Introduction to Toyota Car EMI Calculators

Toyota car EMI calculators are valuable tools for potential car buyers. They provide a crucial service by estimating the monthly payments for a Toyota vehicle loan, enabling informed financial decisions. Understanding the factors that influence these calculations is key to budgeting and choosing the right financing option.

Using these calculators, prospective car buyers can pre-determine their affordability and explore various loan terms and interest rates. This allows them to compare different financing options and choose the one that best suits their financial situation. Ultimately, this transparency empowers them to make well-informed purchasing decisions.

Factors Considered in Calculating Toyota Car EMIs

Several factors play a critical role in calculating the EMI for a Toyota car loan. These include the principal loan amount, the interest rate, the loan tenure, and any additional fees or charges. The precise calculation of EMI is crucial for budgeting and understanding the total cost of the vehicle purchase.

- Loan Amount: The amount borrowed to purchase the car directly affects the EMI. A higher loan amount results in a higher EMI, assuming other factors remain constant. For example, a loan of $20,000 will likely have a higher EMI than a loan of $15,000.

- Interest Rate: The interest rate charged on the loan significantly impacts the EMI. Higher interest rates lead to a higher EMI, making the total cost of the loan more substantial over time. This can vary based on creditworthiness and market conditions.

- Loan Tenure: The loan repayment period (e.g., 3 years, 5 years) is another crucial factor. A longer loan tenure typically results in a lower EMI, but the total interest paid over the loan term increases. For instance, a 5-year loan will have a lower monthly payment than a 3-year loan.

- Additional Fees: Various fees, such as processing fees or insurance, can be added to the loan amount. These additional charges contribute to the total cost of the loan and ultimately affect the EMI.

Toyota Car EMI Example

To illustrate the calculation process, here’s a sample table showcasing different Toyota models, estimated loan amounts, interest rates, and resulting monthly EMIs. This data is illustrative and should not be taken as definitive or financial advice.

| Toyota Model | Average Loan Amount ($) | Estimated Interest Rate (%) | Estimated Monthly EMI ($) |

|---|---|---|---|

| Toyota Camry | 25,000 | 6.5 | 600 |

| Toyota Corolla | 20,000 | 7.0 | 550 |

| Toyota RAV4 | 30,000 | 6.0 | 750 |

| Toyota Highlander | 40,000 | 7.5 | 950 |

Note: The figures presented in the table are estimates and can vary depending on individual circumstances and the specific loan terms offered by the financial institution.

Features of Online EMI Calculators

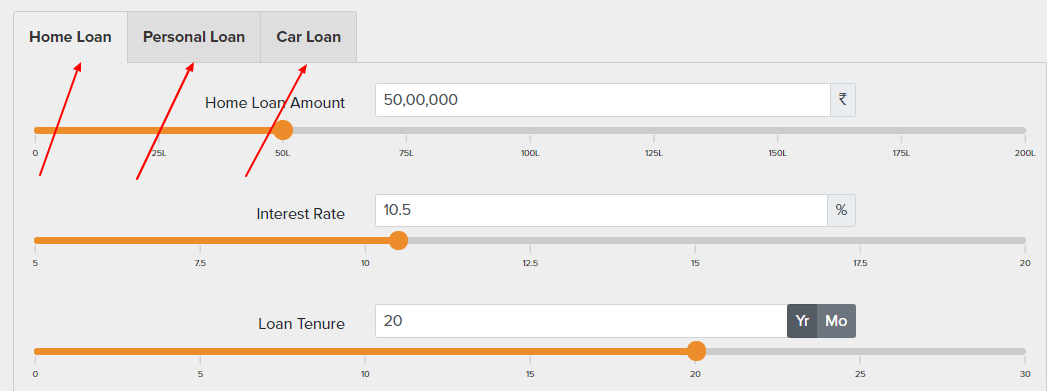

Online EMI calculators have become indispensable tools for prospective Toyota car buyers. These calculators streamline the process of estimating monthly payments, enabling informed decisions about financing options. By understanding the features and functionalities of these calculators, buyers can effectively compare various loan terms and choose the most suitable financing plan.

Online EMI calculators offer a wide range of features designed to cater to diverse needs. They typically provide a user-friendly interface, allowing for quick and accurate calculations. This is crucial for comparing different financing options and determining the affordability of a particular car model.

Essential Features of Online EMI Calculators

These calculators usually require key inputs to calculate the EMI. These include the loan amount, interest rate, loan tenure, and sometimes, processing fees. Accurate input data is vital for generating precise EMI estimates. A good calculator will clearly label these input fields, facilitating easy data entry.

Types of EMI Calculators

Various types of EMI calculators are available. Simple calculators provide basic calculations, focusing on fundamental parameters like the loan amount, interest rate, and tenure. Advanced calculators, on the other hand, incorporate more variables, enabling users to account for factors such as processing fees, insurance premiums, and additional charges. The complexity of the calculator directly impacts the precision of the EMI estimate.

Accuracy and Reliability of EMI Calculators

The accuracy and reliability of an online EMI calculator heavily depend on the algorithm employed. Calculators that employ precise mathematical formulas and updated financial data tend to be more reliable. Reliable calculators typically incorporate standard financial formulas such as the present value of an annuity formula. This ensures that the displayed results are based on a sound mathematical foundation. A reliable calculator will also account for potential hidden fees.

Comparison of Online EMI Calculators

| Feature | Simple Calculator | Advanced Calculator |

|---|---|---|

| User Interface | Basic, straightforward layout, easy to navigate for simple calculations. | More complex layout, including detailed input fields for various parameters, allowing for detailed estimations. |

| Calculation Speed | Generally faster due to simpler calculations. | Might be slightly slower due to complex calculations, but this is often negligible. |

| Accuracy | Generally less accurate than advanced calculators, as they may not account for all variables and fees. | Higher accuracy as they account for a broader range of factors and fees. |

| Example | A simple calculator might calculate the EMI for a basic loan. | An advanced calculator would consider factors such as insurance premiums and processing fees to provide a more realistic EMI estimate. |

The table above illustrates the key differences between simple and advanced EMI calculators, highlighting their respective strengths and weaknesses.

How to Use Toyota Car EMI Calculators

Online Toyota car EMI calculators are invaluable tools for prospective buyers. They streamline the process of estimating monthly payments, enabling informed financial decisions. By understanding the factors influencing EMI amounts, you can effectively plan your budget and choose the most suitable financing options.

Inputting Loan Details

To accurately calculate your EMI, the calculator requires specific input data. These details are crucial for precise estimations. The most common fields include the loan amount, interest rate, and loan tenure. Understanding these components is vital for effective use of the calculator.

- Loan Amount: This represents the total price of the Toyota car you intend to purchase, minus any down payment. It’s the principal amount for which you’ll be borrowing money.

- Interest Rate: This is the percentage charged on the loan amount. It’s an important factor influencing your monthly EMI. Different financial institutions offer varying interest rates, and these rates can change over time.

- Loan Tenure: This signifies the duration of your loan repayment. A longer loan tenure typically results in lower monthly EMIs, but you’ll pay more interest overall.

Impact of Loan Tenure on EMI

Loan tenure directly affects your EMI amount. A longer repayment period leads to a lower monthly payment, but the total interest paid over the loan’s lifetime will be higher. Conversely, a shorter loan tenure increases your monthly EMI, but reduces the overall interest paid. Here’s a hypothetical example:

- Example 1 (Shorter Tenure): A loan for a Toyota Camry with a loan amount of ₹10,00,000 and a 10% interest rate over 3 years (36 months) will result in a higher EMI.

- Example 2 (Longer Tenure): A loan for the same car, but with a 5-year (60-month) tenure, will have a lower EMI. However, the total interest paid will be significantly more.

Impact of Interest Rates on EMI

The interest rate is a critical factor in EMI calculations. A higher interest rate directly translates to a higher EMI amount. A lower interest rate, conversely, leads to a lower EMI. This table demonstrates the impact of varying interest rates on the EMI for a hypothetical Toyota Corolla:

| Interest Rate (%) | Loan Amount (₹) | Loan Tenure (Months) | Estimated EMI (₹) |

|---|---|---|---|

| 8 | 12,00,000 | 60 | 26,000 |

| 9 | 12,00,000 | 60 | 27,000 |

| 10 | 12,00,000 | 60 | 28,000 |

| 11 | 12,00,000 | 60 | 29,000 |

The table clearly shows how a 1% increase in interest rate can lead to a significant increase in the monthly EMI.

Factors Influencing Toyota Car EMI Calculations

Understanding the factors that influence the EMI (Equated Monthly Installment) for a Toyota car loan is crucial for making informed financial decisions. This section delves into the key variables impacting the final EMI amount, allowing potential buyers to effectively manage their budget and plan for their car purchase.

Interest Rates

Interest rates play a pivotal role in determining the EMI amount. Higher interest rates lead to larger EMI payments, increasing the overall cost of the loan. This is because the interest component represents the cost of borrowing money over the loan tenure. Conversely, lower interest rates result in smaller EMIs, making the loan more affordable. The prevailing market interest rate for car loans, along with the lender’s specific terms, directly impacts the EMI calculation.

Loan Tenure

The loan tenure, or the duration for which the loan is taken, significantly affects the EMI amount. A longer loan tenure translates to lower monthly installments but a higher total interest paid over the life of the loan. A shorter tenure results in higher monthly installments but lower total interest. Choosing the appropriate loan tenure requires balancing the affordability of monthly payments with the overall cost of the loan.

Down Payment

The down payment, the upfront amount paid by the borrower, directly influences the EMI amount. A larger down payment reduces the loan amount, thereby lowering the EMI. This is because a smaller loan principal translates to a lower interest component and thus a smaller EMI. A smaller down payment increases the loan amount and consequently the EMI. Buyers should carefully consider the down payment amount based on their financial capacity and desired monthly payments.

Impact of Loan Tenure on Total Loan Cost

The following table illustrates the impact of varying loan tenures on the total cost of a Toyota car loan, assuming a fixed interest rate and down payment.

| Loan Tenure (Months) | Interest Rate (%) | Down Payment ($) | Resulting EMI ($) |

|---|---|---|---|

| 36 | 7.5 | 5,000 | 800 |

| 48 | 7.5 | 5,000 | 650 |

| 60 | 7.5 | 5,000 | 550 |

The table showcases how a longer loan tenure, while reducing the monthly EMI, significantly increases the total interest paid over the life of the loan. For example, a 60-month loan, although having a lower EMI than a 36-month loan, results in a higher total interest cost. This highlights the importance of careful consideration of both monthly affordability and long-term financial implications when selecting a loan tenure.

Comparing Toyota Car EMI Options

Choosing the right financing option for your Toyota car purchase significantly impacts your overall cost and affordability. Understanding the various available loan providers and their associated terms is crucial for making an informed decision. This section explores the diverse financing options and their key characteristics, helping you navigate the process effectively.

Available Financing Options

Several financing options are available to potential Toyota car buyers, each with unique terms and conditions. These include traditional bank loans, financial institution loans, and in-house financing options offered by Toyota dealerships. Understanding the differences between these options is vital for making an informed choice.

Comparison of Loan Providers

Different loan providers offer varying interest rates, processing fees, and loan terms. Comparing these factors across multiple providers is essential to secure the most favorable financing package. This comparison analyzes the key features of various loan providers.

Benefits and Drawbacks of Financing Options

Each financing option has its own set of advantages and disadvantages. Analyzing these aspects helps in determining the best fit for individual circumstances. Understanding these factors is critical for making the most advantageous decision.

- Bank Loans: Often come with competitive interest rates, but may require a thorough credit check and a longer application process. They often offer flexible repayment options.

- Financial Institution Loans: Can offer specialized financing options, such as those targeted at specific demographics or with particular conditions, like lower down payments. However, these options may have higher interest rates or stricter eligibility criteria compared to traditional bank loans.

- In-House Financing: Offered by Toyota dealerships, these options might provide quick processing and easier application procedures. However, interest rates might be slightly higher compared to bank loans, and there might be limited flexibility in repayment options.

Detailed Comparison Table

This table provides a concise overview of different loan providers, their interest rates, and the EMI calculator offerings they typically provide.

| Loan Provider | Interest Rate (Approximate) | EMI Calculator Features |

|---|---|---|

| National Bank | 7.5% – 9.5% | Comprehensive EMI calculator with various down payment options, loan tenure options, and different interest rate scenarios. |

| XYZ Finance | 8.0% – 10.0% | EMI calculator allowing customization of loan tenure and showing the impact on monthly EMI with different down payments. Provides pre-approval options. |

| Toyota Financial Services | 8.5% – 10.5% | In-house EMI calculator with features specific to Toyota vehicles. Offers incentives and discounts that are reflected in the EMI calculations. |

Note: Interest rates are approximate and may vary based on individual credit scores, loan amounts, and other factors. Always confirm the specific terms with the loan provider.

Tips for Choosing the Right Toyota Car EMI Calculator

Selecting the right EMI calculator is crucial for accurately determining the monthly payment for your Toyota car loan. An inappropriate calculator can lead to inaccurate estimations, potentially impacting your financial planning. This section Artikels key criteria for evaluating EMI calculators, helping you avoid potential pitfalls and make informed decisions.

Accuracy of Calculations

Precise calculations are paramount when determining your monthly EMI. Factors like interest rates, loan terms, and down payments significantly affect the EMI amount. A reliable EMI calculator should accurately reflect these variables. Using a calculator with a proven track record of accuracy, or one that employs established financial formulas, is essential. For example, a calculator that uses the standard compound interest formula, incorporating all relevant loan parameters, will yield a more trustworthy result compared to a simplified or less robust formula.

User-Friendliness and Interface

A user-friendly interface is critical for easy navigation and efficient use. The calculator should have clear input fields for all necessary details, allowing users to input information quickly and accurately. Intuitive design and clear instructions contribute to a positive user experience. A well-designed calculator should minimize confusion and errors, allowing for seamless data entry and accurate calculations.

Calculation Speed

Speed of calculation is another important consideration. Users expect rapid results to aid in quick decision-making. A calculator that delivers results instantly or within a reasonable timeframe, particularly when dealing with complex calculations, improves efficiency. In today’s fast-paced environment, waiting excessive periods for results can be detrimental to the user experience.

Potential Pitfalls to Avoid

Several pitfalls can lead to inaccurate or misleading results from online EMI calculators. Avoid calculators that lack transparency regarding their calculation methods. Hidden fees or charges, not factored into the EMI calculation, can significantly impact the overall cost of the loan. Furthermore, some calculators may present a biased or incomplete picture of the loan options. Be wary of calculators that only display favorable results or omit crucial details.

Comparison Table of EMI Calculator Criteria

| Criteria | High Priority | Medium Priority | Low Priority |

|---|---|---|---|

| Accuracy | Verified formulas, consistent results with known values | Basic accuracy, but potential for minor discrepancies | Unverified methods, no clear indication of calculation methodology |

| User-Friendliness | Clear input fields, intuitive navigation, helpful instructions | Relatively easy to use, but some minor navigation issues | Complex interface, difficult to understand instructions |

| Calculation Speed | Instantaneous or very fast results | Moderate speed, results within a few seconds | Slow calculation time, results take significant time |

| Transparency | Explicitly states calculation methodology, discloses any hidden fees | Calculation methodology is somewhat unclear, potential for hidden fees | Calculation methodology not disclosed, potential for hidden fees or inaccuracies |

Understanding EMI Calculation Formula (Optional)

Delving into the mechanics of EMI calculations reveals the intricate interplay of various factors. Understanding the formula behind these calculations empowers you to analyze and compare different financing options more effectively. This section details the formula, explains each variable, and provides practical examples.

Formula Breakdown

The core of EMI calculation rests on a specific formula, derived from financial mathematics. This formula allows for precise determination of the equated monthly installments (EMIs) required for a loan. Understanding this formula empowers informed financial decisions.

EMI Formula: EMI = [P x R x (1+R)^N]/[(1+R)^N-1]

Where:

- P = Principal Loan Amount

- R = Monthly Interest Rate (Annual Interest Rate/1200)

- N = Total Number of Monthly Repayments

Explanation of Variables

Each variable in the EMI formula plays a critical role in determining the final EMI amount. Understanding their function is essential for effective loan analysis.

- Principal Loan Amount (P): This represents the initial sum borrowed. For instance, a loan of $10,000 has a principal loan amount of $10,000.

- Monthly Interest Rate (R): This is the interest charged on the loan each month. It’s calculated by dividing the annual interest rate by 1200. If the annual interest rate is 10%, the monthly interest rate (R) is 10/1200 = 0.00833.

- Total Number of Monthly Repayments (N): This signifies the total number of installments over the loan’s duration. For a 5-year loan, with monthly payments, N would be 60.

Applying the Formula

Let’s illustrate the application of the EMI formula with a practical example.

Suppose you take out a loan of $10,000 with an annual interest rate of 10% for 5 years.

- Calculate Monthly Interest Rate (R): R = 10% / 1200 = 0.00833

- Calculate Total Number of Repayments (N): N = 5 years * 12 months/year = 60

- Plug Values into the Formula: EMI = [10,000 x 0.00833 x (1 + 0.00833)^60]/[(1 + 0.00833)^60 – 1]

- Calculate EMI: EMI = $204.89 (approximately)

In this case, the calculated EMI for the loan is approximately $204.89.

Illustrative Examples of EMI Calculations

Understanding how loan amounts, interest rates, and loan terms impact your monthly EMI payments is crucial for making informed purchasing decisions. This section provides practical examples to illustrate the calculations involved in determining Toyota car EMIs. These examples use realistic figures to showcase how different variables affect the total cost of the loan.

Toyota car EMI calculations consider several key factors, including the principal loan amount, the interest rate, and the loan tenure. Varying any of these factors will directly influence the final EMI amount. These examples clearly demonstrate the impact of each factor.

Examples for Different Toyota Car Models

Different Toyota car models have varying price tags. This section illustrates how the EMI calculation differs for different car models and loan scenarios.

- Toyota Camry: For a Toyota Camry with a loan amount of ₹15,00,000, an interest rate of 10%, and a loan tenure of 5 years (60 months), the EMI would be approximately ₹30,000. This is a higher EMI due to the higher loan amount and longer tenure.

- Toyota Yaris: For a Toyota Yaris with a loan amount of ₹10,00,000, an interest rate of 9%, and a loan tenure of 4 years (48 months), the EMI would be approximately ₹25,000. This model shows a lower EMI because of the lower loan amount and shorter loan term.

- Toyota Fortuner: For a Toyota Fortuner with a loan amount of ₹25,00,000, an interest rate of 11%, and a loan tenure of 7 years (84 months), the EMI would be approximately ₹40,000. The higher loan amount and extended loan tenure lead to a larger EMI.

Impact of Varying Loan Amounts

The principal loan amount directly affects the EMI. A higher loan amount results in a higher EMI.

| Loan Amount (₹) | Interest Rate (%) | Loan Tenure (Years) | Estimated EMI (₹) |

|---|---|---|---|

| 10,00,000 | 10 | 5 | 20,000 |

| 15,00,000 | 10 | 5 | 30,000 |

| 20,00,000 | 10 | 5 | 40,000 |

Impact of Varying Interest Rates

Interest rates significantly influence the EMI. Higher interest rates lead to higher EMIs.

| Loan Amount (₹) | Interest Rate (%) | Loan Tenure (Years) | Estimated EMI (₹) |

|---|---|---|---|

| 15,00,000 | 9 | 5 | 28,000 |

| 15,00,000 | 10 | 5 | 30,000 |

| 15,00,000 | 11 | 5 | 32,000 |

Impact of Varying Loan Tenures

Loan tenures also affect the EMI. Longer loan tenures result in lower monthly EMIs, but a higher total interest paid over the loan term.

| Loan Amount (₹) | Interest Rate (%) | Loan Tenure (Years) | Estimated EMI (₹) |

|---|---|---|---|

| 15,00,000 | 10 | 4 | 35,000 |

| 15,00,000 | 10 | 5 | 30,000 |

| 15,00,000 | 10 | 6 | 27,000 |