated with potential default penalties to manage financial risk.

Questions to Ask Dealerships/Financial Institutions

Proactive inquiries can significantly improve the understanding of financing offers. These questions help clarify potential ambiguities and ensure transparency:

- “What are all the fees associated with this 0% financing offer?” This ensures a comprehensive understanding of all associated charges.

- “What is the total cost of the loan, including all fees, over the life of the loan?” This provides a complete picture of the overall financing cost.

- “Are there any prepayment penalties, and what is the amount?” This ensures understanding of the potential financial consequences of paying off the loan early.

- “What are the late payment fees, and how are they calculated?” This ensures awareness of the potential financial consequences of late payments.

- “Can you provide a breakdown of the interest calculation method used for this loan?” This clarifies the precise mechanism for calculating interest, aiding in accurate cost estimations.