Introduction to SUV Lease Deals

SUV leases offer an attractive alternative to purchasing, allowing drivers to enjoy the latest models without the long-term commitment of ownership. This approach often involves lower monthly payments compared to financing a similar vehicle, providing flexibility to upgrade to a newer model more frequently. However, understanding the nuances of SUV lease deals is crucial to avoid hidden costs and ensure the best possible value. This section explores the key considerations involved in securing favorable SUV lease deals.

Understanding the factors that influence SUV lease deals is essential for making informed decisions. Lease terms are often subject to seasonal fluctuations, manufacturer promotions, and dealer incentives. These factors, in combination with the availability of specific models and trims, create a dynamic landscape for potential leasers.

SUV Lease Benefits and Drawbacks

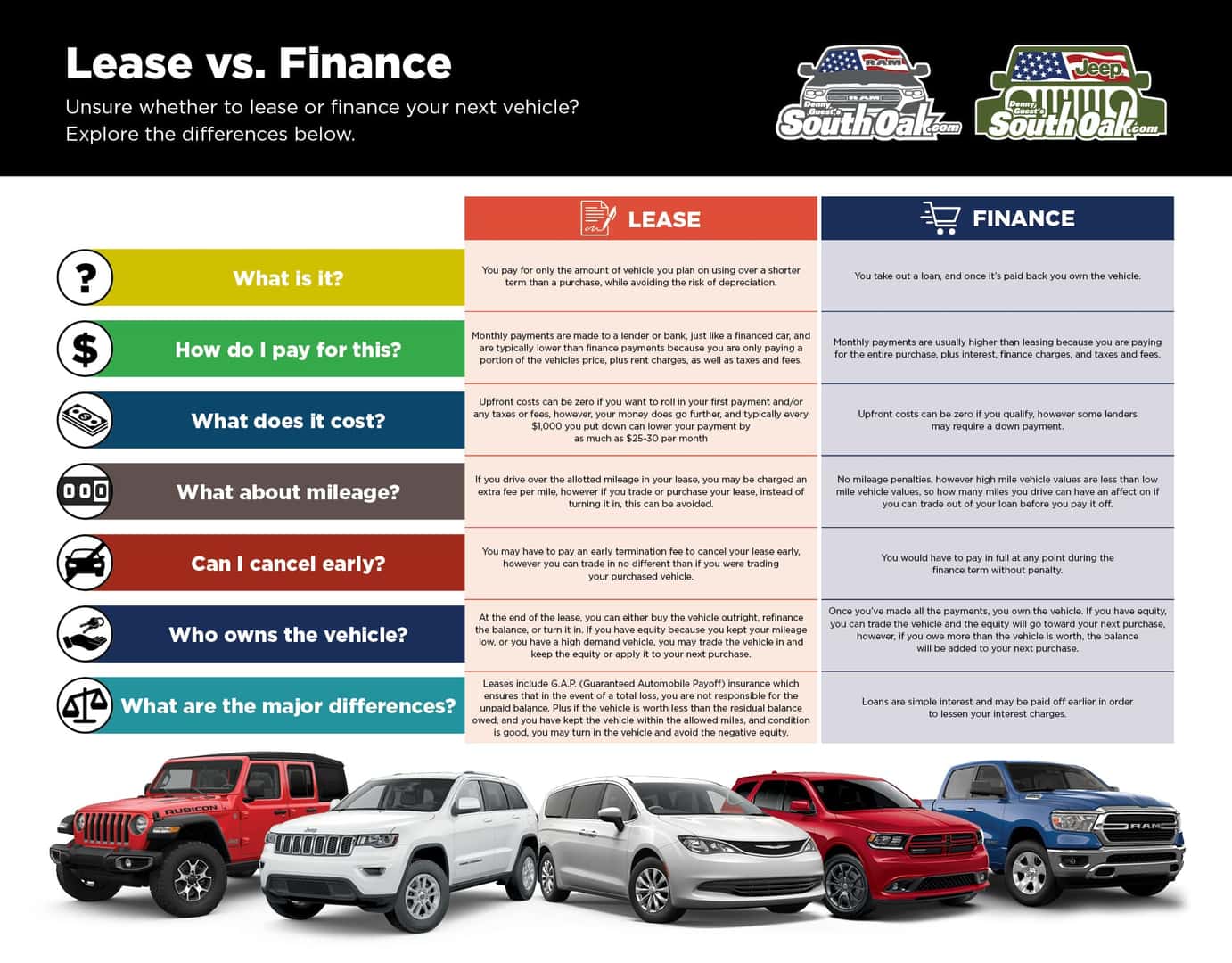

Leasing offers the advantage of driving a newer vehicle without the burden of depreciation, which is a major concern with car ownership. The lower monthly payments are often a major draw for potential leasers. However, a key disadvantage is that the lessee doesn’t own the vehicle at the end of the lease term. Furthermore, exceeding mileage limits or causing significant damage to the vehicle can result in substantial extra charges.

Factors Influencing SUV Lease Deals

Several factors contribute to the competitiveness of SUV lease deals. The time of year often plays a significant role, with manufacturers and dealers offering seasonal incentives to boost sales. Specific manufacturer promotions, like loyalty programs for returning customers or introduction of new models, can also influence the terms of a lease. Dealer incentives, such as bundled packages or financing options, can also impact the overall cost of the lease.

Types of SUV Lease Deals

Various types of deals can be found in the SUV lease market. Loyalty programs often provide discounts or preferential terms to returning customers who lease from the same dealership or brand. Military discounts are another potential source of savings for eligible personnel. Understanding these types of deals can help potential leasers secure more favorable lease agreements.

Importance of Understanding Lease Terms and Conditions

Carefully reviewing lease terms and conditions is critical. Lease agreements typically specify the monthly payment, mileage allowance, and any potential penalties for exceeding mileage or causing damage to the vehicle. Understanding these details helps avoid unexpected costs. For instance, a lease with a high mileage limit may seem attractive initially, but exceeding the limit could lead to significant fees. Similarly, the terms surrounding the return or early termination of the lease must be thoroughly reviewed.

Comparison of Lease Options

| Brand/Model | Lease Term (Months) | Mileage Allowance (Miles) | Monthly Payment ($) | Total Cost ($) |

|---|---|---|---|---|

| Toyota RAV4 | 36 | 36,000 | $350 | $12,600 |

| Honda CR-V | 48 | 48,000 | $400 | $19,200 |

| Ford Explorer | 60 | 60,000 | $550 | $33,000 |

Note: These figures are examples and may vary depending on specific models, trim levels, and individual circumstances. Factors like down payment and creditworthiness also influence the final cost.

Finding Deals Near Me

Locating attractive SUV lease deals in your area requires a strategic approach, combining online research with direct interaction with local dealerships. This process involves leveraging online resources, refining search criteria, and understanding the role of local dealerships. By understanding the interplay of these elements, you can efficiently find lease options that best meet your needs and budget.

Finding the right SUV lease deal often hinges on the interplay between online resources and direct dealership engagement. A well-informed strategy involves effectively using online tools to narrow your search and then visiting dealerships to discuss specific options and negotiate terms.

Online Resources for Locating Deals

Numerous online platforms facilitate the search for SUV lease deals. Websites dedicated to automotive deals, online marketplaces for used cars, and manufacturer websites frequently post lease offers. These resources often allow for geographic filtering, enabling you to focus on deals within your desired area. Using these platforms enables you to compare lease terms, including monthly payments, down payments, and residual values.

Narrowing Down Lease Options

Specific criteria play a crucial role in refining your search for the perfect SUV lease. These criteria can include make, model, trim level, and desired features. For instance, if you’re interested in a specific make like Toyota, you can filter your search results accordingly. Similarly, specifying a desired trim level, like the XLE or Limited, further refines your options. These detailed specifications are essential in finding a lease that aligns with your budget and preferences.

Local Dealerships’ Role

Local dealerships remain vital in the process of securing a lease. Dealerships often have access to exclusive deals and incentives not readily available online. Visiting dealerships allows for a direct assessment of the vehicle’s condition and a personalized negotiation of terms. This direct interaction also provides an opportunity to gain valuable insights into potential lease options not advertised elsewhere.

Comparison of Online and Dealership Approaches

| Website | Criteria Used | Lease Details |

|---|---|---|

| Edmunds | Make: Toyota; Model: RAV4; Trim Level: XLE; Location: 90210 | Monthly Payment: $350; Down Payment: $1,000; Residual Value: $20,000; Lease Term: 36 months |

| Cars.com | Make: Honda; Model: CR-V; Trim Level: EX-L; Location: 10001 | Monthly Payment: $380; Down Payment: $500; Residual Value: $19,500; Lease Term: 36 months |

| Local Dealership (ABC Motors) | Make: Ford; Model: Explorer; Trim Level: XLT; Location: 90210 | Monthly Payment: $400; Down Payment: $0; Residual Value: $21,000; Lease Term: 36 months |

Online search tools offer a broad overview of available lease options and enable comprehensive comparisons across different models. However, they often lack the personalized touch and potential for negotiation that direct interaction with a dealership provides. Dealership visits allow for in-depth discussions about individual needs and potentially unlock better lease terms. The choice between online tools and dealerships depends on individual priorities. If a quick overview and broad comparison are prioritized, online tools are advantageous. However, if personalized negotiation and potentially better terms are desired, visiting dealerships in person is recommended.

Analyzing Lease Terms

Careful evaluation of lease terms is crucial for securing a favorable SUV lease deal. Understanding the various components of a lease agreement, from monthly payments to termination policies, empowers you to make informed decisions and avoid potential pitfalls. A thorough analysis helps you compare different offers and ensures the total cost aligns with your budget and needs.

Thorough examination of the lease agreement is paramount. It is not simply about finding a low monthly payment; it’s about understanding the complete financial commitment. This includes hidden fees, mileage restrictions, and potential early termination penalties. A comprehensive analysis will help you anticipate and address these issues before signing on the dotted line.

Lease Payment Structure

Monthly payments are a key factor in the overall cost of a lease. They are influenced by factors like the vehicle’s MSRP, the interest rate, the term of the lease, and the residual value projected by the dealership. Understanding the impact of these elements allows you to compare different lease offers effectively. Don’t solely focus on the lowest monthly payment; consider the total cost over the lease term.

Down Payment and Security Deposit

The down payment, along with a security deposit, significantly impacts the initial financial outlay. A higher down payment often results in lower monthly payments but requires more upfront capital. It’s essential to evaluate how these upfront costs factor into your overall budget and to compare these costs against other lease offers.

Mileage Allowance and Exceeding Limits

Mileage allowances are crucial lease terms to understand. Exceeding the agreed-upon mileage limit typically incurs extra charges. These fees can vary significantly, so it’s essential to have a clear understanding of the specific mileage limits and associated penalties.

Lease Term Duration

The lease term duration significantly impacts the monthly payments and the overall cost. Shorter lease terms usually mean higher monthly payments, while longer terms may result in lower monthly payments but a larger overall cost over the lease period. Consider the expected use of the vehicle and your financial capacity to manage payments over different timeframes.

Lease Termination Policies and Fees

Understanding the lease termination policy is critical, especially if you anticipate needing to end the lease early. Early termination fees can vary widely, so carefully review the terms and conditions. Be prepared for potential costs if you need to return the vehicle before the end of the lease term.

Lease Clauses to Examine

Carefully review the lease agreement for specific clauses, particularly those related to maintenance, insurance, and the use of the vehicle. Some leases may require specific maintenance schedules or insurance requirements. Clarify the responsibilities of both parties in these situations.

Calculating Total Lease Cost

To calculate the total cost of a lease, add together the monthly payments, down payment, security deposit, and any additional fees, including mileage overage charges and potential early termination fees. Taxes and fees must also be included in the overall calculation. A detailed breakdown of the projected total cost provides a comprehensive picture of the financial commitment.

Sample Lease Agreements

| Lease Term (Months) | Mileage Allowance (Miles) | Monthly Payment (USD) | Total Estimated Cost (USD) |

|---|---|---|---|

| 36 | 36,000 | $450 | $18,000 |

| 48 | 48,000 | $400 | $22,000 |

| 60 | 60,000 | $350 | $25,000 |

Note: These are sample figures and actual costs may vary depending on the specific vehicle, market conditions, and individual circumstances.

Understanding Financial Implications

Navigating the financial landscape of an SUV lease requires a clear understanding of the associated costs and potential savings. A comprehensive evaluation of monthly budgets, interest rates, down payment options, and potential penalties is crucial for making an informed decision. Comparing leasing with purchasing provides a clearer picture of the long-term financial implications.

Thorough analysis of the financial aspects, including potential mileage penalties and early termination fees, is essential for responsible budgeting and financial planning. This analysis helps to understand the potential risks and rewards associated with leasing an SUV, enabling a more strategic approach to the decision-making process.

Monthly Budget Considerations

Understanding your monthly budget is paramount when considering an SUV lease. Factors like existing loan payments, credit card obligations, and other living expenses should be considered. A detailed budget analysis allows you to realistically assess how an additional lease payment fits into your overall financial picture. Failing to accurately project these costs can lead to financial strain.

Impact of Down Payment Options

Down payments significantly influence the monthly lease payment amount. A larger down payment typically results in a lower monthly payment. However, a substantial down payment reduces the amount of financing required and can result in a lower monthly payment. This means you’ll have less money tied up in the vehicle, potentially freeing up cash for other expenses.

Leasing vs. Buying: A Financial Comparison

Leasing and buying an SUV offer distinct financial implications. Leasing typically results in lower monthly payments but can lead to higher total costs over the lease term due to mileage penalties and potential early termination fees. Conversely, buying an SUV offers greater ownership flexibility but may require a larger upfront investment and potentially higher monthly payments. The optimal choice depends on individual financial circumstances and long-term goals.

Mileage Penalties and Early Termination Fees

Mileage penalties and early termination fees are crucial considerations for a successful lease agreement. Exceeding the allowed mileage or terminating the lease prematurely can result in significant financial penalties. Reviewing these provisions carefully and understanding the implications is essential for responsible financial planning. Consider alternative lease terms that may mitigate these potential costs.

Financial Comparison Table

| Feature | Leasing | Buying |

|---|---|---|

| Down Payment | Often lower | Typically higher |

| Monthly Payment | Generally lower | Potentially higher |

| Total Cost (over lease term) | Potentially higher due to mileage penalties, early termination fees, and not owning the vehicle | Higher upfront cost, but lower total cost if paid off |

| Ownership | No ownership after lease term | Full ownership after loan is paid off |

| Example Calculation (36-month lease): |

|

|

Note: The example calculations are for illustrative purposes only and do not represent specific lease or purchase scenarios. Actual costs will vary based on individual circumstances, such as the specific SUV model, lease term, and market conditions.

Tips for Negotiating SUV Lease Deals

Securing a favorable SUV lease deal requires more than just browsing online listings. Effective negotiation hinges on a strategic approach, knowledge of the market, and the ability to counter dealership tactics. This section provides key strategies to help you navigate the process and walk away with the best possible lease terms.

Negotiation is a crucial step in securing the best possible lease deal. By understanding the strategies and pitfalls, you can significantly improve your chances of getting a competitive rate and favorable terms.

Research and Comparison

Thorough research is paramount to a successful negotiation. Understanding the prevailing market rates for comparable SUVs, equipped with similar features, is essential. Compare offers from multiple dealerships in your area to identify the most attractive terms. Leveraging online resources, consumer reports, and reviews can provide invaluable insight into the current market value of the vehicle you’re interested in. Use online tools and resources to compare lease deals, identify potential savings, and understand market trends.

Understanding Dealership Tactics

Dealerships employ various tactics to maximize profits. Recognizing these tactics is the first step in countering them effectively. One common tactic is to present an attractive introductory offer that appears favorable but may not hold up when scrutinized. Another tactic involves emphasizing the benefits of adding optional packages or extended warranties. Be prepared to counter these tactics with well-researched arguments and alternative solutions. By understanding their strategies, you can negotiate more confidently.

Negotiation Strategies

Effective negotiation involves a combination of preparation, assertiveness, and flexibility. Start by presenting your desired lease terms based on your research and comparing offers. Be prepared to walk away if the terms are unfavorable. This shows the dealership that you’re serious and knowledgeable about the market value of the vehicle. Be assertive in your negotiation but remain polite and professional. Focus on the value you bring to the deal, and don’t be afraid to negotiate the lease terms, such as the monthly payment, the down payment, and the term of the lease.

Questions to Ask Dealerships

Asking the right questions is critical for transparency and informed decision-making. Inquire about the vehicle’s condition, any outstanding issues, and the validity of any advertised discounts. Ask about the financing options available and the associated fees. Don’t hesitate to ask about the lease terms, including the mileage allowance, the residual value, and the required down payment. Clarify any clauses in the contract that you don’t fully understand. By obtaining detailed information, you can make a more informed decision and potentially avoid costly surprises later on.

Potential Pitfalls

During the negotiation process, several pitfalls should be avoided. Impulsive decisions based on emotions rather than facts can lead to unfavorable terms. Failing to do thorough research before entering negotiations can result in missed opportunities for savings. Rushing into a deal without fully understanding the terms and conditions can lead to financial repercussions. Avoid succumbing to pressure tactics employed by the dealership.

Additional Considerations

Beyond the core lease terms, several factors significantly impact the overall cost and value proposition of an SUV lease. Understanding trade-in values, potential add-ons, and manufacturer differences is crucial for making an informed decision. This section delves into these aspects to help you navigate the complexities of SUV leasing.

Assessing the full value proposition requires a holistic view beyond the initial lease payment. The final cost often includes various add-ons, which can dramatically affect the total expense. A comprehensive analysis of trade-in scenarios, combined with an understanding of manufacturer-specific lease structures, is essential for securing the best possible deal.

Trade-in Value Assessment

Accurately evaluating your trade-in vehicle’s value is critical. Research online resources and use Kelley Blue Book (KBB) or Edmunds tools to get a realistic appraisal. Factors such as vehicle condition, mileage, and model year heavily influence the trade-in offer. Negotiating a fair trade-in value can directly impact the net cost of the new lease.

Potential Add-ons and Their Impact

Various add-ons can significantly alter the overall lease cost. Understanding these impacts is crucial for budgeting.

- Extended Warranties: These extend the manufacturer’s warranty beyond the standard period. They can protect against unexpected repair costs but often come at an additional monthly fee. Assess the likelihood of needing repairs beyond the standard warranty period to determine the value of this add-on. For example, if a buyer anticipates minimal maintenance, the cost of an extended warranty might not be justified.

- Maintenance Packages: These pre-pay for routine maintenance services over the lease term. This can simplify budgeting, but they might not be worth it if you have the resources and expertise to handle maintenance yourself. A comparison of the package cost to independent mechanic fees is crucial for an informed decision. A maintenance package may save money if the lease is short, but for a longer lease, a lower package cost may not justify the convenience.

- GAP Insurance: This covers the difference between the vehicle’s value and the outstanding loan amount in case of theft or total loss. It is often an optional add-on and its necessity depends on individual financial circumstances.

Analyzing Manufacturer-Specific Lease Offers

Different manufacturers have unique lease programs and incentives. A comparative analysis across brands is necessary to find the best deal. Lease terms, interest rates, and add-on options often vary significantly.

- Lease Terms: Some manufacturers offer shorter lease terms with lower monthly payments, but this could result in a higher total cost over the lease period. Longer lease terms often come with higher monthly payments but a lower overall cost.

- Incentives: Manufacturers frequently offer discounts, rebates, or special financing packages. Scrutinizing these incentives is critical for comparing deals effectively.

- Service Network: Consider the manufacturer’s service network and reputation for quality repairs. A reliable network of dealerships can greatly impact maintenance costs and availability.

Summary Table of SUV Lease Deal Considerations

| Criteria | Description | Importance |

|---|---|---|

| Trade-in Value | Appraised value of your current vehicle | Impacts the net cost of the new lease |

| Add-ons (e.g., Extended Warranty, Maintenance Package) | Optional extras like extended warranties and maintenance packages | Significantly impacts total lease cost |

| Lease Terms (Duration, Monthly Payment) | Length of the lease and monthly payments | Affects overall cost and affordability |

| Manufacturer Incentives | Discounts, rebates, or financing offers | Crucial for comparing different lease deals |

| Service Network | Reputation and availability of dealerships for repairs | Impacts maintenance costs and convenience |