Loan Qualification Factors

Securing a 60-month used car loan hinges on a lender’s thorough assessment of your financial standing. This evaluation considers various factors to determine your creditworthiness and ability to repay the loan. Lenders employ a systematic approach, carefully weighing different aspects to minimize risk while ensuring a fair and equitable loan process.

Key Factors in Loan Assessment

Lenders meticulously scrutinize several factors to gauge your ability to repay a 60-month used car loan. These factors are designed to balance the risk of loan default with the opportunity to provide financing. A comprehensive understanding of these factors empowers borrowers to prepare a strong application.

Credit Score

A strong credit score is a critical factor in loan approval. Lenders use credit scores to assess your credit history and repayment track record. A higher credit score typically translates to a lower interest rate and greater likelihood of loan approval. For example, a borrower with a credit score above 700 might qualify for a lower interest rate than someone with a score below 660. This difference in rates can significantly impact the total cost of the loan over the 60-month period.

Debt-to-Income Ratio (DTI)

The debt-to-income ratio (DTI) is a crucial indicator of your financial obligations relative to your income. Lenders calculate your DTI by dividing your monthly debt payments by your gross monthly income. A lower DTI signifies a greater ability to manage debt, making you a less risky borrower. For instance, a DTI of 35% might be considered favorable compared to a DTI of 50%, indicating a more manageable debt burden. This factor helps lenders evaluate your overall financial health and your capacity to handle the added expense of a loan.

Down Payment

A down payment, a portion of the car’s price paid upfront, demonstrates your commitment to the purchase. A larger down payment can lower the loan amount, reducing the lender’s risk. For example, a 20% down payment could potentially result in a lower interest rate and a more favorable loan structure. The down payment amount is a crucial element in assessing the borrower’s financial preparedness.

Loan Documentation

Lenders require specific documentation to support your loan application. This process ensures the accuracy of your financial information and verifies your ability to repay the loan.

| Factor | Description | Importance |

|---|---|---|

| Credit Score | Measures credit history and repayment track record. | Higher scores generally lead to better loan terms. |

| Debt-to-Income Ratio (DTI) | Compares monthly debt payments to gross monthly income. | Lower DTIs indicate a greater ability to manage debt. |

| Down Payment | Portion of the car’s price paid upfront. | A larger down payment reduces loan amount and risk. |

| Documentation | Includes income verification, credit reports, and other financial records. | Validates the accuracy of your financial information. |

Interest Rates and Fees

Securing a 60-month used car loan hinges on understanding the interplay of interest rates and associated fees. These factors significantly impact the overall cost of borrowing and the affordability of the vehicle. Navigating these elements is crucial for making an informed decision and avoiding potential financial pitfalls.

Typical Interest Rate Ranges

Interest rates for 60-month used car loans vary widely, influenced primarily by the borrower’s creditworthiness and prevailing market conditions. Generally, rates fall within a spectrum, with lower rates typically accessible to borrowers with excellent credit scores. Historically, rates have fluctuated based on economic trends and central bank policies.

Influence of Creditworthiness and Market Conditions

Creditworthiness plays a pivotal role in determining interest rates. Borrowers with strong credit histories, evidenced by high credit scores, often qualify for lower interest rates. This is because lenders perceive them as possessing a lower risk of default. Conversely, borrowers with less-than-ideal credit scores might face higher rates. Market conditions, including overall economic health and prevailing interest rates on other types of loans, also influence the rates offered for car loans. During periods of high inflation, for instance, interest rates tend to rise across the board.

Common Loan Fees

Beyond the interest rate, various fees can add to the total cost of a used car loan. Understanding these fees is vital for accurately assessing the true cost of borrowing. Common fees include origination fees, which are charged at the loan’s inception, and prepayment penalties, which might be imposed if the loan is paid off before the agreed-upon term. These fees, while sometimes seemingly minor, can add up significantly, potentially increasing the overall borrowing cost.

Interest Rate Scenarios by Credit Score and Loan Amount

| Credit Score | Loan Amount ($) | Estimated Interest Rate (%) | Total Interest Paid ($) |

|---|---|---|---|

| 700-750 | $10,000 | 5.5% – 7.0% | $1,200 – $1,600 |

| 750-800 | $15,000 | 4.8% – 6.5% | $1,500 – $2,000 |

| 800+ | $20,000 | 4.0% – 5.5% | $1,000 – $1,500 |

Note: These are illustrative examples and actual interest rates may vary depending on individual circumstances and market conditions. Factors such as loan terms, vehicle make and model, and the lender’s policies can all influence the final rate.

Loan Repayment Strategies

Choosing the right loan repayment strategy is crucial for managing your finances and minimizing the overall cost of your 60-month used car loan. Understanding the different options available, their associated risks and benefits, and the impact of amortization will help you make an informed decision.

Different repayment strategies offer varying levels of predictability and control over your monthly payments. This section will delve into the common types of loan repayment plans, highlighting their advantages and disadvantages, and the significance of amortization schedules in managing your loan obligations.

Fixed-Rate Repayment

Fixed-rate loans offer a predictable monthly payment throughout the loan term. The interest rate remains constant, making budgeting easier. This predictability is attractive to borrowers who prefer consistent financial planning. However, fixed-rate loans may not always offer the lowest possible interest rate compared to variable-rate options, particularly in fluctuating economic conditions.

Variable-Rate Repayment

Variable-rate loans feature an interest rate that adjusts based on prevailing market conditions. This can lead to lower initial interest rates, potentially saving you money in the short term. However, the fluctuating nature of variable rates introduces an element of risk. Your monthly payments could increase if market interest rates rise, making budgeting more challenging.

Amortization

Amortization is the process of gradually paying off a loan through regular installments. Each payment portion goes toward both principal and interest. Early in the loan term, a larger portion of each payment goes towards interest, while a larger portion of each payment goes towards principal as the loan progresses. Understanding amortization allows you to track the principal reduction and anticipate the timeline for loan repayment. Amortization schedules are typically presented in tables or graphs that visually depict how the loan balance decreases over time.

Amortization schedules illustrate how loan payments are allocated between principal and interest. As the loan progresses, the principal portion of the payment increases while the interest portion decreases.

Monthly Payment Examples

The following table illustrates the impact of different loan amounts and interest rates on monthly payments for a 60-month loan. These examples are based on a simplified model and may not reflect the exact figures provided by a specific lender.

| Loan Amount | Interest Rate (Annual) | Monthly Payment |

|---|---|---|

| $10,000 | 5% | $200.00 |

| $15,000 | 5% | $299.50 |

| $10,000 | 7% | $208.00 |

| $15,000 | 7% | $311.00 |

Shopping for the Best Deal

Securing the most favorable terms for your 60-month used car loan requires a proactive approach to comparison shopping. Understanding the process of comparing loan offers and knowing what to look for in loan documents are crucial steps in achieving the best possible deal. Thorough research and careful consideration of various factors will ultimately lead to a loan that meets your financial needs and budget.

A critical aspect of obtaining a good loan is understanding the loan terms offered by different lenders. Comparing offers involves evaluating factors beyond just the interest rate, encompassing fees and repayment strategies. This detailed comparison process ensures you’re not just getting a good rate, but a comprehensive and cost-effective loan package.

Comparing Loan Offers from Different Lenders

Comparing loan offers from multiple lenders is essential to securing the best possible terms. Each lender may have unique criteria for loan approval, interest rates, and fees. This competitive landscape necessitates a thorough comparison to identify the most favorable offer.

- Begin by gathering information from various lenders. This might involve visiting their websites, contacting them directly, or using online loan comparison tools. These resources allow you to quickly compare loan terms from different financial institutions, such as banks, credit unions, and online lenders.

- Carefully review each lender’s loan terms. Key aspects to consider include the annual percentage rate (APR), loan fees, and repayment schedule. APR reflects the total cost of borrowing, factoring in interest and fees. Fees can include origination fees, application fees, and prepayment penalties.

- Understand the lender’s loan qualification criteria. Each lender sets its own eligibility requirements for loan applications. These criteria may include credit score, debt-to-income ratio, and the amount of the loan. Thorough understanding of these criteria is crucial in determining whether a particular lender is the right fit.

Information to Look for in Loan Documents

Loan documents contain crucial information about the loan terms and conditions. Thorough review of these documents is vital to understanding the entire cost and commitment of the loan.

- Annual Percentage Rate (APR): The APR reflects the total cost of borrowing, including interest and fees. It’s a critical factor in comparing different loan offers. A lower APR typically means a more affordable loan.

- Loan Fees: Scrutinize all fees associated with the loan, including origination fees, application fees, and prepayment penalties. These fees can significantly impact the overall cost of the loan.

- Loan Repayment Schedule: The repayment schedule Artikels the terms of your loan, including the monthly payment amount, the loan duration, and the total repayment amount. Understanding the repayment schedule helps you budget and plan for loan repayments.

- Prepayment Penalties: If a lender charges a prepayment penalty, it means that paying off the loan early may result in additional charges. Always inquire about potential prepayment penalties before finalizing the loan.

Importance of Shopping Around

Shopping around for the most favorable terms is crucial for obtaining the best possible loan for your needs. By comparing multiple offers, you can identify the lender offering the most favorable terms in terms of interest rate, fees, and repayment options.

- Comparison shopping ensures you’re not accepting the first offer you receive. This proactive approach enables you to find the best deal tailored to your financial situation.

- By comparing offers from various lenders, you can save money on interest and fees. This translates to a more affordable monthly payment and a lower total loan cost.

Factors to Consider When Comparing Loan Offers

A comprehensive comparison involves considering multiple factors beyond the interest rate.

| Factor | Description |

|---|---|

| Interest Rate | The percentage charged on the loan amount. |

| APR | Annual Percentage Rate, representing the total cost of borrowing. |

| Loan Fees | All fees associated with the loan application, processing, and origination. |

| Loan Term | The duration of the loan, typically measured in months or years. |

| Repayment Schedule | The monthly payment amount and the total repayment amount. |

| Loan Qualification Criteria | The lender’s eligibility requirements for loan approval. |

| Prepayment Penalties | Potential penalties for paying off the loan early. |

Understanding the Loan Agreement

Navigating a used car loan agreement can feel daunting, but understanding its key terms is crucial for a smooth and responsible borrowing experience. Thorough comprehension of the loan’s stipulations, including potential consequences of default, is essential to making informed financial decisions. This section delves into the core elements of a 60-month used car loan agreement, outlining the rights and responsibilities of both the borrower and the lender.

A well-structured loan agreement clearly Artikels the terms and conditions of the loan, protecting both the lender and the borrower. This transparency helps manage expectations and prevents misunderstandings. A borrower should thoroughly review every aspect of the agreement before signing, seeking clarification on any unclear points.

Key Terms in a Used Car Loan Agreement

A used car loan agreement contains numerous crucial terms, each impacting the borrower’s financial obligations. Understanding these terms is paramount for responsible financial management. The following are some key elements:

- Loan Amount: This specifies the total sum of money borrowed. It directly affects the monthly payment amount and total interest paid.

- Interest Rate: This is the percentage charged on the loan amount. Different interest rates will lead to different monthly payments and total loan costs. Higher interest rates generally mean higher monthly payments and more total interest paid over the life of the loan.

- Loan Term: The duration of the loan, expressed in months or years, dictates the length of the repayment period and the overall cost of borrowing. A longer loan term results in lower monthly payments but more total interest paid.

- Monthly Payment: This is the fixed amount the borrower must pay each month to repay the loan. It’s calculated based on the loan amount, interest rate, and loan term.

- Late Payment Fee: This is a penalty charged if a payment is made after the due date. Understanding this fee is critical for managing financial obligations.

- Prepayment Penalty: Some loans may charge a penalty if the borrower pays off the loan before the agreed-upon term. Knowing if a prepayment penalty exists is vital for financial planning.

- Security: If the loan is secured, it typically means the borrower pledges an asset (like the car) as collateral. This protects the lender if the borrower defaults.

- Default Clause: This clause Artikels the lender’s recourse if the borrower fails to meet their payment obligations. This can include repossession of the car, further charges, and negative impact on credit score.

Implications of Defaulting on a Loan

Defaulting on a used car loan has serious consequences. Failure to meet payment obligations can lead to significant financial hardship and damage to creditworthiness.

- Repossession: The lender may repossess the vehicle, effectively taking it back from the borrower. This leaves the borrower with no car and can lead to additional fees.

- Negative Impact on Credit Score: Defaulting on a loan significantly harms a borrower’s credit score, making it more challenging to secure future loans or credit lines.

- Legal Action: In cases of severe default, the lender may pursue legal action to recover the outstanding balance. This can lead to court appearances and further financial burdens.

- Collection Activities: Debt collection agencies may be involved to pursue the outstanding balance. This can include phone calls, letters, and potentially lawsuits.

Rights and Responsibilities of Borrower and Lender

A balanced loan agreement defines the rights and responsibilities of both the borrower and the lender. Understanding these ensures both parties adhere to the agreement.

- Borrower’s Rights: Borrowers have the right to receive clear information about the loan terms, including interest rates, fees, and repayment schedules. They have the right to understand the implications of default.

- Borrower’s Responsibilities: Borrowers are responsible for making timely payments, adhering to the terms of the agreement, and understanding their financial obligations.

- Lender’s Rights: Lenders have the right to collect payments as agreed upon and take action in the event of default, as Artikeld in the agreement.

- Lender’s Responsibilities: Lenders are responsible for providing accurate and complete information regarding the loan terms and maintaining transparency throughout the loan process.

Summary of Key Clauses in a Typical Loan Agreement

| Clause | Description |

|---|---|

| Loan Amount | The total amount borrowed. |

| Interest Rate | The percentage charged on the loan. |

| Loan Term | The duration of the loan. |

| Monthly Payment | The fixed amount due each month. |

| Late Payment Fee | Penalty for payments made after the due date. |

| Prepayment Penalty | Penalty for paying off the loan early. |

| Default Clause | Specifies the lender’s recourse if the borrower defaults. |

| Security | Describes collateral, if any, securing the loan. |

Potential Pitfalls

Navigating a 60-month used car loan can be straightforward, but hidden pitfalls can lead to financial strain. Understanding these potential challenges and proactive measures to avoid them is crucial for a smooth borrowing experience. Careful consideration of the loan terms and conditions, and responsible repayment practices are essential for success.

Common Loan Pitfalls

Unforeseen circumstances, such as job loss or unexpected medical expenses, can make loan repayments difficult. A detailed understanding of the loan terms, including interest rates, fees, and repayment schedules, can help borrowers prepare for potential challenges. Failing to carefully review the agreement before signing can result in unfavorable conditions.

Importance of Understanding Terms and Conditions

Thorough review of the loan agreement is paramount. Loan documents Artikel specific repayment terms, including the principal amount, interest rate, and any associated fees. Understanding these terms allows borrowers to anticipate potential costs and manage their finances accordingly. For example, hidden fees, prepayment penalties, or balloon payments can significantly impact the overall cost of the loan.

Consequences of Late Payments or Default

Late payments can trigger escalating penalties, including interest charges and late fees. These fees can quickly accumulate, increasing the total cost of the loan and making repayment even more challenging. Defaulting on a loan can have severe consequences, impacting credit scores and potentially leading to legal action. Failing to meet repayment obligations can result in negative consequences for future borrowing opportunities.

Examples of Scams and Fraudulent Activities

Fraudulent schemes targeting car loan borrowers are prevalent. Borrowers should be wary of unsolicited loan offers, especially those promising exceptionally low interest rates. Scrutinizing the legitimacy of lenders and loan offers is vital to avoid scams. Phishing emails or websites mimicking legitimate loan providers can steal personal information, such as Social Security numbers or bank account details. Verification of the lender’s legitimacy is critical to avoid financial losses. Beware of websites or individuals claiming to offer loans with extremely low interest rates or quick approvals, as these could be fraudulent schemes.

Alternatives to 60-Month Loans

Choosing a 60-month loan for a used car isn’t the only option. Understanding alternatives can help you make a more informed financial decision, potentially saving you money and reducing your monthly burden. Factors like your credit score, budget, and the specific vehicle you’re considering all play a crucial role in determining the best loan term.

Alternative loan options for used cars can significantly impact your monthly payments and total interest paid. Different terms, from shorter-term loans to leasing, present various trade-offs. Careful consideration of these options allows you to tailor your financing strategy to your specific needs and circumstances.

Shorter-Term Loans

Shorter-term loans, typically ranging from 24 to 36 months, offer a quicker path to vehicle ownership. They often come with lower total interest costs over the loan period, but monthly payments are generally higher compared to a 60-month loan. This is because the total amount of interest is spread across fewer months.

Example: A $20,000 used car loan with a 6% interest rate can have a monthly payment of $400 over 60 months, while the same loan over 36 months would likely have a monthly payment around $600. The total interest paid over 36 months would be considerably less than the total interest paid over 60 months.

This approach is beneficial for individuals who prioritize faster debt repayment and lower overall interest costs. The trade-off is higher monthly payments.

Leasing

Leasing allows you to use a vehicle for a specified period (typically 24 to 60 months) without owning it. Instead of paying off the entire vehicle’s value, you make monthly lease payments covering the vehicle’s depreciation and usage over the lease term. At the end of the lease, you typically return the vehicle.

Monthly lease payments are often lower than monthly loan payments for a comparable vehicle, but leasing generally involves a higher upfront cost (e.g., down payment or security deposit). This is often combined with mileage limitations, which can affect your costs.

Leasing might be a suitable option if you prefer lower monthly payments and don’t intend to keep the vehicle for the long term.

Comparison Table

| Feature | 60-Month Loan | 36-Month Loan | Lease |

|---|---|---|---|

| Monthly Payment | Lower | Higher | Potentially Lower |

| Total Interest Paid | Higher | Lower | Depends on the lease terms; often lower than 60-month loan but higher than 36-month loan |

| Ownership | You own the vehicle after the loan is paid off | You own the vehicle after the loan is paid off | You do not own the vehicle; it is returned at the end of the lease |

| Mileage Restrictions | None | None | Usually exists |

| Upfront Costs | Typically lower | Typically lower | Typically higher |

This table provides a general overview of the key differences between these loan types. Your individual circumstances will determine the best option.

Illustrative Examples

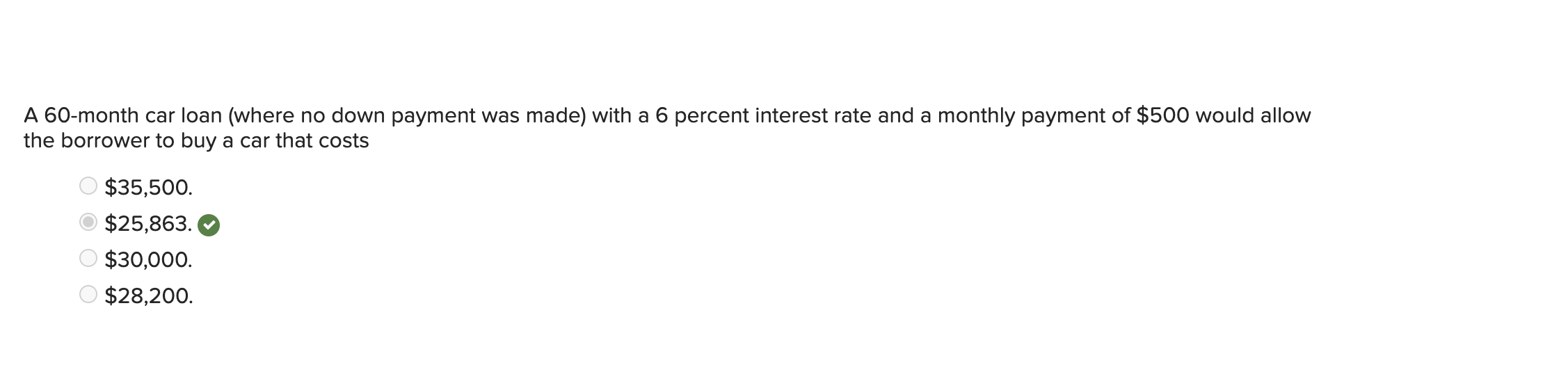

Understanding the financial implications of a 60-month used car loan requires concrete examples. This section provides practical scenarios to illustrate loan amounts, interest rates, repayment schedules, and the impact of credit scores on loan terms. We will also explore the total cost of a 60-month loan and compare it to alternative financing options.

Example 1: A Typical 60-Month Used Car Loan

This example demonstrates a typical 60-month used car loan scenario. Understanding the loan’s components, including the loan amount, interest rate, and repayment schedule, is crucial for informed decision-making.

- Loan Amount: $20,000

- Interest Rate: 6.5% APR

- Loan Term: 60 months

- Monthly Payment: Approximately $400

This represents a common scenario for a used car loan. Note that the exact monthly payment will vary based on specific lender terms and fees.

Example 2: Impact of Credit Score on Loan Terms

Credit scores significantly influence loan approval and interest rates. A higher credit score typically leads to better loan terms.

- Credit Score (Example 1): 750

- Interest Rate (Example 1): 6.5% APR

- Credit Score (Example 2): 650

- Interest Rate (Example 2): 8.0% APR

The difference in credit scores results in a noticeable increase in the interest rate. This higher rate translates into a substantially higher total cost of the loan over the 60-month period.

Example 3: Total Cost Comparison

This example Artikels the total cost of a 60-month loan and compares it to other loan options. Comparing the total cost of a loan with various loan terms, interest rates, and repayment strategies is essential for informed decision-making.

| Loan Option | Interest Rate | Total Cost |

|---|---|---|

| 60-Month Loan (Example 1) | 6.5% APR | $2,600 |

| 60-Month Loan (Example 2) | 8.0% APR | $3,200 |

| 36-Month Loan (Alternative) | 7.5% APR | $2,100 |

A 36-month loan, although potentially requiring a higher monthly payment, reduces the total cost compared to the 60-month loan with a higher interest rate. The total cost includes not only interest but also potential fees associated with the loan.