Overview of Used Car Warranties

Used car warranties provide varying levels of protection against mechanical issues, offering peace of mind for buyers. Understanding the different types, terms, and influencing factors is crucial for making informed decisions. These warranties can significantly impact the cost and reliability of a used vehicle, especially if unexpected repairs arise.

Types of Used Car Warranties

Used car warranties come in several forms, each with unique coverage and conditions. These options include manufacturer warranties, extended warranties, and powertrain warranties. Understanding these variations is key to matching the appropriate protection with your needs and budget.

- Manufacturer Warranties: These warranties, often offered for a limited time after the original sale, are usually tied to the vehicle’s make and model. They cover specific components and issues. Conditions for coverage often include adhering to the manufacturer’s maintenance schedule and authorized repair shops. They are typically less expensive but offer narrower coverage.

- Extended Warranties: These warranties, purchased separately, extend the coverage beyond the original manufacturer’s warranty period. They provide added protection for a specified period or mileage. Terms often include specific exclusions, like pre-existing conditions or normal wear and tear. These warranties can cost significantly more than manufacturer warranties but offer broader coverage.

- Powertrain Warranties: A specific type of extended warranty, focusing solely on the vehicle’s engine, transmission, and other critical drivetrain components. They are popular for high-mileage vehicles or those with significant engine wear. These warranties often have a lower cost compared to comprehensive extended warranties, targeting a more focused part of the vehicle’s mechanics.

Terms and Conditions of Warranties

Understanding the terms and conditions of any warranty is essential. This ensures clarity about what is covered and what isn’t. Key factors include the duration of the warranty, the specific components covered, and the limitations or exclusions. For example, some warranties may not cover repairs due to accidents, neglect, or improper maintenance. It is crucial to carefully review the warranty document before purchase to avoid any future misunderstandings.

Factors Influencing Warranty Cost

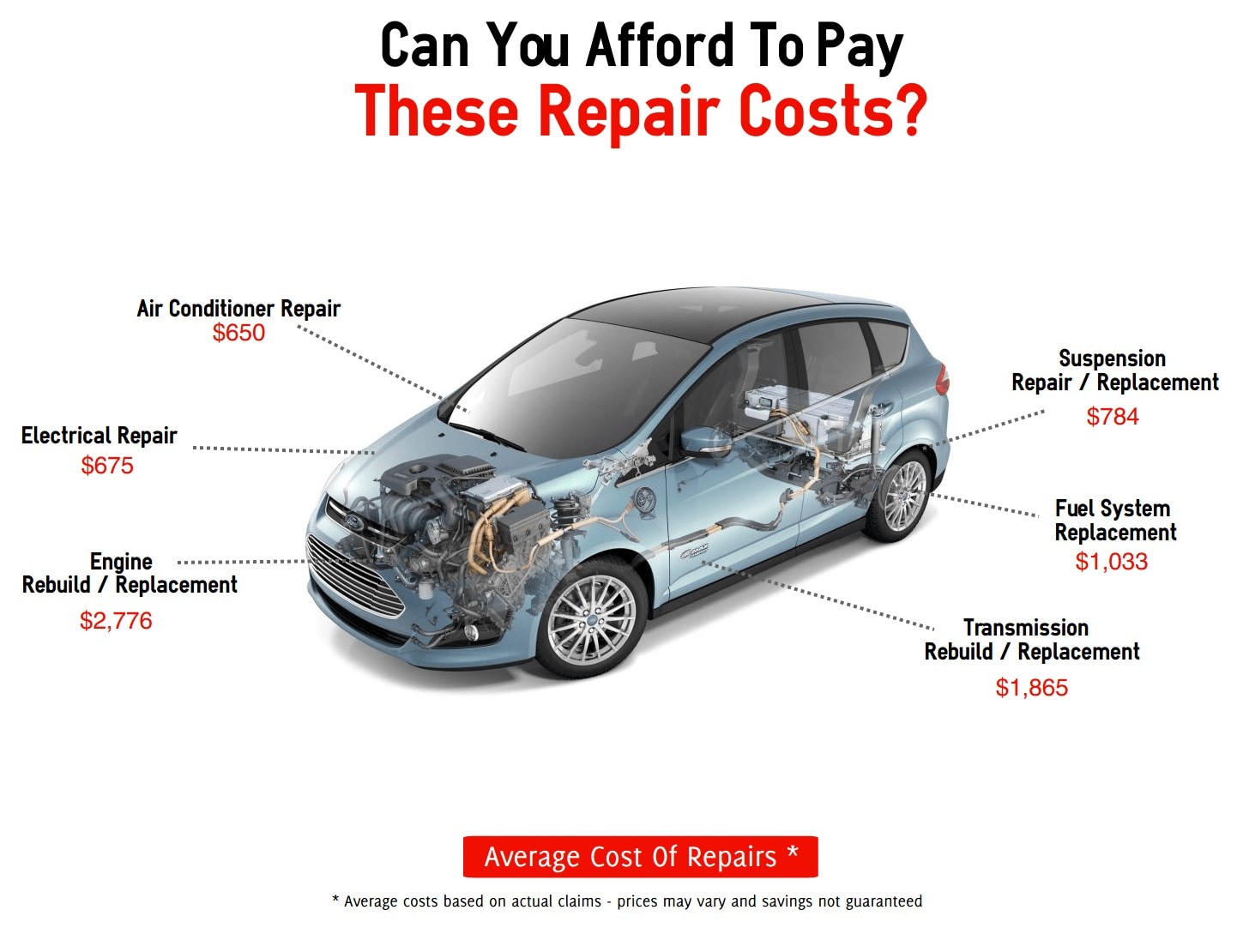

Several factors influence the cost of a used car warranty. Vehicle age, mileage, make/model, and the scope of coverage significantly impact the premium. For instance, older vehicles with high mileage tend to have higher warranty costs, as they are more prone to mechanical issues. Similarly, more complex or expensive vehicle models might come with higher-priced warranties.

Warranty Coverage and Cost Comparison

| Warranty Type | Coverage | Typical Cost |

|---|---|---|

| Manufacturer Warranty (Example: 3 years/36,000 miles) | Covers defects in materials and workmanship on specified components during the warranty period, usually limited to the original manufacturer’s specifications. | Typically minimal or included in the purchase price. |

| Extended Powertrain Warranty (Example: 5 years/100,000 miles) | Focuses on the vehicle’s engine, transmission, and related components. Excludes body parts and interior components. | $500 – $2,000+ (depending on vehicle age, mileage, and make/model). |

| Comprehensive Extended Warranty (Example: 2 years/50,000 miles) | Covers a wider range of vehicle components beyond the powertrain, including parts like the electrical system, suspension, and cooling system. | $1,000 – $3,000+ (depending on vehicle age, mileage, and make/model). |

Factors Affecting Warranty Costs

Used car warranties, while offering peace of mind, aren’t a one-size-fits-all proposition. The price of a warranty is influenced by a multitude of factors, making it crucial to understand these variables before committing to a policy. Understanding these factors allows consumers to make informed decisions and avoid overpaying for coverage.

Warranty costs are dynamic and depend on several variables, including the vehicle’s condition, its history, and the reputation of the provider. These variables influence the risk assessment undertaken by the warranty company, which, in turn, impacts the premium charged. Knowing these influences can empower you to negotiate favorable terms or even choose a more suitable coverage plan.

Vehicle Mileage Impact

High mileage often translates to a higher warranty cost. Vehicles with extensive mileage are more likely to require repairs and maintenance, increasing the risk for the warranty provider. This elevated risk is reflected in the premium, with higher mileage typically correlating to a greater cost for the same coverage. Warranty providers analyze the wear and tear associated with increased mileage to calculate the potential future repair costs.

Vehicle Age Impact

Older vehicles typically have higher warranty costs than newer ones. This is primarily due to the increased likelihood of mechanical failures in older models. The age of a vehicle is a critical factor as parts degrade over time. Predicting the need for future repairs becomes more complex with increasing age. The greater the age, the more likely components are to require replacement, leading to a higher premium.

Make and Model Influence

Different car makes and models have varying repair costs. Some brands are known for specific mechanical vulnerabilities or high-cost maintenance. This translates to different warranty premiums for similar coverage levels. For example, a warranty for a known problematic model will likely cost more than a warranty for a model renowned for its reliability. Understanding the reputation of a specific make and model is critical in determining the potential cost of a warranty.

Warranty Provider Reputation

The reputation of the warranty provider significantly impacts the pricing. Providers with a history of fair claims handling and prompt service are often perceived as trustworthy. This reliability often results in more affordable premiums, while those with a reputation for less favorable practices might have higher prices. Consumers should research the warranty provider’s track record to ensure they are choosing a reputable and trustworthy company.

Mileage and Cost Relationship (Example)

| Mileage (in miles) | Estimated Warranty Cost (USD) |

|---|---|

| 20,000 | $500 |

| 50,000 | $750 |

| 80,000 | $1,000 |

| 100,000 | $1,250 |

| 150,000 | $1,500 |

This table provides a simplified example for a specific car model, showcasing how mileage can affect the estimated warranty cost. Actual costs may vary based on several factors, including the specific model, the type of warranty, and the provider.

Comparing Warranty Providers

Navigating the landscape of used car warranties can be challenging. Different providers employ various pricing strategies and offer varying levels of coverage. Understanding these nuances is crucial for making an informed decision and securing the best possible protection for your vehicle.

Comparing warranty providers goes beyond simply looking at price. It requires careful analysis of coverage details, exclusions, and the reputation of the provider. A comprehensive evaluation considers not only the initial cost but also the potential long-term benefits and the support available should a claim arise.

Pricing Strategies of Warranty Providers

Warranty providers often employ diverse pricing models. Some use a fixed price per component, while others base their costs on the vehicle’s age, mileage, or make and model. Others may offer tiered plans with increasing coverage at progressively higher prices. Understanding the rationale behind these different pricing structures is vital for aligning the cost with the desired level of protection.

Coverage and Exclusions

The scope of coverage significantly influences the warranty’s value. Some providers offer comprehensive protection encompassing a wide range of mechanical components, while others may have specific exclusions for certain parts or conditions. Understanding the specifics of coverage and exclusions is paramount to determining the appropriate level of warranty for a particular vehicle. A thorough review of the fine print is crucial to avoid surprises later.

Customer Service Reputation

Customer service plays a vital role in the warranty experience. Providers with a strong reputation for responsiveness, efficiency, and helpfulness are more likely to offer a positive experience when claims arise. Reviews and testimonials from previous customers can provide valuable insights into the quality of service offered by different providers.

Comparison of Warranty Providers

| Provider Name | Coverage Highlights | Customer Reviews |

|---|---|---|

| Example Provider 1 | Comprehensive coverage for major engine components, transmission, and electrical systems. Generally high customer satisfaction ratings. Offers flexible claim processes. | Positive reviews highlighting efficient claim handling and fair settlement amounts. |

| Example Provider 2 | Strong coverage for powertrain components, but with specific exclusions for wear-and-tear items. Pricing tends to be competitive. | Mixed reviews; some customers report difficulties with claims processing, while others praise the competitive pricing. |

| Example Provider 3 | Focuses on preventative maintenance and routine repairs. Provides a broader range of coverage than some competitors, but with more specific exclusions for pre-existing conditions. | High ratings for clear terms and conditions. Customers frequently praise the straightforward claim process. |

Careful consideration of the factors Artikeld above allows for a well-informed decision on the most suitable used car warranty for your needs.

Cost Breakdown of a Warranty

Understanding the components of a used car warranty cost is crucial for making informed decisions. Knowing exactly what’s included and the potential hidden fees can help you avoid unpleasant surprises down the road. This transparency allows you to compare different warranty options and select the one that best fits your needs and budget.

The total cost of a used car warranty isn’t simply a fixed price. It’s a combination of factors that can vary significantly based on the vehicle’s make, model, age, mileage, and the specific coverage offered. Understanding these components is key to evaluating the value of any warranty package.

Components of Warranty Costs

A used car warranty cost isn’t a single figure; it’s a collection of expenses that add up to the total price. These costs can include upfront premiums, administrative fees, and potentially, ongoing maintenance charges depending on the specific warranty package. Understanding each element is essential for evaluating the overall value of the warranty.

Upfront Premium

This is the primary cost and typically the most significant component of a used car warranty. It represents the initial payment made to the warranty provider. The premium amount is often determined by the vehicle’s age, mileage, and the extent of coverage provided. Examples include coverage for specific parts, repair types, and the duration of the warranty. Higher premiums generally indicate more comprehensive coverage, potentially including repairs for more complex or expensive components.

Administrative Fees

These fees cover the administrative costs associated with processing the warranty claim. They might include handling charges, processing fees, or administrative overhead costs incurred by the warranty provider. Examples of such costs include paperwork, claims investigation, and the overall management of the warranty contract.

Potential Deductibles

Some warranties may require a deductible to be paid by the customer. This deductible is the amount the customer is responsible for paying towards a covered repair before the warranty provider steps in. For example, a warranty with a $100 deductible would require the customer to pay the first $100 of a covered repair, while the warranty provider covers the remaining costs. This is an important factor to consider, as it can significantly impact the overall cost of repairs.

Hidden Fees and Additional Charges

Be aware that additional charges might be included, which aren’t always explicitly stated. These can include, but aren’t limited to, a “processing fee,” “admin fee,” “claims handling fee,” or “reimbursement delay fee.” It is essential to review the fine print carefully to understand the total cost and ensure transparency. These fees can sometimes be substantial, adding up to a significant amount over the life of the warranty.

Warranty Cost Breakdown Table

| Cost Component | Description | Estimated Cost |

|---|---|---|

| Upfront Premium | Initial payment for the warranty | $200 – $1,500+ (varies greatly by vehicle and coverage) |

| Administrative Fees | Processing, handling, and claims management | $25 – $100 (variable) |

| Deductibles | Customer’s responsibility before warranty coverage applies | $50 – $500+ (varies) |

| Hidden Fees | Potential additional charges not explicitly stated | Variable (review fine print carefully) |

Negotiating Warranty Costs

Securing the best possible price for a used car warranty involves strategic negotiation. Understanding the factors influencing warranty costs and the tactics employed by both buyers and sellers is crucial to achieving a favorable agreement. Successful negotiation often hinges on a combination of preparation, assertiveness, and compromise.

Effective negotiation requires a deep understanding of the market value of the warranty, the seller’s motivations, and your own financial position. This knowledge empowers you to make informed decisions and advocate for your interests. Ultimately, a well-executed negotiation strategy can save you significant money.

Strategies for Negotiating Warranty Prices

Negotiation strategies often involve presenting a counter-offer, based on thorough research and a realistic understanding of the warranty’s worth. This approach involves understanding the market value of the warranty and presenting a fair counter-offer, demonstrating your understanding of the warranty’s value. Flexibility and compromise are often necessary to reach a mutually acceptable agreement.

Common Negotiation Tactics

A variety of negotiation tactics can be employed to secure a better deal on a used car warranty. These tactics are often employed by skilled negotiators and are effective in achieving favorable outcomes.

- Highlighting comparable warranties. Researching similar warranties offered by other providers is crucial. This allows you to present a competitive price point based on industry standards. Comparing the coverage and terms of similar warranties available from different providers provides valuable leverage in negotiations.

- Leveraging market research. A thorough analysis of current market rates for similar warranties is crucial. This analysis allows you to determine a fair price range and present a well-reasoned counter-offer to the seller. A well-researched understanding of current market values gives you a stronger position in negotiations.

- Emphasizing the warranty’s value proposition. Highlighting the benefits and value of the warranty, such as extended coverage, specific repair protections, and roadside assistance, strengthens your position during negotiations. Focus on the tangible advantages of the warranty and how it protects the buyer.

- Presenting a counter-offer. Instead of simply accepting the seller’s initial offer, consider presenting a counter-offer based on your research and understanding of the warranty’s value. This demonstrates your willingness to negotiate and allows for a more balanced agreement.

- Acknowledging the seller’s position. Acknowledging the seller’s perspective and concerns, while still advocating for your interests, fosters a more productive negotiation environment. A respectful approach often leads to more positive outcomes.

Tips for Getting the Best Possible Deal

Implementing these tips enhances the likelihood of securing a favorable deal during negotiations.

- Be prepared with research. Thorough research into the market value of the warranty is essential. Gather information on similar warranties and their associated costs to support your counter-offers.

- Be assertive, but polite. Express your needs and concerns clearly and confidently, while maintaining a respectful and professional demeanor. This balance is key to effective negotiation.

- Be flexible. Compromise and flexibility are vital in reaching a mutually beneficial agreement. Be willing to adjust your position to accommodate the seller’s needs, within reason.

- Document everything. Record all discussions, offers, and agreements in writing. This creates a clear record of the negotiation process and protects both parties.

Step-by-Step Guide for Negotiating a Warranty

This structured approach helps streamline the negotiation process and increases the likelihood of a successful outcome.

- Research the market value. Thoroughly research the current market value for similar warranties. This crucial step provides a foundation for negotiation.

- Identify your budget. Establish a realistic budget for the warranty cost. This will guide your negotiation strategy.

- Prepare a counter-offer. Based on your research and budget, formulate a counter-offer that reflects a fair price for the warranty.

- Communicate clearly and respectfully. Articulate your concerns and needs, while maintaining a respectful and professional demeanor.

- Be prepared to walk away. If the negotiation does not reach a mutually agreeable point, be prepared to walk away from the deal. This demonstrates your resolve and strengthens your position.

Understanding Warranty Exclusions

Used car warranties, while offering peace of mind, don’t cover everything. Understanding the exclusions is crucial to avoid disappointment and unexpected repair costs. A thorough review of the fine print is essential before purchasing a warranty, as hidden exclusions can significantly impact the value of the protection.

Knowing what’s excluded allows you to make informed decisions and better prepare for potential repair expenses. This section delves into common exclusions, helping you anticipate potential pitfalls and navigate the complexities of used car warranty contracts.

Common Exclusions in Used Car Warranties

Understanding the specifics of what’s not covered in a used car warranty is paramount to avoiding surprises. Knowing these exclusions upfront allows for a more realistic assessment of the warranty’s value.

- Wear and Tear: Many warranties exclude normal wear and tear. This includes items like brakes, tires, and suspension components that degrade over time due to usage. For instance, if your brakes need replacement after several years of driving, the warranty likely won’t cover the cost.

- Damage from Accidents or Misuse: Accidents, vandalism, or misuse, including improper maintenance or neglect, are often excluded. If the car sustains damage from an accident after the warranty purchase, repairs are typically not covered.

- Modifications or Alterations: Any modifications or alterations to the vehicle after the purchase date, or prior to the warranty’s effective date, can invalidate the warranty. This could include aftermarket parts or custom modifications that affect the original design of the vehicle.

- Routine Maintenance: Routine maintenance items, like oil changes, tire rotations, and filter replacements, are generally not covered by a warranty, unless explicitly stated otherwise.

- Problems Related to Pre-existing Conditions: Problems already present in the vehicle before the warranty was purchased, such as a pre-existing mechanical issue, are typically not covered. Thoroughly inspecting the vehicle before purchasing a warranty is vital in identifying any such issues.

- Damage from Environmental Factors: Damage caused by weather conditions, such as flood or hail, or other environmental factors, are often excluded. If a car is damaged by an unexpected flood event, the warranty likely will not cover the repairs.

Importance of Reviewing the Fine Print

The fine print of a used car warranty often contains crucial details that can significantly impact your coverage. It’s not enough to just look at the summary; a careful examination of the terms and conditions is vital.

- Specific Exclusions: The fine print often details specific circumstances that fall outside the warranty’s scope. This might include mileage limits, specific components, or geographic restrictions.

- Exclusions for Specific Parts: Certain parts of the vehicle may be excluded from coverage, even if other parts are covered. Knowing what components are excluded is important to avoid any misinterpretations.

- Limitations on Repairs: The fine print may Artikel limitations on the number of repairs or the total amount of expenses covered by the warranty. Understanding these limitations helps to avoid surprises when claiming repairs.

Examples of Situations Where a Warranty Might Not Cover Repairs

The following examples illustrate scenarios where a warranty might not cover repairs.

- Neglect: If a vehicle owner fails to perform regular maintenance, such as oil changes, and a related component malfunctions, the warranty may not cover the repair.

- Accidental Damage: If a vehicle is involved in an accident after the warranty purchase, the repairs for the damage caused by the accident may not be covered by the warranty.

- Modifications: If aftermarket parts are installed on the vehicle after the warranty was purchased, the warranty may not cover any damage or malfunction related to those aftermarket parts.

Common Warranty Exclusions Table

This table provides a concise overview of common warranty exclusions.

| Exclusion Category | Example |

|---|---|

| Wear and Tear | Tires, brakes, suspension components |

| Accidents/Misuse | Damage from accidents, vandalism, or neglect |

| Modifications | Aftermarket parts, custom modifications |

| Routine Maintenance | Oil changes, tire rotations, filter replacements |

| Pre-existing Conditions | Problems present before the warranty purchase |

| Environmental Damage | Damage from floods, hail, or other weather events |

Warranty Claims Process

Navigating the process of filing a warranty claim can sometimes feel daunting. Understanding the steps involved, the necessary documentation, and the typical timeframe for resolution can significantly ease the process. This section details the claim procedure, empowering you to make informed decisions when seeking warranty coverage.

Filing a Warranty Claim

The warranty claim process typically involves a series of steps designed to efficiently assess the validity of the claim and facilitate a prompt resolution. Each provider will have its own specific procedures, so it’s crucial to carefully review the warranty details. Contacting the warranty provider directly is usually the first step, and the claim form is often available online.

Necessary Documentation

Adequate documentation is critical to a successful warranty claim. Without proper evidence, the claim may be rejected or delayed. Commonly required documents include:

- A copy of the original purchase agreement or sales contract for the used vehicle.

- Proof of the date of purchase.

- A detailed description of the vehicle malfunction or issue.

- Photos or videos of the damaged part or the malfunctioning system. These visual aids provide a concrete record of the problem.

- Copies of any repair invoices related to the issue, if applicable.

- A copy of the warranty policy document.

- A completed warranty claim form.

Typical Timeframe for Claim Resolution

The timeframe for resolving a warranty claim varies depending on the complexity of the issue, the warranty provider’s workload, and the availability of parts. Some providers may offer estimated timelines in their policy documents, which are helpful in managing expectations. Keep in mind that delays can sometimes occur due to unforeseen circumstances or the need for additional investigations. However, most providers strive to resolve claims as quickly as possible, often within a few weeks.

Steps in the Claim Process (Flowchart)

| Step | Description |

|---|---|

| 1. Contact Warranty Provider | Initiate the claim process by contacting the warranty provider. This usually involves using a designated phone number, email address, or online portal. |

| 2. Provide Required Documentation | Submit the necessary documentation, including proof of purchase, the warranty policy, and a detailed description of the issue. Visual evidence like photos and videos is highly recommended. |

| 3. Claim Assessment | The warranty provider reviews the claim, ensuring all required information is present and the issue falls under the warranty coverage. |

| 4. Repair or Replacement Decision | Based on the assessment, the provider determines if the repair or replacement is covered under the warranty terms. |

| 5. Repair or Replacement | If approved, the provider arranges for the repair or replacement of the faulty component or system. |

| 6. Claim Closure | Once the repair or replacement is completed, the provider closes the claim, confirming the resolution and any remaining obligations. |