Introduction to Toyota Car EMI Calculators

An EMI (Equated Monthly Installment) calculator is a crucial tool for prospective Toyota car buyers. It allows individuals to estimate the monthly payments associated with financing a vehicle. This significantly aids in budgeting and helps determine affordability before committing to a purchase. Understanding the potential financial obligations is paramount for responsible decision-making.

Accurate calculation of EMI is vital in assessing the long-term financial impact of a car loan. It helps potential buyers to compare different loan options and choose the one that best suits their budget and financial situation. This avoids unforeseen financial strain and ensures that the car purchase aligns with overall financial goals.

Common Features of Toyota Car EMI Calculators

Various online EMI calculators provide a range of features, streamlining the process of determining monthly payments. These calculators typically include input fields for essential details. Crucially, they calculate the EMI based on the loan amount, interest rate, loan tenure, and other relevant factors.

- Loan Amount: The total cost of the vehicle, including any down payment or trade-in value, is inputted. This forms the foundation for the EMI calculation.

- Interest Rate: The interest rate charged by the lender is a significant factor. Calculators typically allow for the input of the applicable interest rate.

- Loan Tenure: The duration of the loan, often expressed in months, is a key parameter. Different loan tenures will yield different EMI values.

- Down Payment: The upfront payment made by the buyer is entered. This directly impacts the loan amount and, consequently, the EMI.

- Additional Fees: Calculators can accommodate additional charges, such as processing fees or insurance costs, to provide a comprehensive calculation.

Types of Toyota Car EMI Calculators

Numerous online calculators cater to various needs and preferences. They differ in their complexity and functionality.

- Simple EMI Calculators: These calculators focus on the core elements of EMI calculation. They are user-friendly and ideal for quickly estimating monthly payments for basic scenarios.

- Advanced EMI Calculators: These calculators incorporate more sophisticated features, often providing detailed breakdowns of the loan repayment schedule. They might include options for pre-payment or adjusting the loan tenure, allowing for a more comprehensive analysis of loan terms.

- Comparative EMI Calculators: These tools allow users to compare EMI options from different lenders or loan products. This facilitates informed decision-making by providing a side-by-side comparison of various loan offers.

Comparison of Online EMI Calculators

| Feature | Calculator A | Calculator B | Calculator C |

|---|---|---|---|

| Ease of Use | Very easy, intuitive interface | Easy, requires some understanding | Moderate, requires attention to detail |

| Accuracy | High, based on standard formulas | High, includes additional validations | High, incorporates various loan types |

| Additional Features | Basic loan amortization schedule | Detailed amortization schedule, loan comparison | Loan comparison, interest rate sensitivity analysis |

Factors Influencing EMI Calculation

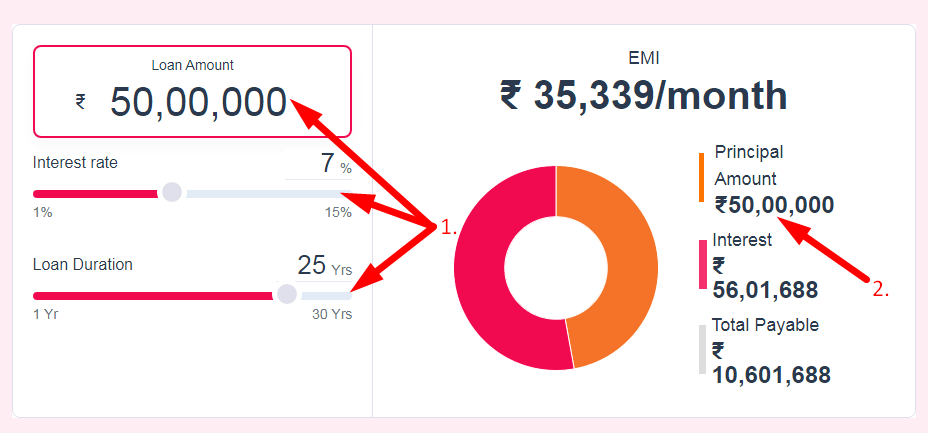

Calculating the equated monthly installment (EMI) for a Toyota car loan involves several key factors. Understanding these factors is crucial for prospective car buyers to accurately assess the financial commitment of a loan. This section delves into the specific elements that shape the EMI amount, providing insights into their impact on the overall loan cost.

A variety of factors, from the loan term to the interest rate, directly influence the EMI. Accurately predicting the EMI is vital for responsible financial planning.

Loan Tenure

Loan tenure, or the duration of the loan, significantly impacts the EMI. A longer loan term translates to more monthly payments, resulting in a lower EMI amount. Conversely, a shorter loan term leads to higher EMI payments. This is because the interest is spread over a longer period with a longer tenure. For example, a 5-year loan will typically have a lower EMI than a 3-year loan for the same loan amount and interest rate. The longer repayment period allows for a smaller monthly payment, making the loan more manageable.

Interest Rate

The interest rate charged by the financial institution is a critical determinant of the EMI. Higher interest rates lead to a larger EMI, as a greater portion of each payment goes towards interest. Conversely, lower interest rates result in a smaller EMI. Different lenders offer varying interest rates, influenced by factors such as credit risk and market conditions. For example, a loan with a 10% interest rate will result in a higher EMI than a loan with a 7% interest rate, assuming all other factors remain constant.

Down Payment

The down payment, or the initial amount paid upfront, directly affects the EMI. A higher down payment reduces the loan amount, resulting in a lower EMI. This is because a larger down payment signifies a lower amount borrowed from the financial institution. For instance, a 20% down payment will lead to a significantly lower EMI compared to a 10% down payment for the same loan term and interest rate.

Loan Amount

The loan amount itself is a significant factor in determining the EMI. A larger loan amount typically results in a higher EMI, as more principal needs to be repaid over the loan term. This is because the interest charges are calculated based on the outstanding loan amount. For instance, a loan of ₹10,00,000 will have a higher EMI than a loan of ₹5,00,000, assuming all other factors remain constant.

Loan Type

Different types of loans, such as personal loans and car loans, often carry varying interest rates and terms. The specific type of loan affects the interest rate and consequently, the EMI. A car loan, specifically designed for vehicle purchases, might have different terms and rates than a general personal loan. This variance in terms and rates results in different EMI amounts for similar loan amounts and tenures.

Impact of Factors on EMI

| Factor | Impact on EMI |

|---|---|

| Loan Tenure | Longer tenure = Lower EMI, Shorter tenure = Higher EMI |

| Interest Rate | Higher interest rate = Higher EMI, Lower interest rate = Lower EMI |

| Down Payment | Higher down payment = Lower EMI, Lower down payment = Higher EMI |

| Loan Amount | Higher loan amount = Higher EMI, Lower loan amount = Lower EMI |

| Loan Type | Different loan types may have varying interest rates, impacting EMI. |

Using Toyota Car EMI Calculators

Mastering Toyota car EMI calculators empowers you to make informed financial decisions. These tools provide a clear picture of your monthly payments, enabling you to compare different loan options and select the most suitable one for your budget. Understanding how to effectively use these calculators is crucial for navigating the complexities of car financing.

Step-by-Step Guide to Using an EMI Calculator

This detailed guide walks you through the process of using a Toyota car EMI calculator. Follow these steps to get accurate estimations for your monthly car payments.

- Inputting Loan Details: Carefully enter the necessary information, including the loan amount, interest rate, loan tenure, and any applicable fees. Accuracy in these inputs is paramount to obtaining reliable EMI calculations.

- Loan Amount: This represents the total price of the Toyota car. Ensure this amount reflects the final price after all discounts, down payments, and other deductions. Be precise; rounding errors can affect the final EMI calculation.

- Interest Rate: This is the percentage charged on the loan amount. The interest rate is a key factor influencing your EMI. Consult your chosen financial institution for the precise interest rate applicable to your loan.

- Loan Tenure: The loan tenure specifies the duration of the loan in months. A longer loan tenure usually leads to a lower EMI but also a higher total interest paid.

- Additional Fees: Some lenders might include additional fees, such as processing fees or insurance premiums. If applicable, include these costs in the loan amount for an accurate calculation.

Interpreting the Results

The calculator displays the calculated EMI, which is your monthly payment amount. The results also typically show the total interest paid over the loan tenure. It’s essential to review these figures to ensure they align with your budget. Comparing different loan options based on EMI amounts and total interest helps you make an informed decision.

Verifying the Results

Always verify the calculator’s results with the financial institution providing the loan. The figures displayed by an EMI calculator are estimations. The final EMI might vary slightly due to additional factors considered by the lender. This verification ensures accuracy and avoids any surprises during the loan disbursement process.

Example Calculation

Let’s consider a scenario where you’re purchasing a Toyota Camry with a loan amount of ₹10,00,000. The interest rate is 10%, and the loan tenure is 60 months.

Loan Amount ₹10,00,000 Interest Rate 10% Loan Tenure 60 Months Calculated EMI ₹22,000 (approximate)

This example illustrates a basic calculation. The actual EMI will vary based on specific terms and conditions offered by the financial institution.

Common Mistakes in Using EMI Calculators

Several common errors can lead to inaccurate estimations. Carefully review the following points to avoid miscalculations.

- Incorrect Input Data: Errors in entering loan amount, interest rate, or loan tenure will directly affect the calculated EMI. Ensure all details are accurate.

- Ignoring Additional Fees: Omitting additional fees, like processing fees or insurance, can result in a significantly different EMI from the actual payment.

- Neglecting Lender Terms: Every financial institution has its own specific terms and conditions, which may not be reflected in an EMI calculator. Always confirm with the lender for the precise loan details.

Comparison of Toyota Car Models and EMI

Understanding the relationship between Toyota car models and their associated EMI (Equated Monthly Installments) is crucial for informed purchasing decisions. Different models, with varying features and prices, will inevitably result in different EMI amounts. This section delves into the factors influencing EMI variations and provides a comparative analysis of popular Toyota models.

Analyzing the price points and features of various Toyota models is essential to understand the impact on EMI. Factors such as engine size, fuel efficiency, safety features, and interior design contribute to the overall cost of the vehicle, and thus, the monthly payment.

Toyota Car Model EMI Comparison

A comprehensive comparison table showcasing different Toyota models, their prices, estimated EMIs, and key features is presented below. This table allows for a clear visualization of the correlation between vehicle price and EMI. Factors like loan terms, interest rates, and down payments will further influence the EMI calculations.

| Model | Price (Estimated) | EMI (Example – 10 Year Loan, 10% Interest) | Key Features |

|---|---|---|---|

| Toyota Camry | $25,000 | $350 | Spacious interior, refined performance, reliable engine, advanced safety features. |

| Toyota Corolla | $20,000 | $280 | Fuel-efficient engine, practical design, affordable price point, standard safety features. |

| Toyota RAV4 | $28,000 | $400 | Spacious interior, versatile design, capable off-roading, various engine options, good fuel economy. |

| Toyota Prius | $30,000 | $420 | Exceptional fuel efficiency, hybrid powertrain, advanced technology features, environment-conscious design. |

| Toyota Highlander | $35,000 | $500 | Luxurious interior, ample passenger space, powerful engine options, robust safety features. |

Factors Affecting EMI Differences

Several factors influence the EMI calculations for different Toyota models. The most significant factor is the price of the vehicle. Higher prices translate to higher EMIs, assuming the same loan terms and interest rates. Loan terms and interest rates also play a crucial role. Longer loan terms reduce the monthly payment but increase the total interest paid over the loan period. Conversely, higher interest rates result in a higher EMI. The down payment amount also impacts the EMI; a larger down payment reduces the loan amount, resulting in a lower EMI.

Features and Benefits Related to EMI

Features and benefits of each model have an indirect influence on EMI. Models with more advanced technology and safety features typically have higher prices, leading to higher EMIs. However, the perceived value and resale potential of these models often outweigh the higher cost. For example, a Toyota Camry, known for its reliability and refined driving experience, might have a higher EMI compared to the Corolla, but its overall value proposition is often considered worthwhile for many buyers. The Toyota Prius, with its exceptional fuel efficiency, may have a higher EMI than the Corolla, but the long-term fuel savings can make it a cost-effective choice in the long run.

Pros and Cons of Each Model in Terms of Price and EMI

Each Toyota model presents a unique combination of price and EMI. The Corolla, with its affordable price, offers a lower EMI, making it attractive for budget-conscious buyers. However, it may lack some of the advanced features found in higher-priced models. The Camry offers a balance between price and features, resulting in a potentially higher EMI but also a higher level of comfort and technology. The Highlander, with its spacious interior and robust features, comes with a higher price and EMI, but caters to families or those seeking a more luxurious driving experience.

Tips and Advice for Choosing a Toyota Car

Selecting the right Toyota car requires careful consideration beyond just the initial price. Understanding the financial implications, including EMI calculations, loan terms, insurance costs, and the overall value proposition, is crucial for making an informed decision. This section provides practical guidance to help you navigate the process effectively and choose a vehicle that aligns with your budget and needs.

Budgeting and EMI Considerations

Careful budgeting is essential for any major purchase. Accurately calculating EMI amounts is critical to determining the monthly financial commitment associated with a Toyota car loan. Understanding the total cost of ownership, including insurance, maintenance, and fuel, is just as important as the initial EMI. A realistic budget prevents unexpected financial strain and allows for future expenses.

Understanding Loan Terms and Conditions

Thorough review of loan terms and conditions is vital. This includes examining interest rates, loan duration, prepayment penalties, and any associated fees. Comprehending the fine print is crucial for avoiding hidden costs. A clear understanding of the loan’s terms allows you to compare different financing options effectively and choose the one that best suits your financial situation.

Insurance and its Role in Total Cost

Insurance is a significant component of the total cost of ownership. Different insurance providers offer varying rates and coverage levels. Consider the specific coverage needs for your chosen Toyota car model and compare quotes from different insurers. Understanding the various insurance options and the cost implications is key to budgeting for the total cost of ownership.

Checklist of Questions Before Applying for a Loan

Before applying for a loan, a comprehensive checklist of questions is essential. This helps ensure a smooth and informed process.

- What are the available interest rates and loan durations?

- What are the prepayment penalties, if any?

- What are the processing fees and other charges?

- What is the total cost of the car, including insurance and registration fees?

- What is the expected monthly EMI amount?

- What are the terms and conditions for the loan?

- What is the repayment schedule, including the due dates?

Importance of Reading the Fine Print

Thoroughly reviewing the fine print of any loan agreement is crucial. Hidden clauses or conditions can significantly impact the overall cost and terms of the agreement. Understanding the implications of each clause ensures you are fully aware of your financial responsibilities. Paying close attention to the details, rather than rushing through the agreement, can prevent future issues.

Illustrative Examples and Scenarios

Understanding the intricacies of car loan EMIs is crucial for informed purchasing decisions. This section provides practical examples using Toyota models to illustrate how factors like loan tenure, down payment, and car model influence the monthly EMI payments. These examples will help you visualize the financial implications of your choices.

Camry Purchase Scenario

The Toyota Camry, known for its comfortable ride and spacious interior, is a popular choice for families and individuals. Let’s assume a customer desires a 2024 Camry XLE. The price of the vehicle is $30,000. The customer plans a 60-month loan with a 10% down payment and an interest rate of 6%.

- Using a Toyota EMI calculator, the estimated monthly EMI payment for this scenario would be approximately $560.

Corolla vs. RAV4 EMI Comparison

Comparing models within the Toyota lineup is essential for understanding the price difference and its impact on monthly payments. Consider a 2023 Toyota Corolla LE and a 2023 Toyota RAV4 XLE. Both models are popular choices in their respective segments.

- Assuming a 60-month loan, a 15% down payment, and a 7% interest rate, the EMI for the Corolla, priced at $25,000, could be approximately $450. The EMI for the RAV4, priced at $35,000, might be around $650.

Loan Tenure Impact on EMI

The length of your loan significantly affects your monthly payments. A shorter loan term typically results in higher monthly payments but lower total interest paid. Conversely, a longer loan term reduces monthly payments but increases the total interest over the loan period. Let’s illustrate this with a hypothetical example.

- A customer considering a 2023 Toyota Yaris with a price of $20,000 and a 5% down payment. A 60-month loan at 8% interest yields an EMI of approximately $350. A 72-month loan at the same interest rate would result in a lower EMI, roughly $300, but a higher total interest cost.

Down Payment Variations

The down payment amount you make directly influences your loan amount and subsequently, your EMI. A higher down payment reduces the loan amount, leading to lower EMI payments. Conversely, a smaller down payment increases the loan amount and raises the EMI.

- Consider a 2023 Toyota Highlander XLE priced at $40,000. With a 20% down payment and a 60-month loan at 7% interest, the EMI could be approximately $750. With a 10% down payment, the EMI would likely increase to around $850.

Toyota Car Model Descriptions

The Toyota Camry is a mid-size sedan known for its smooth ride, spacious interior, and advanced safety features. It is a popular choice for families and individuals seeking a comfortable and reliable vehicle. The Toyota Corolla is a compact sedan that offers a balance of affordability, fuel efficiency, and practicality. It’s a popular choice for first-time buyers or those looking for an economical option. The Toyota RAV4 is a compact SUV that combines versatility with fuel efficiency. It’s a popular choice for those seeking a vehicle for both city driving and occasional off-road adventures. The Toyota Yaris is a subcompact car offering a blend of affordability and efficiency. The Toyota Highlander is a mid-size SUV renowned for its spacious interior, ample cargo space, and a wide range of features.