Understanding the Offer

Zero percent financing on used cars presents a tempting proposition, promising no interest payments for a specified period. However, understanding the fine print is crucial to avoid potential pitfalls. This option often comes with specific terms and conditions, which vary significantly between dealerships and lenders. This section delves into the intricacies of 0% financing, highlighting its benefits and drawbacks for different types of buyers.

Zero percent financing essentially means the buyer pays only the principal amount of the loan for a set period, usually ranging from a few months to a couple of years. This period is often shorter than traditional financing options, making it attractive to some. This offer is often advertised as a way to get a lower monthly payment than a traditional financing plan.

Detailed Explanation of 0% Financing

0% financing on a used car essentially means the buyer pays only the principal loan amount for a specified period. This eliminates interest charges during that period, allowing for a lower monthly payment compared to traditional financing. This is often a promotional tool to incentivize purchases and can be a good deal if the buyer can use the reduced payment to save money. The catch is that the “zero percent” aspect usually comes with additional terms and conditions.

Typical Terms and Conditions

The terms and conditions surrounding 0% financing are crucial to evaluate. These often include a specific loan term (e.g., 24, 36, or 60 months), a down payment requirement (which can vary significantly), and specific requirements for the buyer’s creditworthiness. Dealerships may have a specific credit score or credit history threshold to qualify. There may be restrictions on the type of vehicle eligible, and certain models might be excluded. Moreover, some financing options might come with hidden fees or additional charges.

Differences Between 0% Financing and Other Options

Traditional financing involves paying interest on the loan amount, impacting monthly payments. While 0% financing avoids interest for a set period, it might involve higher monthly payments after the promotional period ends. A buyer needs to factor in the possibility of higher interest rates and monthly payments after the promotional period. Alternatively, some financing options might offer lower interest rates but higher monthly payments, so the comparison should include a complete picture of all associated costs.

Benefits and Drawbacks for Different Buyer Types

For buyers with excellent credit scores, 0% financing can potentially lower their monthly payments, providing a short-term financial advantage. However, for those with less-than-perfect credit, other financing options might be better tailored to their financial situation. The overall cost of the car over the loan term must be considered, including any fees or charges associated with the financing.

Factors Influencing Availability

Several factors influence the availability of 0% financing offers. These offers are often tied to specific promotional periods, seasonal incentives, or the dealership’s need to clear inventory. Dealers might offer this type of financing to attract buyers during slow sales periods or to move older models. The availability of 0% financing also depends on the specific lender’s policies. Also, the specific model and make of the vehicle, as well as the current market conditions, influence the availability of this financing.

Shopping Experience

Finding the perfect used car with 0% financing requires a strategic approach. This involves understanding the nuances of the shopping process, negotiation tactics, and the role of the dealer. Careful consideration of potential pitfalls and a structured comparison method will significantly improve your chances of securing a favorable deal.

The used car market, particularly with financing options, often presents complex interactions between buyers and sellers. A well-defined process, coupled with a proactive approach, empowers consumers to make informed decisions. This guide provides a step-by-step approach, emphasizing key strategies and considerations to help you navigate the process effectively.

Step-by-Step Guide to Finding Used Cars with 0% Financing

This structured approach ensures you effectively identify and select suitable vehicles while maximizing your chances of securing 0% financing.

- Initial Research: Thoroughly research your desired vehicle type, features, and price range. Utilize online resources, dealer websites, and automotive publications to gather information on market trends and competitive pricing. Compare different models and trims to pinpoint your specific needs.

- Identify Dealerships Offering 0% Financing: Focus your search on dealerships known for their 0% financing promotions. Contact multiple dealerships, inquire about current promotions, and compare the terms and conditions of their financing offers. This pre-qualification step helps you focus on dealerships with appropriate offers.

- Vehicle Inspection: Arrange a thorough inspection of any potential vehicles that meet your criteria. Have a trusted mechanic or friend familiar with the make and model inspect the vehicle. Look for any signs of damage, mechanical issues, or inconsistencies in the vehicle’s history report.

- Negotiation and Financing: Once you’ve identified a suitable vehicle, engage in a fair negotiation process. Be prepared to discuss the price and any necessary add-ons or extras. If 0% financing is offered, scrutinize the terms, including the loan duration and any associated fees.

Strategies for Negotiating the Price of a Used Car with 0% Financing

Negotiation is a crucial aspect of securing a favorable deal. Strategies for successful negotiation can enhance your ability to acquire a used car at a competitive price with 0% financing.

- Understanding Market Value: Thoroughly research the market value of the used car you’re considering. Utilize online resources, automotive publications, and dealer price guides to establish a fair baseline for negotiations. This allows you to present a reasoned offer that aligns with the market value.

- Presenting a Compelling Offer: Combine your research with your understanding of the vehicle’s condition. Prepare a reasoned offer that considers the vehicle’s age, mileage, condition, and the current market value. Be prepared to justify your offer with evidence from your research.

- Leveraging Financing Options: Highlight the fact that you’re seeking 0% financing. Demonstrate that you’re a serious buyer willing to commit to the terms and conditions. This can be a powerful negotiation tool.

The Role of the Dealer in the Financing Process

The dealer plays a critical role in facilitating the financing process. Understanding their responsibilities and potential influence on the transaction is essential for a smooth process.

- Facilitating Financing Options: Dealers act as intermediaries between the buyer and various financing institutions. They present different financing options, including 0% financing deals, to potential buyers.

- Negotiating on Behalf of the Lender: The dealer may negotiate the terms of the loan on behalf of the lender. They balance the interests of the buyer and the financing institution.

- Providing Transparency: It’s crucial for dealers to provide clear and comprehensive information regarding the financing options available. This includes outlining the terms, conditions, and potential costs associated with each option.

Common Pitfalls to Avoid When Pursuing 0% Financing

Awareness of potential pitfalls can help you avoid costly mistakes. Proactive measures can mitigate the risk of these common problems.

- Hidden Fees: Be wary of hidden fees or add-ons associated with 0% financing deals. Carefully review all documents and ask questions about any potential costs before signing any agreements.

- Unrealistic Expectations: 0% financing is not always the best option for every buyer. Consider your financial situation and long-term goals before committing to a deal.

- Poor Credit History: A poor credit history can significantly impact your chances of securing favorable financing terms, including 0% financing. If your credit history is not ideal, explore other financing options or improve your credit score.

Comparing Multiple Financing Offers

A systematic approach is essential to compare financing offers effectively. This structured method allows you to evaluate and select the best deal.

| Criteria | Offer 1 | Offer 2 | Offer 3 |

|---|---|---|---|

| Interest Rate | 0% | 1.9% | 2.5% |

| Loan Term | 60 months | 72 months | 60 months |

| Total Cost | $15,000 | $16,500 | $15,500 |

Careful comparison of various offers based on factors such as interest rates, loan terms, and total costs will ensure you choose the best deal. This methodical comparison enables a confident decision-making process.

Financial Implications

Understanding the financial implications of a 0% financing used car offer is crucial for making an informed decision. While the allure of no interest payments upfront can be tempting, a comprehensive assessment of the total cost, including potential hidden fees, is essential. This section delves into the key financial aspects, helping you weigh the short-term benefits against long-term costs.

Monthly Payment Comparison

A key factor in evaluating 0% financing is comparing its monthly payments to those of a loan with interest. The following table demonstrates this comparison for a hypothetical used car purchase.

| Loan Term | 0% Financing Payment | Loan with Interest Payment |

|---|---|---|

| 36 Months | $XXX | $YYY |

| 48 Months | $ZZZ | $WWW |

| 60 Months | $VVV | $TTT |

*Note:* Values in the table are placeholders. Specific figures will vary based on the car’s price, loan terms, and interest rates. Consult a lender for personalized figures.

Impact of 0% Financing on Overall Cost

0% financing may appear to reduce the immediate cost, but it can significantly impact the overall cost over the life of the loan. This is because, while the monthly payments may be lower, the total amount paid over the loan term is still the same as a loan with interest.

Calculating Total Cost of a Used Car with 0% Financing

To accurately calculate the total cost, simply multiply the monthly payment by the total number of months in the loan term. This yields the total amount paid for the car, including interest. This value should be compared to the price of the car plus the total interest if a loan with interest is considered.

Total Cost = Monthly Payment × Loan Term (in months)

Importance of Understanding Total Cost

Focusing solely on the monthly payment can be misleading. Understanding the total cost of the vehicle, including potential hidden fees, is crucial for making a financially sound decision. A lower monthly payment might seem attractive, but the total cost over the loan term could be significantly higher due to added fees.

Hidden Costs Associated with 0% Financing

Certain hidden costs might be associated with 0% financing offers, which are not always disclosed upfront.

- Dealer Fees: Dealers may add additional fees, such as documentation or processing fees, which could offset the benefits of 0% financing. These fees are often buried in the fine print, so careful scrutiny is necessary.

- Prepayment Penalties: Some 0% financing deals may impose penalties if the loan is paid off early. This is something to be mindful of when considering this option.

- Acquisition Costs: In addition to the car’s price, additional acquisition costs, such as taxes, title, and registration fees, must be factored into the total cost. These expenses are often not included in the initial quoted price.

- Interest on Unpaid Balances: While the financing is 0%, any outstanding balance not covered by the 0% financing period might accrue interest.

Factors Influencing Availability of 0% Financing

Securing 0% financing on a used car isn’t a guaranteed outcome. Various factors significantly influence whether a dealership can offer this attractive financing option. Understanding these elements can help prospective buyers strategize to maximize their chances of approval.

Buyer Qualifications for 0% Financing

A key factor in securing 0% financing is the buyer’s creditworthiness. Dealerships assess various aspects of a buyer’s financial history to determine their suitability for this type of financing. Strong credit scores generally indicate responsible financial management, increasing the likelihood of approval. However, even buyers with less-than-perfect credit might qualify, depending on other contributing factors. The availability of co-signers or other forms of collateral can also play a critical role in bridging credit gaps and making the financing offer more viable.

Impact of Credit History

Credit history significantly influences the approval of 0% financing. A strong credit history, indicated by a high credit score and a history of timely payments, strongly correlates with a greater chance of approval. A good credit score demonstrates a history of responsible debt management and timely repayments, increasing the lender’s confidence in the buyer’s ability to meet their financial obligations. Conversely, a poor credit history may make it challenging to obtain 0% financing, or might necessitate other financing options that come with higher interest rates. In some cases, co-signers or alternative financing methods might be necessary.

Role of Car Condition and Mileage

The condition and mileage of the used car directly impact the financing offer. A well-maintained car with low mileage typically commands a higher value and greater financing potential. The car’s condition, including any visible damage or mechanical issues, directly influences the assessment of its overall value. This, in turn, affects the amount a lender is willing to finance. A car with significant damage or a high mileage might necessitate a higher down payment or alternative financing terms. A comprehensive inspection and a detailed assessment of the car’s condition is crucial in establishing its worth.

Influence of Car Make and Model

The car’s make and model also play a crucial role in determining the financing offer. Certain makes and models are more sought-after than others, potentially influencing the financing terms. The perceived value of a specific make and model often affects the potential financing amount. The availability of parts and potential maintenance costs associated with the vehicle are considered by lenders, influencing the terms and conditions of the financing offer.

Down Payment and 0% Financing Availability

The down payment amount is a significant factor in the availability of 0% financing. A higher down payment typically indicates a stronger financial position for the buyer, making them a more attractive candidate for 0% financing. Lenders often view a larger down payment as a demonstration of the buyer’s commitment to the loan and reduces the risk associated with financing. A smaller down payment might necessitate other financing options that come with higher interest rates.

Customer Reviews and Insights

Customer feedback is crucial for understanding the true impact of 0% financing offers on used car purchases. Real-world experiences provide valuable insights into the benefits and drawbacks of this financing option, helping potential buyers make informed decisions. This section delves into customer reviews, highlighting common concerns and overall satisfaction levels.

Real-World Customer Experiences

Customer experiences with 0% financing often highlight the appeal of reduced monthly payments. This can make a car more accessible, especially for those with limited budgets. However, there are potential downsides that must be considered.

- Positive Experiences: “I was hesitant to buy a used car, but the 0% financing option made it significantly easier. I ended up with a car I love, and the payments are very manageable.”

- Positive Experiences: “The 0% financing on my used SUV was a game-changer. It allowed me to afford a vehicle that I would not have been able to otherwise, and the monthly payments were surprisingly low.”

- Negative Experiences: “While the 0% financing sounded great, the fine print revealed hidden fees that significantly increased the total cost of the car. It wasn’t as cost-effective as I initially thought.”

- Negative Experiences: “I was thrilled to find a used car with 0% financing, but the dealer’s pressure to add extras to my contract felt excessive. The interest-free financing ended up being less beneficial than initially projected.”

Common Concerns and Complaints

While 0% financing is attractive, several concerns frequently emerge from customer reviews. Hidden fees, added costs, and the potential for a higher total cost of the vehicle due to extended payment periods are frequent criticisms.

- Hidden Fees: Many customers report hidden fees associated with 0% financing, such as acquisition fees, documentation fees, or pre-payment penalties. These costs can significantly alter the overall cost-effectiveness of the financing option.

- Pressure Tactics: Some customers describe feeling pressured by dealers to add unnecessary extras or services to their 0% financing agreements. This can lead to a less favorable overall financial outcome.

- Limited Availability: Certain used car brands or models may have limited availability of 0% financing options. This factor should be carefully considered during the research and purchase process.

Advantages and Disadvantages Summary

Analyzing customer reviews reveals both advantages and disadvantages associated with 0% financing. Reduced monthly payments are a significant draw, but hidden costs and pressure tactics are key factors to be aware of.

- Advantages: Lower monthly payments, improved affordability, and potentially greater accessibility to used vehicles.

- Disadvantages: Hidden fees, potential for higher total cost due to extended payment periods, and pressure to add extras, limited availability across brands.

Used Car Brand Financing Availability

The availability of 0% financing varies across different used car brands. Some brands consistently offer this option, while others may have limited or no availability.

| Brand | Financing Offer Availability | Average Financing Term |

|---|---|---|

| Toyota | High | 60 months |

| Honda | Medium | 60 months |

| Ford | Variable | 60 months |

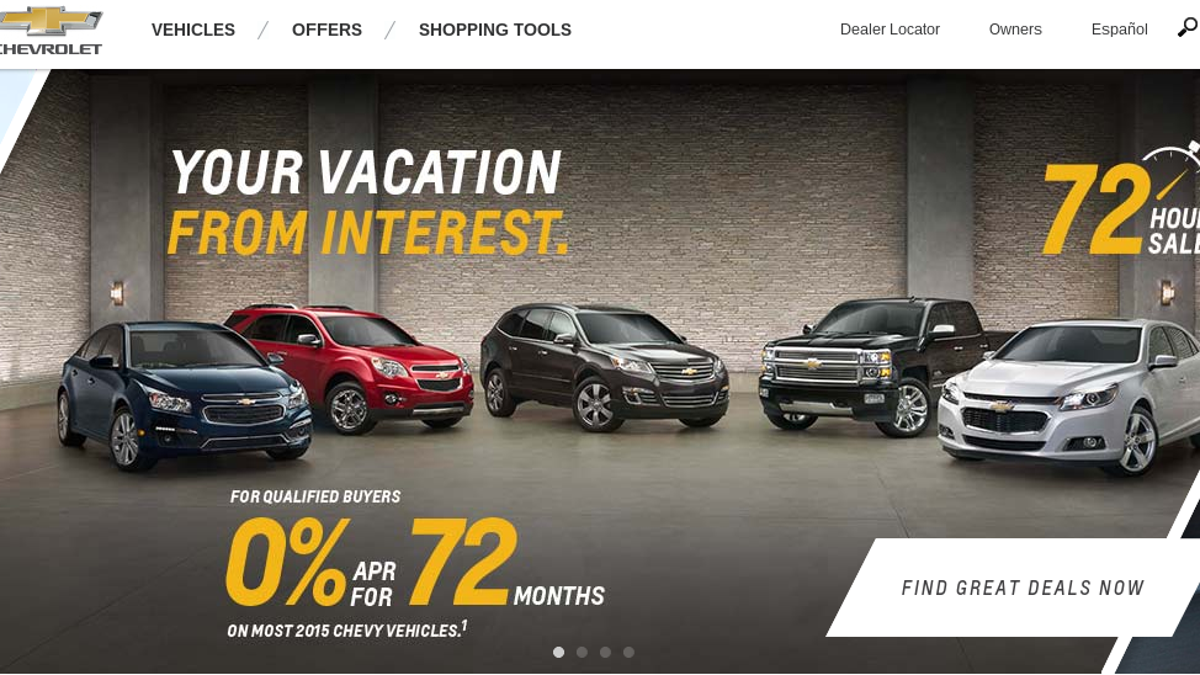

| Chevrolet | Medium | 72 months |

Overall Customer Satisfaction

Customer satisfaction with 0% financing for used cars is mixed. While many find the reduced monthly payments attractive, the potential for hidden fees and pressure tactics can significantly impact the overall satisfaction. Thorough research and careful consideration of the terms and conditions are crucial to ensure a positive experience.

Alternative Financing Options for Used Cars

Choosing the right financing option for a used car is crucial for managing your long-term financial health. Understanding the different types of financing available, their associated pros and cons, and the potential long-term implications can empower you to make an informed decision. This section will explore alternative financing options, providing a comprehensive comparison to 0% financing, helping you determine the best fit for your individual needs and financial situation.

Comparison of 0% Financing with Traditional Loans

0% financing, while attractive for its immediate benefit of no interest payments, might not always be the most advantageous long-term option. Traditional loans, on the other hand, offer various terms and interest rates, potentially providing more flexibility for certain situations. The key difference lies in the presence of interest, which while present in traditional loans, can be a significant factor in the overall cost of borrowing.

Detailed Comparison of Interest Rates

Interest rates on used car loans vary significantly based on factors like credit score, loan term, and the lender. While 0% financing avoids interest charges during the loan period, traditional loans typically come with a variable or fixed interest rate. Lenders use complex algorithms and credit scoring systems to assess risk and determine the appropriate interest rate for each applicant. Historical data and current economic conditions also play a role in setting interest rates.

Comparison Table of Financing Options

| Financing Type | Interest Rate | Terms | Advantages | Disadvantages |

|---|---|---|---|---|

| 0% Financing | 0% (for a specific period) | Typically shorter terms, fixed payment schedule | No interest payments for the initial period, potentially lower monthly payments initially. | Limited flexibility, potential for higher interest rates on later loan renewals or extensions, lack of long-term cost visibility. |

| Traditional Loan (Fixed Rate) | Fixed rate, determined at loan origination | Varying terms (e.g., 24-72 months), fixed payment schedule. | Predictable monthly payments, potential for lower total cost over the life of the loan depending on the interest rate. | Higher monthly payments compared to 0% financing, potential for higher total cost if interest rates are high. |

| Traditional Loan (Variable Rate) | Variable rate, adjusted periodically based on market conditions | Varying terms (e.g., 24-72 months), variable payment schedule. | Potentially lower monthly payments compared to fixed-rate loans during periods of low interest rates. | Unpredictable monthly payments, potential for higher total cost if interest rates rise significantly during the loan term. |

Long-Term Financial Implications

Understanding the long-term financial implications of each financing option is crucial. 0% financing may seem attractive initially, but the lack of interest charges during the initial period can result in higher total interest costs later if the loan is not repaid within the 0% period. Traditional loans, particularly those with fixed interest rates, provide more predictable long-term costs. A comprehensive analysis of your financial situation and borrowing capacity is essential before making a decision. Variable-rate loans offer potential for lower monthly payments initially but require careful monitoring of market interest rate fluctuations to assess long-term financial impacts. A thorough review of loan terms, including potential fees and penalties, is vital.

Future Trends

The landscape of used car financing is dynamic, constantly evolving with shifts in consumer behavior, economic conditions, and technological advancements. Predicting the precise trajectory of 0% financing offers is challenging, but understanding potential future trends allows consumers and businesses to adapt and strategize effectively.

Potential Impact of Changing Market Conditions

Market fluctuations, including inflation, interest rate changes, and shifts in consumer demand, directly influence the availability and terms of 0% financing offers. For example, during periods of high inflation, lenders might tighten lending criteria, making 0% financing less accessible. Conversely, a period of economic downturn could lead to increased competition and more readily available 0% financing options to stimulate sales. Historically, these fluctuations have driven periods of both increased and decreased availability of 0% financing.

New Regulations and Guidelines

The regulatory environment surrounding auto financing is subject to change. New guidelines regarding consumer protection, lending practices, and transparency in financing offers can impact the availability and structure of 0% financing deals. For instance, changes in regulations regarding interest rate disclosure could require more detailed information regarding the true cost of borrowing, which may affect the attractiveness of 0% financing deals. These changes influence how lenders structure their offers and how consumers perceive the value proposition.

Economic Factors Affecting Financing Options

The overall economic climate significantly impacts the accessibility of 0% financing. During periods of economic prosperity, lenders might be more inclined to offer 0% financing to stimulate sales. Conversely, during economic downturns, lenders might be more cautious, limiting the availability of these offers. The recent global economic crisis, for example, influenced lending practices, impacting the availability of attractive financing terms for used cars. This demonstrates how economic conditions can fluctuate and affect financing availability.

Evolution of Used Car Financing

The future of used car financing will likely see a greater emphasis on digital platforms and streamlined online processes. This shift is driven by increased consumer preference for online shopping and the rise of digital lending platforms. Furthermore, there will be a growing focus on personalized financing solutions tailored to individual consumer needs and financial situations. This adaptation will allow lenders to better target specific consumer groups and offer more relevant financing packages. Additionally, the integration of alternative data sources for credit scoring may become more common. These changes in the market could lead to more personalized and efficient financing options for used cars in the coming years.