Overview of the Tax Credit

The used electric vehicle (EV) tax credit provides a financial incentive to encourage the adoption of environmentally friendly transportation. This credit, aimed at boosting the market for pre-owned EVs, is designed to make these vehicles more accessible and competitive with their gasoline-powered counterparts. Understanding the eligibility criteria and types of vehicles covered is crucial for maximizing the benefit of this credit.

Eligibility Criteria for the Credit

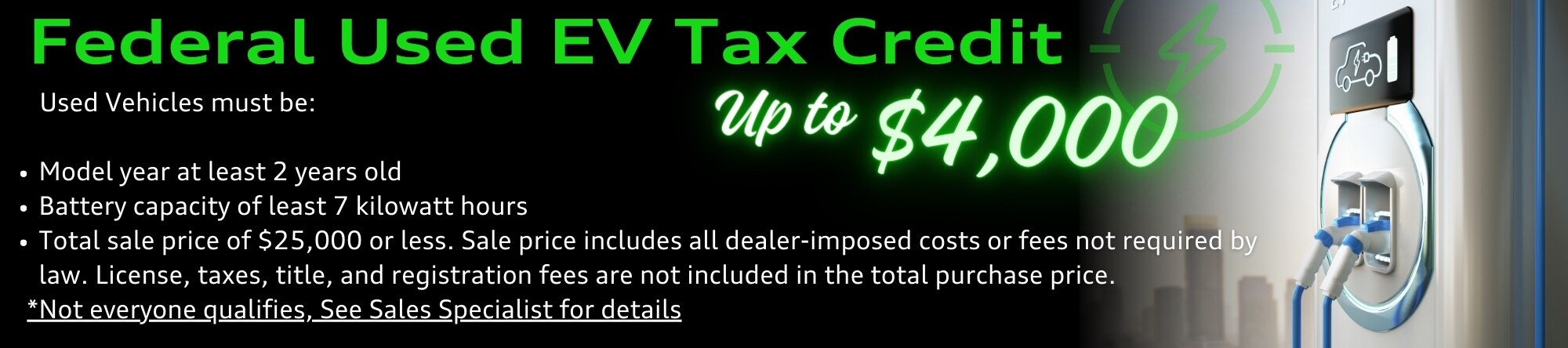

The tax credit’s eligibility criteria are designed to target specific vehicles and owners, ensuring the credit effectively stimulates the market for used EVs. The specific requirements are vital for accurately assessing the potential benefits.

- Vehicle Age and Model Year: The vehicle must meet specific age and model year requirements. This ensures the credit is targeted toward newer, more efficient EV models. For example, vehicles manufactured after a specific year, such as 2017, might qualify. Older models, or those outside the eligible timeframe, may not be eligible.

- Vehicle Origin and Ownership: The vehicle must meet specific requirements regarding its origin (e.g., domestically manufactured) and the ownership history of the vehicle. This is crucial to verify the vehicle’s compliance with the tax credit guidelines.

- Buyer Requirements: Certain criteria must be met by the buyer, such as residency or income level. The buyer might be required to demonstrate their eligibility through documentation. This ensures the credit reaches the intended demographic.

Types of Electric Vehicles (EVs) that Qualify

The credit encompasses a wide range of EV models, promoting broader adoption across different types of electric vehicles. This ensures that the tax credit effectively targets a diverse selection of vehicles.

- Battery Electric Vehicles (BEVs): BEVs are fully electric vehicles that rely solely on batteries for propulsion. These vehicles often offer higher efficiency and lower emissions than gasoline-powered cars.

- Plug-in Hybrid Electric Vehicles (PHEVs): PHEVs use both an electric motor and a gasoline engine. While not solely electric, they offer the ability to travel some distance on electric power alone.

- Fuel Cell Electric Vehicles (FCEVs): FCEVs use hydrogen fuel cells to generate electricity. These vehicles have a different operating mechanism than BEVs or PHEVs.

Historical Context and Evolution of the Tax Credit

The EV tax credit has evolved over time to reflect changing market needs and environmental goals. Its historical development has influenced the current regulations.

The credit’s initial implementation focused on encouraging the early adoption of electric vehicles. Over time, the credit has been modified to address issues like battery technology advancements and the increasing demand for EVs.

Current Regulations and Guidelines for the Credit

The guidelines for claiming the EV tax credit are crucial for maximizing the benefit and avoiding potential issues. The precise regulations, which are constantly updated, should be reviewed regularly.

The Internal Revenue Service (IRS) provides official guidance and regulations regarding the credit. Taxpayers should refer to official IRS publications and resources for the most up-to-date information.

Calculating the Electric Vehicle Tax Credit Amount

The electric vehicle (EV) tax credit provides a financial incentive to encourage the adoption of EVs, making them more affordable for consumers. Calculating the credit amount involves several factors, and understanding these factors is crucial for prospective buyers. This section delves into the formulas, influencing factors, and practical implications for various vehicle models and ages.

The amount of the tax credit is determined by a complex interplay of factors, including the vehicle’s battery capacity, the manufacturer, and the vehicle’s price. The calculation isn’t straightforward, but the process can be broken down into several components, each contributing to the final credit value.

Credit Calculation Formulas

The precise formula for calculating the EV tax credit is subject to change. However, a core component involves the vehicle’s battery capacity and its impact on the overall price. Furthermore, manufacturers and the price of the vehicle play significant roles. A simplified representation of the calculation, though not the complete formula, is often helpful for general understanding.

Example: (Battery Capacity in kWh) * (Factor based on manufacturer) * (Price Adjustment Factor) = Credit Amount

This example is illustrative and not a complete representation of the formula. The actual calculation involves more intricate steps and considerations.

Factors Influencing Credit Amount

Several factors influence the maximum credit amount an individual can receive. These factors often interact, and their influence can vary depending on the specific vehicle.

- Battery Capacity: Higher battery capacity vehicles often receive larger credits. This reflects the increased cost and technological advancement associated with larger battery packs. For instance, a vehicle with a 100 kWh battery pack might receive a higher credit than one with a 60 kWh battery pack, other factors being equal.

- Vehicle Price: The price of the vehicle plays a significant role in determining the final credit amount. Credits are typically capped, and this cap is influenced by the sale price. A more expensive vehicle might receive a smaller credit, as the credit amount is usually a percentage of the price, not a fixed amount.

- Manufacturer: Some manufacturers may receive specific incentives or have different battery technology, leading to varying credit amounts for their vehicles. This difference in credits reflects the competitiveness of the market and the manufacturers’ role in technological advancement.

- Vehicle Age: The age of the vehicle can impact the eligibility for the tax credit. The credit is often designed to encourage the purchase of new or recently manufactured vehicles, reducing the credit amount or eliminating it for older vehicles.

Credit Amount Comparison Across Vehicle Models

The tax credit amount varies considerably across different EV models. Factors like battery capacity, vehicle price, and manufacturer influence the final credit amount. A direct comparison requires specific models, but a general trend is observable. For example, luxury EVs, while often having higher prices, may not necessarily receive a higher percentage of the credit, as the maximum credit amount can be capped.

Impact of Vehicle Age on the Credit

Vehicle age is a critical factor in determining the eligibility for the EV tax credit. Generally, the newer the vehicle, the higher the potential credit. Older vehicles may not qualify for any credit at all, or they might receive a reduced credit amount. This policy encourages the purchase of newer, more technologically advanced EVs.

Relationship Between Vehicle Price and Credit

The vehicle’s price has a direct correlation with the tax credit amount. A more expensive vehicle will often receive a smaller percentage of the credit compared to a less expensive vehicle. This is because the credit amount is often a percentage of the sale price, with maximum credit limits to prevent over-incentivizing higher-priced vehicles. For example, a vehicle priced at $50,000 might receive a smaller percentage credit than a vehicle priced at $30,000, even though both are eligible for the credit.

Applying for the Tax Credit

Securing the EV tax credit requires a structured application process. Understanding the steps, documentation, and deadlines is crucial for a smooth and successful claim. This section details the procedure for claiming the credit, ensuring compliance with the established guidelines.

Steps in Claiming the Tax Credit

The process for claiming the EV tax credit involves several key steps. Proper adherence to these procedures is vital to avoid delays or rejection of the claim.

- Gather Required Documentation: Before initiating the application, meticulously collect all necessary documents. This includes proof of vehicle purchase, manufacturer information, and potentially income documentation, depending on the specific requirements. Failure to provide the complete and correct documentation can lead to delays or rejection of the claim.

- Complete the Application Form: Thoroughly review the application form and accurately fill in all the requested information. This form typically requires details about the vehicle, purchaser, and purchase date. Mistakes or omissions in the application can result in delays or disqualification.

- Submit the Application: Once the application form and supporting documents are ready, submit the complete application to the designated authority. This can be done electronically or via mail, as specified by the guidelines. Adhering to the designated submission method is critical.

- Await Review and Approval: The designated authority will review the application and supporting documents to ensure compliance with the eligibility criteria. This process can take some time, depending on the workload and the completeness of the application. Regularly checking the status of the application is recommended.

- Receive Confirmation and Tax Credit: Upon successful review and approval, the applicant will receive confirmation of the approved tax credit amount. The tax credit will be reflected on subsequent tax returns, as specified in the guidelines.

Required Documentation

A comprehensive list of supporting documents is necessary for a successful application. These documents help verify the eligibility of the claim and ensure compliance with the guidelines.

- Proof of Vehicle Purchase: This typically includes a sales contract, invoice, or bill of sale that demonstrates the purchase of the qualifying electric vehicle.

- Manufacturer Information: Documentation from the manufacturer, such as a certificate of origin or a model year verification, is often needed. This confirms the vehicle’s eligibility under the tax credit guidelines.

- Income Documentation (if applicable): Depending on the specific requirements, income documentation might be necessary to demonstrate the applicant’s eligibility. This could include tax returns or other relevant financial records.

- Vehicle Identification Number (VIN): The VIN is essential for verifying the vehicle’s identity and eligibility. Providing an accurate VIN is vital for processing the application correctly.

Procedures for Filing the Claim

The filing procedures vary based on the applicable jurisdiction. A clear understanding of the designated procedures is essential to avoid potential errors.

- Online Submission: Many jurisdictions allow for online applications, offering convenience and potentially faster processing times. Ensure the online submission process is completed correctly.

- Mail Submission: In some cases, the application might need to be submitted via mail. Following the prescribed format and including all necessary documents is crucial for a successful mail submission.

- Contacting the Authority: If there are questions or uncertainties regarding the application process, contacting the designated authority is recommended for clarification. This ensures the application is completed correctly and efficiently.

Deadlines and Timeframes

Understanding the deadlines and timeframes for applying for the EV tax credit is crucial. Meeting these deadlines is essential to avoid potential penalties or ineligibility.

- Filing Deadlines: The deadline for filing tax returns often determines the deadline for claiming the EV tax credit. It is important to review the specific guidelines and deadlines set by the governing body.

- Processing Timeframes: The processing timeframe for applications can vary based on the volume of applications and the efficiency of the review process. Checking the status of the application regularly can help manage expectations.

Application Process Flowchart

[A flowchart illustrating the application process is not included in this text-based format.]

Impact on the Used Car Market

The introduction of an electric vehicle (EV) tax credit significantly impacts the used car market, altering sales patterns, pricing dynamics, and overall market equilibrium. This influence is particularly pronounced in the used EV segment, as the credit incentivizes buyers and potentially reshapes the market’s supply and demand.

The EV tax credit, while aimed at boosting new EV adoption, has a cascading effect on the used market. This effect stems from the interplay between buyer demand, seller incentives, and the inherent depreciation of EVs over time. The credit can influence the attractiveness of used EVs, potentially leading to shifts in pricing and market trends.

Influence on Used EV Sales

The EV tax credit directly affects used EV sales by making them more competitive with comparable used internal combustion engine (ICE) vehicles. Incentivized buyers may be more inclined to purchase a used EV due to the credit’s impact on the effective price. This can be particularly true if the credit reduces the perceived cost difference between a used EV and a used ICE vehicle.

Effect on Prices of Used EVs

The introduction of the EV tax credit can influence the prices of used EVs. If demand for used EVs increases significantly due to the credit, prices might rise. Conversely, if the supply of used EVs remains relatively constant or even increases, prices could experience downward pressure. Market forces, such as the overall availability of used EVs and consumer preferences, will also play a crucial role in determining the final price adjustments.

Comparison with the Used ICE Car Market

The used EV market reacts differently to the tax credit compared to the used ICE car market. The used ICE market is largely unaffected by the credit, unless the credit leads to a broader shift in consumer preferences towards EVs, which could indirectly influence the used ICE market. A significant increase in used EV sales might potentially lead to a decrease in used ICE car sales, depending on consumer preferences and the relative affordability of each option.

Effects on Market Supply and Demand for Used EVs

The tax credit directly impacts the supply and demand dynamics of the used EV market. Increased demand from buyers seeking the credit can outpace the supply, potentially leading to price increases. Conversely, a substantial increase in used EV supply due to new vehicle sales or other factors could exert downward pressure on prices. The equilibrium point between supply and demand is dynamic and influenced by factors such as the availability of used EVs and consumer preferences.

Data Points on Trends in Used EV Sales

Tracking used EV sales trends provides insights into the credit’s impact. Sales data, gathered over time, can show the correlation between the introduction of the EV tax credit and changes in used EV sales volume and price fluctuations. For example, if sales of used EVs increase substantially after the tax credit’s implementation, this would indicate a positive correlation.

Consumer Considerations

The electric vehicle (EV) tax credit for used cars presents both opportunities and challenges for consumers. Understanding the intricacies of this credit, alongside the factors influencing used EV pricing, is crucial for making informed purchasing decisions. This section delves into the benefits and drawbacks of the credit, providing guidance for maximizing its value and comparing it to other EV incentives.

Benefits of the Tax Credit

The primary benefit of the used EV tax credit is a reduction in the overall cost of the vehicle. This can be a significant incentive for consumers, especially those looking to purchase an EV for the first time. The credit can make EVs more accessible to a broader range of buyers, potentially stimulating demand for used electric vehicles. For example, a $4,000 credit on a $40,000 used EV significantly lowers the final price.

Drawbacks of the Tax Credit

The used EV tax credit is not without limitations. Strict eligibility criteria may exclude some potential buyers. Additionally, the availability of the credit can vary based on the manufacturer and model year. Furthermore, the credit’s impact on the used car market might lead to inflated prices or reduced market competitiveness for certain models.

Factors to Consider Before Purchasing a Used EV

Consumers should carefully evaluate several factors before purchasing a used EV. These include the vehicle’s age, mileage, condition, battery health, and remaining warranty. Independent inspections, particularly of the battery’s performance, are highly recommended. Additionally, the availability of parts and future maintenance costs should be considered. Understanding the potential long-term costs of ownership is critical.

Comparing the Tax Credit with Other Incentives

Several incentives exist for purchasing electric vehicles, such as state and local rebates, charging station subsidies, and potentially employer-sponsored programs. Consumers should compare the EV tax credit with these other incentives to determine the most advantageous approach. Evaluating the specific benefits of each incentive is crucial.

Maximizing the Value of the Tax Credit

To maximize the value of the used EV tax credit, consumers should ensure they meet all eligibility requirements. This includes carefully reviewing the specific guidelines for the credit, understanding the documentation needed for claiming it, and adhering to all applicable rules.

Table Comparing Used EV Models Based on Tax Credit

| Model | Year | Price | Estimated Credit |

|---|---|---|---|

| Model S | 2020 | $40,000 | $4,000 |

| Model 3 | 2021 | $30,000 | $3,000 |

| Bolt EV | 2019 | $20,000 | $2,000 |

Government and Industry Perspectives

The electric vehicle (EV) tax credit has sparked diverse responses from government agencies and industry stakeholders. Understanding these perspectives is crucial for evaluating the credit’s long-term impact and its role in accelerating the transition to sustainable transportation. The government’s rationale for the credit often involves environmental concerns, economic incentives, and technological advancements. Industry responses reflect varying degrees of enthusiasm and concern, highlighting the credit’s potential to reshape the automotive landscape.

Government Rationale for the Credit

The government’s primary rationale for implementing the EV tax credit often centers on environmental sustainability goals. Reducing carbon emissions and promoting cleaner transportation are key drivers. The credit also aims to stimulate economic growth by fostering innovation in the EV sector and creating jobs related to manufacturing, research, and development. Furthermore, the government may view the credit as a crucial step in national competitiveness, positioning the country as a leader in clean energy technology.

Industry Responses to the Credit

Industry responses to the EV tax credit are varied. Car manufacturers, often eager to capitalize on the growing demand for EVs, generally support the credit as a powerful incentive. Dealerships, however, might have mixed feelings, balancing the potential increase in sales with concerns about the complexities of handling the new incentives and the impact on traditional internal combustion engine (ICE) vehicle sales. The impact on supply chains, particularly the availability of battery components, is another crucial aspect of industry responses.

Industry Perspective on the Impact of the Credit

Manufacturers view the tax credit as a crucial tool to boost EV adoption and establish a wider market for electric vehicles. Dealerships might see it as a temporary measure with potential challenges in adapting to the changing market dynamics. The industry anticipates increased sales of electric vehicles, leading to a shift in consumer preferences. Supply chain constraints, particularly concerning battery materials, are a major concern for the industry.

Government Expectations for the Credit

The government likely anticipates a significant increase in EV sales, leading to a reduction in carbon emissions and an acceleration in the adoption of clean energy technologies. Furthermore, the government expects the tax credit to incentivize investments in EV infrastructure, creating a more comprehensive ecosystem for electric vehicles. The government may have specific targets for EV sales or charging station installations, indicating their long-term goals.

Comparison of Stakeholders’ Perspectives

| Stakeholder | Perspective |

|---|---|

| Car Manufacturers | Positive; the credit boosts sales, establishes a larger EV market, and encourages investment in electric vehicle technology. |

| Dealerships | Mixed; increased sales from the credit are seen as beneficial, but there are challenges in adapting to the new market dynamics, especially for dealerships that primarily deal with traditional vehicles. |

| Consumers | Positive; the credit makes EVs more affordable and accessible, incentivizing the shift to electric vehicles. |

Different stakeholders hold varied perspectives on the EV tax credit. Manufacturers see it as a catalyst for market growth, while dealerships face adaptation challenges. Consumers are generally receptive to the financial incentive. These differing perspectives highlight the complexity of implementing and evaluating such policies.

Potential Challenges and Limitations

The introduction of an electric vehicle (EV) tax credit presents opportunities for increased EV adoption but also potential challenges that must be carefully considered. These challenges encompass issues related to fraud and abuse, administrative burden, and the potential for unintended consequences within the used car market. Understanding these limitations is crucial for ensuring the effectiveness and fairness of the program.

Potential for Fraud and Abuse

The EV tax credit’s value incentivizes potential fraudulent activities. This includes individuals misrepresenting the vehicle’s true characteristics or origin to claim a higher credit. For example, a used EV might be falsely declared as new or its battery capacity exaggerated to obtain a larger credit. The complexity of verifying the authenticity and specifications of used EVs can pose a significant hurdle for the program’s integrity. Stricter verification measures and penalties for fraudulent claims are necessary to mitigate this risk.

Administrative Burden

The administration of the EV tax credit involves significant logistical and bureaucratic challenges. Processing claims, verifying vehicle specifications, and ensuring compliance with eligibility requirements necessitates substantial resources and dedicated personnel. The volume of applications and the potential for inconsistencies in data reporting could overwhelm existing administrative capacity. Streamlining the application process, utilizing data analytics to identify potential inconsistencies, and enhancing inter-agency collaboration are vital steps to alleviate this burden.

Limitations of the Credit

The EV tax credit, while beneficial, is not without limitations. Certain categories of EVs, like those with limited battery capacity or from specific manufacturers, may not qualify for the full credit amount. This can lead to inequities and limit the accessibility of the incentive for certain consumers. Furthermore, the tax credit might not adequately address the total cost of ownership for EVs, which includes factors like charging infrastructure and potential maintenance costs.

Impact on the Used Car Market

The EV tax credit’s introduction may significantly impact the used EV market. As new EV models are released, the demand for used models will potentially increase, potentially driving up prices for specific models. Conversely, the influx of new used EVs into the market might depress prices for older, less desirable models. This dynamic requires careful monitoring and analysis to understand the market’s reaction and mitigate any adverse effects on consumers. Furthermore, the resale value of vehicles may be affected due to factors such as battery degradation, and this will affect the tax credit eligibility.

Solutions to Address Challenges

To address the potential challenges and limitations of the EV tax credit, several solutions are viable. Strengthening verification procedures through advanced technology and collaborations between government agencies is critical. This could involve using digital verification tools, blockchain technology, or partnerships with manufacturers to ensure vehicle authenticity and battery capacity accuracy. Simplification of the application process and utilization of data analytics to identify potential fraud are additional strategies. Finally, supplementing the tax credit with other incentives that account for the full cost of EV ownership could further enhance the program’s impact.

Future of the Tax Credit

The future of the electric vehicle (EV) tax credit remains a subject of considerable discussion and anticipation. Policymakers and industry stakeholders are constantly evaluating its effectiveness and potential impacts, prompting speculation about potential changes and modifications to the program. The credit’s longevity and its impact on the broader EV market are key factors driving this ongoing debate.

Potential Changes to Eligibility Criteria

The current eligibility criteria for the EV tax credit are likely to undergo adjustments in the future. These adjustments might involve refining the definition of “domestically produced” components, potentially expanding the range of eligible vehicle types, or altering the battery capacity requirements. Furthermore, the definition of “new” vehicles could be revisited to account for technological advancements and the evolving nature of the automotive industry. A broader spectrum of EV types, such as commercial vehicles or specialized electric vehicles, might become eligible, reflecting a shift in consumer demands and government priorities.

Impact of Evolving EV Technology

The rapid advancements in EV battery technology and vehicle design are likely to influence the tax credit’s future. As battery production costs decline and charging infrastructure expands, the eligibility requirements might need to adapt. Technological innovations might necessitate adjustments to the battery capacity thresholds, or even the introduction of new criteria related to vehicle efficiency or charging capabilities. For example, the emergence of solid-state batteries or advancements in charging speeds might warrant revisions to the credit’s guidelines to encourage the adoption of these newer technologies.

Factors Influencing Future Changes

Several factors could significantly influence the future direction of the EV tax credit. Government policy changes, including shifts in national energy strategies or environmental regulations, could prompt alterations to the credit. Consumer demand for EVs, coupled with the growth of the EV market, will also play a crucial role in shaping future policies. Public opinion regarding the credit’s effectiveness and fairness, alongside industry feedback, will likely contribute to the ongoing dialogue about the credit’s future. Finally, the global economic landscape, including fluctuating raw material costs and international trade agreements, could also impact the credit’s design.

Predictions about the Future of the Credit

Predictions about the future of the EV tax credit are varied. Some anticipate continued support for the credit, with potential adjustments to eligibility requirements to reflect technological advancements. Others predict the credit’s eventual phase-out, replaced by alternative incentives or policies focused on supporting EV adoption. A gradual reduction in the credit’s value over time, or a shift toward a more targeted approach focusing on specific vehicle types or regions, are also plausible scenarios. The future trajectory of the EV tax credit will depend on the interplay of these factors, and their relative importance will shape the policy’s evolution.

Evolving Impact on the Used Car Market

The ongoing debate and potential changes to the tax credit could have significant repercussions for the used car market. If the credit is extended or modified, it could potentially impact the value of used EVs, making them more attractive to buyers. Conversely, a phase-out of the credit could depress the used EV market. In the event of changes, the used EV market will be closely monitored for any shifts in supply and demand.