Overview of Used Car Interest Rates

Used car interest rates are a crucial component of the financing process, determining the cost of borrowing money to purchase a pre-owned vehicle. Understanding these rates is essential for both buyers and sellers to make informed decisions. They represent the percentage of the loan amount charged as interest over the loan’s duration.

Used car interest rates are influenced by a multitude of factors, each playing a distinct role in shaping the final borrowing cost. These rates aren’t static; they fluctuate based on economic conditions, market trends, and the individual borrower’s profile. Ultimately, these rates directly impact the total amount a buyer pays for the vehicle.

Factors Influencing Used Car Interest Rates

Several key elements contribute to the determination of used car interest rates. These factors encompass the borrower’s creditworthiness, the prevailing economic climate, and the specific terms of the loan agreement.

- Borrower Creditworthiness: A borrower’s credit score significantly impacts the interest rate they are offered. Lenders assess the borrower’s credit history, payment habits, and debt-to-income ratio to evaluate their risk profile. A higher credit score usually translates to a lower interest rate, reflecting the lender’s reduced risk. For example, a borrower with a strong credit history and a low debt-to-income ratio will likely qualify for a lower interest rate compared to a borrower with a poor credit history or high debt.

- Vehicle Condition and Value: The condition and perceived value of the used car play a critical role in the interest rate. A well-maintained vehicle with a higher market value is often associated with a lower interest rate, as it presents less risk to the lender. Conversely, a damaged or older vehicle might attract a higher interest rate. A vehicle with a documented accident history, for instance, might have a higher interest rate assigned.

- Loan Term: The duration of the loan significantly impacts the interest rate. Shorter loan terms generally result in lower monthly payments but often come with slightly higher interest rates. Longer loan terms, conversely, lower monthly payments but can lead to higher total interest paid over the loan’s life. For instance, a 36-month loan might have a slightly higher interest rate compared to a 60-month loan.

- Interest Rate Environment: The prevailing economic conditions and overall interest rate environment affect used car interest rates. During periods of high-interest rates, such as when the Federal Reserve raises rates, used car interest rates tend to rise, as well. Conversely, when interest rates are low, used car interest rates tend to be lower. The impact of national economic factors, such as inflation, on interest rates is substantial. For instance, a period of high inflation might lead to higher interest rates across all borrowing products.

- Down Payment: A larger down payment reduces the loan amount, lowering the risk for the lender. This often results in a lower interest rate. For instance, a down payment of 20% or more often reduces the interest rate compared to a smaller down payment.

Common Financing Terms

Understanding the terminology associated with used car financing is crucial for making informed decisions.

- Annual Percentage Rate (APR): The APR represents the total cost of borrowing over a year, encompassing both the interest rate and other fees. It is a standardized measure of the loan’s cost, allowing for easy comparison between different financing options.

- Loan Term: This refers to the duration of the loan, typically measured in months or years. Longer loan terms provide lower monthly payments but accrue more interest over the life of the loan. For example, a 5-year loan term will have a longer period of repayment and more accumulated interest compared to a 3-year term.

- Down Payment: A down payment is the initial amount paid upfront towards the purchase price of the vehicle. A larger down payment reduces the loan amount, often leading to a lower interest rate. For instance, a 10% down payment may offer a slightly higher interest rate than a 20% down payment.

Summary Table of Used Car Interest Rate Factors

| Factor | Description | Impact on Rates |

|---|---|---|

| Borrower Creditworthiness | The borrower’s credit history, payment habits, and debt-to-income ratio. | Higher credit scores generally lead to lower rates. |

| Vehicle Condition and Value | The vehicle’s condition and perceived market value. | Better condition and higher value usually lead to lower rates. |

| Loan Term | The duration of the loan. | Longer terms often result in lower monthly payments but higher total interest. |

| Interest Rate Environment | The prevailing economic conditions and interest rates. | Higher interest rates in the market usually lead to higher rates. |

| Down Payment | The upfront payment made towards the purchase price. | Larger down payments typically lead to lower rates. |

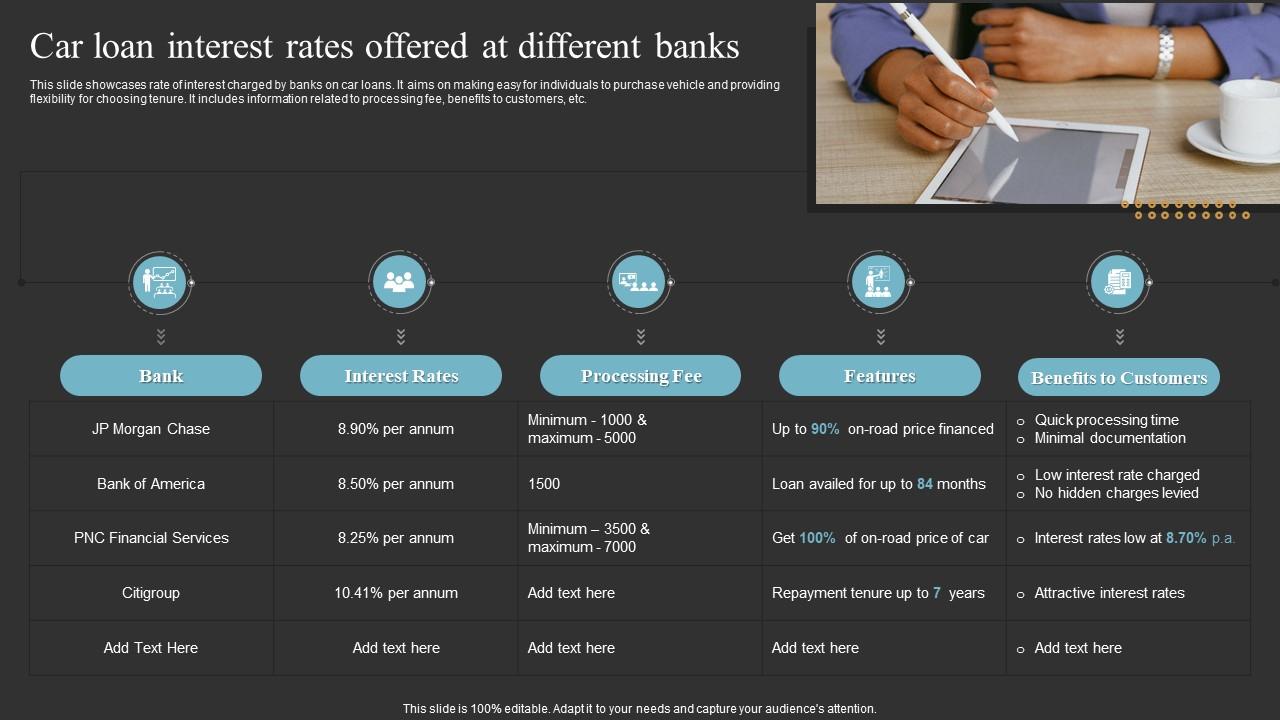

Comparing Interest Rates Across Different Lenders

Used car financing options are diverse, ranging from dealerships to banks and credit unions. Understanding the interest rates and terms offered by each lender is crucial for securing the best possible deal. Comparing these options allows consumers to make informed decisions and potentially save money on their financing.

Sources of Used Car Financing

Various entities provide used car financing, each with its own approach and associated rates. Dealerships often offer in-house financing options, while banks and credit unions provide broader choices tailored to individual credit profiles. These differences influence the interest rates available and the terms of the loan.

Interest Rate Variations Among Lenders

Interest rates for used car loans vary significantly across lenders. Factors such as the lender’s lending policies, the borrower’s creditworthiness, and the prevailing market conditions all play a role in determining the rate. Dealerships, known for their quick turnaround, sometimes offer higher rates than banks or credit unions, who may assess credit more thoroughly.

Creditworthiness and Interest Rates

A borrower’s creditworthiness significantly impacts the interest rate they receive from different lenders. Individuals with strong credit histories typically qualify for lower interest rates, as lenders perceive them as lower risk. Conversely, borrowers with weaker credit profiles face higher interest rates, reflecting the increased risk associated with their financial history. This difference is crucial in understanding the financial implications of borrowing.

Comparison Table of Used Car Financing Options

| Lender | Interest Rate (Example) | Loan Term (Example) | Other Terms (Example) |

|---|---|---|---|

| Dealership In-House Financing | 6.5% – 9.5% | 24 – 72 months | Often quicker approval but potentially higher rates |

| National Bank | 5.0% – 8.0% | 36 – 60 months | Stricter credit checks, competitive rates |

| Credit Union | 4.5% – 7.5% | 36 – 60 months | Often favorable rates for members, competitive terms |

Example: A borrower with a strong credit score of 750 might secure a 5.5% interest rate from a national bank, while a borrower with a credit score of 650 might face a 7.5% interest rate from the same lender.

The table illustrates the potential range of interest rates and terms associated with each lender. Individual experiences may vary based on specific circumstances and financial profiles. These factors underscore the importance of comparing offers carefully before committing to a loan.

Impact of Credit Score on Used Car Interest Rates

Your credit score significantly influences the interest rate you’ll pay for a used car loan. Lenders assess creditworthiness to gauge the risk associated with lending you money. A higher credit score indicates a lower risk, allowing you to secure more favorable interest rates. Conversely, a lower credit score increases the perceived risk, potentially resulting in higher interest rates or loan denial.

Lenders meticulously analyze credit scores to predict the likelihood of loan repayment. A strong credit history, demonstrated by timely payments and responsible borrowing habits, translates to a lower risk profile for the lender. This, in turn, enables them to offer competitive interest rates. Conversely, a weak credit history, signified by missed payments or high debt levels, signals a higher risk, necessitating higher interest rates to compensate for the increased chance of default.

Credit Score and Interest Rate Risk

Lenders use credit scores as a primary indicator of creditworthiness, directly correlating it to the interest rate risk. A higher credit score translates to a lower risk for the lender, enabling them to offer lower interest rates. Conversely, a lower credit score signifies a higher risk, leading to higher interest rates to mitigate potential losses. This relationship is crucial for both the borrower and the lender, as it ensures a balance between affordability for the borrower and reasonable risk tolerance for the lender.

Typical Interest Rate Ranges by Credit Score

The following table illustrates typical interest rate ranges for used car loans based on different credit score categories. Note that these are averages and actual rates may vary depending on the specific lender, loan terms, and other factors.

| Credit Score Range | Typical Interest Rate Range (Example) |

|---|---|

| 700-850 (Excellent) | 2.50% – 5.00% |

| 660-699 (Good) | 5.00% – 7.50% |

| 620-659 (Fair) | 7.50% – 10.00% |

| Below 620 (Poor) | 10.00% – 15.00%+ |

Consequences of a Low Credit Score

A low credit score can significantly impact your ability to secure a used car loan and the interest rate you’ll pay. Borrowers with low credit scores often face higher interest rates, making the loan less affordable. In some cases, lenders might deny the loan altogether. This underscores the importance of maintaining a good credit score for financial well-being, especially when considering major purchases like a used car.

Factors Affecting Used Car Interest Rate Fluctuations

Used car interest rates, like other financial products, are dynamic and respond to a complex interplay of economic forces. Understanding these factors is crucial for consumers seeking to finance their used vehicle purchases, as it allows them to anticipate potential rate changes and make informed decisions. This section will delve into the economic forces that drive fluctuations in these rates, from market trends to broader economic conditions.

Used car interest rates are not static; they are constantly in flux, responding to a variety of economic forces. These fluctuations can significantly impact a buyer’s affordability and the overall cost of acquiring a used vehicle. Understanding the drivers behind these changes is essential for both consumers and lenders.

Economic Factors Influencing Used Car Interest Rates

Numerous economic factors influence the fluctuations in used car interest rates. These factors range from broad macroeconomic conditions to specific market dynamics within the used car industry. Understanding these interconnected forces provides a clearer picture of the forces impacting the cost of used car financing.

- Federal Funds Rate Changes: The Federal Reserve’s benchmark interest rate, the federal funds rate, significantly impacts borrowing costs across the entire economy. Changes in this rate ripple through various financial markets, influencing the cost of loans for used cars. For example, when the Federal Reserve raises the federal funds rate, lenders typically adjust their used car interest rates upward to maintain their profitability margins. Conversely, a decrease in the federal funds rate often leads to lower used car interest rates, making financing more accessible for buyers. This direct relationship between the federal funds rate and used car interest rates is a critical consideration for both consumers and lenders.

- Inflationary Pressures: High inflation often leads to higher used car interest rates. Lenders raise rates to compensate for the eroding purchasing power of money. For instance, during periods of rapid inflation, the real value of the principal and interest payments decreases over time, necessitating higher interest rates to maintain the lender’s expected return. This inflationary impact is a crucial element in the fluctuation of used car interest rates.

- Recessionary Pressures: Conversely, during recessions, there’s a tendency for used car interest rates to fall. Reduced consumer spending and decreased economic activity can lead to lower borrowing costs as lenders compete for available capital. This relationship is exemplified by the decreased borrowing rates during the 2008 financial crisis. However, this decrease in interest rates isn’t always uniform, and other factors can still influence the final rate.

Market Trends and Used Car Financing

Market trends play a vital role in shaping the supply and demand for used cars, and thus the rates charged for financing them. These fluctuations often influence used car financing rates, creating both opportunities and challenges for consumers.

- Supply and Demand Dynamics: Changes in the supply and demand for used cars directly impact financing rates. High demand and low supply can lead to higher interest rates as lenders capitalize on the increased scarcity. Conversely, a surplus of used cars can result in lower interest rates as competition among lenders intensifies. This dynamic interaction between supply and demand is a key factor affecting used car interest rates.

- Used Car Inventory Fluctuations: Changes in the overall inventory of used cars available for sale can influence the rates charged by lenders. A shortage of available vehicles in a particular market segment, for instance, can push rates upward as demand outstrips supply. Conversely, an oversupply can lead to downward pressure on interest rates.

- Economic Growth and Consumer Confidence: Economic growth and consumer confidence often correlate with used car interest rates. Robust economic conditions typically lead to higher rates, while a period of uncertainty or recession can result in lower interest rates. This correlation is driven by the overall economic climate and its impact on consumer spending habits and lending practices.

Loan Terms and Their Influence on Interest Rates

Loan terms, particularly the loan duration, significantly impact the overall cost of borrowing for a used car. Understanding this relationship is crucial for borrowers to make informed decisions and avoid overpaying on their financing. Choosing a loan term that aligns with your budget and financial goals is key to managing your monthly payments and the total cost of the loan.

The relationship between loan terms and interest rates is often inversely proportional. While a shorter loan term generally leads to lower monthly payments, it typically comes with a higher interest rate. Conversely, a longer loan term reduces monthly payments but results in a higher total interest paid over the life of the loan. This trade-off is a fundamental aspect of financing, requiring careful consideration of individual financial situations.

Loan Duration and Interest Rates

Loan duration, often expressed in months or years, dictates the length of time you have to repay the loan. A shorter loan term reduces the time your lender carries the loan balance, which typically leads to a higher interest rate. Conversely, a longer loan term increases the time the lender carries the balance, often resulting in a lower interest rate but higher total interest paid. This inverse relationship is a key factor in determining the overall cost of borrowing.

Impact of Loan Terms on Monthly Payments

Loan terms directly influence the monthly payment amount. Longer loan terms result in lower monthly payments, as the same loan amount is spread over a more extended period. Conversely, shorter loan terms increase monthly payments because the loan amount is repaid more quickly. This is a critical factor to consider when evaluating your budget and repayment capacity.

Impact of Loan Terms on Total Cost of Loan

While a longer loan term might have lower monthly payments, it dramatically increases the total cost of the loan due to accumulated interest over the extended period. A shorter loan term, with higher monthly payments, results in a lower total cost of interest paid over the life of the loan. This difference is essential to calculate the true cost of borrowing.

Loan Term Impact on Interest Rates – Example Table

| Loan Term (Months) | Estimated Interest Rate (%) | Monthly Payment (Example: $10,000 Loan) | Total Interest Paid |

|---|---|---|---|

| 24 | 7.5% | $480 | $750 |

| 36 | 6.8% | $330 | $1,200 |

| 48 | 6.2% | $250 | $1,800 |

Note: The table above provides illustrative examples. Actual interest rates and monthly payments will vary based on individual credit scores, loan amounts, and market conditions.

Strategies for Obtaining Lower Interest Rates

Securing a favorable interest rate on a used car loan is crucial for minimizing the overall cost of the purchase. Understanding the factors influencing rates and implementing effective strategies can significantly impact the final loan terms. Proactive measures, such as improving credit scores and negotiating terms, are key to securing a lower interest rate.

Improving Credit Scores

A strong credit score is a powerful tool for securing lower interest rates. Creditworthiness is a primary factor lenders consider when evaluating loan applications. Building and maintaining a good credit history involves responsible credit management.

- Paying bills on time: Consistently meeting payment deadlines demonstrates responsible financial habits, a key element in maintaining a healthy credit score. Late payments negatively impact credit scores and increase the likelihood of higher interest rates.

- Managing credit utilization: Keeping credit card balances low relative to credit limits demonstrates responsible use of available credit. High credit utilization ratios can significantly lower credit scores.

- Monitoring credit reports: Regularly checking credit reports for inaccuracies is crucial. Identifying and correcting errors can positively impact the credit score. This helps avoid any potential miscalculations that may negatively affect creditworthiness.

- Diversifying credit history: Maintaining a mix of credit accounts, such as credit cards and loans, can contribute to a balanced credit history and potentially improve credit scores.

Negotiating Interest Rates

Negotiating interest rates with lenders can yield significant savings. Effective negotiation requires a proactive approach and a clear understanding of the market rates.

- Researching market rates: Thoroughly researching current used car loan interest rates allows for informed comparisons and strengthens negotiation leverage. Comparing rates across different lenders is vital for identifying the best possible terms.

- Understanding lender policies: Familiarizing oneself with lender policies regarding interest rate adjustments can provide insight into potential negotiation strategies. This understanding helps in tailoring negotiation approaches based on specific lender practices.

- Presenting a strong case: Highlighting positive financial aspects, such as a substantial down payment or a long credit history, can position the borrower favorably during negotiations. Demonstrating financial stability and commitment to repayment can increase the likelihood of securing a lower interest rate.

- Comparing offers: Carefully comparing interest rates, fees, and other terms from multiple lenders before making a final decision is essential. This allows for a comprehensive evaluation and helps ensure the most favorable terms are secured.

Utilizing Co-Signers or Larger Down Payments

Co-signers and larger down payments can improve loan terms. These strategies often result in better interest rates.

- Co-signers: A co-signer with a strong credit history can provide a safety net for lenders. Their creditworthiness strengthens the borrower’s application, potentially leading to a lower interest rate.

- Down Payments: A larger down payment demonstrates financial commitment and reduces the loan amount. This reduction often translates to a lower interest rate.

Illustrative Examples of Used Car Interest Rates

Understanding used car interest rates is crucial for making informed financial decisions. Interest rates vary significantly based on numerous factors, including credit score, loan term, and the lender itself. This section provides illustrative examples to help visualize the potential costs associated with financing a used car purchase.

Illustrative Used Car Loan Scenarios

Different credit scores and loan terms will result in varying interest rates and monthly payments. These examples highlight the impact of these factors.

| Scenario | Credit Score | Loan Amount | Loan Term (months) | Interest Rate | Monthly Payment | Total Interest Paid |

|---|---|---|---|---|---|---|

| High Credit Score | 750+ | $15,000 | 60 | 4.5% | $280.00 | $1,800 |

| Moderate Credit Score | 680-749 | $15,000 | 60 | 6.0% | $295.00 | $2,100 |

| Low Credit Score | 600-679 | $15,000 | 60 | 9.5% | $350.00 | $4,500 |

| High Credit Score, Longer Term | 750+ | $15,000 | 72 | 4.8% | $250.00 | $2,880 |

Calculating Total Cost of Borrowing

Calculating the total cost of borrowing involves more than just the monthly payment. It’s essential to understand the total interest paid over the life of the loan.

Total interest paid = (Monthly Payment * Number of Months) – Loan Amount

For example, in the “Low Credit Score” scenario above, the total interest paid ($4,500) is significantly higher than in the “High Credit Score” scenario ($1,800). This difference highlights the crucial role of creditworthiness in managing loan costs.

Important Considerations

These are just illustrative examples. Actual interest rates will vary based on factors like the specific lender, the used car’s condition, and any additional fees. Always review the loan terms carefully before making a final decision.

Understanding Used Car Loan Repayment Options

Choosing the right repayment option for your used car loan is crucial for minimizing the overall cost and ensuring financial stability. Understanding the different types of repayment schedules available, and their associated pros and cons, empowers you to make an informed decision. Different repayment options can significantly impact the total interest paid over the life of the loan.

Understanding these options allows you to compare and contrast their impact on your budget and overall financial health. This empowers you to select the repayment method that best aligns with your financial goals and circumstances.

Fixed-Rate Repayment Options

Fixed-rate loans offer a consistent monthly payment throughout the loan term. This predictability is a significant advantage, as it allows for easier budgeting and financial planning. Knowing the exact amount of each payment simplifies managing your finances. The fixed interest rate remains constant for the entire loan duration.

Variable-Rate Repayment Options

Variable-rate loans feature interest rates that fluctuate based on prevailing market conditions. This can lead to either lower or higher monthly payments over time. While potentially offering lower initial rates, variable rates can expose borrowers to risk if interest rates rise substantially during the loan term. This variability can make budgeting more challenging.

Key Differences Between Repayment Options

| Feature | Fixed-Rate | Variable-Rate |

|---|---|---|

| Interest Rate | Fixed for the loan term | Adjustable based on market conditions |

| Monthly Payments | Consistent throughout the loan term | Potentially fluctuating throughout the loan term |

| Budgeting | Easier due to consistent payments | More challenging due to potential payment changes |

| Risk | Lower risk of unexpected payment increases | Higher risk of unexpected payment increases |

| Potential Cost | Can have a higher overall cost due to a fixed rate | Can have a lower or higher overall cost depending on market fluctuations |

Impact on the Overall Cost of the Loan

The choice of repayment option significantly influences the total cost of the loan. A fixed-rate loan, while offering predictable payments, may result in a slightly higher overall interest expense compared to a variable-rate loan if interest rates remain low throughout the loan term. Conversely, if interest rates increase substantially during the loan term, a variable-rate loan could lead to a significantly higher overall cost.